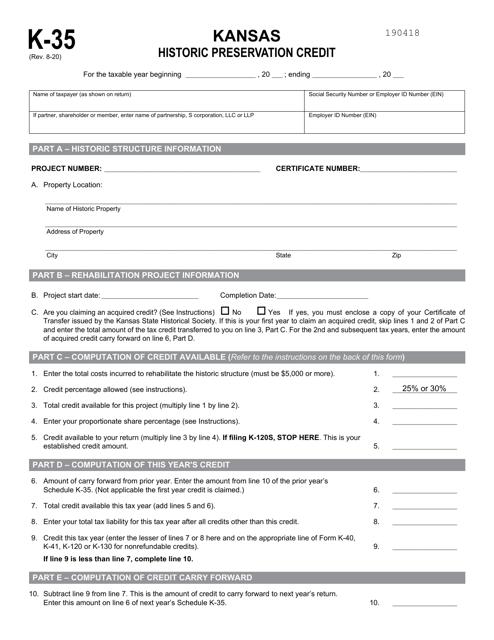

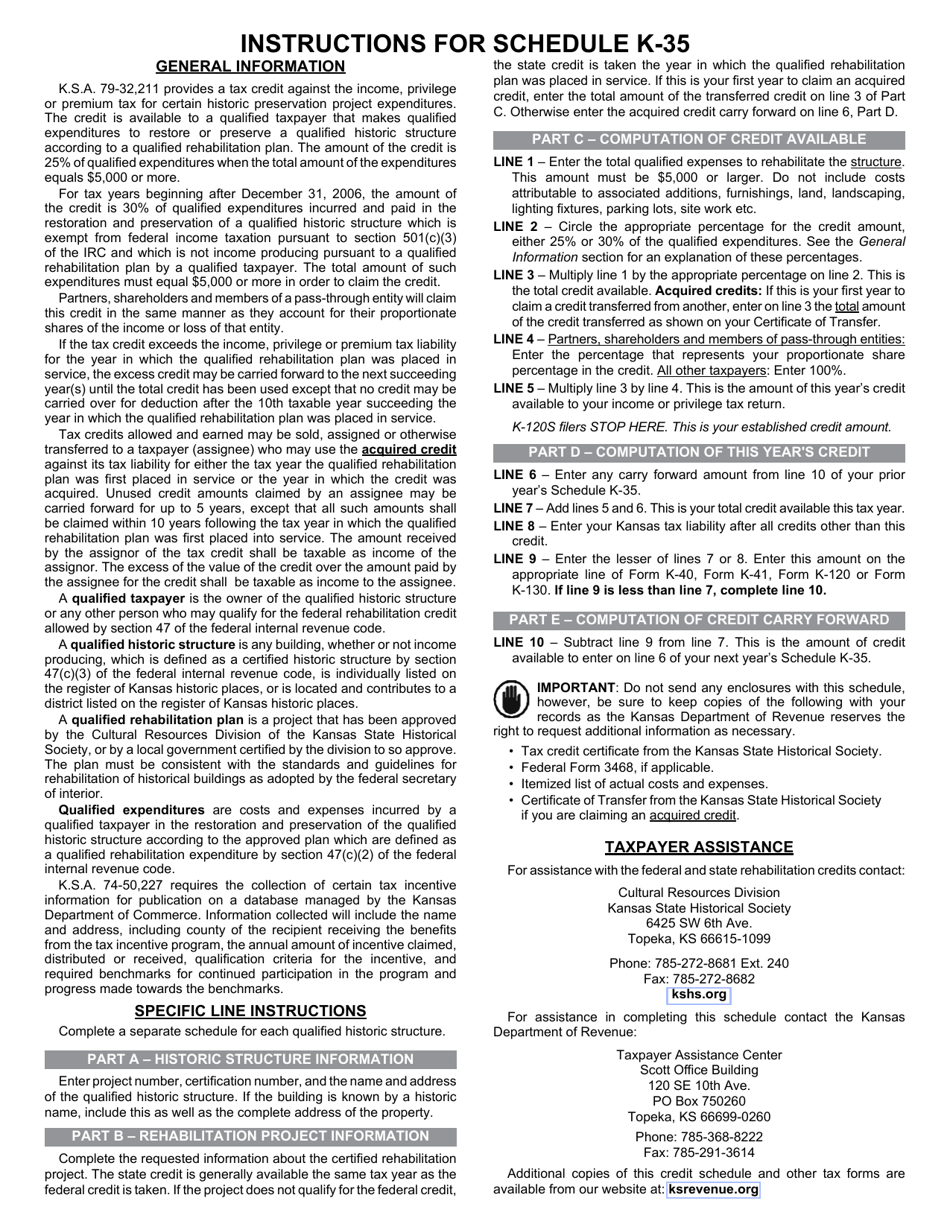

Schedule K-35 Kansas Historic Preservation Credit - Kansas

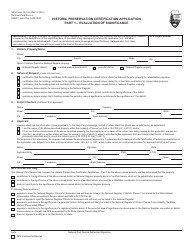

What Is Schedule K-35?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-35?

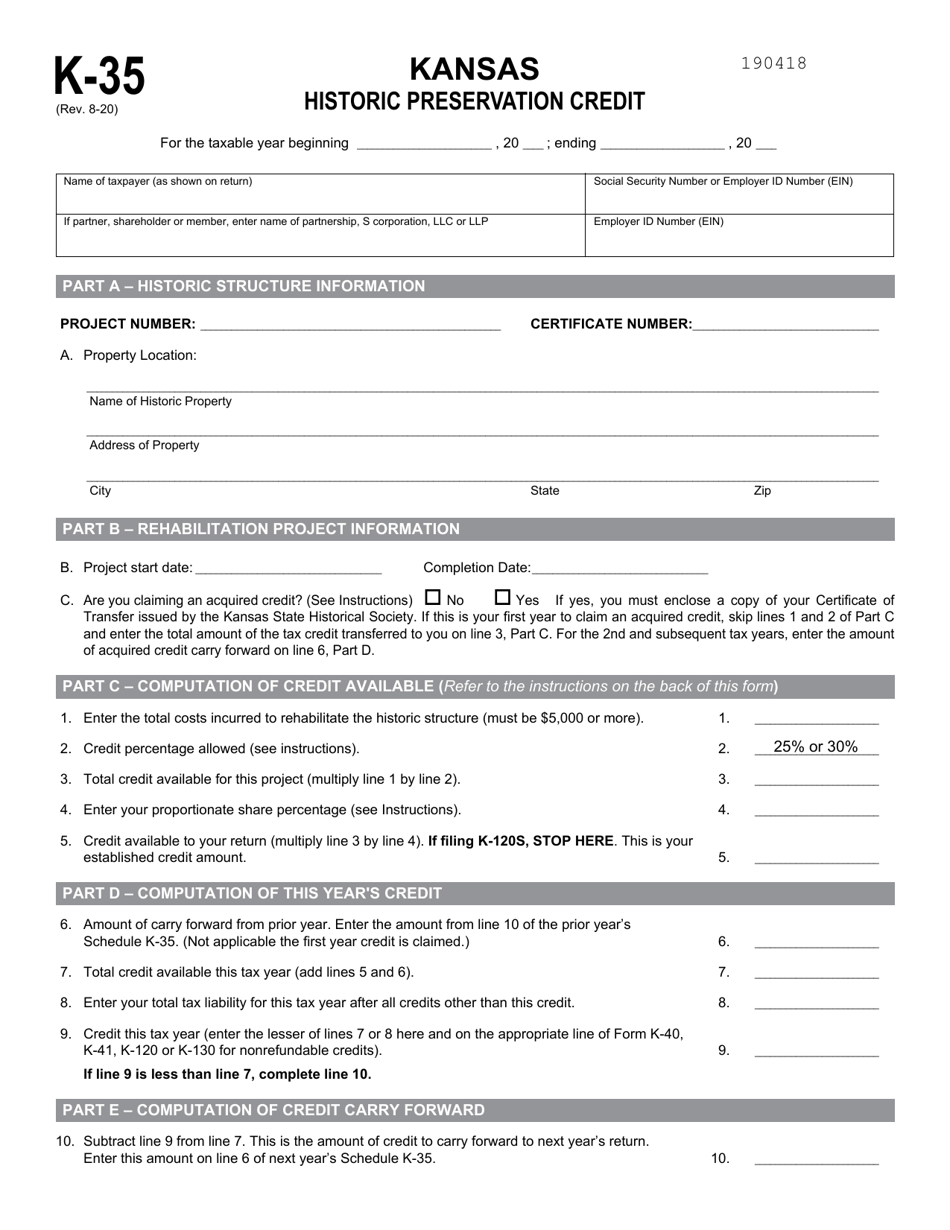

A: Schedule K-35 is a tax form used in Kansas to claim the Historic Preservation Credit.

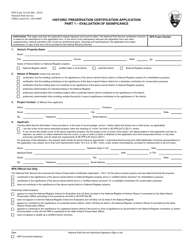

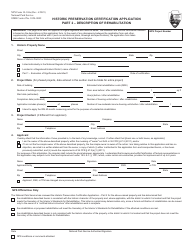

Q: What is the Historic Preservation Credit?

A: The Historic Preservation Credit is a tax credit available to individuals and companies in Kansas who rehabilitate historic buildings.

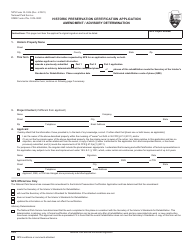

Q: Who is eligible to claim the Historic Preservation Credit?

A: Individuals and companies who have rehabilitated a historic building in Kansas are eligible to claim the Historic Preservation Credit.

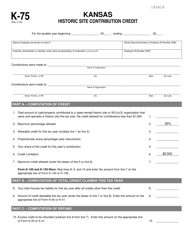

Q: How much is the Historic Preservation Credit worth?

A: The credit is worth 25% of the qualified rehabilitation expenses for a historic building.

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses include costs such as construction, architectural fees, and engineering fees incurred during the rehabilitation of a historic building.

Q: How do I claim the Historic Preservation Credit?

A: To claim the credit, you need to fill out Schedule K-35 and attach it to your Kansas income tax return.

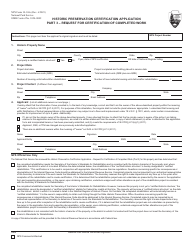

Q: Is there a limit to how much Historic Preservation Credit I can claim?

A: No, there is no limit to the amount of credit you can claim, but any unused credit can be carried forward for up to 10 years.

Q: Can the Historic Preservation Credit be transferred or sold?

A: No, the credit cannot be transferred or sold to another individual or company.

Q: Are there any other requirements to claim the Historic Preservation Credit?

A: Yes, you must receive certification from the Kansas State Historic Preservation Office before claiming the credit.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-35 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.