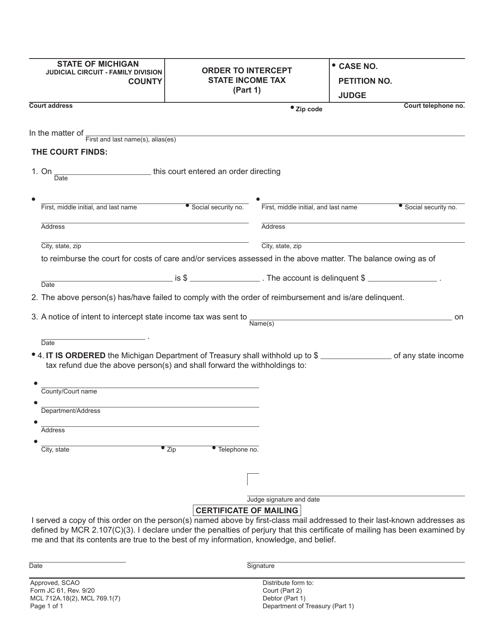

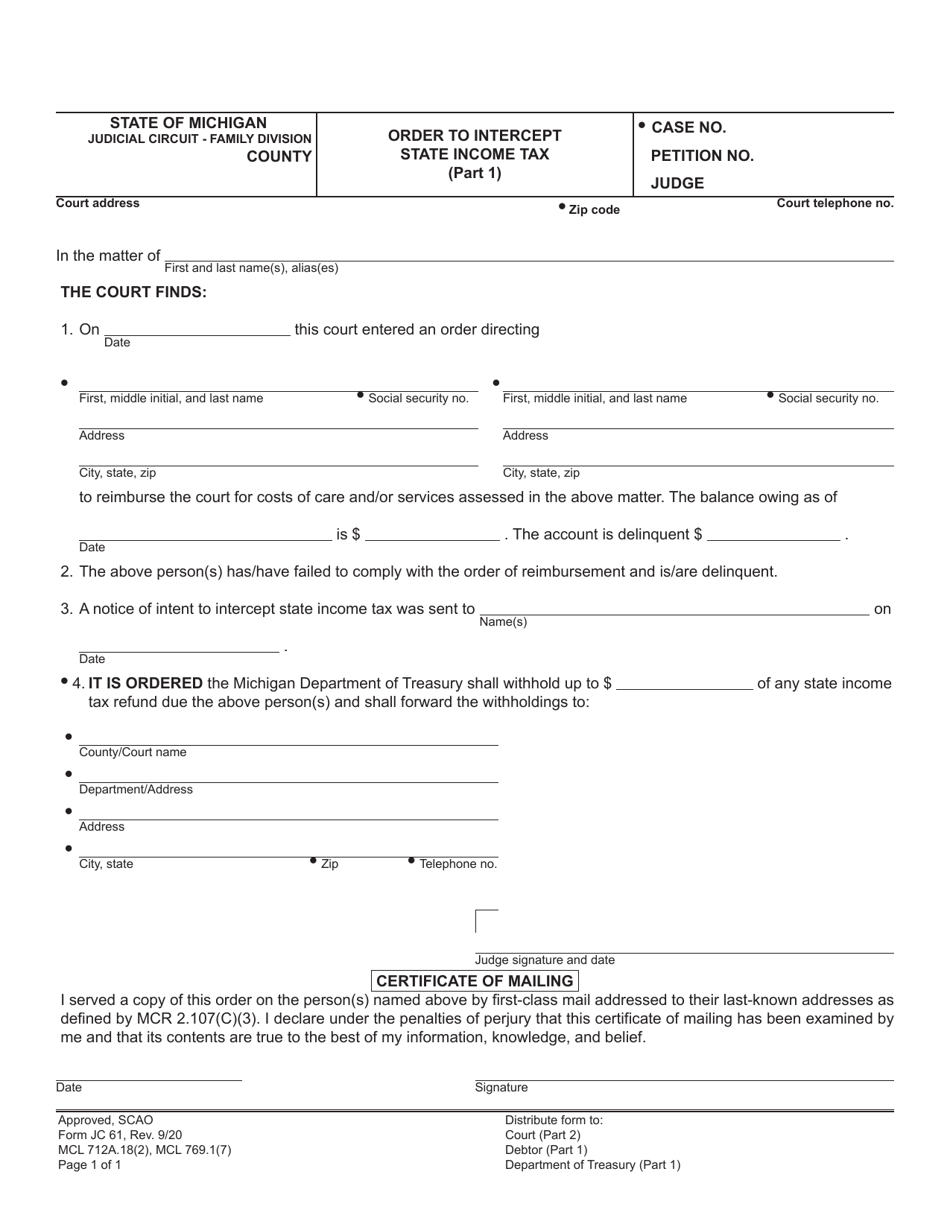

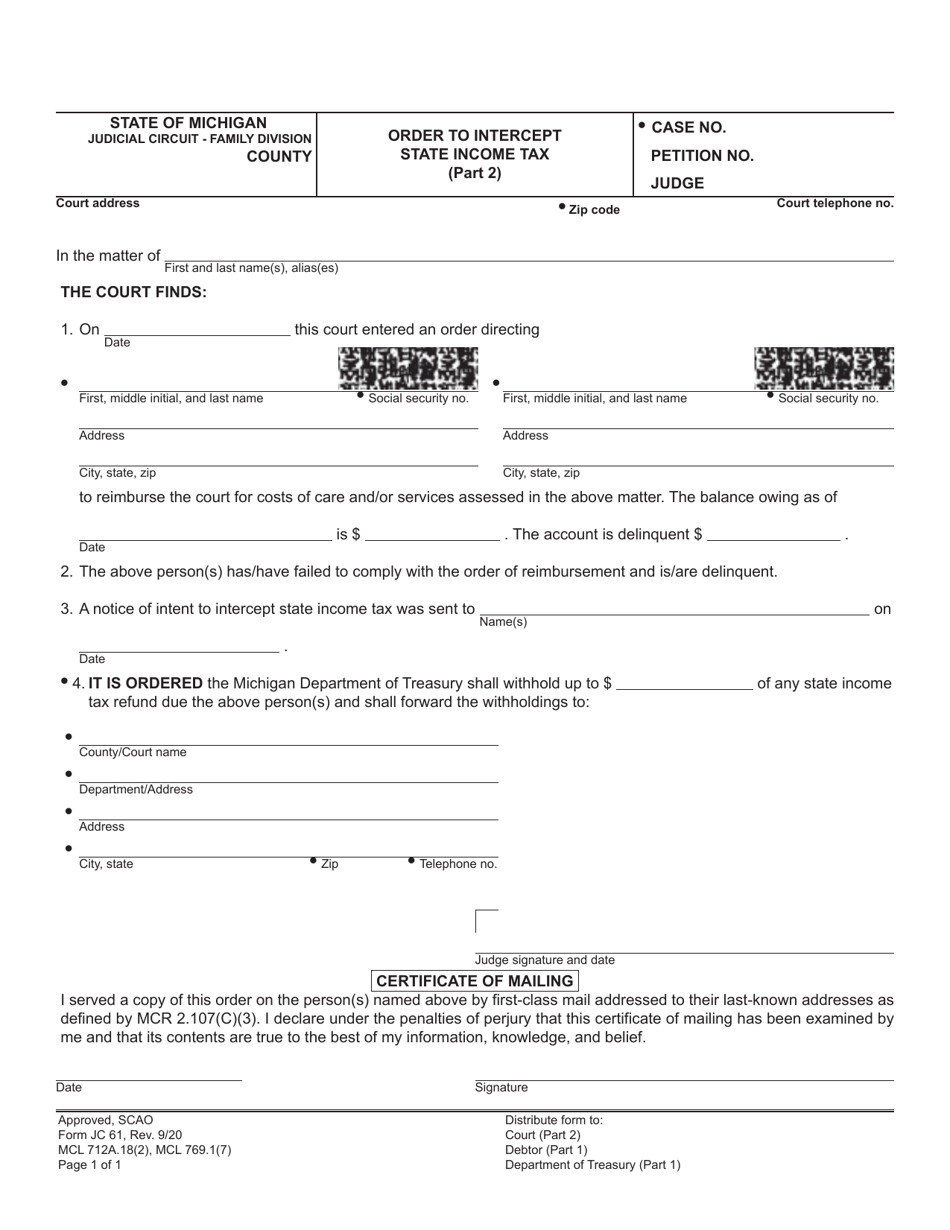

Form JC61 Order to Intercept State Income Tax - Michigan

What Is Form JC61?

This is a legal form that was released by the Michigan Circuit Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form JC61?

A: Form JC61 is the Order to Intercept State Income Tax specifically intended for the state of Michigan.

Q: What is the purpose of Form JC61?

A: The purpose of Form JC61 is to authorize the interception of state income tax refunds to satisfy a debt owed to the state of Michigan.

Q: Who can use Form JC61?

A: Form JC61 can be used by state agencies, municipalities, and other governmental entities in Michigan to collect debts owed to them.

Q: How do I obtain Form JC61?

A: You can obtain Form JC61 by contacting the appropriate agency or municipality in Michigan that is seeking to collect the debt.

Q: Can I use Form JC61 to intercept federal income tax refunds?

A: No, Form JC61 specifically authorizes the interception of state income tax refunds and does not apply to federal income tax refunds.

Q: What happens after I submit Form JC61?

A: After you submit Form JC61, the Michigan Department of Treasury will review the form and determine if interception of the taxpayer's state income tax refund is appropriate.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Michigan Circuit Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form JC61 by clicking the link below or browse more documents and templates provided by the Michigan Circuit Court.