Form BCT Beer Connoisseur's Semi-annual Tax Report Return - Montana

What Is Form BCT?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

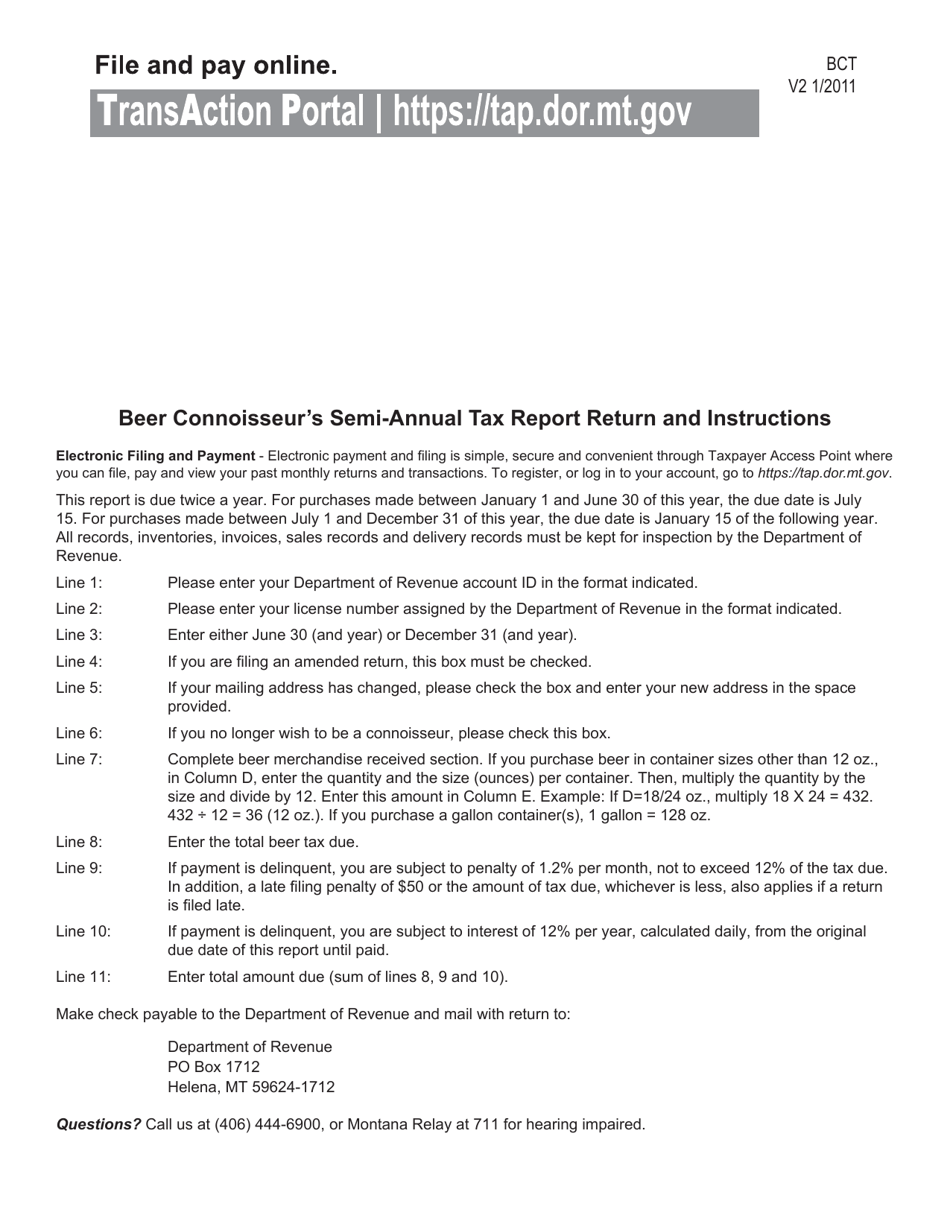

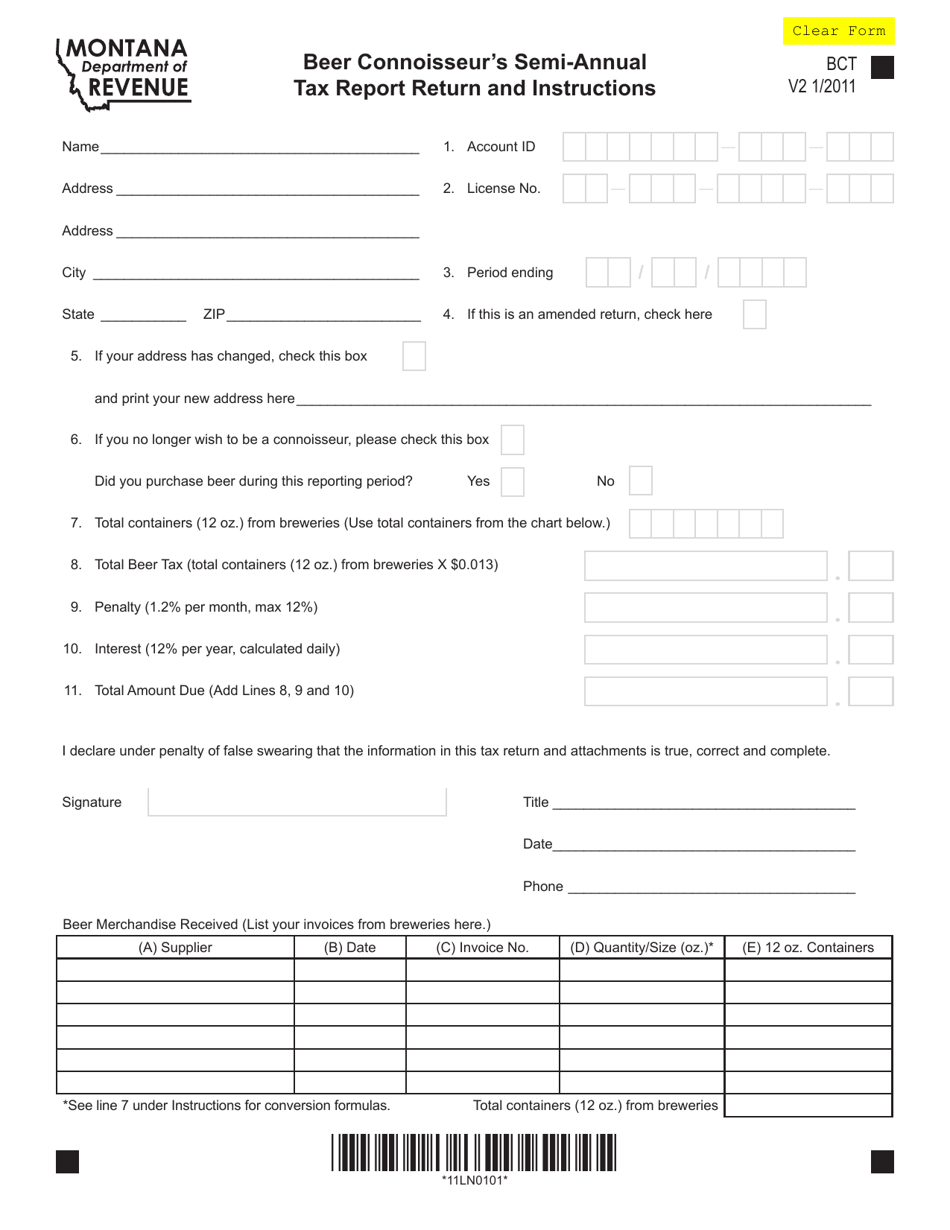

Q: What is the BCT Beer Connoisseur's Semi-annual Tax Report Return?

A: The BCT Beer Connoisseur's Semi-annual Tax Report Return is a tax form specifically for reporting and paying taxes on beer sales in Montana.

Q: Who needs to file the BCT Beer Connoisseur's Semi-annual Tax Report Return?

A: Any business or individual engaged in the sale of beer in Montana needs to file the BCT Beer Connoisseur's Semi-annual Tax Report Return.

Q: What information is required on the BCT Beer Connoisseur's Semi-annual Tax Report Return?

A: The BCT Beer Connoisseur's Semi-annual Tax Report Return requires information such as total beer sales, tax due, and any credits or exemptions claimed.

Q: When is the deadline for filing the BCT Beer Connoisseur's Semi-annual Tax Report Return?

A: The deadline for filing the BCT Beer Connoisseur's Semi-annual Tax Report Return in Montana is usually 30 days after the end of the reporting period.

Form Details:

- Released on January 1, 2011;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BCT by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.