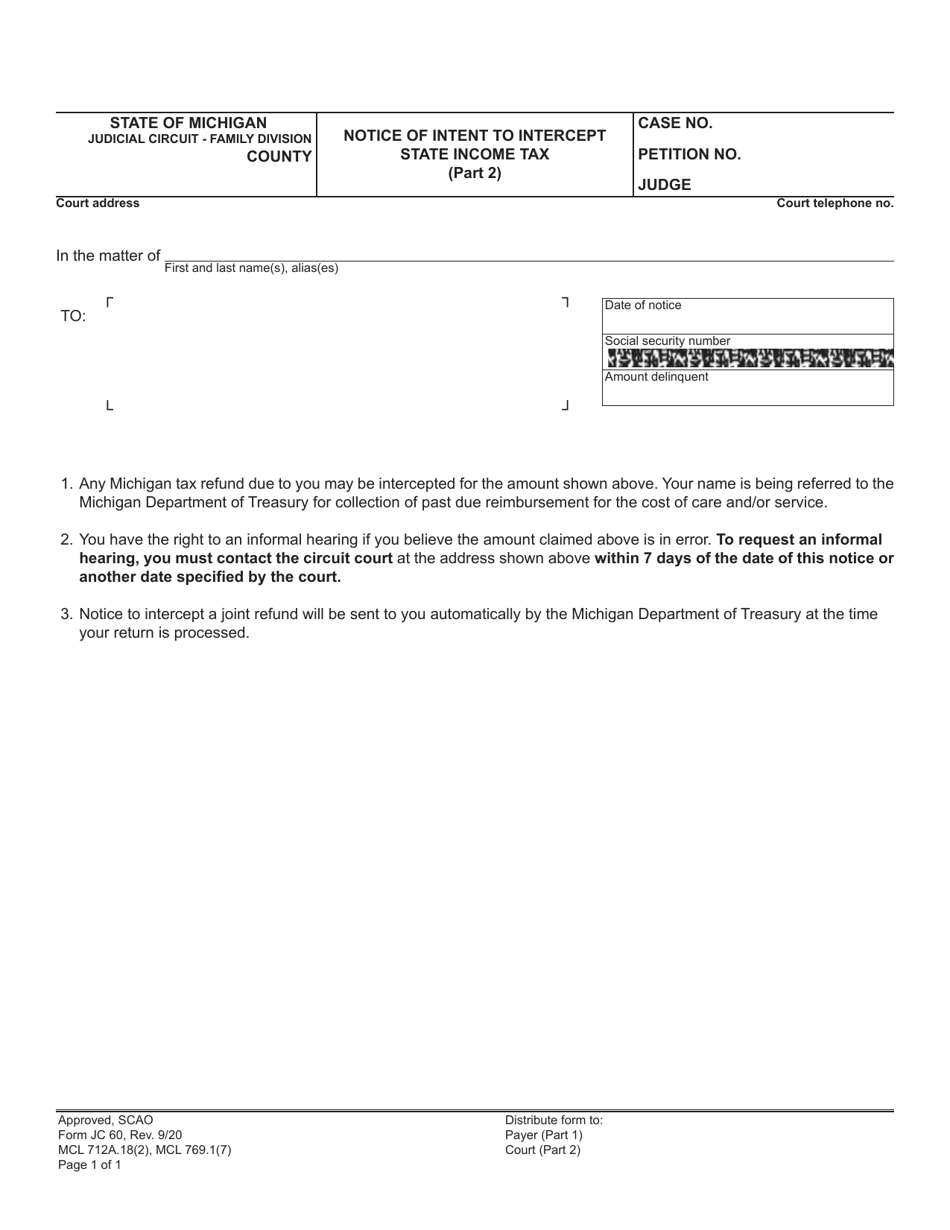

This version of the form is not currently in use and is provided for reference only. Download this version of

Form JC60

for the current year.

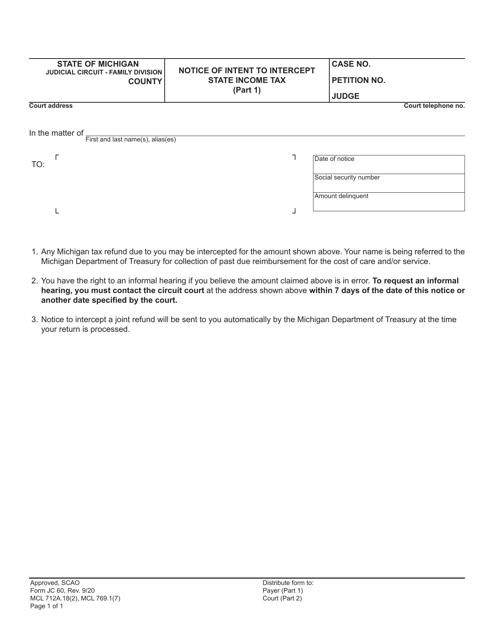

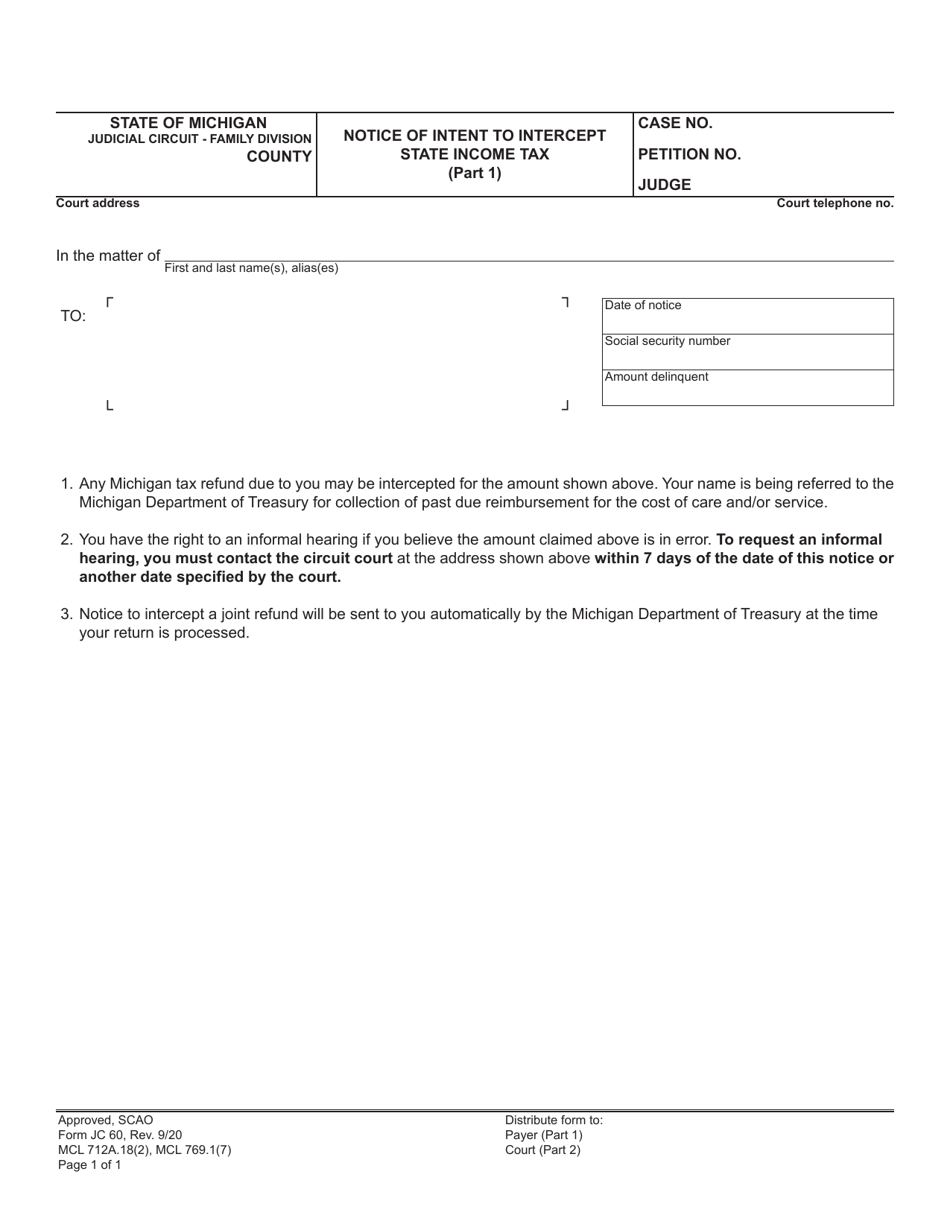

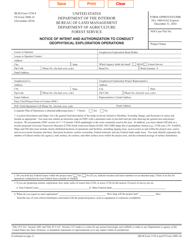

Form JC60 Notice of Intent to Intercept State Income Tax - Michigan

What Is Form JC60?

This is a legal form that was released by the Michigan Juvenile Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form JC60?

A: Form JC60 is a Notice of Intent to Intercept State Income Tax in Michigan.

Q: What is the purpose of Form JC60?

A: The purpose of Form JC60 is to inform a taxpayer that their state income tax refund may be intercepted to repay a debt owed to the state.

Q: Why would a state income tax refund be intercepted?

A: A state income tax refund may be intercepted if the taxpayer owes a debt to the state, such as unpaid taxes, child support, or student loans.

Q: How does the interception process work?

A: If a taxpayer owes a debt to the state and their state income tax refund is intercepted, the refund will be applied to the debt before any remaining funds are issued to the taxpayer.

Q: What should I do if I receive a Form JC60?

A: If you receive a Form JC60, you should review the notice carefully and take any necessary actions, such as contacting the issuing agency or making arrangements to repay the debt.

Q: Can I appeal the interception of my state income tax refund?

A: Yes, you have the right to appeal the interception of your state income tax refund. Contact the issuing agency for more information on the appeals process.

Q: How can I prevent my state income tax refund from being intercepted?

A: To prevent your state income tax refund from being intercepted, make sure to pay any outstanding debts owed to the state, such as taxes, child support, or student loans, in a timely manner.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Michigan Juvenile Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form JC60 by clicking the link below or browse more documents and templates provided by the Michigan Juvenile Court.