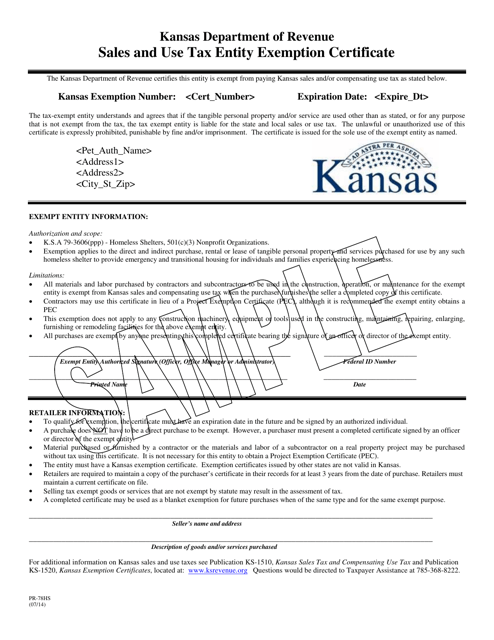

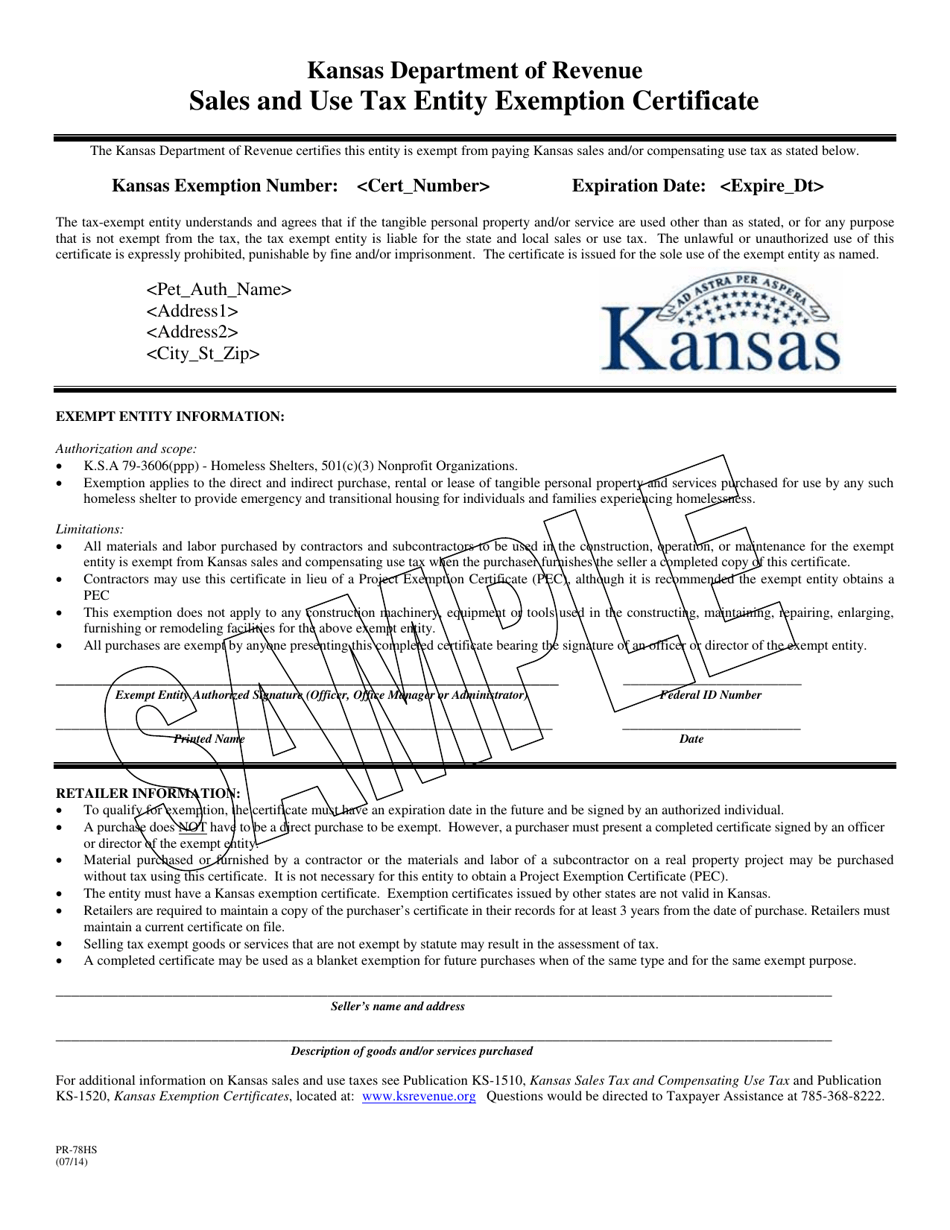

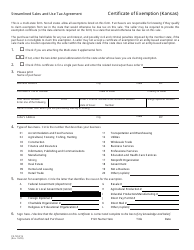

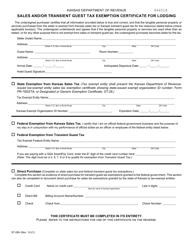

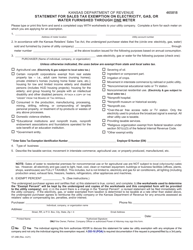

Form PR-78HS Sales and Use Tax Entity Exemption Certificate - Homeless Shelters - Sample - Kansas

What Is Form PR-78HS?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PR-78HS Sales and Use Tax Entity Exemption Certificate?

A: The PR-78HS Sales and Use Tax Entity Exemption Certificate is a form used to claim sales and use tax exemption for eligible entities.

Q: What does the form apply to?

A: This particular sample form applies to homeless shelters in the state of Kansas.

Q: What is the purpose of the form?

A: The purpose of the form is to allow qualifying homeless shelters to purchase items without paying sales tax.

Q: Who is eligible to use this form?

A: Only eligible homeless shelters in Kansas can use this form.

Q: What information is required on the form?

A: The form requires information such as the shelter's name, address, taxpayer ID number, and a statement of eligibility.

Q: Is this form valid in other states?

A: No, this form is specific to the state of Kansas and may not be valid in other states.

Q: Can individuals or businesses claim exemption using this form?

A: No, this form is specifically for eligible homeless shelters and cannot be used by individuals or businesses.

Q: How often should this form be renewed?

A: The form should be renewed annually or as required by the Kansas Department of Revenue.

Q: Are there any penalties for using this form incorrectly?

A: Yes, incorrect use of this form may result in penalties or fines imposed by the Kansas Department of Revenue.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-78HS by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.