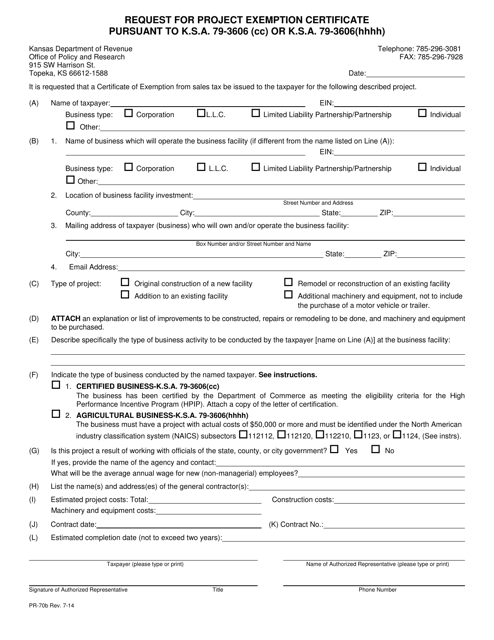

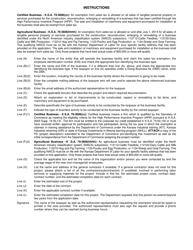

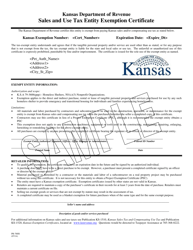

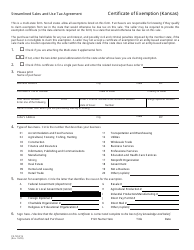

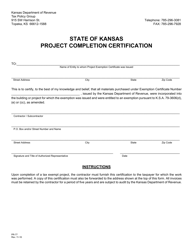

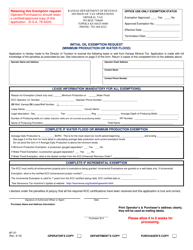

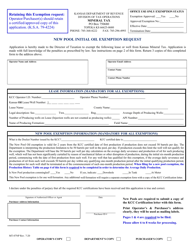

Form PR-70B Project Exemption Request (Enterprise Zone) - Kansas

What Is Form PR-70B?

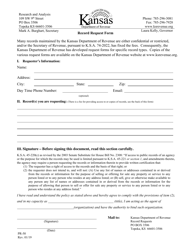

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

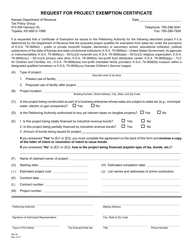

Q: What is the PR-70B Project Exemption Request?

A: The PR-70B Project Exemption Request is a form used to request an enterprise zone exemption in Kansas.

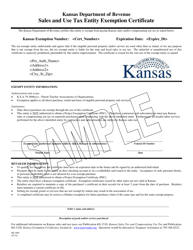

Q: What is an enterprise zone exemption?

A: An enterprise zone exemption is a tax incentive provided to businesses located in designated economically distressed areas to encourage investment and job creation.

Q: Who can use the PR-70B Project Exemption Request form?

A: Businesses that are located in an enterprise zone in Kansas and are seeking a tax exemption for a specific project can use this form.

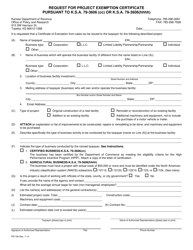

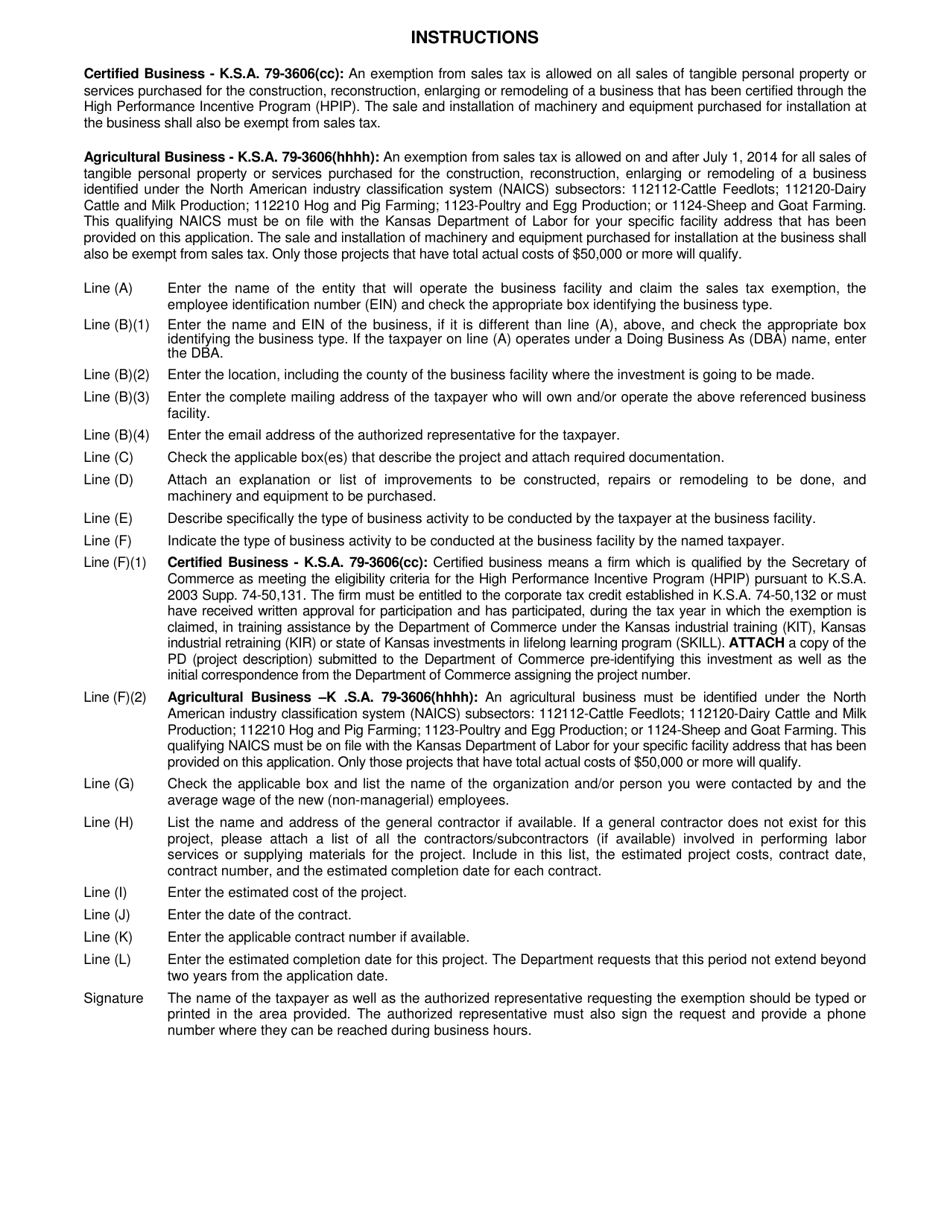

Q: What information is required on the PR-70B form?

A: The form requires detailed information about the project, including the location, cost, and expected economic impact.

Q: Are there any fees associated with submitting the PR-70B form?

A: No, there are no fees required to submit the form.

Q: What is the deadline for submitting the PR-70B form?

A: The form should be submitted at least 30 days prior to the start of the project to allow for processing.

Q: What are the benefits of obtaining an enterprise zone exemption?

A: The benefits include tax savings and potentially increased economic opportunities for businesses operating in economically distressed areas.

Q: Can an enterprise zone exemption be granted for any type of project?

A: No, the project must meet certain criteria and be approved by the designated authorities in order to qualify for the exemption.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PR-70B by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.