This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

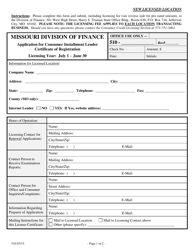

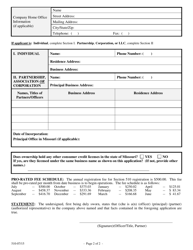

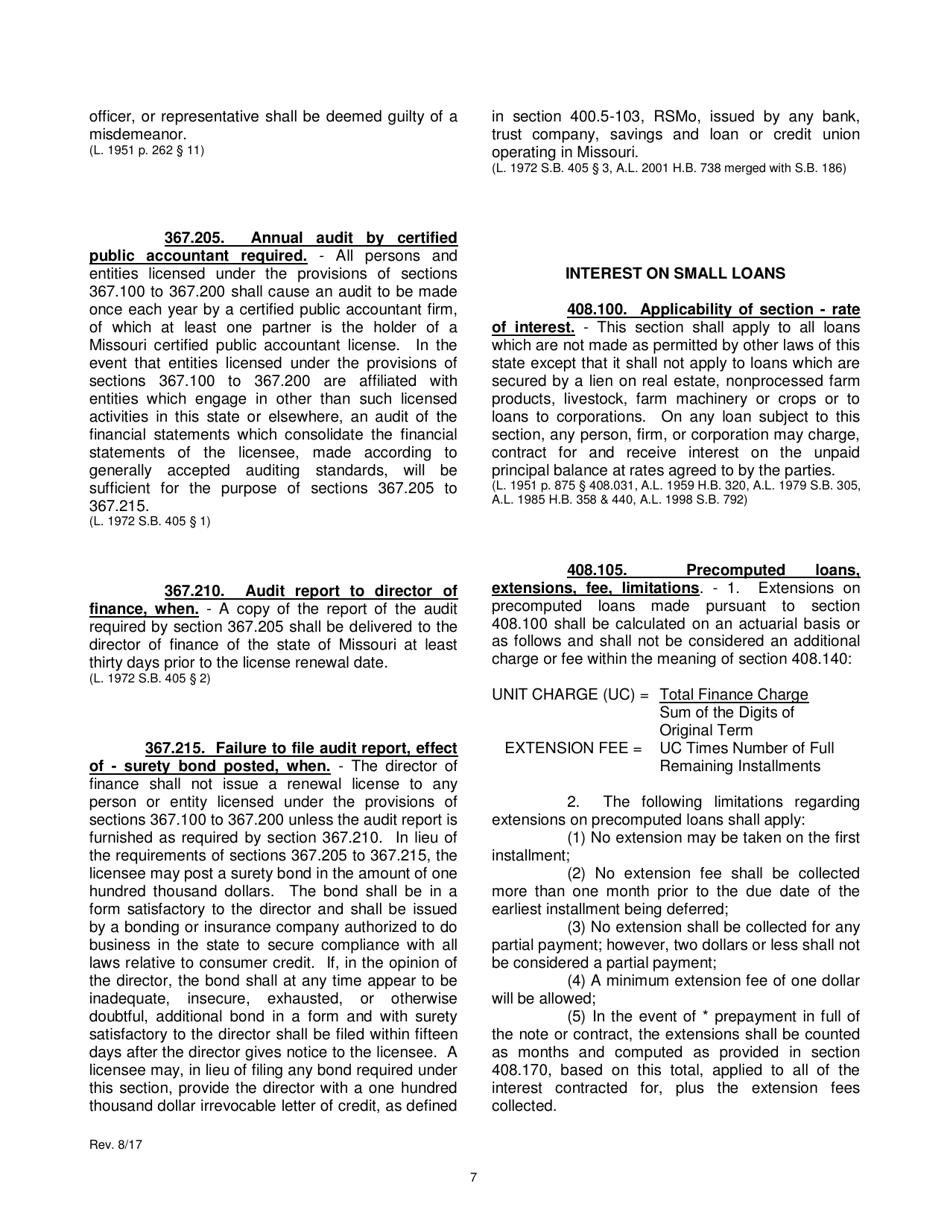

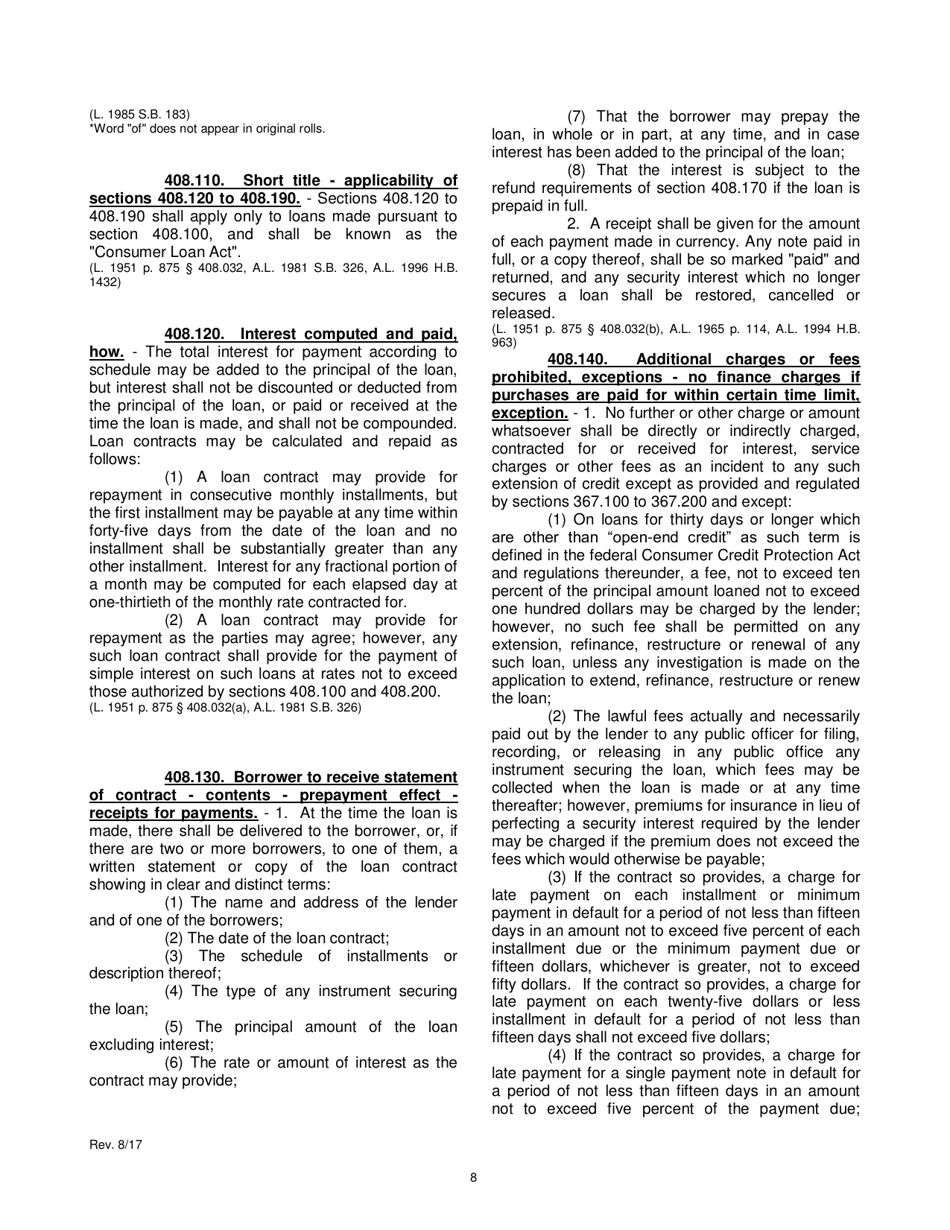

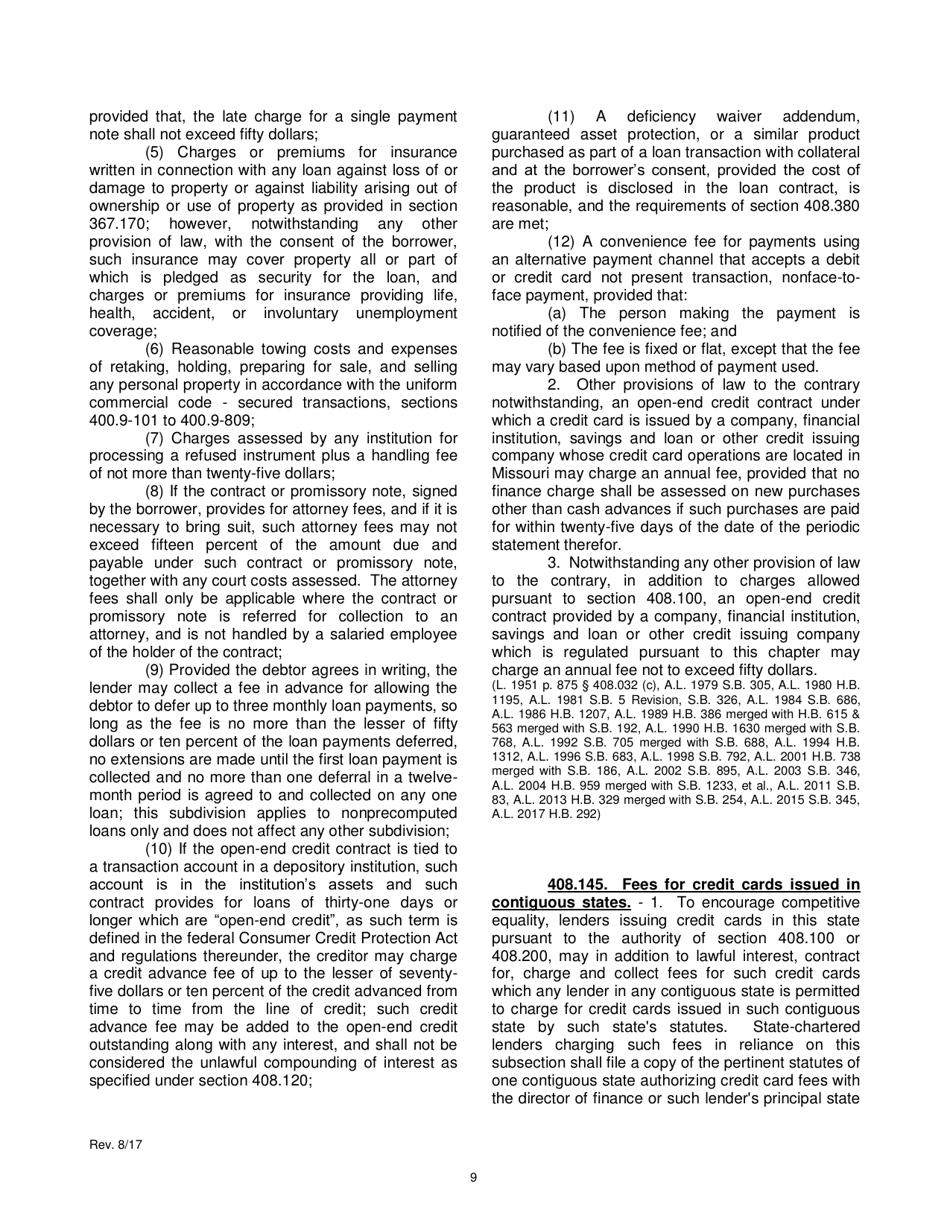

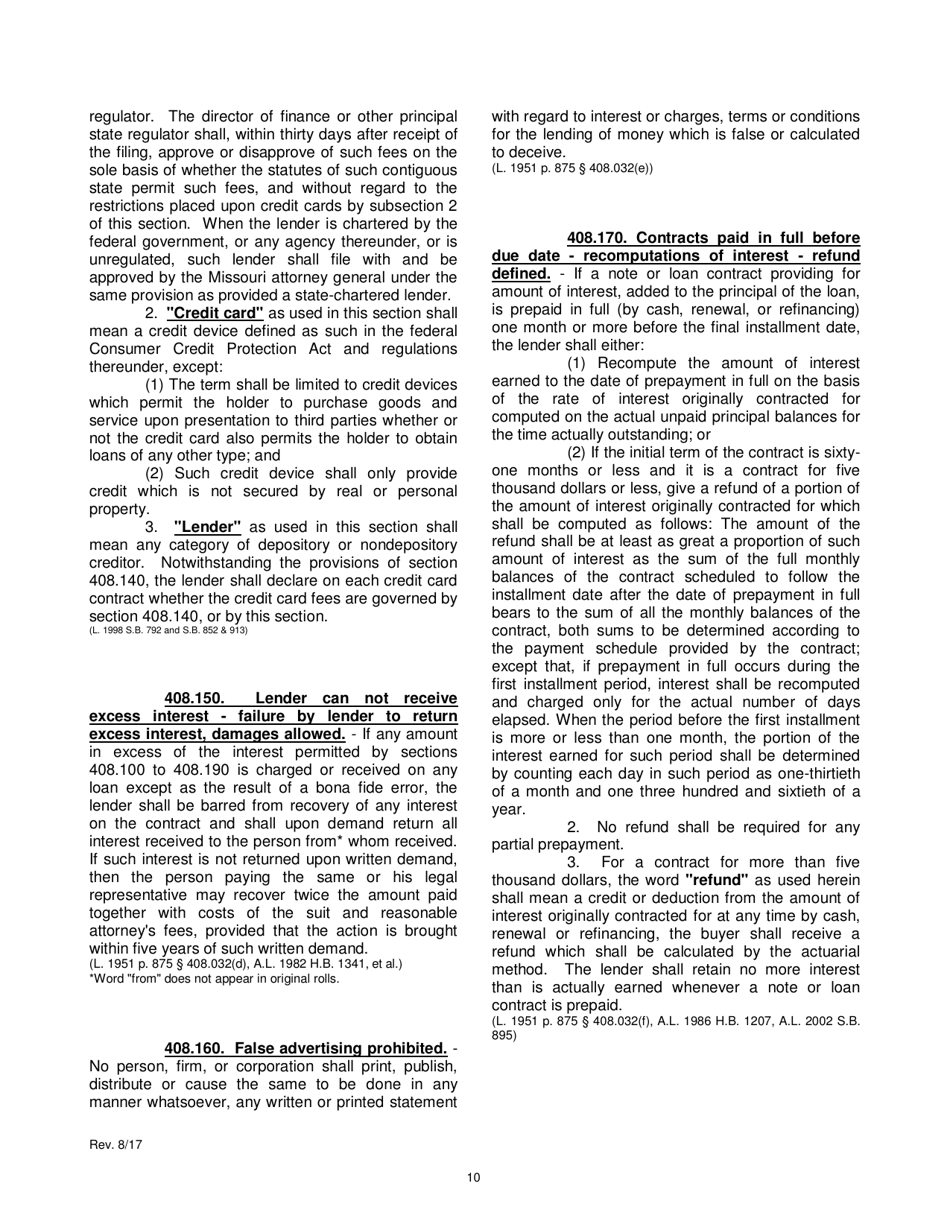

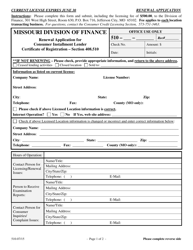

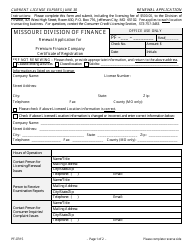

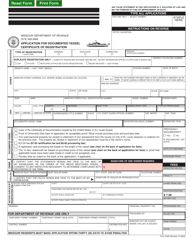

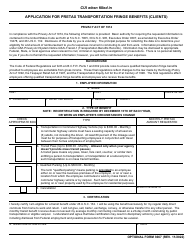

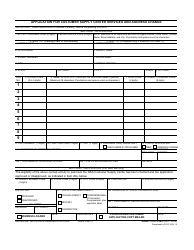

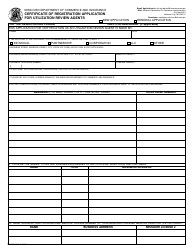

Application for Consumer Installment Lender Certificate of Registration - Missouri

Application for Consumer Installment Lender Certificate of Registration is a legal document that was released by the Missouri Division of Finance - a government authority operating within Missouri.

FAQ

Q: What is a Consumer Installment Lender Certificate of Registration?

A: It is a certificate that allows a company to operate as a consumer installment lender in Missouri.

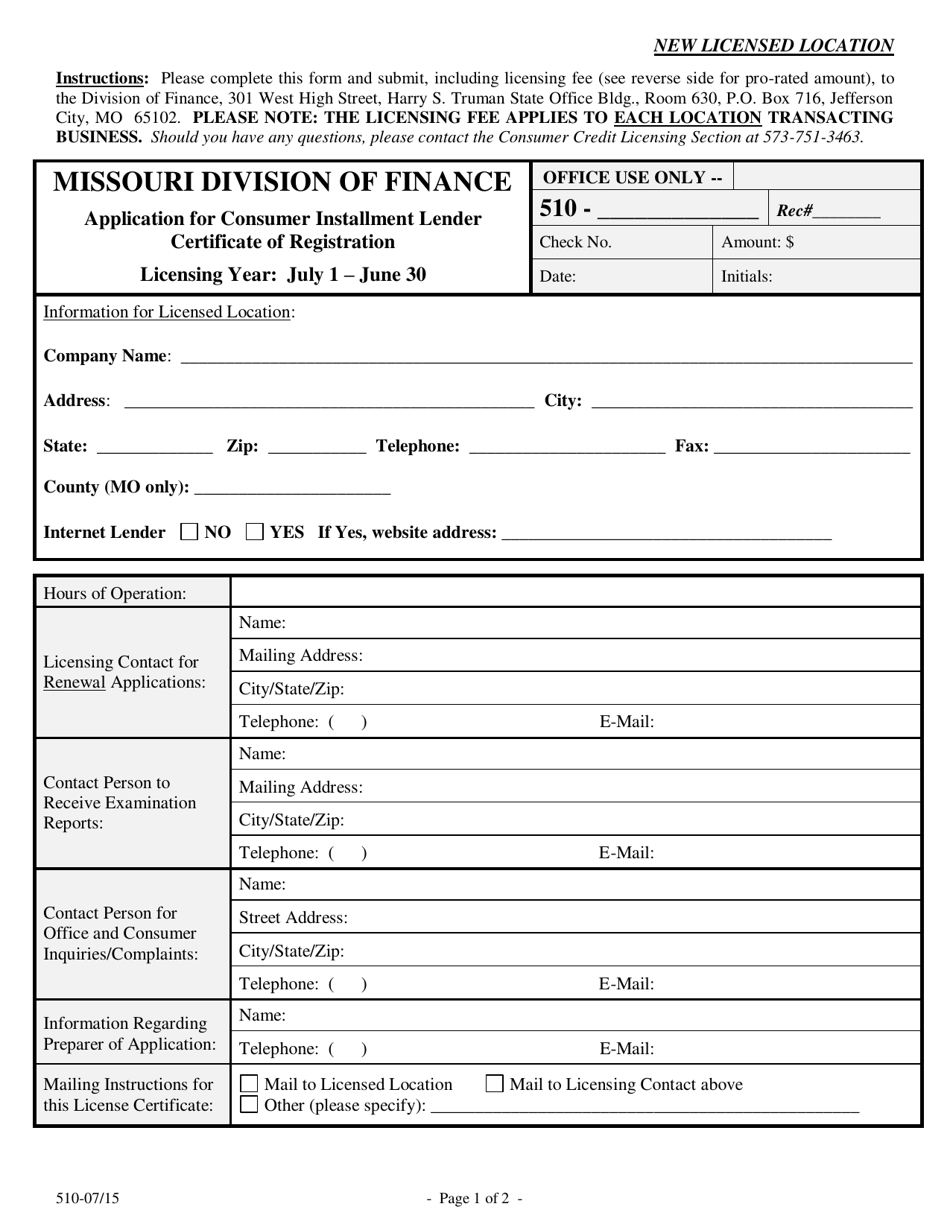

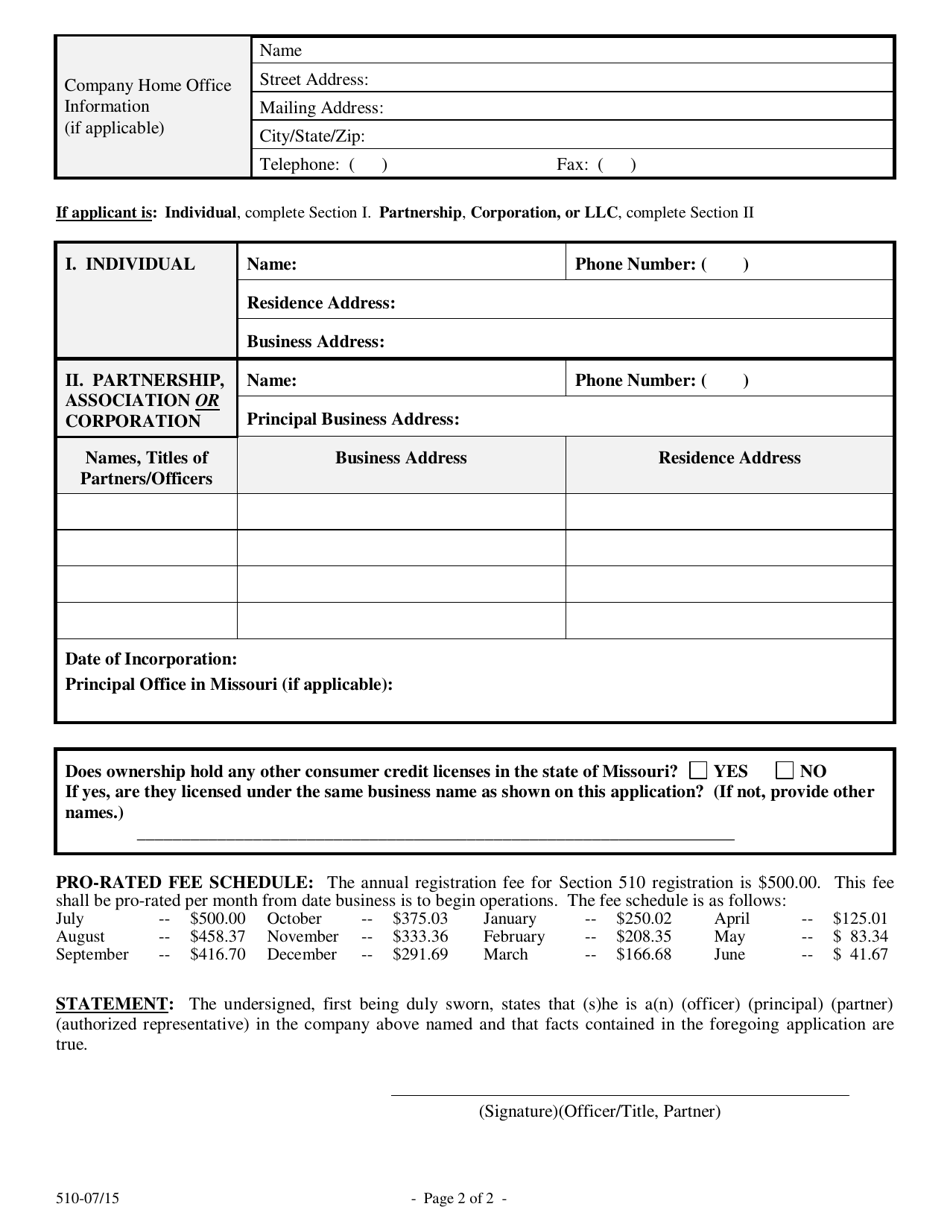

Q: How can I apply for a Consumer Installment Lender Certificate of Registration in Missouri?

A: You can apply by filling out an application form and submitting it to the appropriate regulatory agency in Missouri.

Q: What are the requirements for obtaining a Consumer Installment Lender Certificate of Registration in Missouri?

A: Requirements may include a background check, financial statement submission, and proof of compliance with state regulations.

Q: How long does it take to get a Consumer Installment Lender Certificate of Registration in Missouri?

A: The processing time varies, but it typically takes several weeks to a couple of months.

Q: Can an out-of-state company apply for a Consumer Installment Lender Certificate of Registration in Missouri?

A: Yes, out-of-state companies can apply, but they may need to meet additional requirements.

Q: How much does it cost to apply for a Consumer Installment Lender Certificate of Registration in Missouri?

A: The application fee varies depending on the size and type of the lending institution.

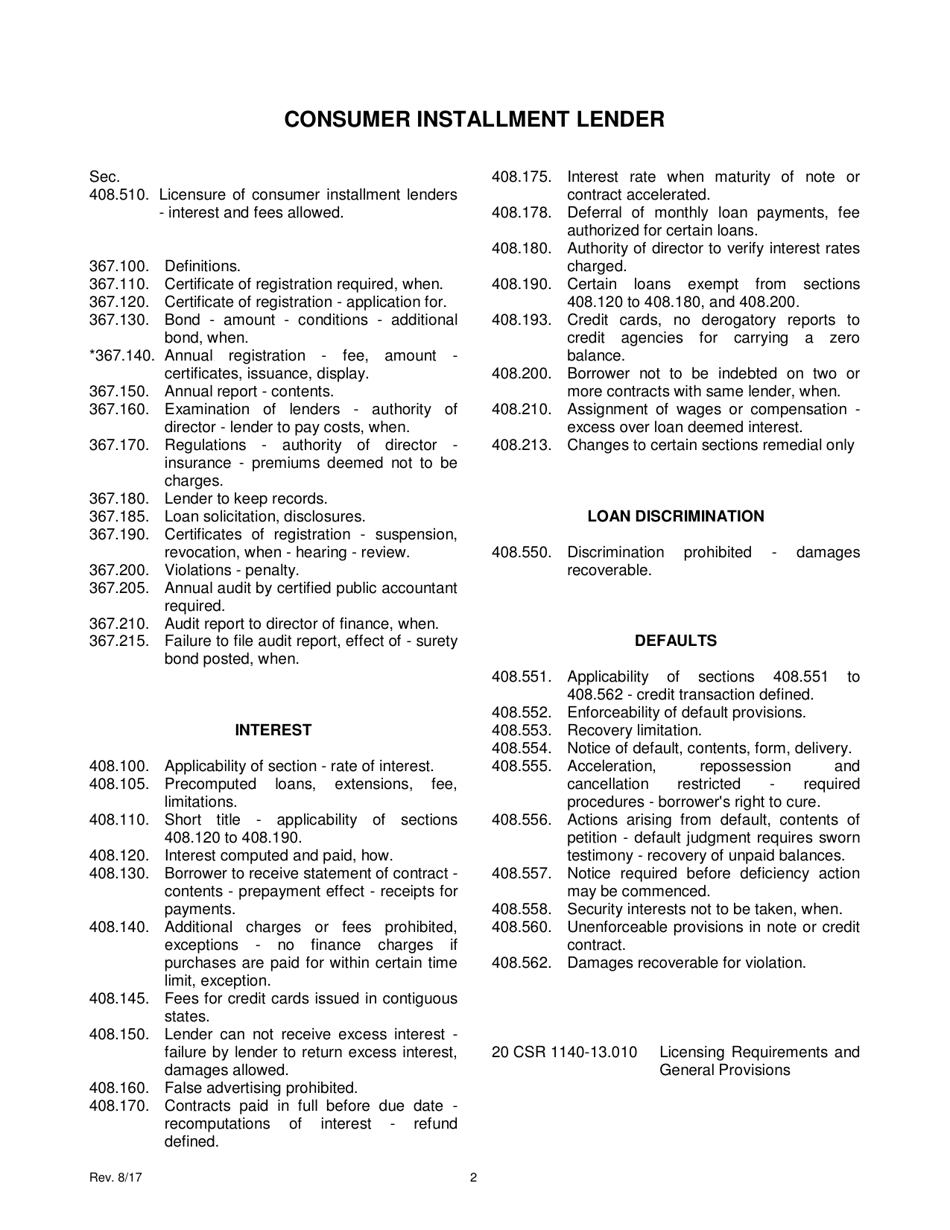

Q: What are the responsibilities of a consumer installment lender in Missouri?

A: Responsibilities include complying with state lending laws, providing accurate loan information, and maintaining proper records.

Q: Do consumer installment lenders in Missouri have any consumer protection regulations?

A: Yes, Missouri has consumer protection laws that govern the lending practices of consumer installment lenders.

Q: Are there any restrictions on the interest rates charged by consumer installment lenders in Missouri?

A: Yes, Missouri has regulations on the maximum interest rates that consumer installment lenders can charge.

Q: What happens if a consumer installment lender in Missouri violates the state regulations?

A: Violations can result in penalties, fines, license suspension, or revocation of the Consumer Installment Lender Certificate of Registration.

Form Details:

- Released on August 1, 2017;

- The latest edition currently provided by the Missouri Division of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Division of Finance.