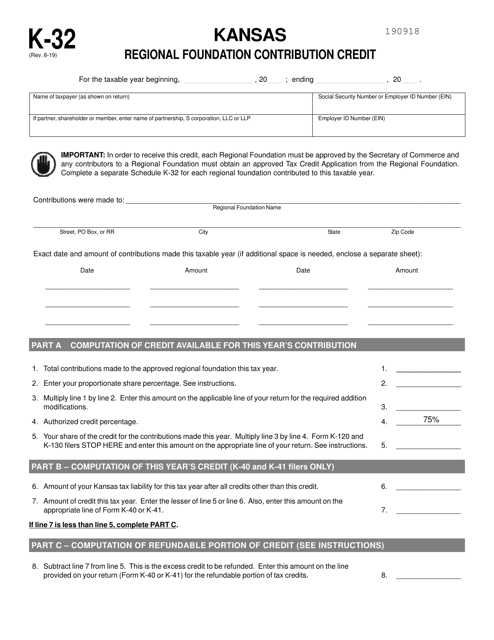

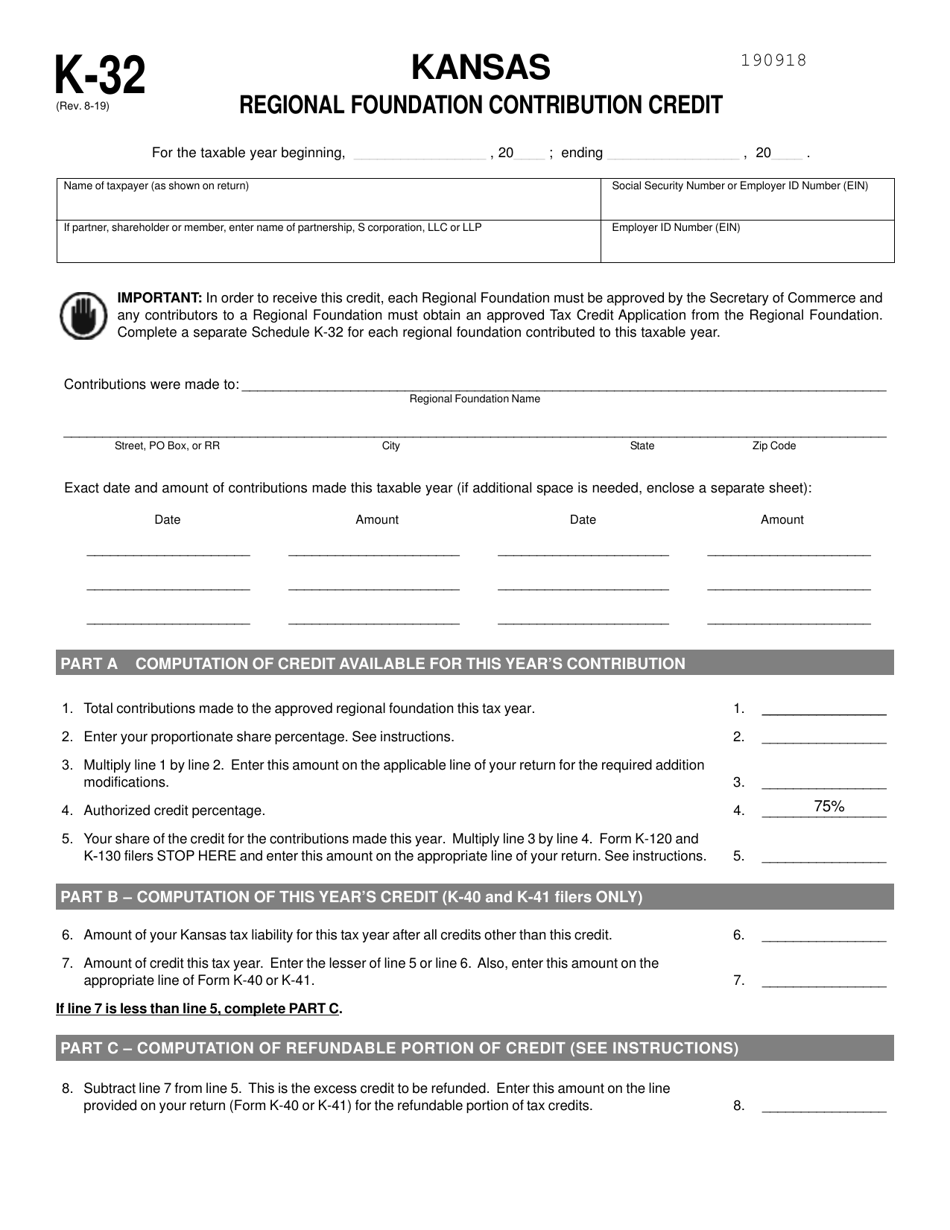

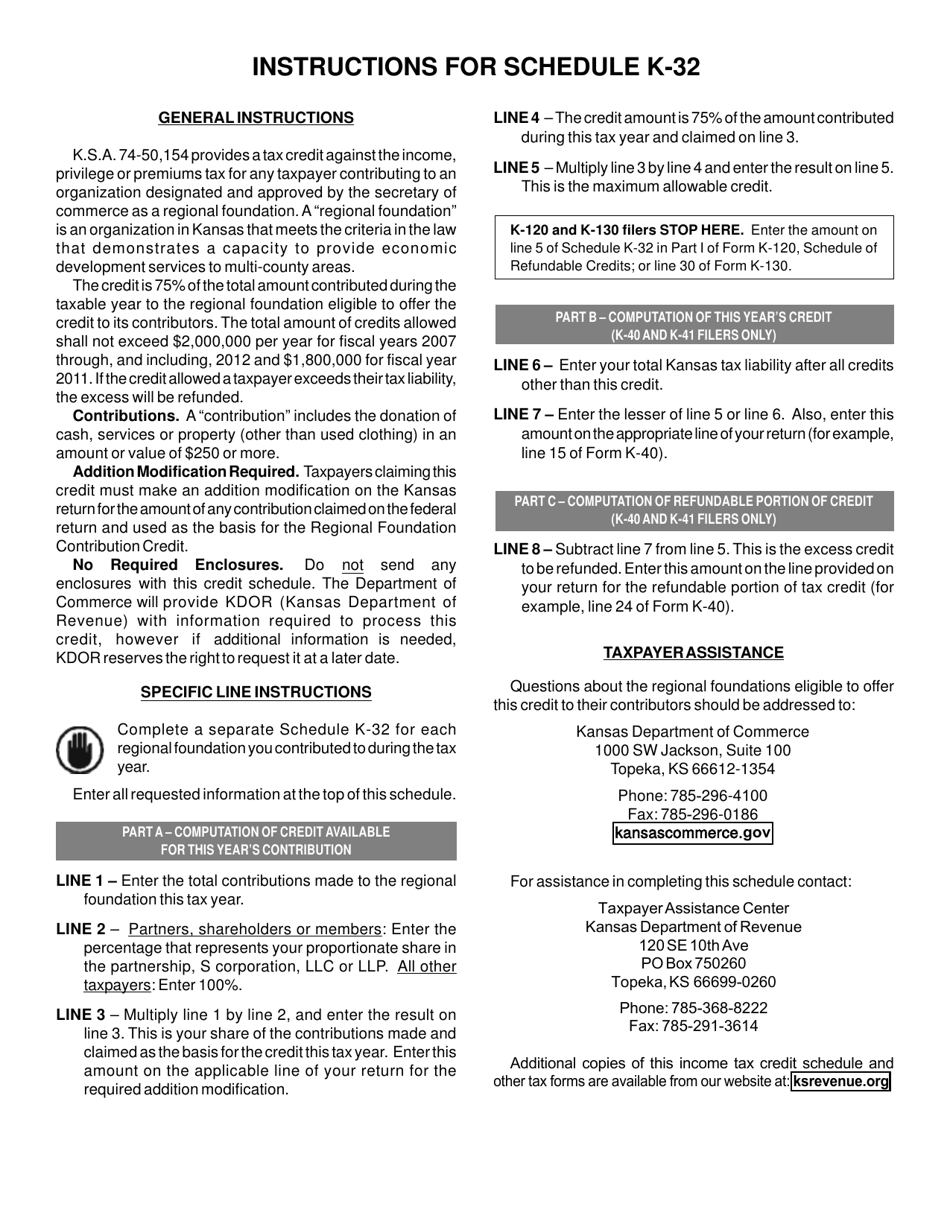

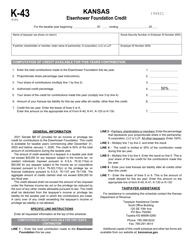

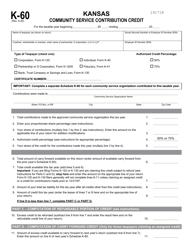

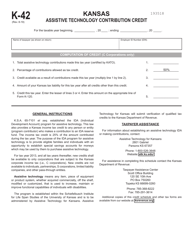

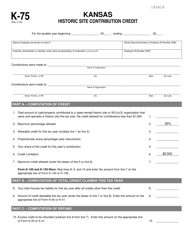

Schedule K-32 Kansas Regional Foundation Contribution Credit - Kansas

What Is Schedule K-32?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-32?

A: Schedule K-32 is a form used in Kansas to claim the Regional Foundation Contribution Credit.

Q: What is the Regional Foundation Contribution Credit?

A: The Regional Foundation Contribution Credit is a tax credit available to taxpayers in Kansas who make a qualified contribution to a regional foundation.

Q: Who is eligible for the Regional Foundation Contribution Credit?

A: Taxpayers in Kansas who make a qualified contribution to a regional foundation are eligible for the credit.

Q: What is a regional foundation?

A: A regional foundation is a charitable organization that provides support to specific regions or communities in Kansas.

Q: How much is the Regional Foundation Contribution Credit?

A: The credit is equal to 40% of the taxpayer's qualified contribution to a regional foundation.

Q: How do I claim the Regional Foundation Contribution Credit?

A: To claim the credit, you need to complete and attach Schedule K-32 to your Kansas tax return.

Q: Are there any limitations or restrictions for the Regional Foundation Contribution Credit?

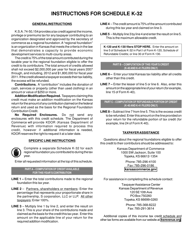

A: Yes, there are limitations on the amount of credit that can be claimed and the types of contributions that qualify. Consult the instructions for Schedule K-32 for more information.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

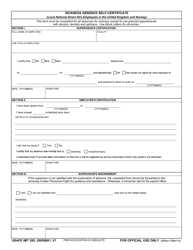

Download a fillable version of Schedule K-32 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.