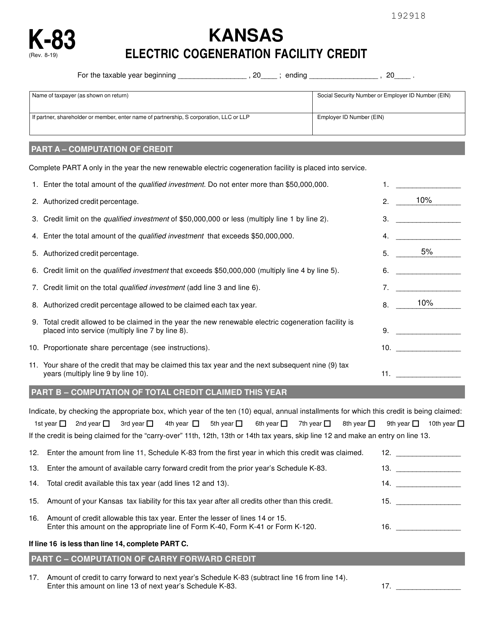

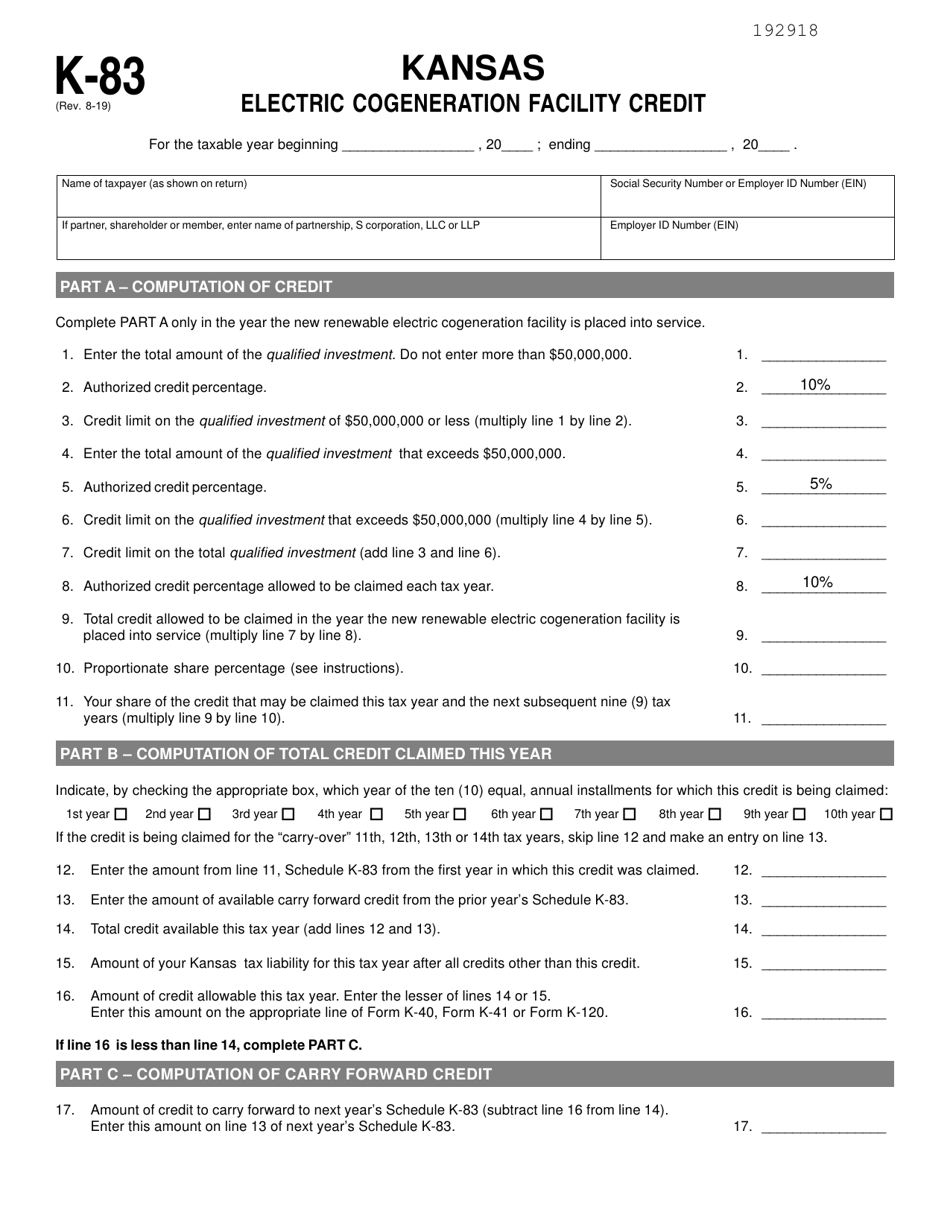

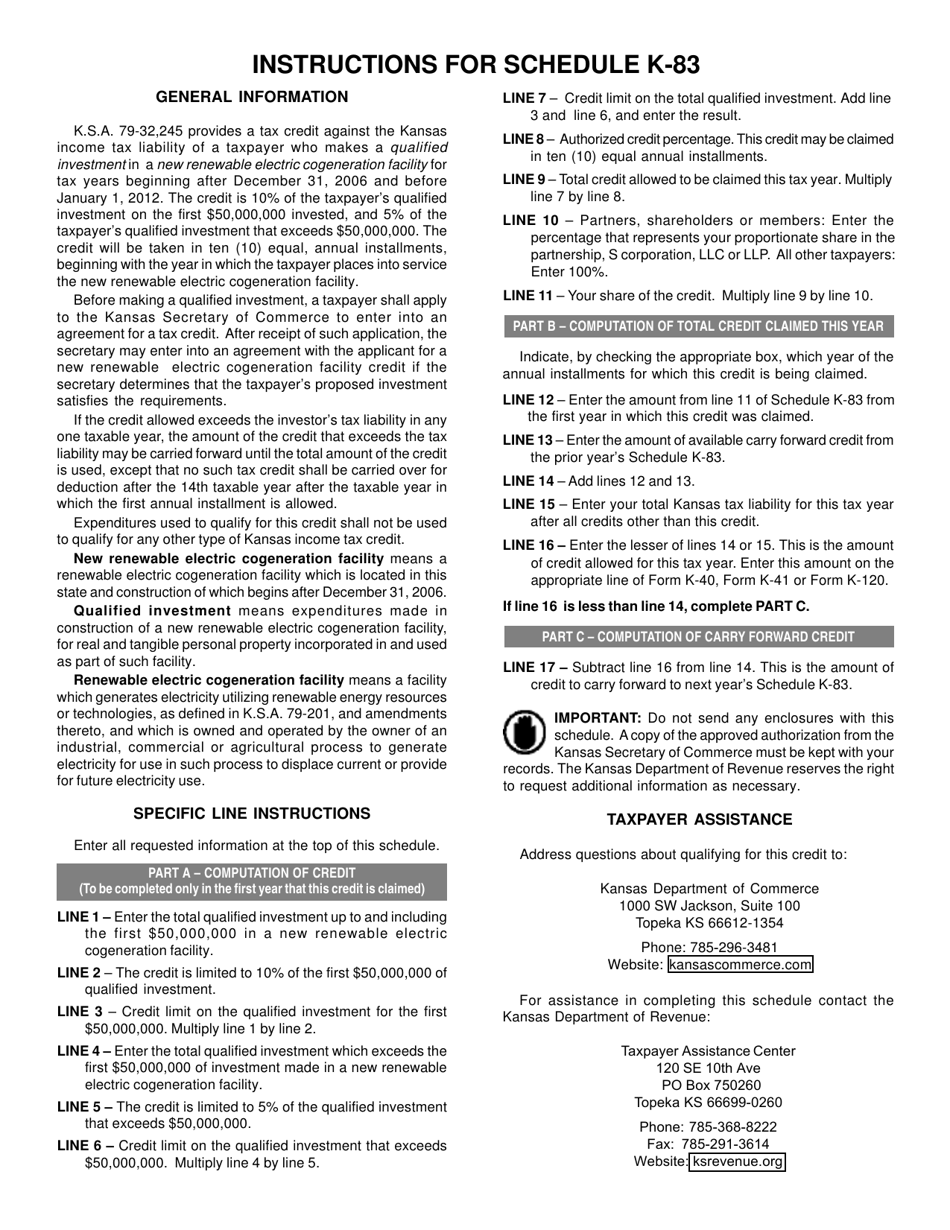

Schedule K-83 Kansas Electric Cogeneration Facility Credit - Kansas

What Is Schedule K-83?

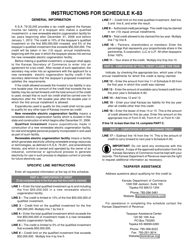

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-83?

A: Schedule K-83 is a form used to claim the Kansas Electric Cogeneration Facility Credit.

Q: What is the Kansas Electric Cogeneration Facility Credit?

A: The Kansas Electric Cogeneration Facility Credit is a credit available for qualifying cogeneration facilities in Kansas.

Q: Who is eligible for the Kansas Electric Cogeneration Facility Credit?

A: Qualifying cogeneration facilities in Kansas are eligible for this credit.

Q: What is a cogeneration facility?

A: A cogeneration facility is a facility that simultaneously produces electricity and useful heat or steam from the same energy source.

Q: How do I claim the Kansas Electric Cogeneration Facility Credit?

A: To claim the credit, you need to complete and file Schedule K-83 with your Kansas state tax return.

Q: Is there a deadline for claiming the Kansas Electric Cogeneration Facility Credit?

A: Yes, the deadline for claiming the credit is the same as the deadline for filing your Kansas state tax return.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-83 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.