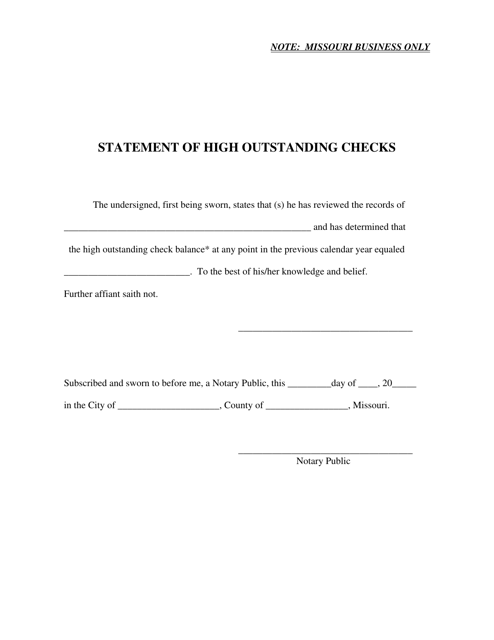

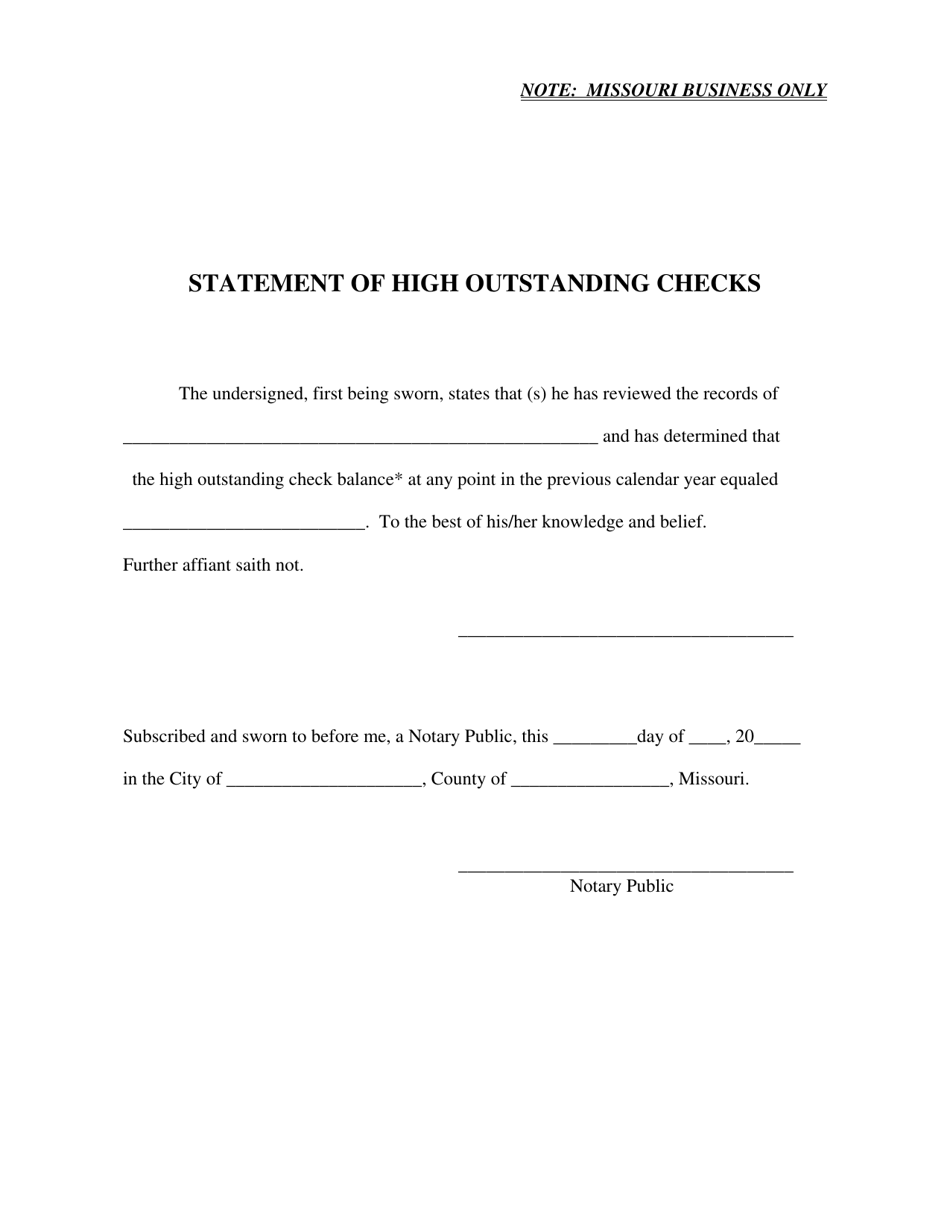

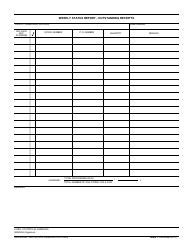

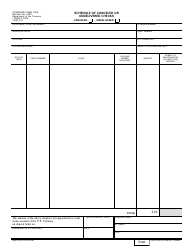

Statement of High Outstanding Checks - Missouri

Statement of High Outstanding Checks is a legal document that was released by the Missouri Division of Finance - a government authority operating within Missouri.

FAQ

Q: What is a Statement of High Outstanding Checks?

A: A Statement of High Outstanding Checks is a document that lists the checks issued by a bank that have not yet been cashed or deposited by the recipients.

Q: Why is a Statement of High Outstanding Checks important?

A: A Statement of High Outstanding Checks helps the bank and the account holder reconcile their records and identify any discrepancies or potential issues with unprocessed checks.

Q: How does a Statement of High Outstanding Checks work?

A: The bank provides the account holder with a list of outstanding checks, including the check number, date, and amount. The account holder can then compare this information with their own records to ensure accuracy.

Q: Who uses a Statement of High Outstanding Checks?

A: The bank and the account holder both use a Statement of High Outstanding Checks to monitor the status of unprocessed checks and maintain accurate financial records.

Q: Can a Statement of High Outstanding Checks help prevent fraud?

A: Yes, a Statement of High Outstanding Checks can help detect potential instances of fraud, such as unauthorized checks being issued or duplicated checks being cashed.

Q: What should I do if I find discrepancies in my Statement of High Outstanding Checks?

A: If you find any discrepancies in your Statement of High Outstanding Checks, you should immediately contact your bank and provide them with the necessary information to investigate and resolve the issue.

Form Details:

- The latest edition currently provided by the Missouri Division of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Division of Finance.