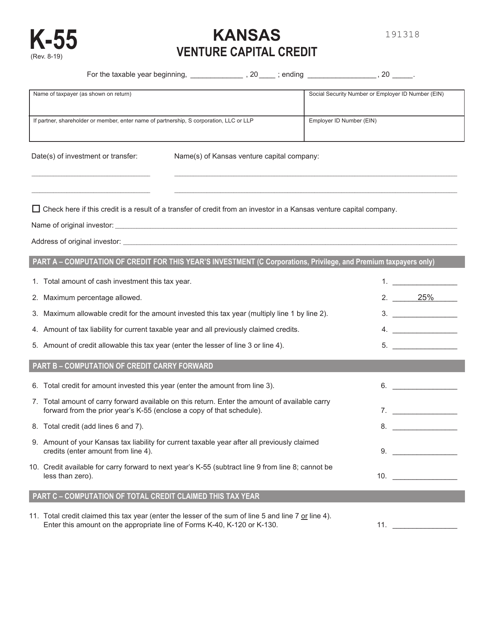

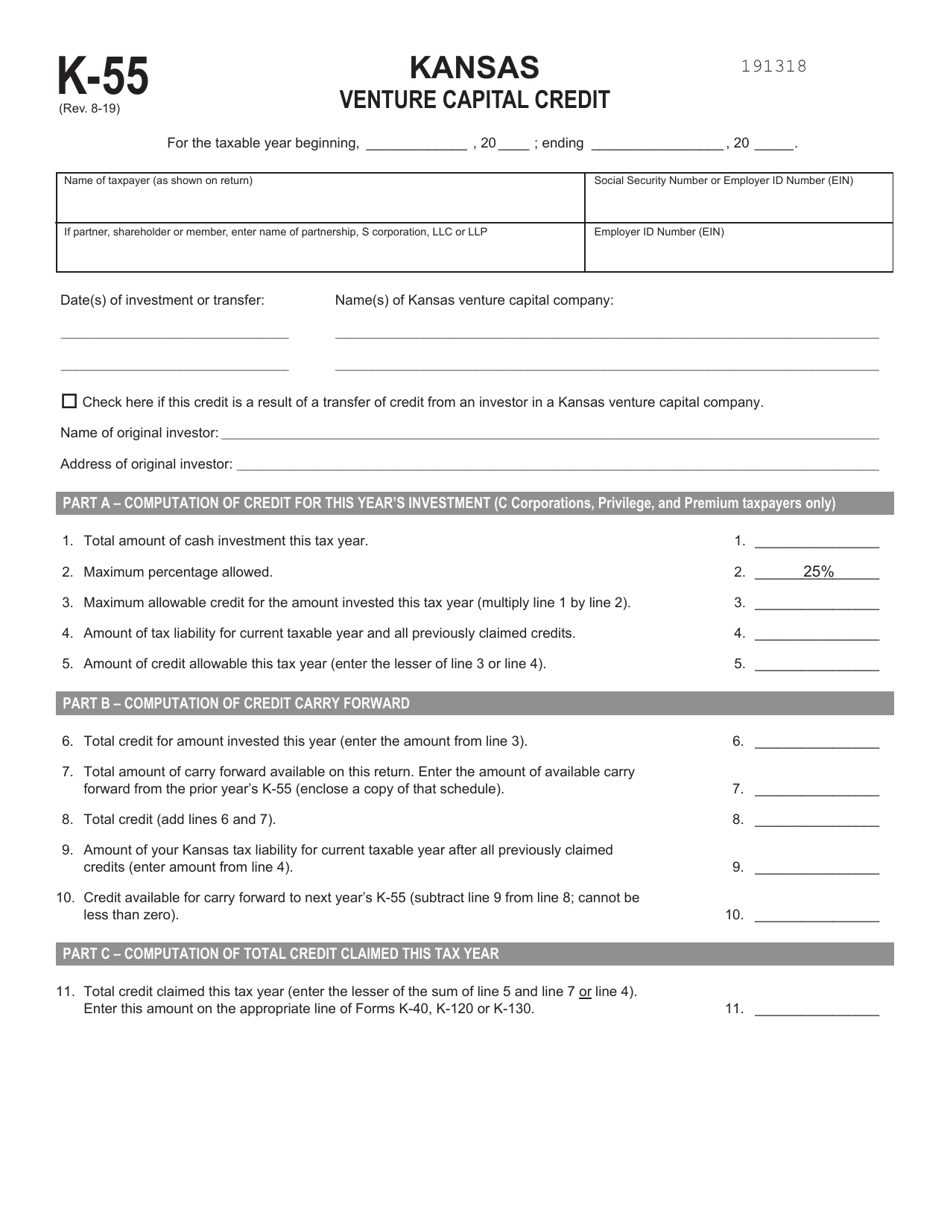

Schedule K-55 Kansas Venture Capital Credit - Kansas

What Is Schedule K-55?

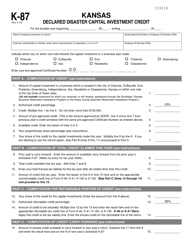

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-55?

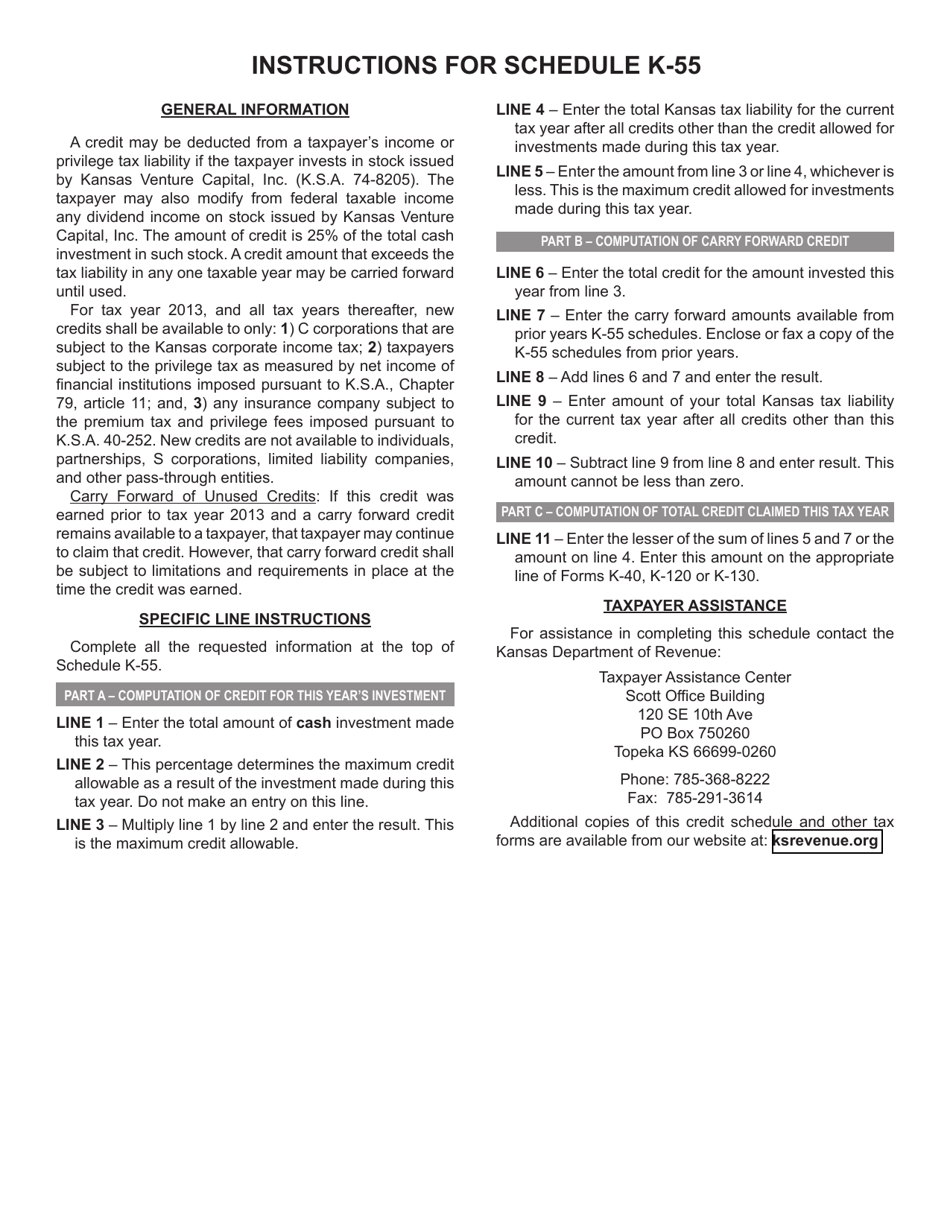

A: Schedule K-55 is a form used in Kansas to claim the Venture Capital Credit.

Q: What is the Kansas Venture Capital Credit?

A: The Kansas Venture Capital Credit is a tax credit available to individuals or entities that invest in qualified Kansas businesses.

Q: Who is eligible for the Kansas Venture Capital Credit?

A: Individuals and entities who make qualified investments in Kansas businesses are eligible for the credit.

Q: How is the Kansas Venture Capital Credit calculated?

A: The credit is calculated as a percentage of the qualified investment made in a Kansas business.

Q: What types of investments qualify for the Kansas Venture Capital Credit?

A: Qualified investments include equity investments in Kansas businesses that meet certain criteria.

Q: How can I claim the Kansas Venture Capital Credit?

A: To claim the credit, you need to complete and submit Schedule K-55 along with your Kansas income tax return.

Q: Are there any limitations or restrictions on the Kansas Venture Capital Credit?

A: Yes, there are limitations and restrictions on the credit, such as a maximum credit amount and a carryover provision for unused credits.

Q: Is the Kansas Venture Capital Credit refundable?

A: No, the credit is not refundable, but it can be carried forward to future tax years if not fully utilized.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-55 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.