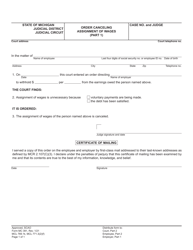

This version of the form is not currently in use and is provided for reference only. Download this version of

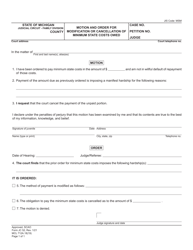

Form JC62

for the current year.

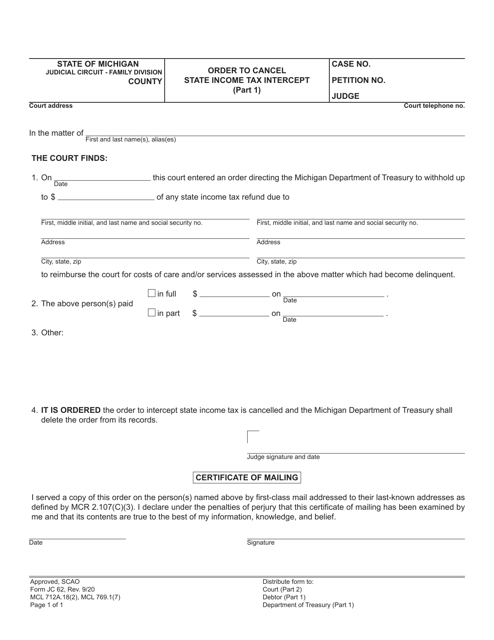

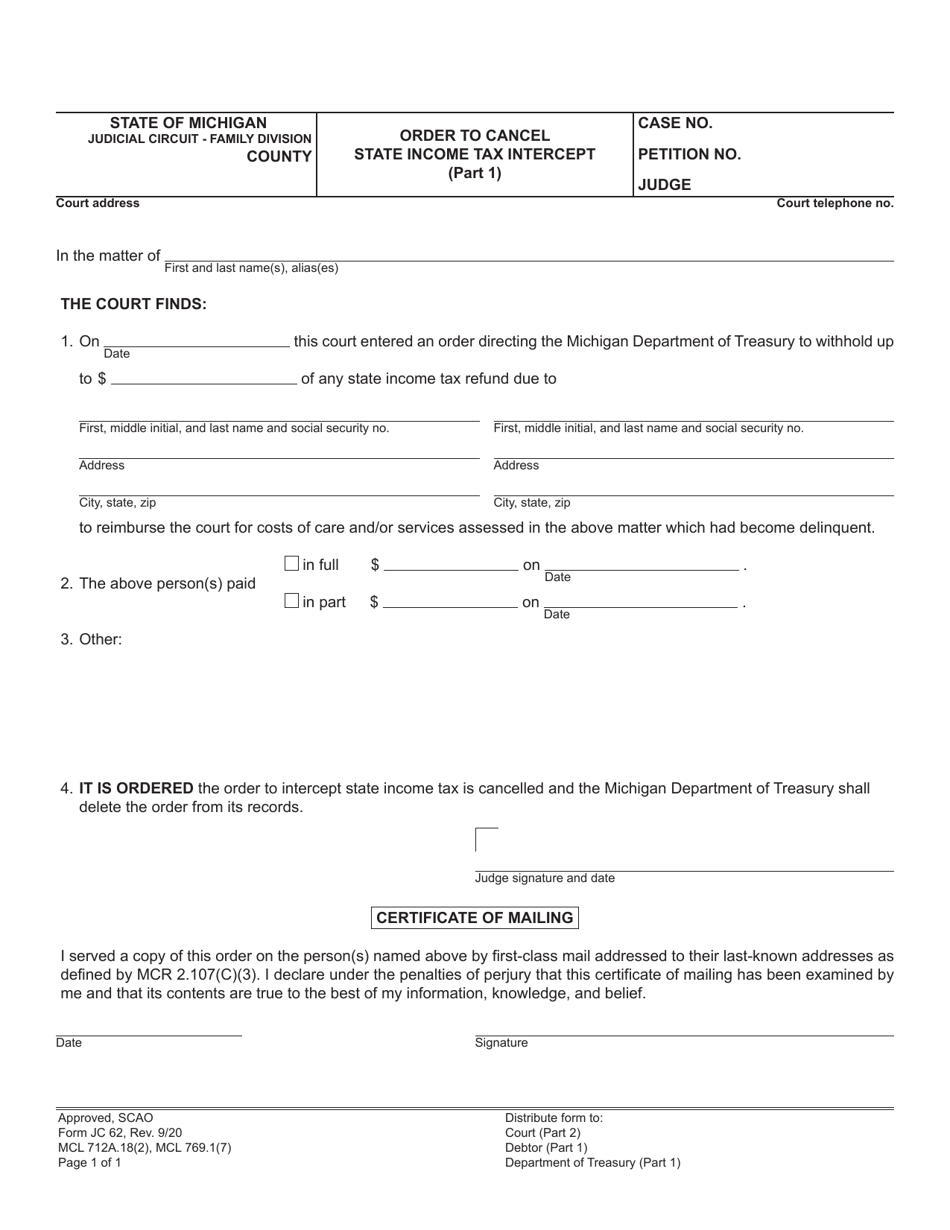

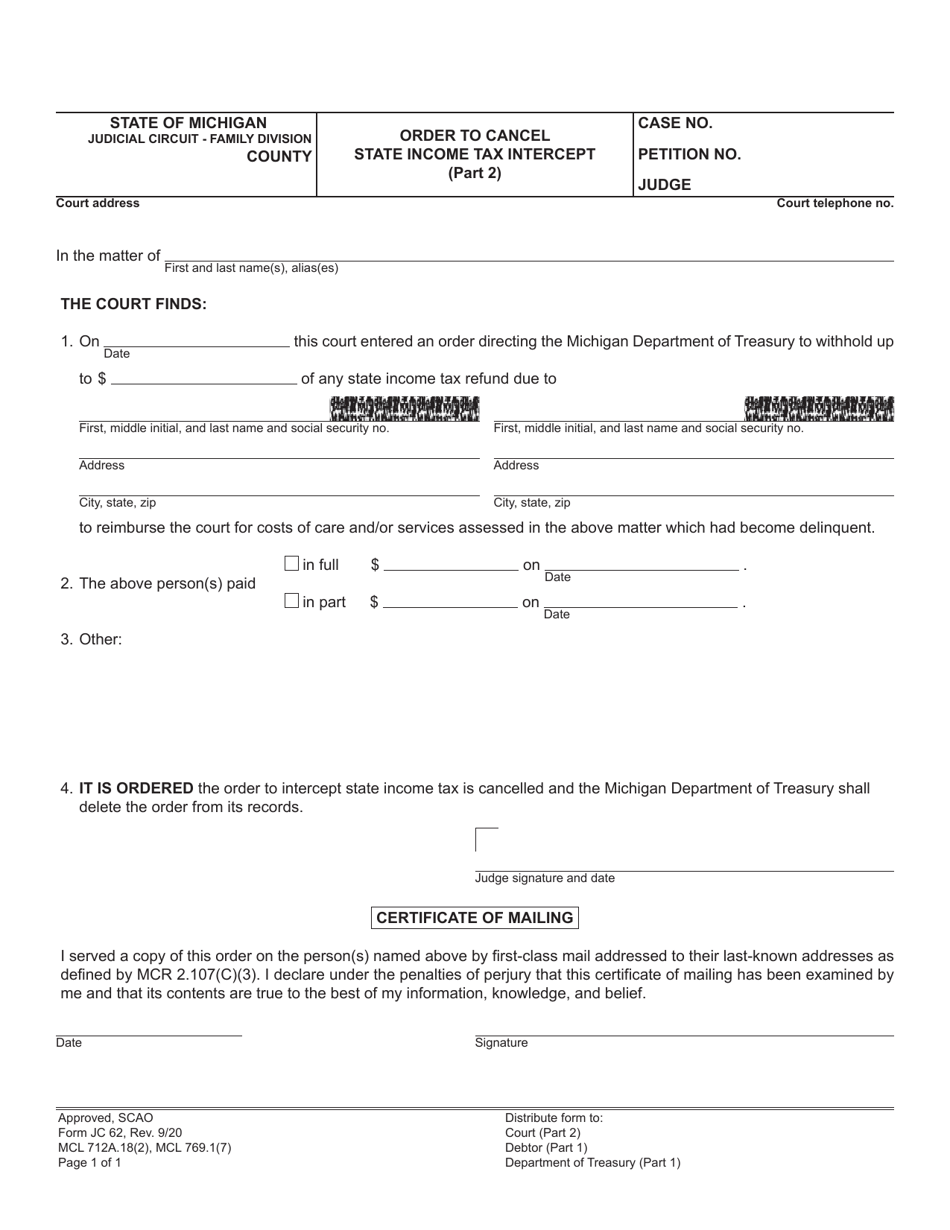

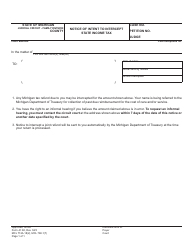

Form JC62 Order to Cancel State Income Tax Intercept - Michigan

What Is Form JC62?

This is a legal form that was released by the Michigan Juvenile Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

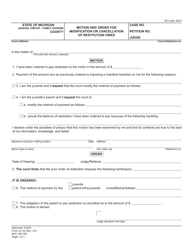

Q: What is a JC62 Order?

A: A JC62 Order is a document used to cancel a state income tax intercept.

Q: What is a state income tax intercept?

A: A state income tax intercept is when a state government withholds a portion of an individual's tax refund to satisfy a debt owed to a state agency or department.

Q: Why would someone need to cancel a state income tax intercept?

A: Someone may need to cancel a state income tax intercept if they believe it was initiated in error, or if they have resolved the debt that led to the intercept.

Q: How can I cancel a state income tax intercept in Michigan?

A: To cancel a state income tax intercept in Michigan, you would need to complete and submit a JC62 Order to the appropriate state agency or department.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Michigan Juvenile Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form JC62 by clicking the link below or browse more documents and templates provided by the Michigan Juvenile Court.