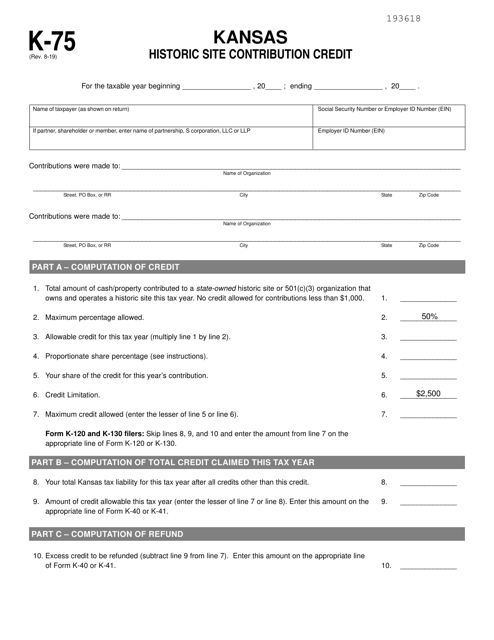

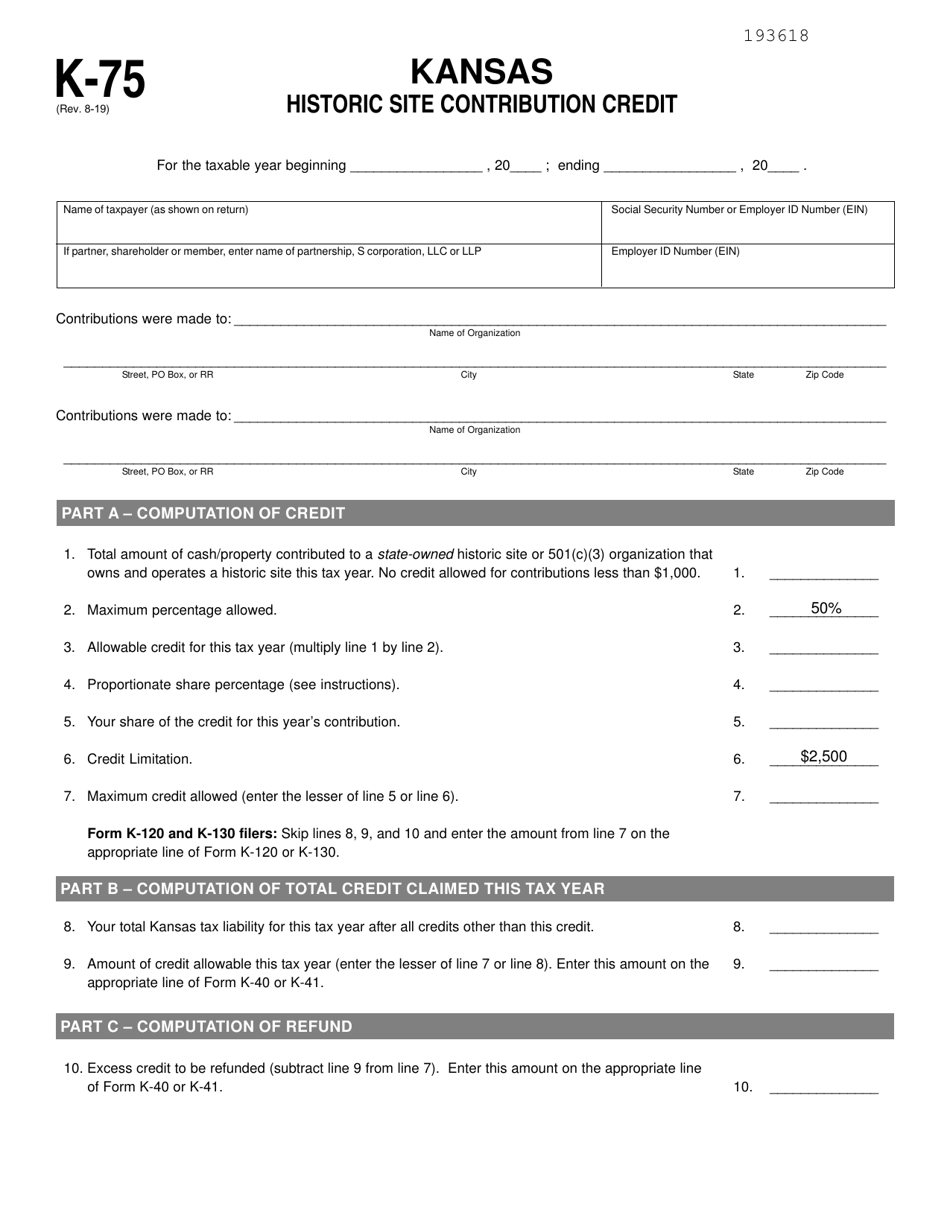

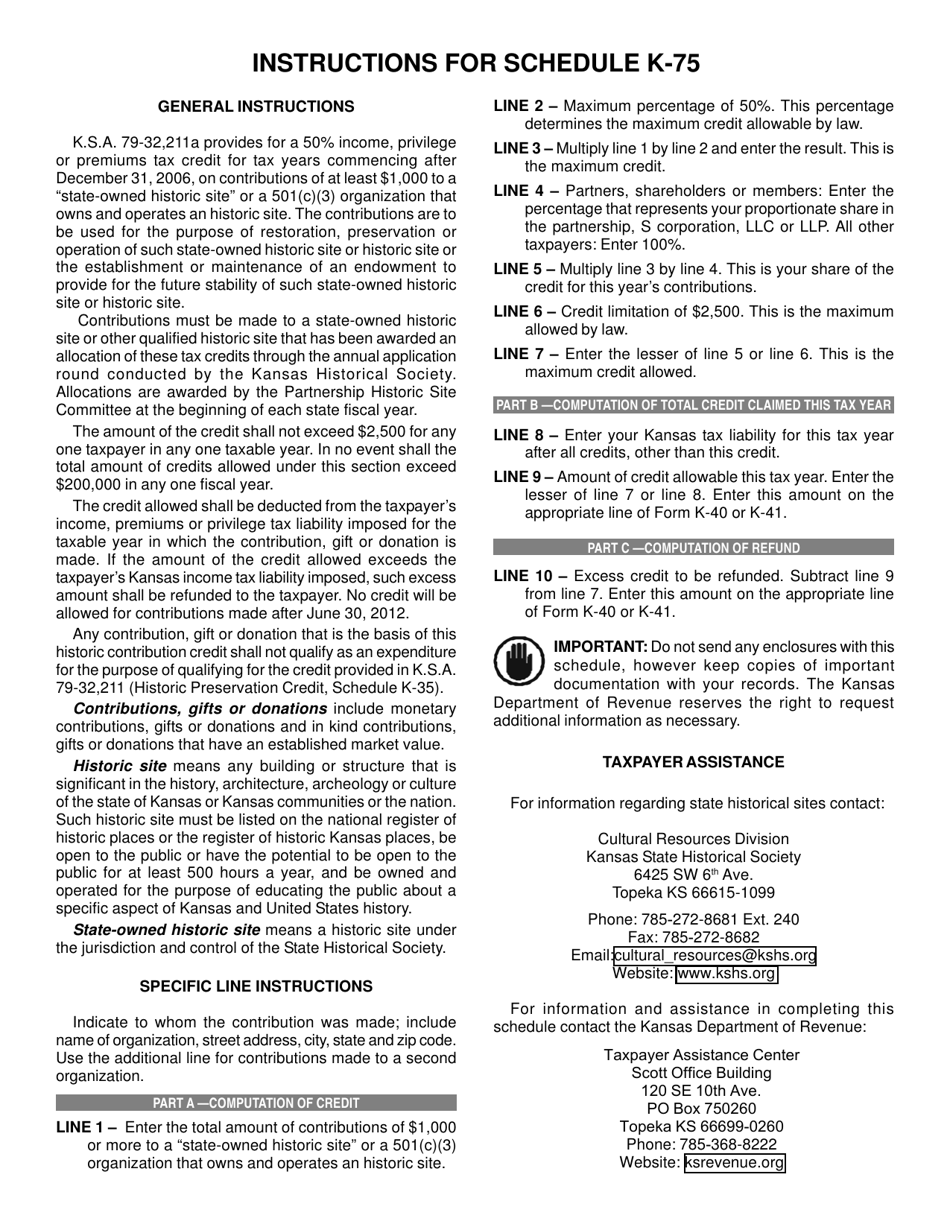

Schedule K-75 Kansas Historic Site Contribution Credit - Kansas

What Is Schedule K-75?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-75?

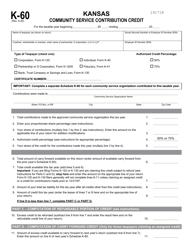

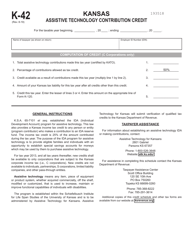

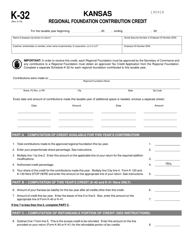

A: Schedule K-75 is a form used in Kansas tax returns for claiming the Historic Site Contribution Credit.

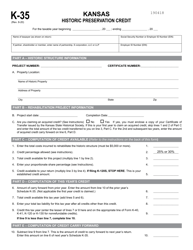

Q: What is the Historic Site Contribution Credit?

A: The Historic Site Contribution Credit is a tax credit available to Kansas taxpayers who make qualifying contributions to eligible historic sites in Kansas.

Q: Who is eligible for the Historic Site Contribution Credit?

A: Kansas taxpayers who make qualifying contributions to eligible historic sites in Kansas are eligible for the Historic Site Contribution Credit.

Q: What is considered a qualifying contribution?

A: A qualifying contribution is a cash contribution made to an eligible historic site in Kansas.

Q: What is an eligible historic site?

A: An eligible historic site is a property listed on the Kansas Register of Historic Places or the National Register of Historic Places.

Q: How much is the Historic Site Contribution Credit?

A: The credit is equal to 25% of the total qualifying contributions made during the tax year, up to a maximum credit of $500,000 per year.

Q: How do I claim the Historic Site Contribution Credit?

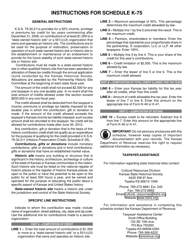

A: To claim the credit, you must complete Schedule K-75 and include it with your Kansas income tax return.

Q: Is there a carryover provision for unused credit?

A: No, any unused credit cannot be carried forward to future years.

Q: Are there any limitations or restrictions for claiming the credit?

A: Yes, there are certain limitations and restrictions for claiming the credit. It is recommended to consult the official instructions or a tax professional for detailed guidance.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-75 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.