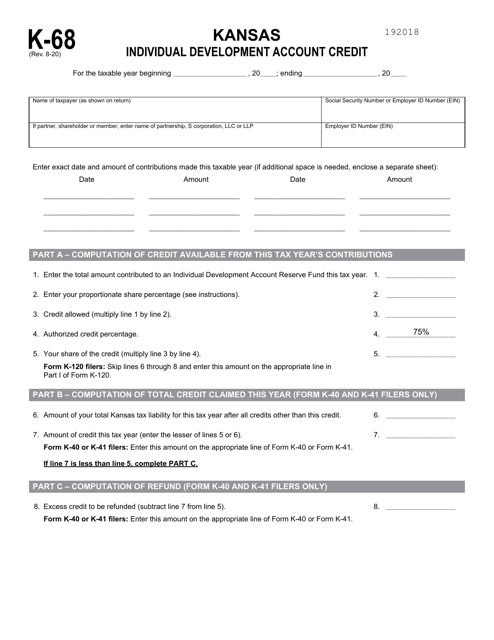

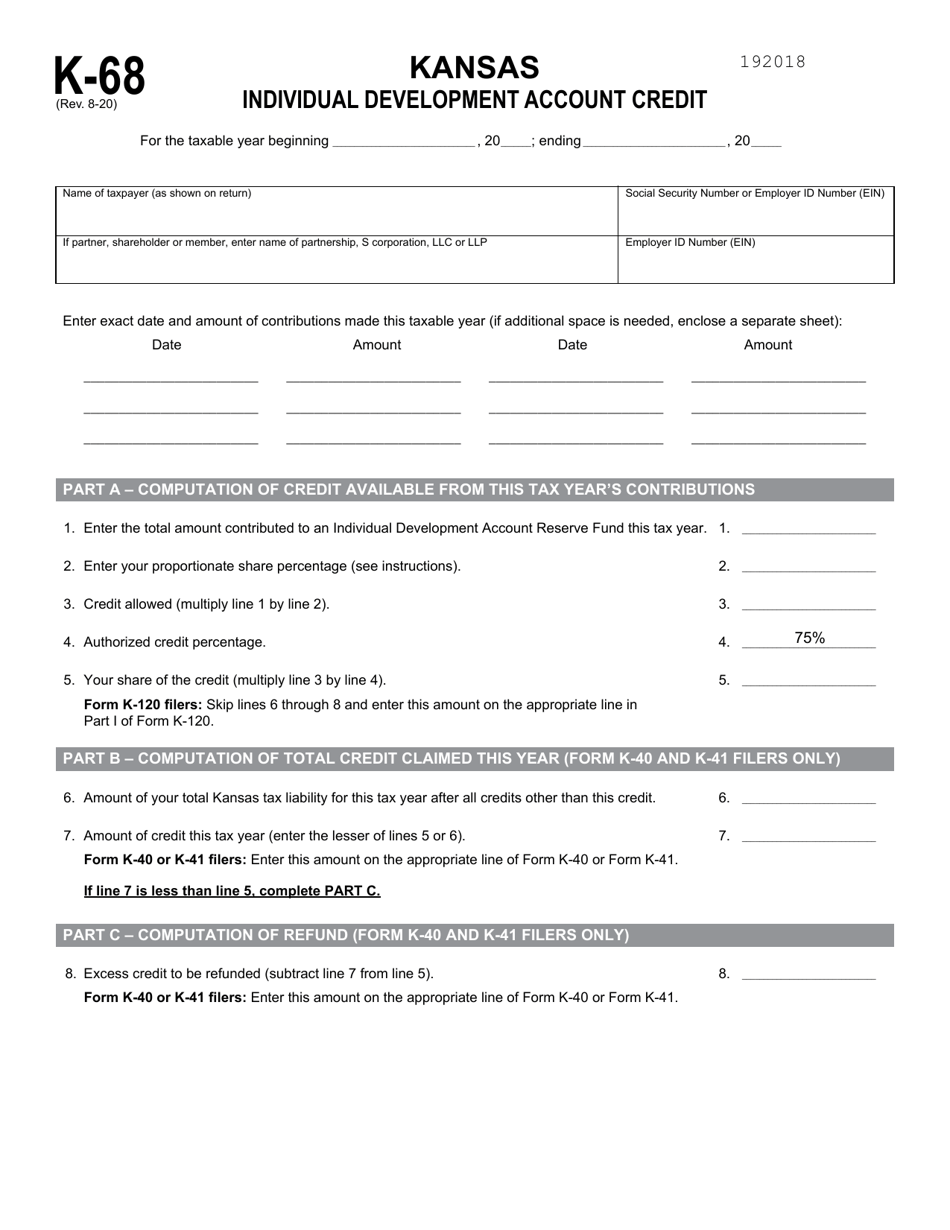

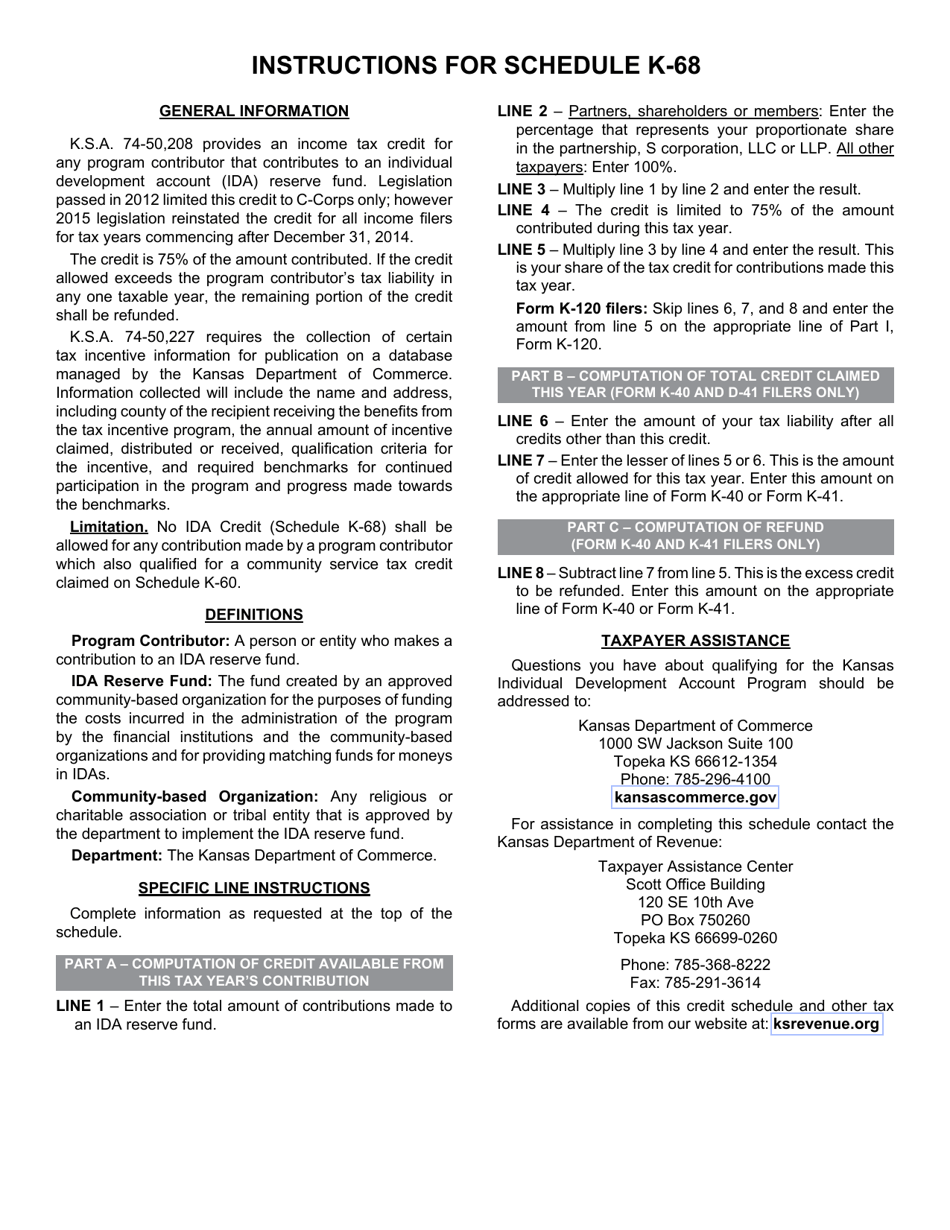

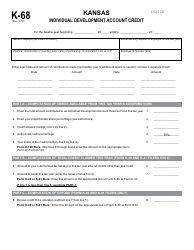

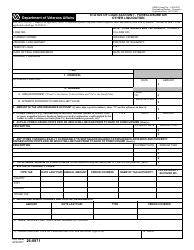

Schedule K-68 Kansas Individual Development Account Credit - Kansas

What Is Schedule K-68?

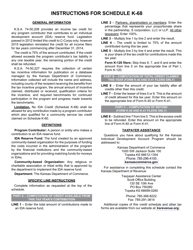

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-68?

A: Schedule K-68 is a form used to claim the Kansas Individual Development Account Credit.

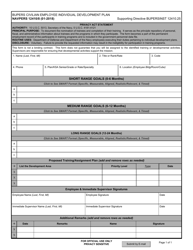

Q: What is the Kansas Individual Development Account Credit?

A: The Kansas Individual Development Account Credit is a tax credit designed to encourage individuals to save money and build assets.

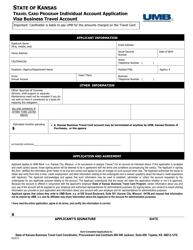

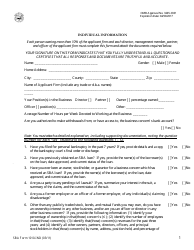

Q: Who is eligible for the Kansas Individual Development Account Credit?

A: Kansas residents who participate in a qualified Individual Development Account (IDA) program are eligible for the credit.

Q: What is an Individual Development Account (IDA) program?

A: An Individual Development Account program is a savings program that provides matching funds to help low-income individuals save for a specific goal, such as buying a home or starting a small business.

Q: How much is the Kansas Individual Development Account Credit?

A: The credit is equal to 75% of the total amount deposited into the Individual Development Account, up to a maximum credit of $2,500 per year.

Q: How do I claim the Kansas Individual Development Account Credit?

A: To claim the credit, you need to fill out Schedule K-68 and include it with your Kansas state tax return.

Q: Is there a limit on how many years I can claim the Kansas Individual Development Account Credit?

A: No, there is no limit on the number of years you can claim the credit.

Q: Can I claim the Kansas Individual Development Account Credit if I don't owe any Kansas state taxes?

A: No, the credit is nonrefundable and can only be used to offset your Kansas state tax liability.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-68 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.