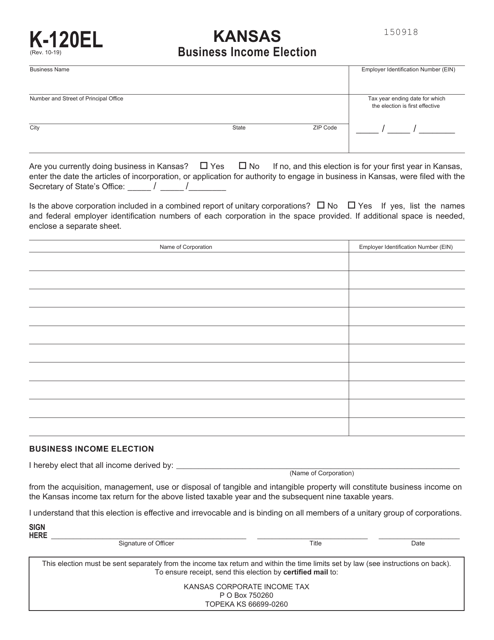

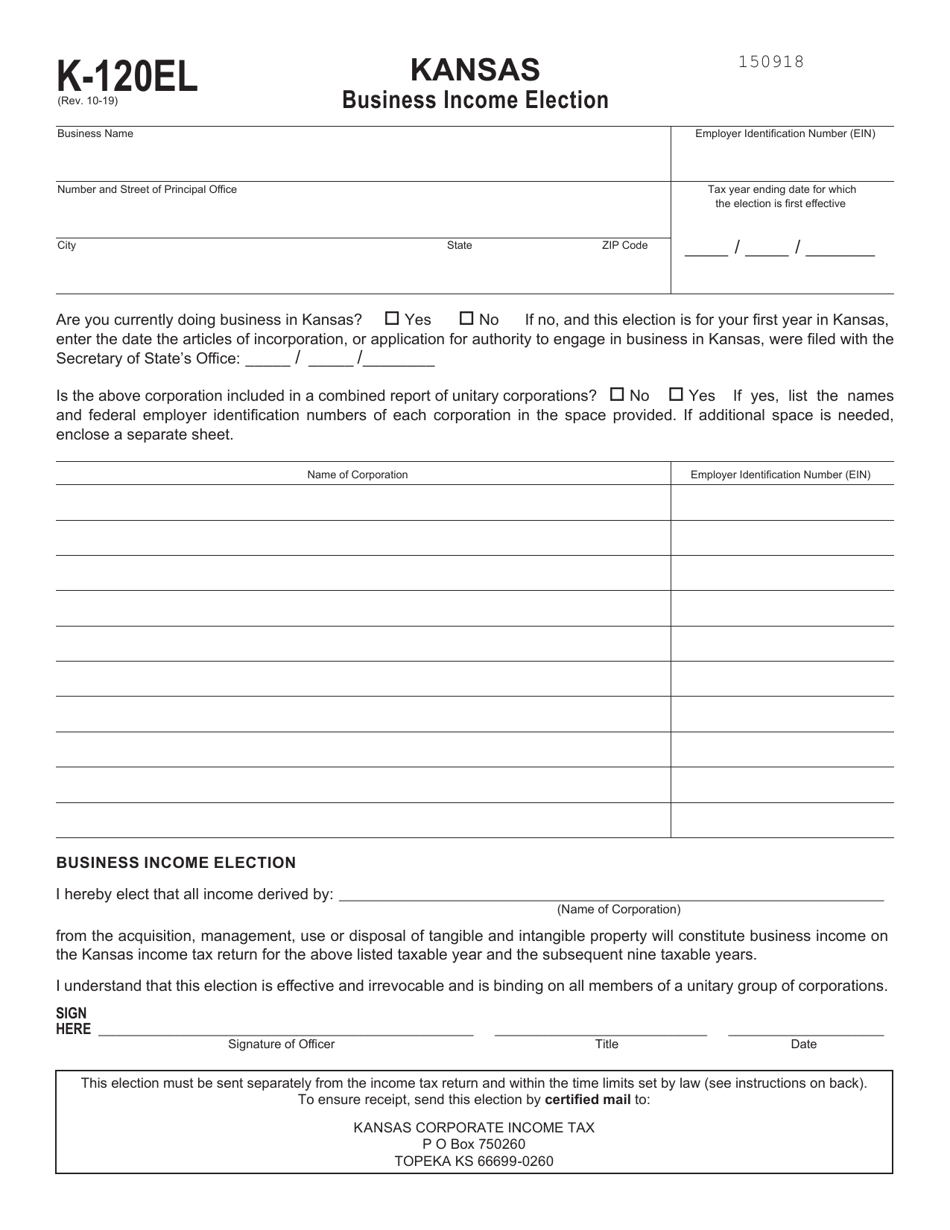

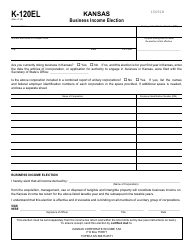

Schedule K-120EL Kansas Business Income Election - Kansas

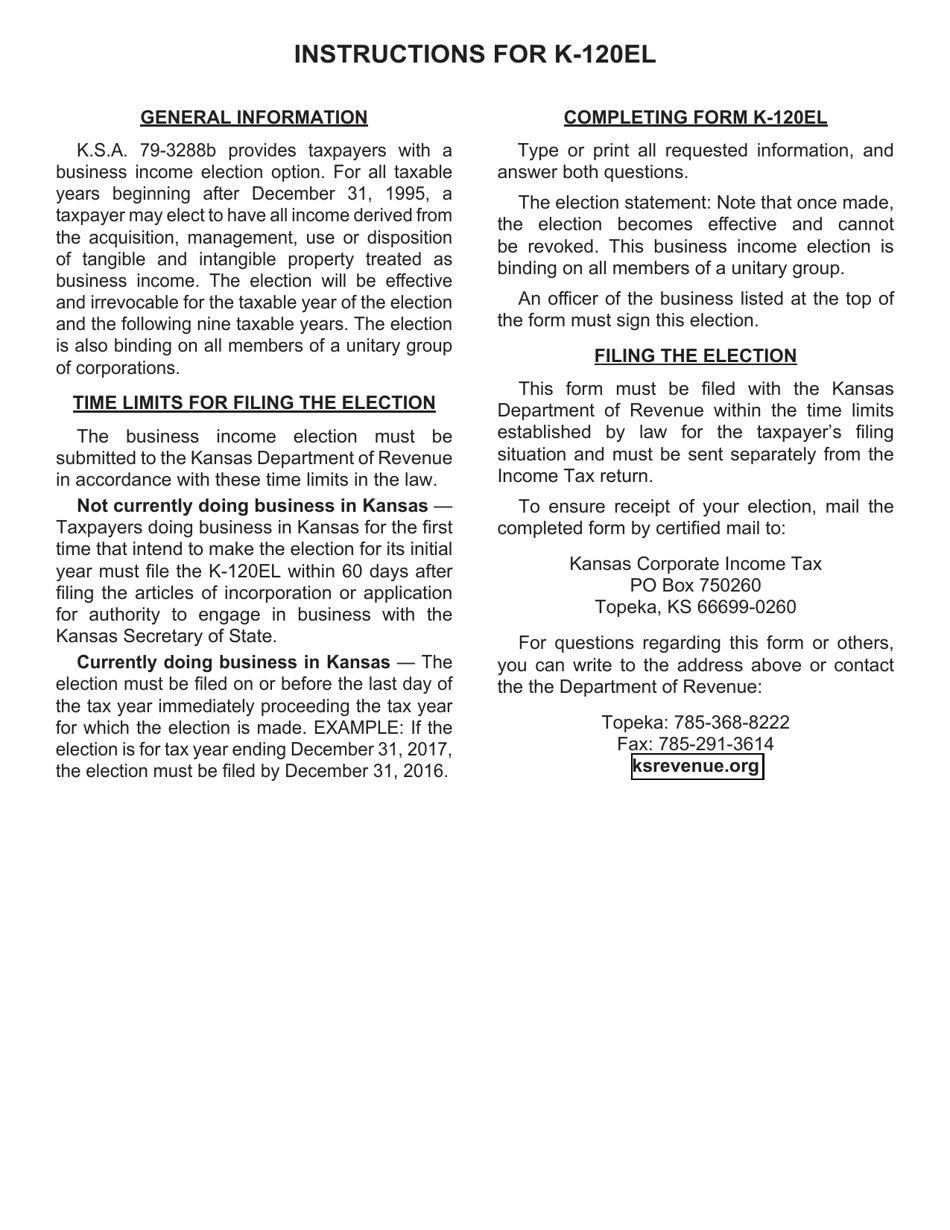

What Is Schedule K-120EL?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-120EL?

A: Schedule K-120EL is a form used in Kansas for electing to calculate your Kansas business income using a different method than the standard method.

Q: Who needs to file Schedule K-120EL?

A: Any taxpayer in Kansas who wants to use an alternate method to calculate their business income instead of the standard method needs to file Schedule K-120EL.

Q: What is the purpose of Schedule K-120EL?

A: The purpose of Schedule K-120EL is to allow taxpayers in Kansas to choose an alternate method for calculating their business income if it will result in a lower tax liability.

Q: How do I file Schedule K-120EL?

A: To file Schedule K-120EL, you need to complete the form with the necessary information, including your alternate method of calculating business income, and submit it along with your Kansas income tax return.

Q: What is the deadline for filing Schedule K-120EL?

A: Schedule K-120EL must be filed along with your Kansas income tax return by the same deadline as your return, which is usually April 15th.

Q: Are there any restrictions or limitations on using Schedule K-120EL?

A: Yes, there are certain restrictions and limitations on using Schedule K-120EL. It is important to carefully review the instructions and requirements outlined in the form.

Q: Can I amend my Kansas tax return to include Schedule K-120EL?

A: Yes, if you have already filed your Kansas tax return and later decide to use Schedule K-120EL, you can file an amended return to include the form.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-120EL by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.