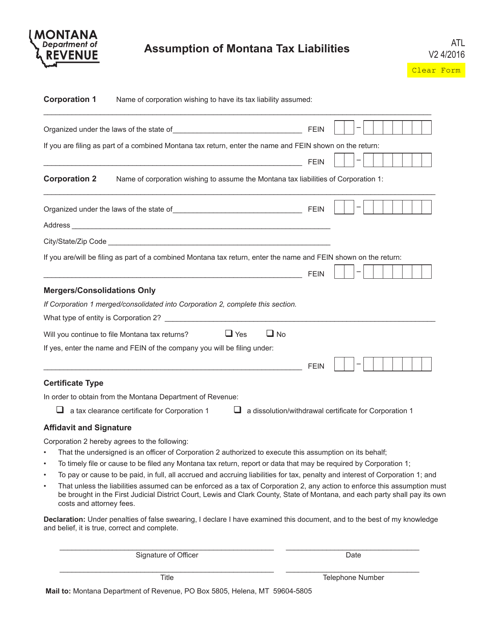

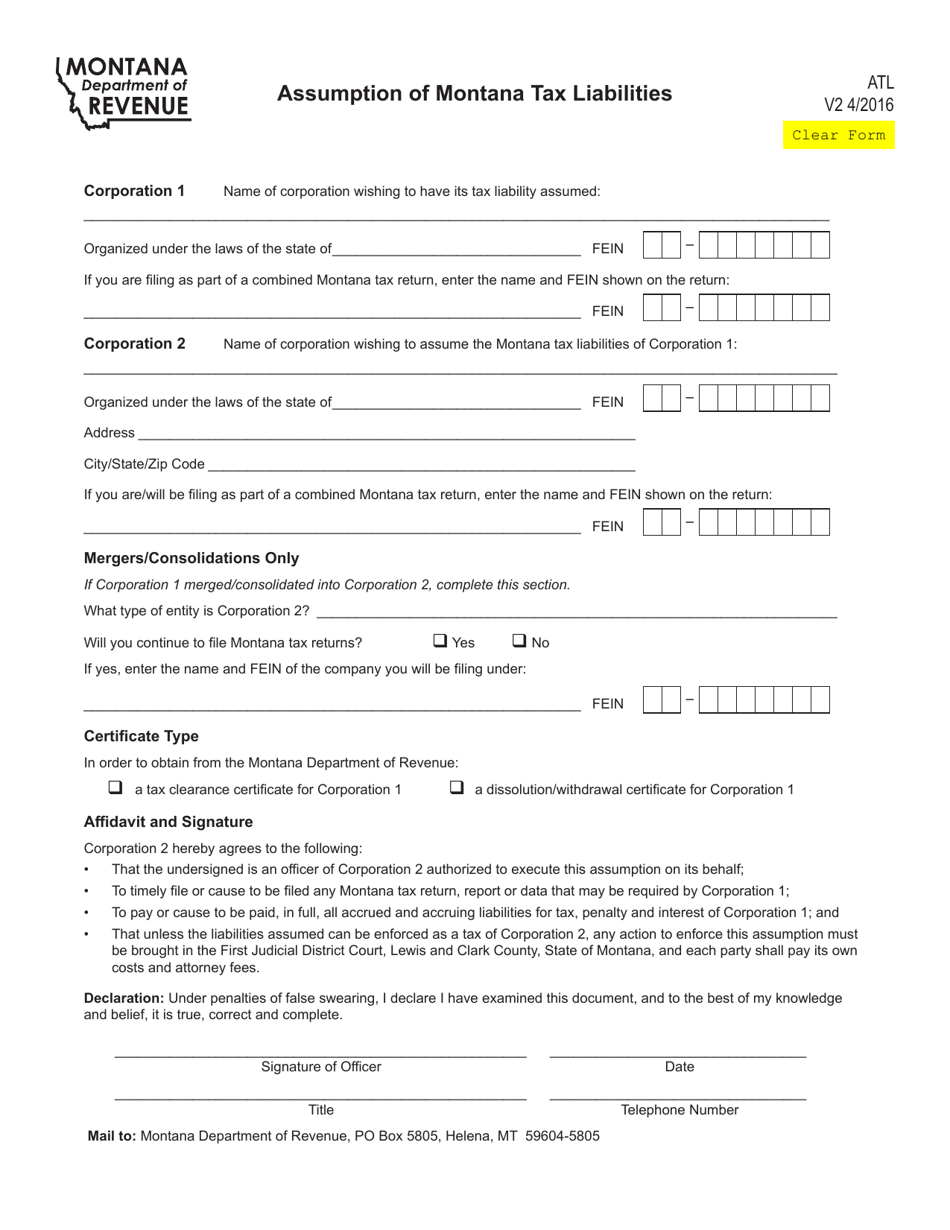

Form ATL Assumption of Montana Tax Liabilities - Montana

What Is Form ATL?

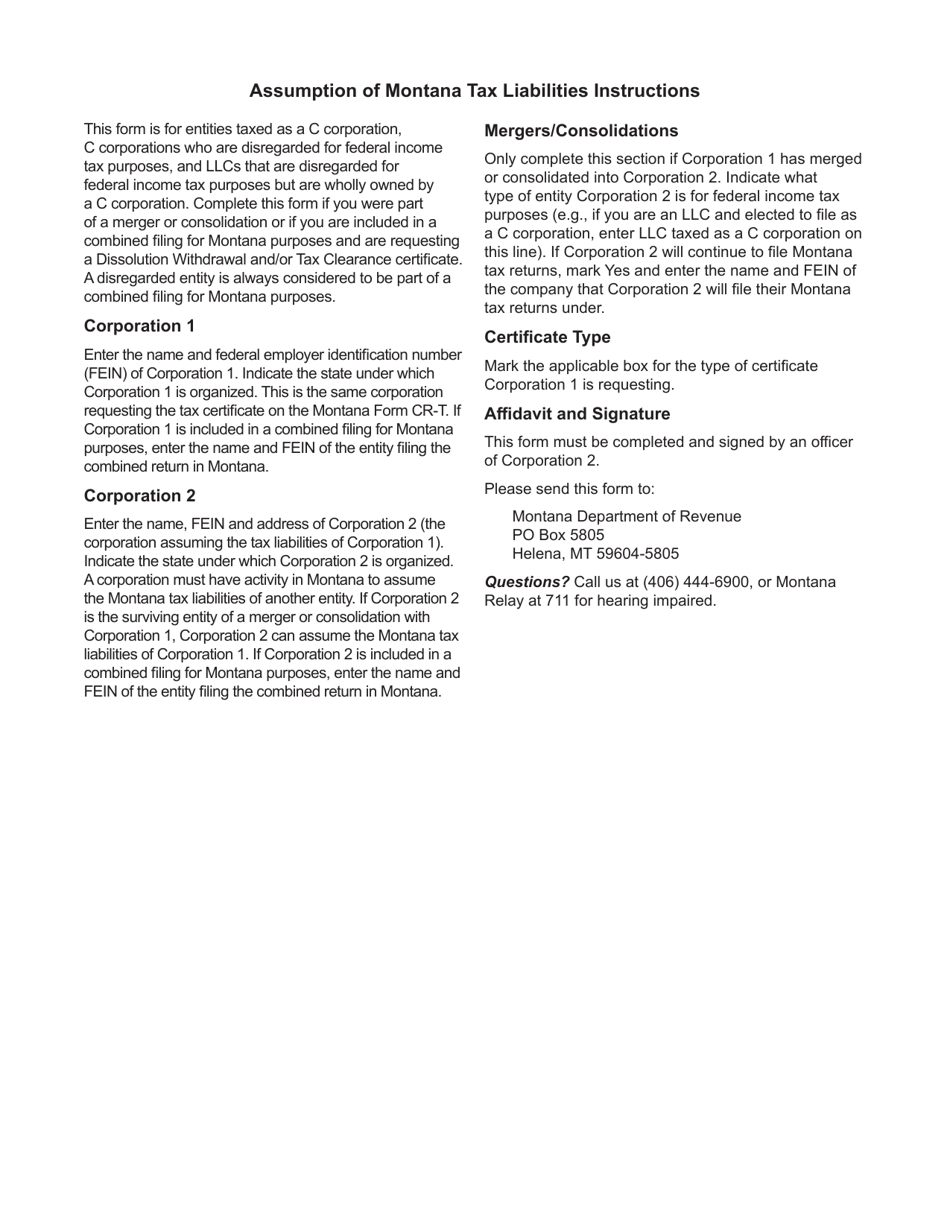

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the ATL Assumption of Montana Tax Liabilities form?

A: The ATL Assumption of Montana Tax Liabilities form is a document that allows one party to assume the tax liabilities of another party in Montana.

Q: Who can use the ATL Assumption of Montana Tax Liabilities form?

A: Anyone who wishes to assume another party's tax liabilities in Montana can use this form.

Q: Is the ATL Assumption of Montana Tax Liabilities form mandatory?

A: No, it is not mandatory. It is a voluntary form that parties can use if they wish to assume tax liabilities.

Q: What information is required on the ATL Assumption of Montana Tax Liabilities form?

A: The form typically requires information about the parties involved, details of the tax liabilities being assumed, and any relevant signatures.

Q: Are there any fees associated with filing the ATL Assumption of Montana Tax Liabilities form?

A: There may be a fee associated with filing the form. You should check with the Montana Department of Revenue for specific fee information.

Q: What should I do after completing the ATL Assumption of Montana Tax Liabilities form?

A: After completing the form, you should submit it to the Montana Department of Revenue for processing.

Q: Can I cancel or revoke the ATL Assumption of Montana Tax Liabilities form?

A: Yes, you can cancel or revoke the form by notifying the Montana Department of Revenue in writing.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ATL by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.