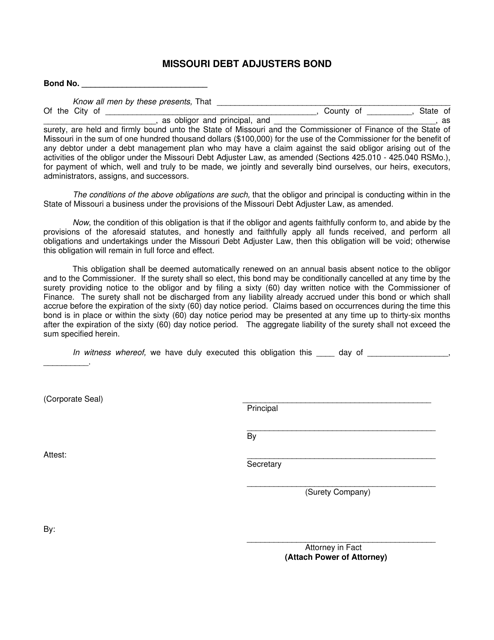

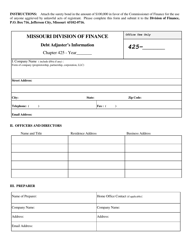

Missouri Debt Adjusters Bond - Missouri

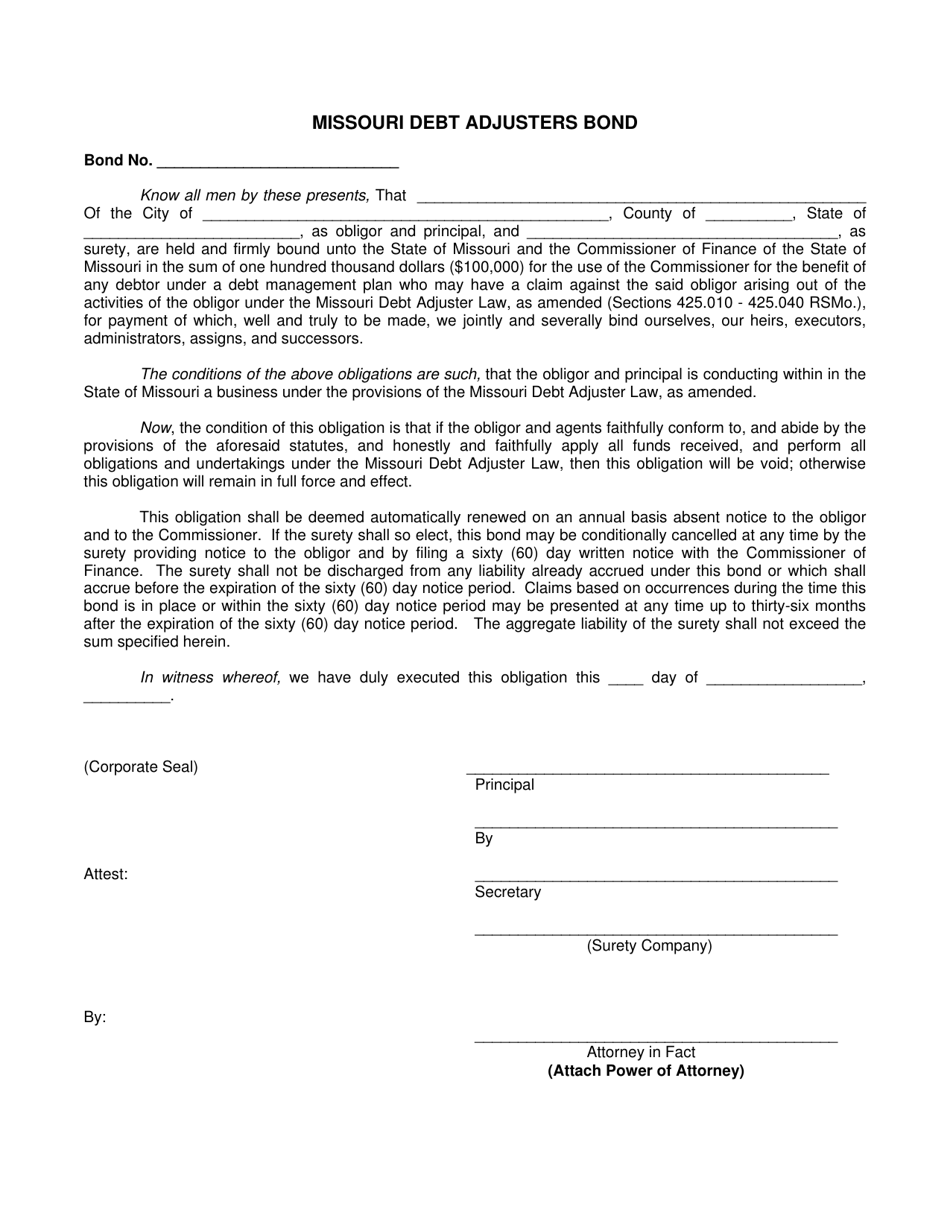

Missouri Debt Adjusters Bond is a legal document that was released by the Missouri Division of Finance - a government authority operating within Missouri.

FAQ

Q: What is a Missouri Debt Adjusters Bond?

A: A Missouri Debt Adjusters Bond is a type of surety bond that debt adjusters in the state of Missouri are required to obtain.

Q: What is a debt adjuster?

A: A debt adjuster is a company or individual that offers debt management services to consumers.

Q: Why do debt adjusters need a bond?

A: Debt adjusters need a bond to provide financial protection to consumers. If a debt adjuster fails to comply with state laws or engages in fraudulent activities, consumers can make a claim against the bond.

Q: How does a Missouri Debt Adjusters Bond work?

A: If a consumer has a valid claim against a debt adjuster, they can file a claim with the bond company. If the claim is found to be valid, the bond company will compensate the consumer.

Q: How much does a Missouri Debt Adjusters Bond cost?

A: The cost of a Missouri Debt Adjusters Bond can vary depending on the creditworthiness of the bond applicant. However, a common range for bond amounts is between $25,000 and $100,000.

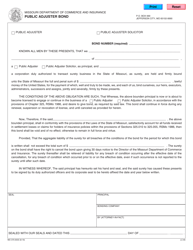

Form Details:

- The latest edition currently provided by the Missouri Division of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Division of Finance.