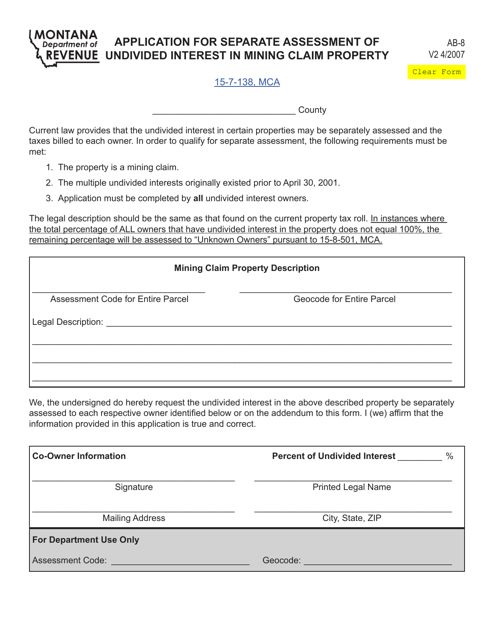

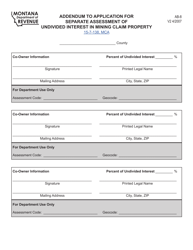

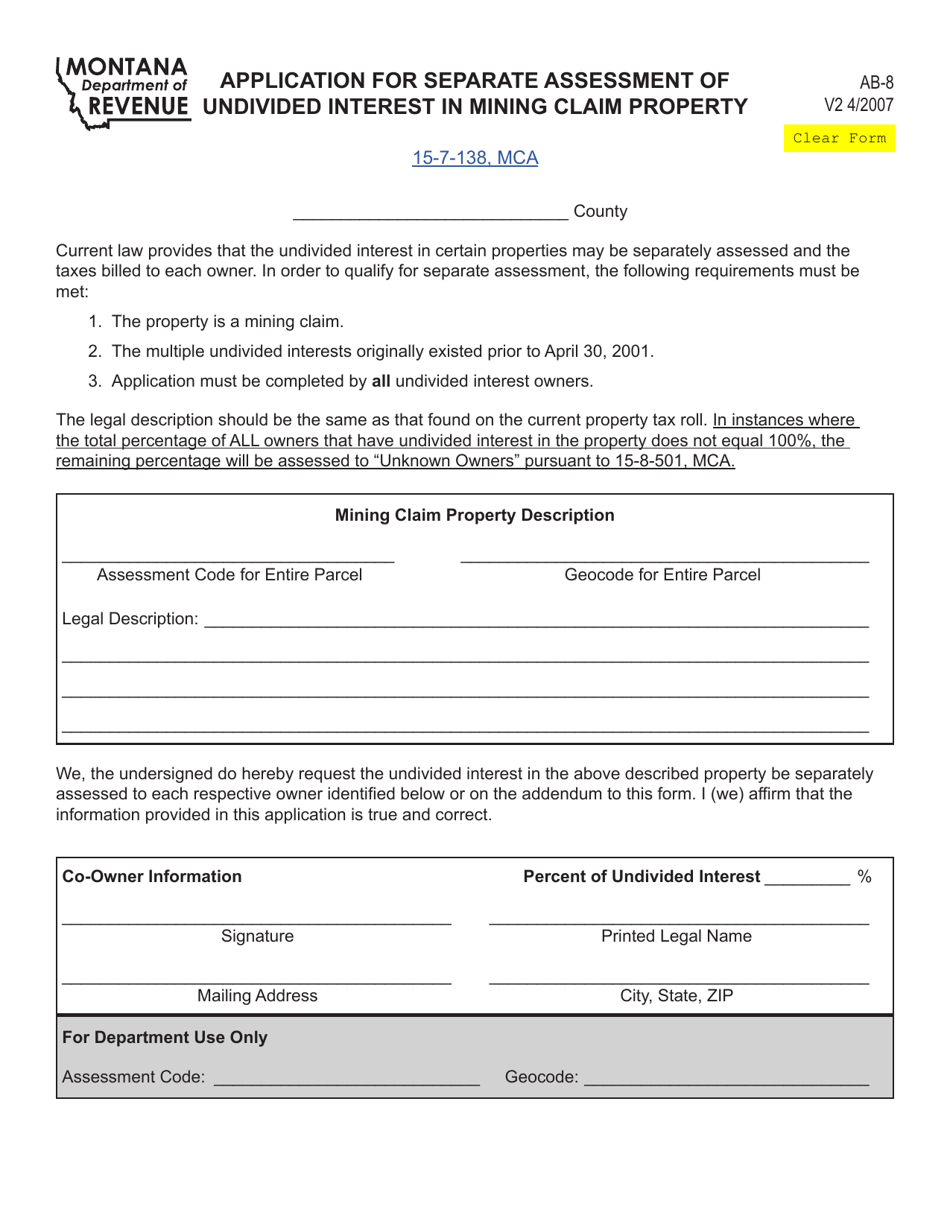

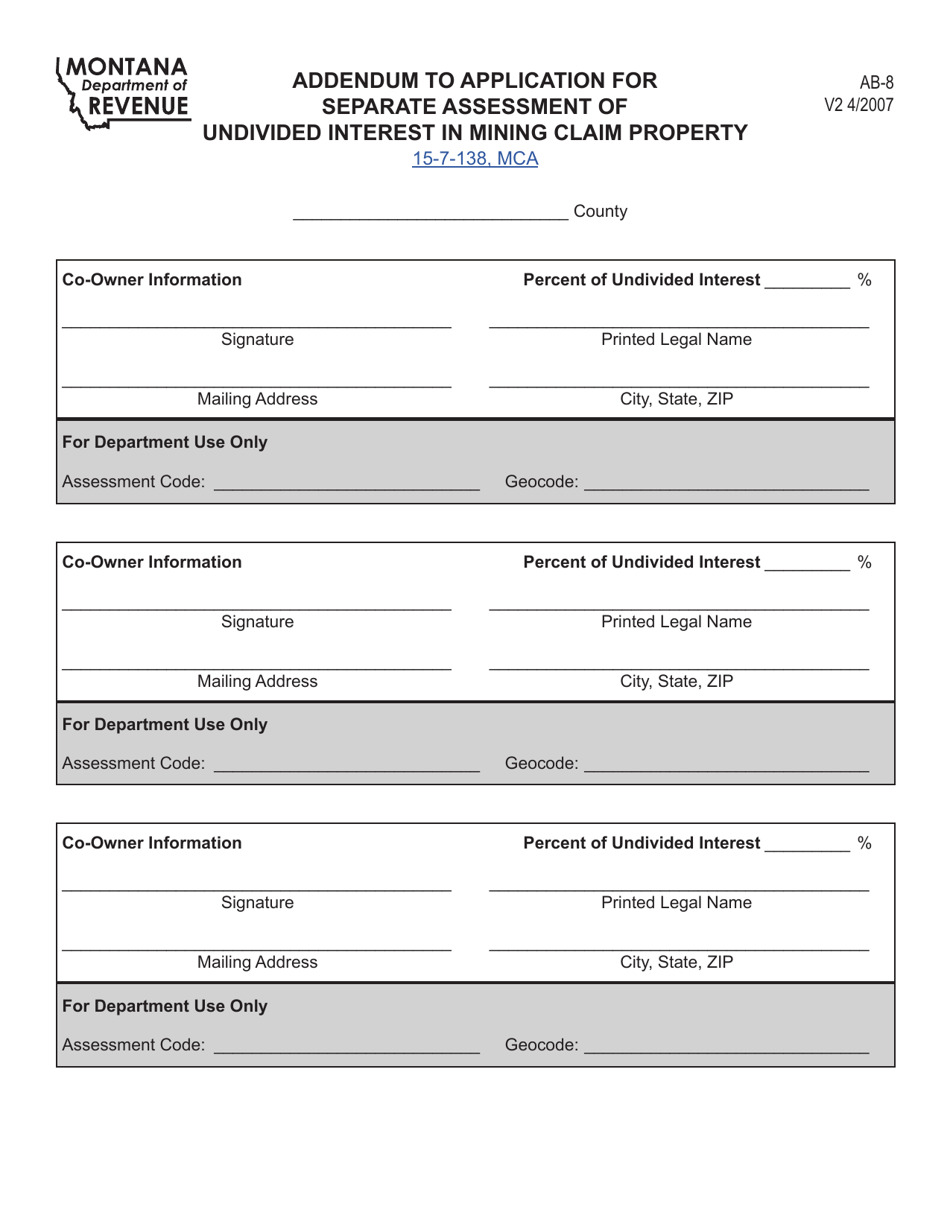

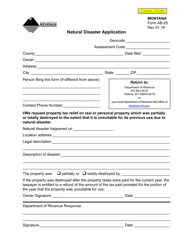

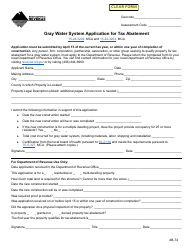

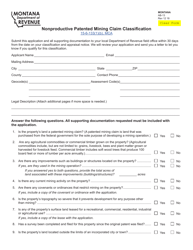

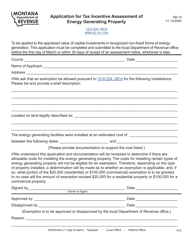

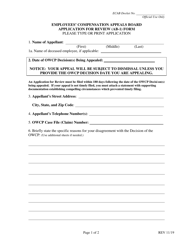

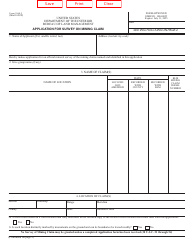

Form AB-8 Application for Separate Assessment of Undivided Interest in Mining Claim Property - Montana

What Is Form AB-8?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AB-8?

A: Form AB-8 is an application for separate assessment of undivided interest in mining claim property in Montana.

Q: What is the purpose of Form AB-8?

A: The purpose of Form AB-8 is to request separate assessment of undivided interest in mining claim property.

Q: Who should use Form AB-8?

A: Form AB-8 should be used by individuals or entities who want to request separate assessment of undivided interest in mining claim property.

Q: What is a mining claim property?

A: A mining claim property is a tract of land that has been claimed by individuals or entities for the purpose of mining valuable minerals.

Q: What does 'undivided interest' mean?

A: Undivided interest refers to ownership rights or shares in a property that are not divided or separated.

Q: Why would someone want separate assessment of undivided interest in mining claim property?

A: Separate assessment of undivided interest allows the owner to be taxed based on their share of the property's value, rather than the entire property.

Q: Are there any fees associated with filing Form AB-8?

A: Please check the instructions accompanying the form for any applicable fees or contact the Montana Department of Revenue for more information.

Q: What is the deadline for filing Form AB-8?

A: The deadline for filing Form AB-8 may vary depending on Montana's tax laws. It is recommended to check the instructions or contact the Montana Department of Revenue for the specific deadline.

Q: Is Form AB-8 only applicable to residents of Montana?

A: Yes, Form AB-8 is specifically designed for individuals or entities with mining claim property in Montana.

Form Details:

- Released on April 1, 2007;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AB-8 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.