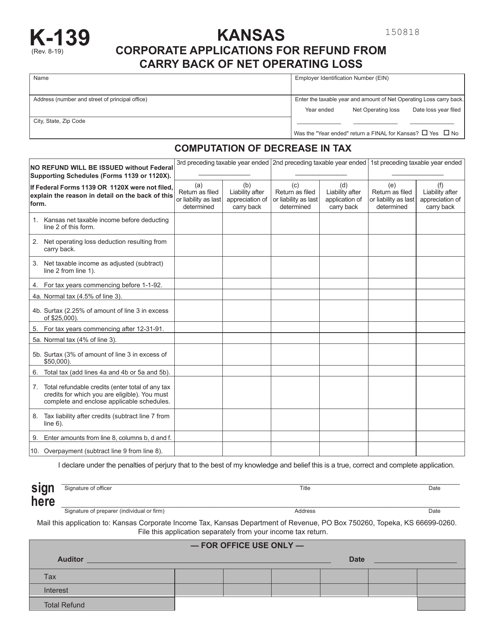

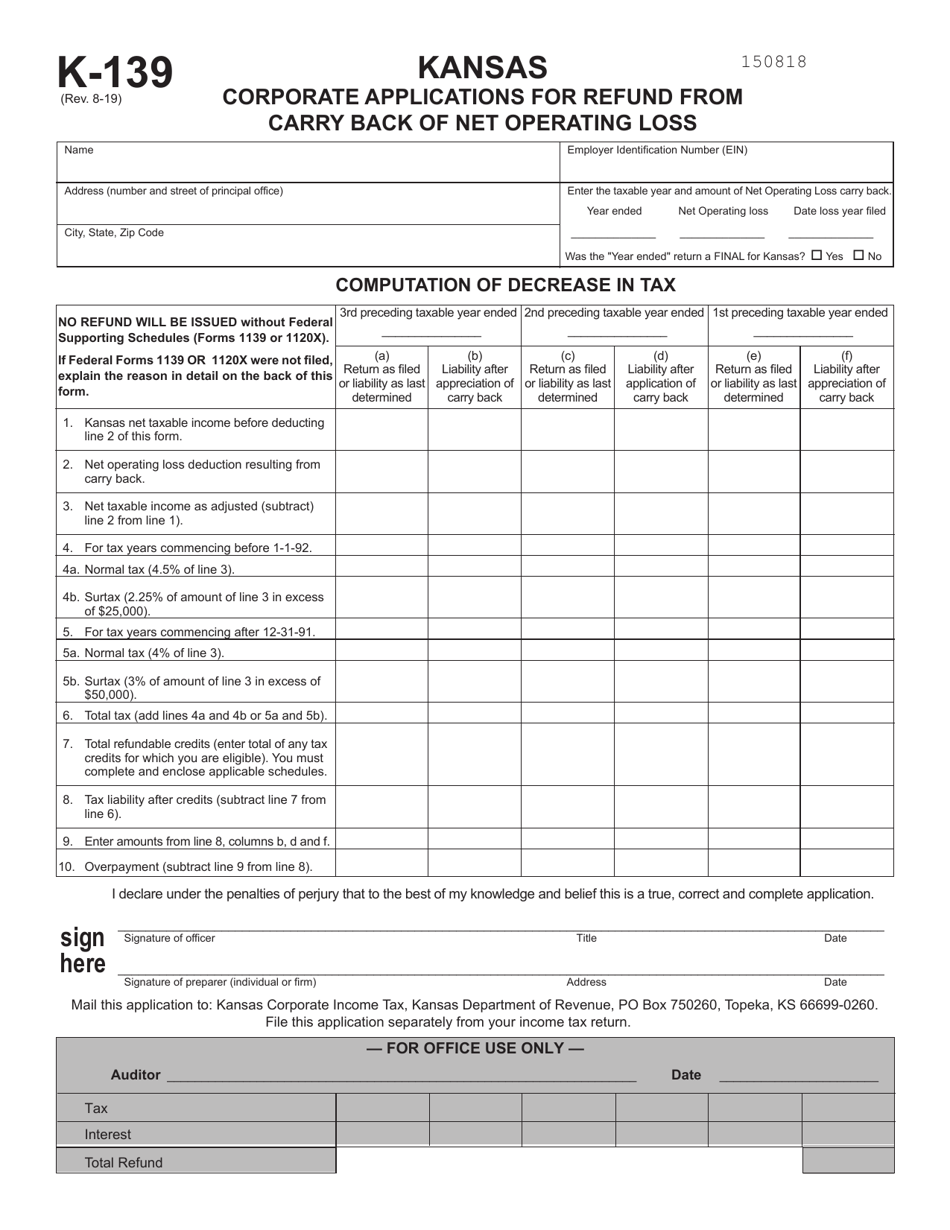

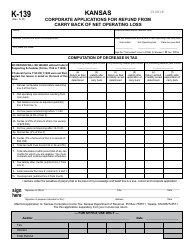

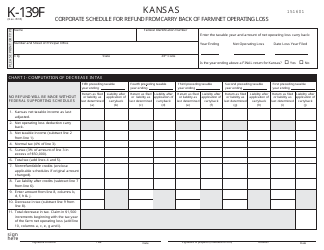

Schedule K-139 Kansas Corporate Applications for Refund From Carry Back of Net Operating Loss - Kansas

What Is Schedule K-139?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-139?

A: Schedule K-139 is a form used by corporations in Kansas to apply for a refund of taxes paid from the carry back of a net operating loss.

Q: Who can use Schedule K-139?

A: Corporations in Kansas can use Schedule K-139 to apply for a refund of taxes paid.

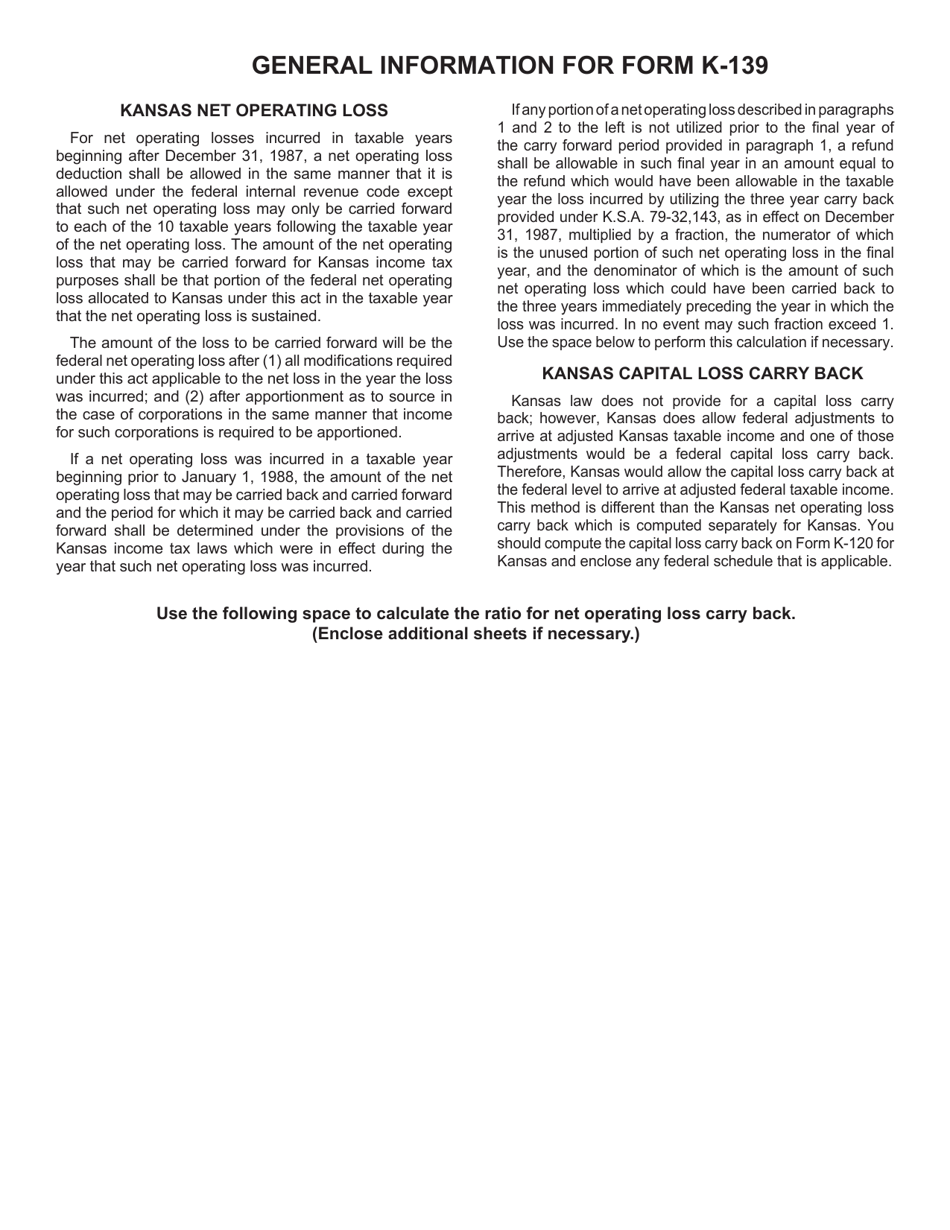

Q: What is a net operating loss?

A: A net operating loss is when a company's deductible expenses exceed its taxable income.

Q: How does the carry back of a net operating loss work?

A: The carry back of a net operating loss allows a company to apply the loss to previous years' taxable income and potentially receive a refund of taxes paid in those years.

Q: What information is required on Schedule K-139?

A: Schedule K-139 requires information about the corporation's net operating loss, taxable income in the carry back years, and the amount of tax paid in those years.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-139 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.