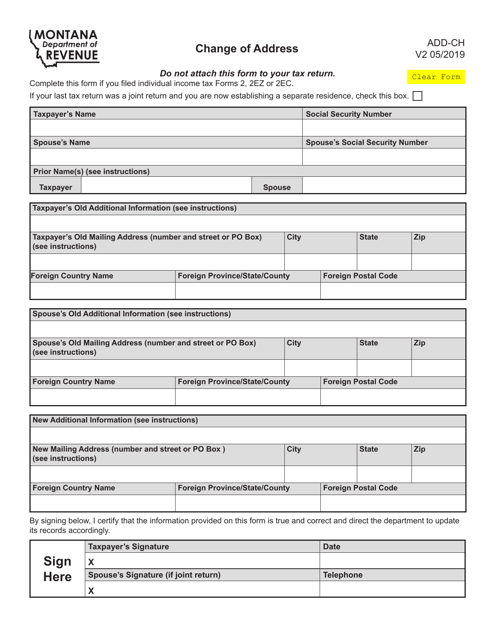

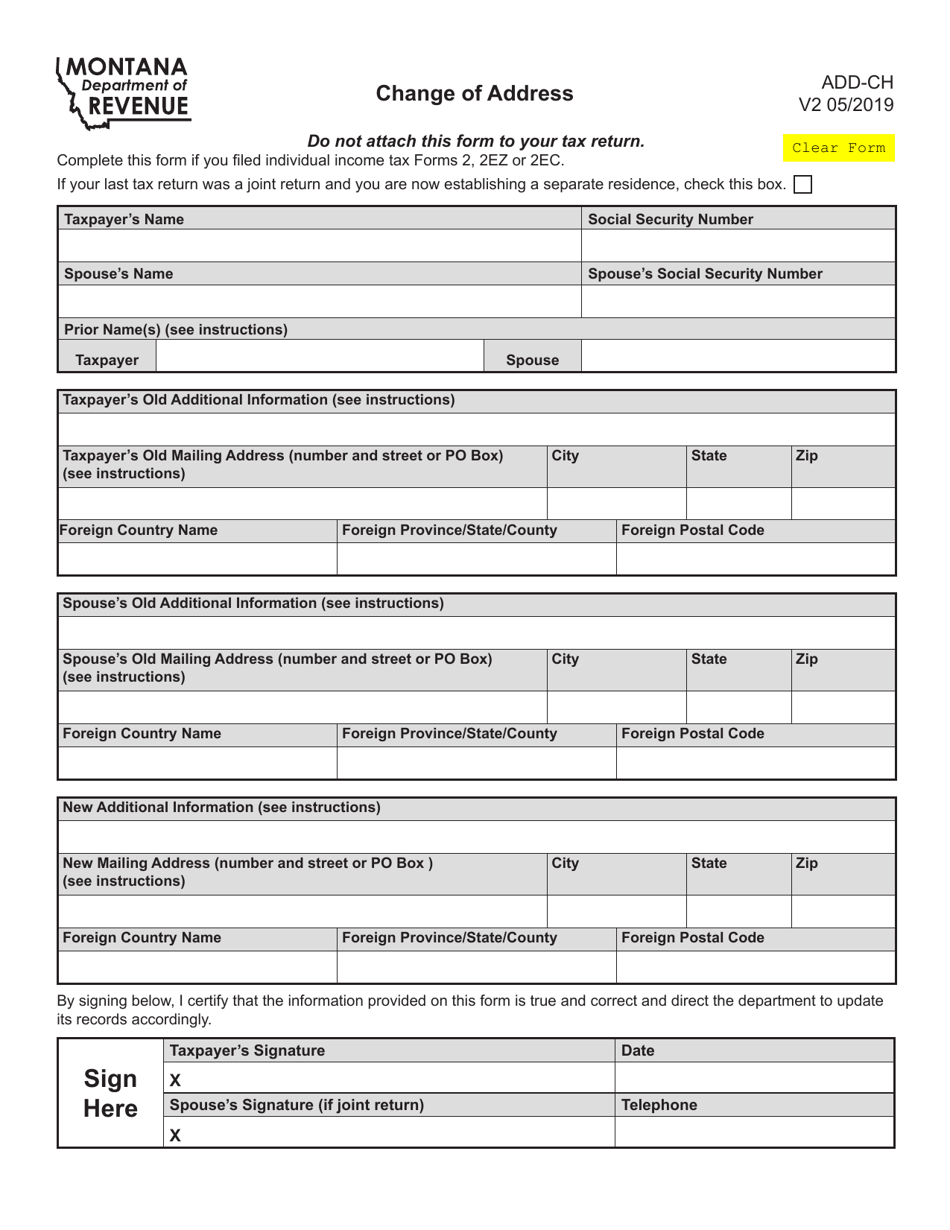

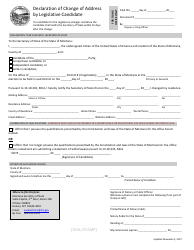

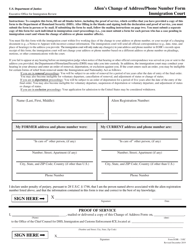

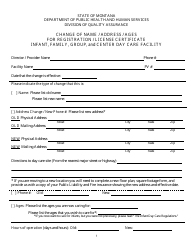

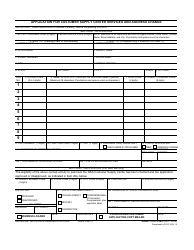

Form ADD-CH Change of Address - Montana

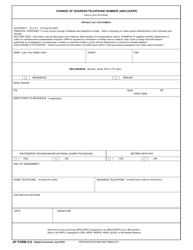

What Is Form ADD-CH?

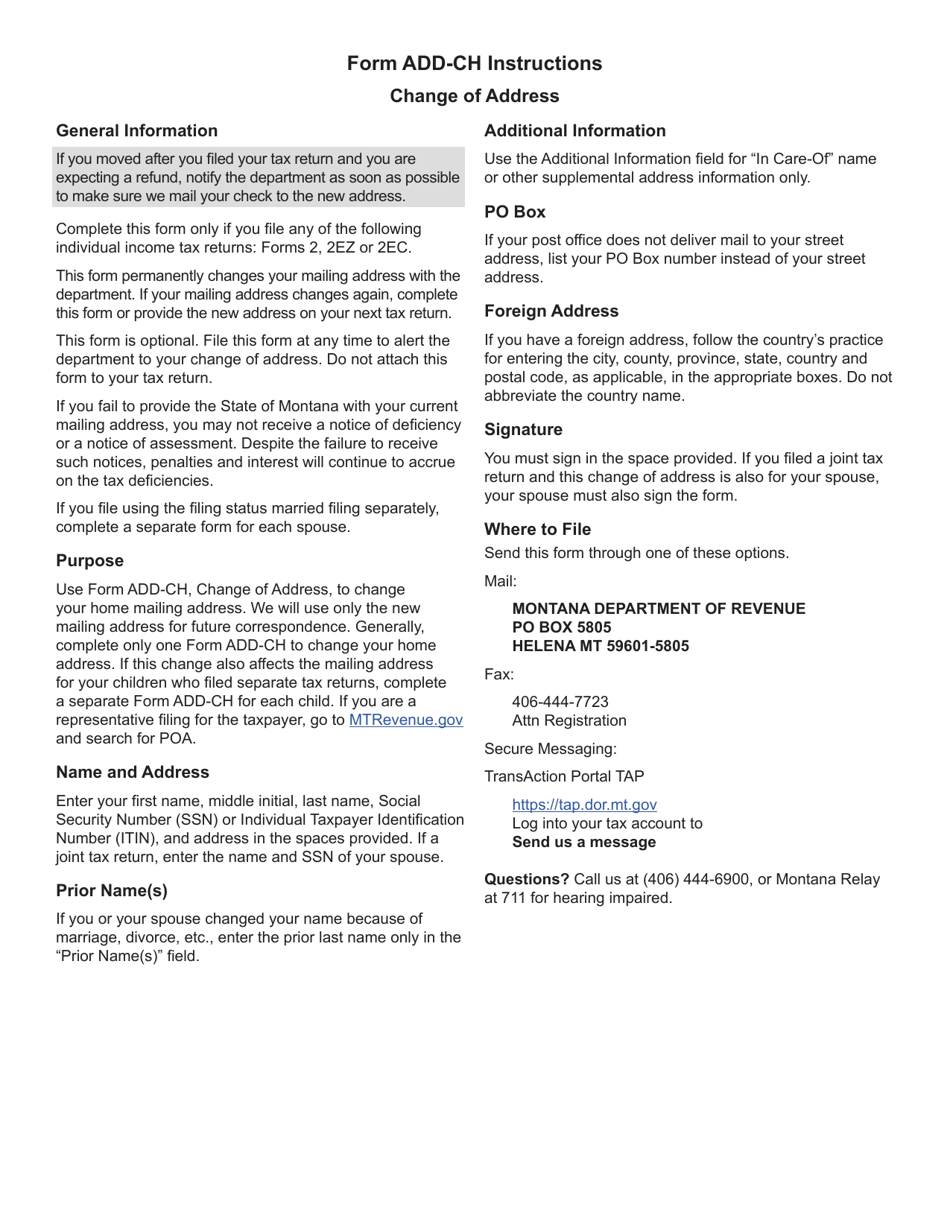

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADD-CH?

A: Form ADD-CH is the Change of Address form for Montana.

Q: How do I use Form ADD-CH?

A: Form ADD-CH is used to change your address in Montana.

Q: Can I use Form ADD-CH to change my address in other states?

A: No, Form ADD-CH is specifically for changing your address in Montana.

Q: Do I need to pay a fee to submit Form ADD-CH?

A: No, there is no fee to submit Form ADD-CH.

Q: What information do I need to provide on Form ADD-CH?

A: You will need to provide your old address, new address, and your name.

Q: How long does it take to process Form ADD-CH?

A: Processing times vary, but it typically takes a few weeks to update your address.

Q: What should I do after submitting Form ADD-CH?

A: After submitting Form ADD-CH, make sure to update your address with other relevant organizations, such as your employer, banks, and insurance providers.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADD-CH by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.