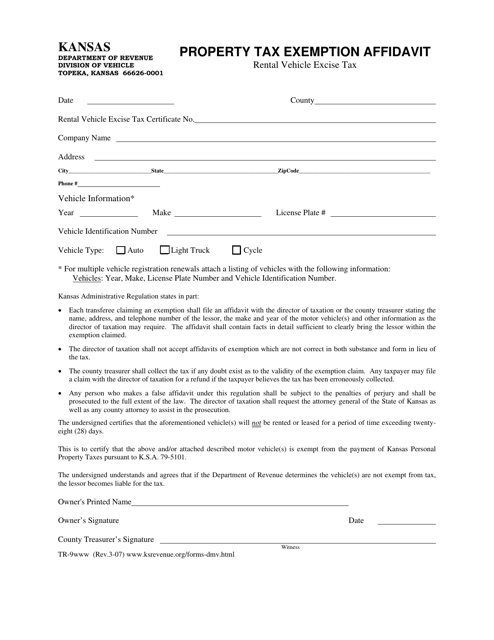

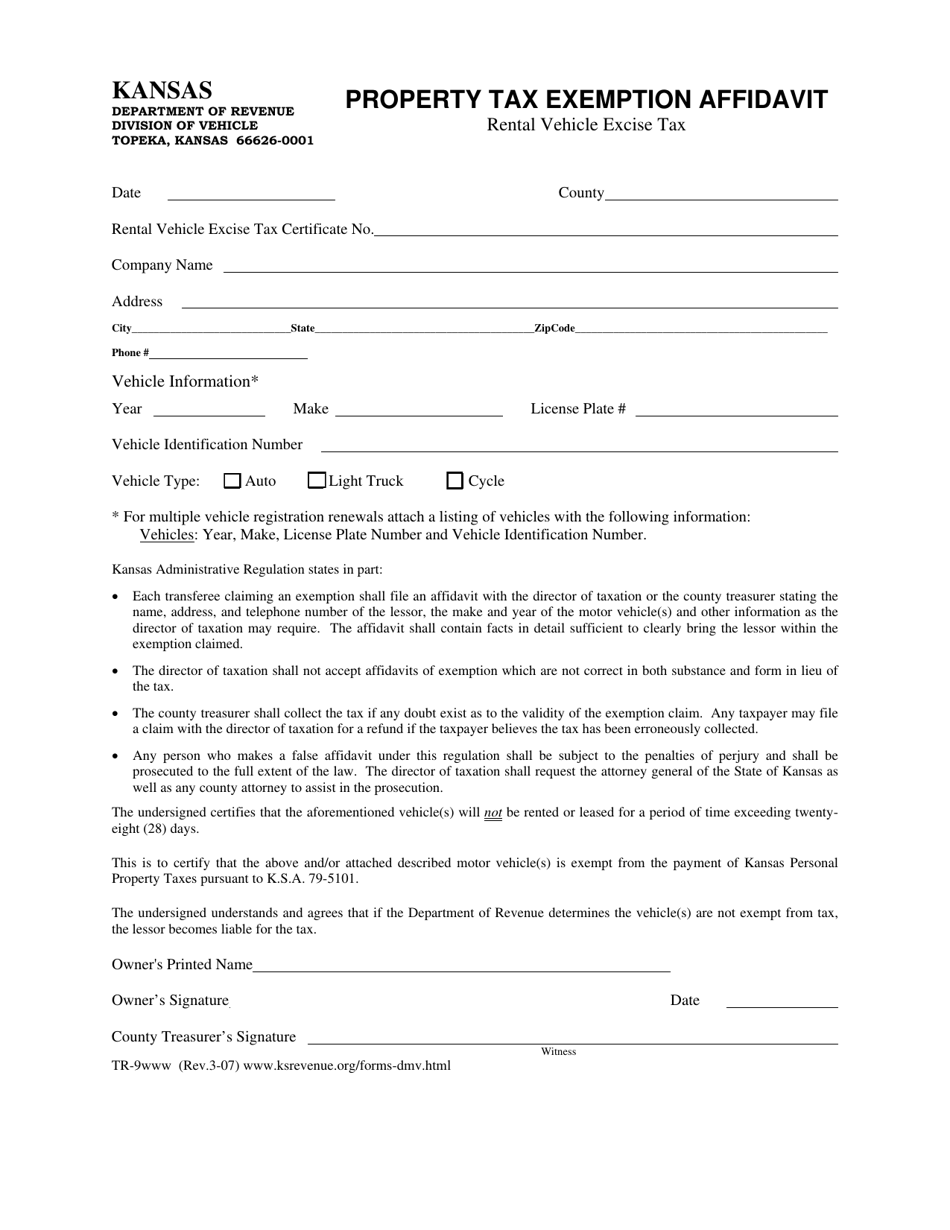

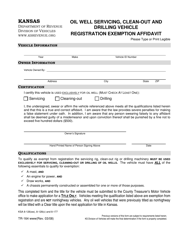

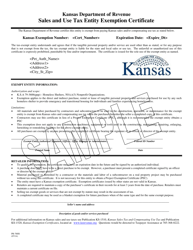

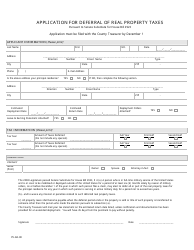

Form TR-9 Property Tax Exemption Affidavit - Kansas

What Is Form TR-9?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

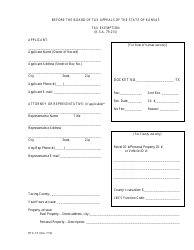

Q: What is a Form TR-9?

A: Form TR-9 is a Property Tax Exemption Affidavit in Kansas.

Q: What is the purpose of Form TR-9?

A: The purpose of Form TR-9 is to apply for property tax exemption in Kansas.

Q: Who needs to fill out Form TR-9?

A: Anyone who wants to apply for property tax exemption in Kansas needs to fill out Form TR-9.

Q: What information do I need to provide on Form TR-9?

A: You will need to provide information about the property and the reason for the exemption, as well as your contact information.

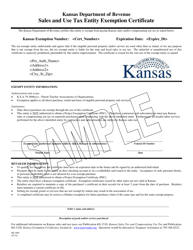

Q: Are there any filing fees for Form TR-9?

A: There are no filing fees for Form TR-9.

Q: When should I submit Form TR-9?

A: You should submit Form TR-9 to your county treasurer's office by March 15th of the tax year for which you are seeking exemption.

Q: What happens after I submit Form TR-9?

A: After you submit Form TR-9, your application will be reviewed by the county treasurer's office, and you will be notified of the decision.

Q: Can I appeal if my application for property tax exemption is denied?

A: Yes, if your application is denied, you can appeal the decision.

Form Details:

- Released on March 1, 2007;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-9 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.