This version of the form is not currently in use and is provided for reference only. Download this version of

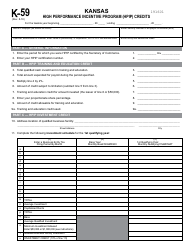

Schedule K-59

for the current year.

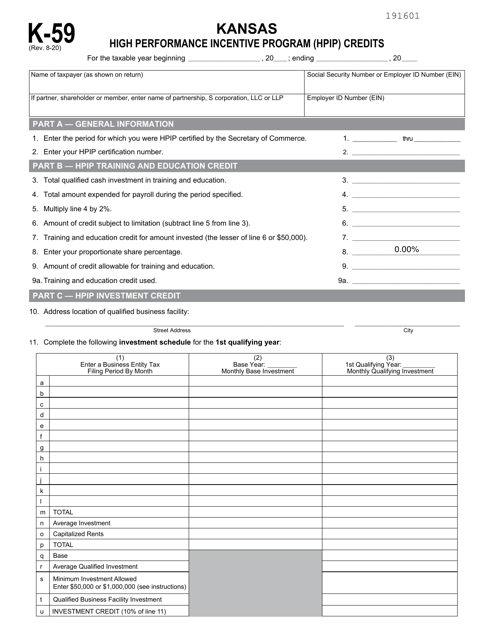

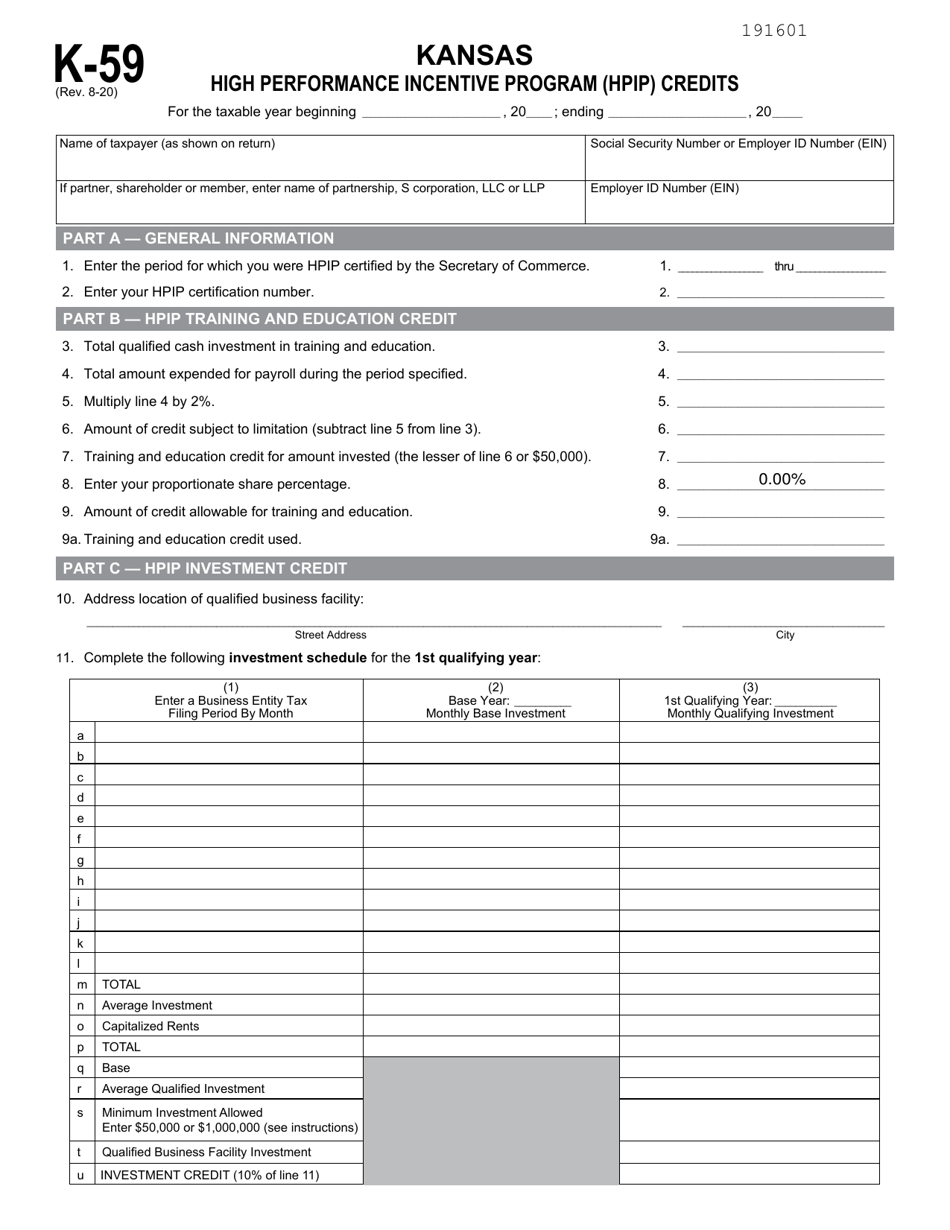

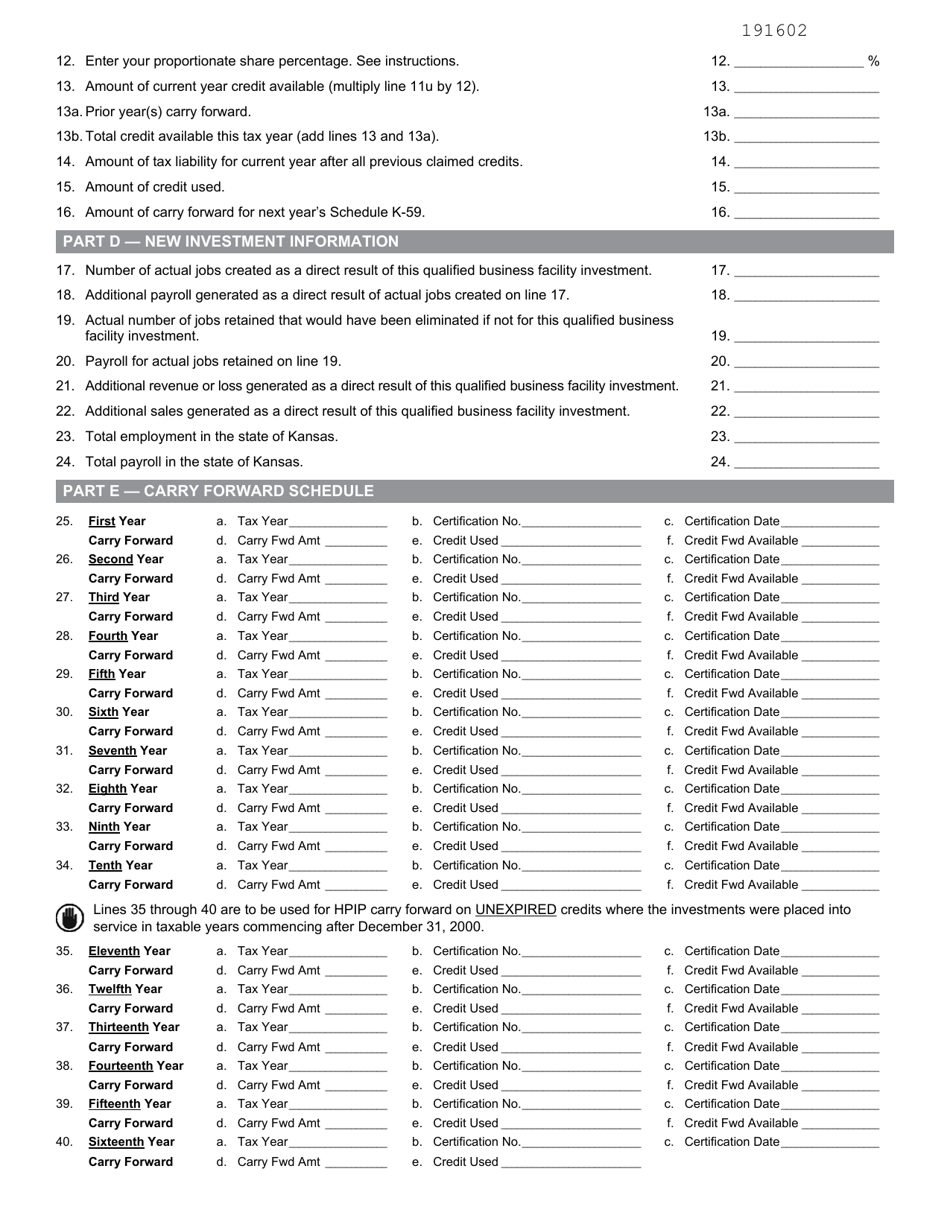

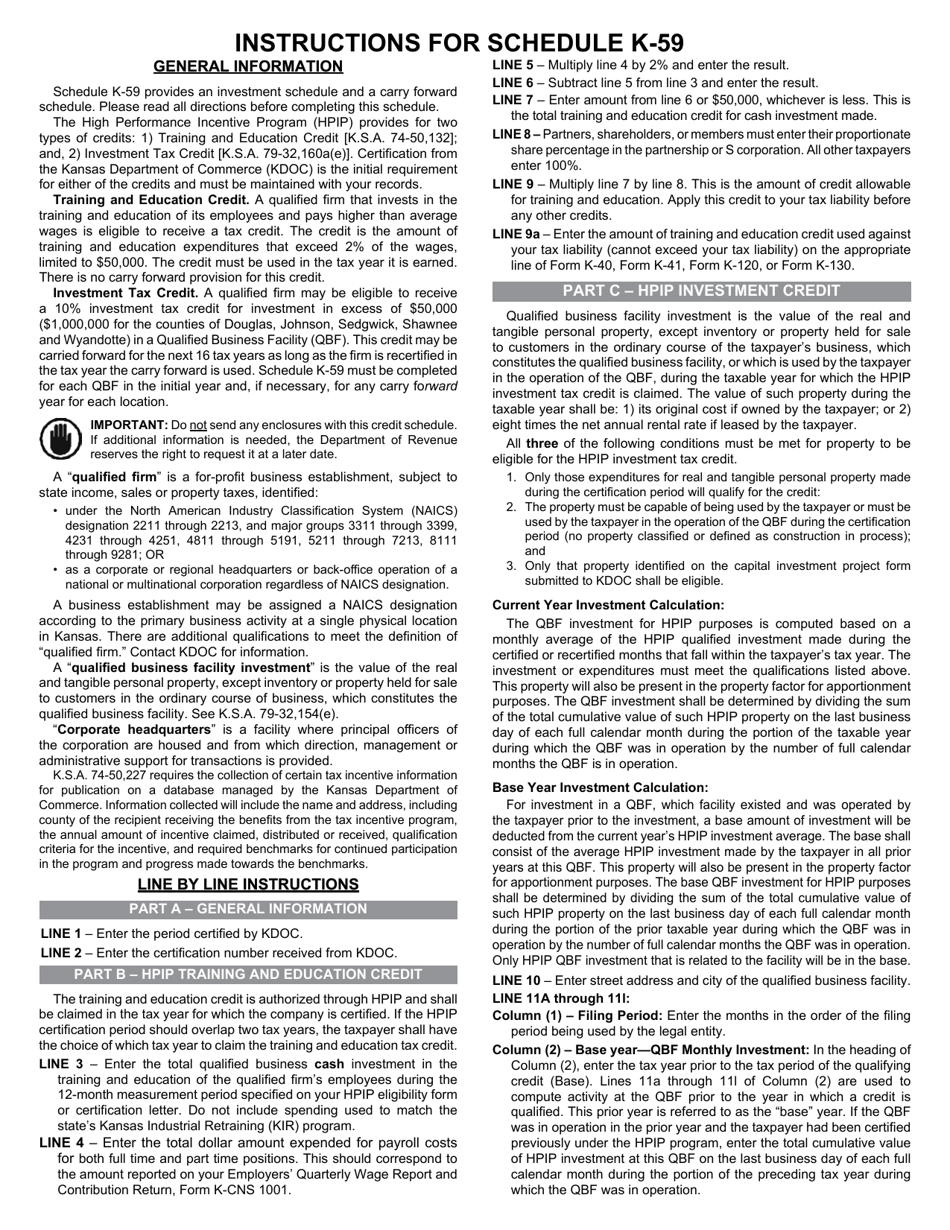

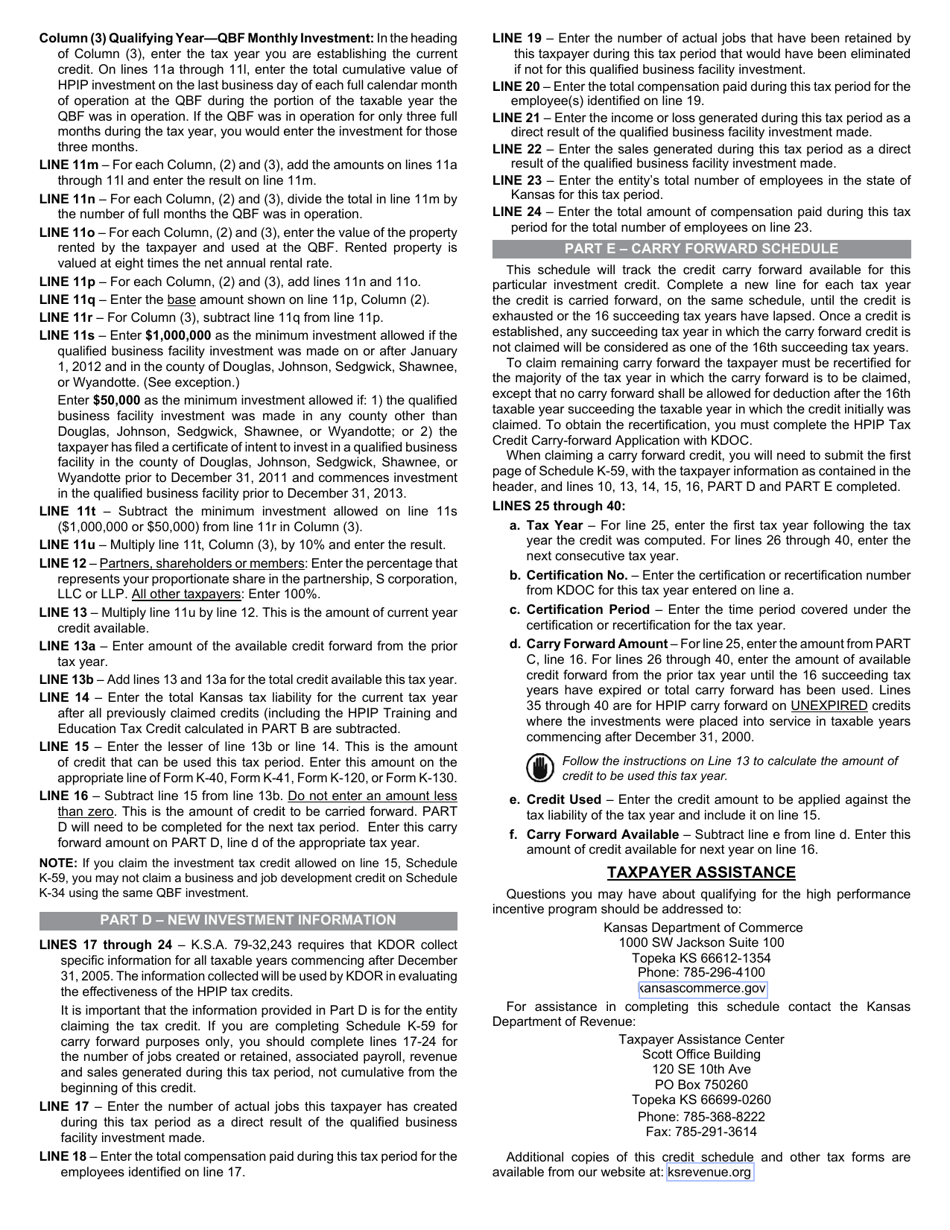

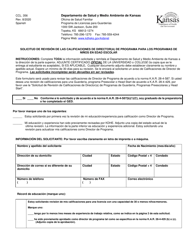

Schedule K-59 Kansas High Performance Incentive Program (Hpip) Credits - Kansas

What Is Schedule K-59?

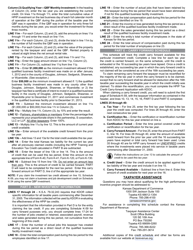

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-59?

A: Schedule K-59 is a form used in Kansas to claim High Performance Incentive Program (HPIP) credits.

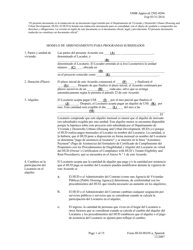

Q: What is the Kansas High Performance Incentive Program (HPIP)?

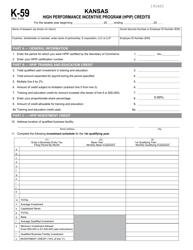

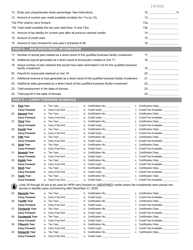

A: The Kansas High Performance Incentive Program (HPIP) is a program that provides incentives to businesses that make capital investments in their operations and create new jobs.

Q: What are HPIP credits?

A: HPIP credits are tax credits that businesses can claim as part of the High Performance Incentive Program. These credits can help reduce the amount of tax owed by the business.

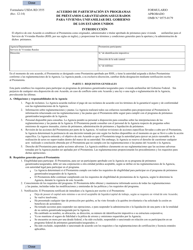

Q: Who is eligible for HPIP credits?

A: Eligibility for HPIP credits is limited to businesses that make capital investments in their operations and create new jobs in Kansas.

Q: How can businesses claim HPIP credits?

A: Businesses can claim HPIP credits by filing Schedule K-59 along with their Kansas tax return.

Q: Are there any limitations or restrictions on HPIP credits?

A: Yes, there are limitations and restrictions on HPIP credits. The specific details can be found in the HPIP program guidelines.

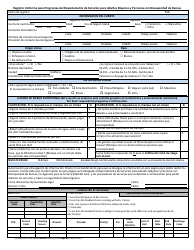

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-59 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.