This version of the form is not currently in use and is provided for reference only. Download this version of

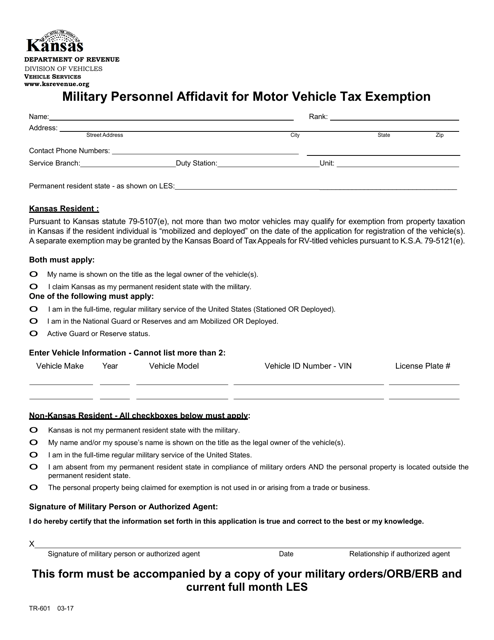

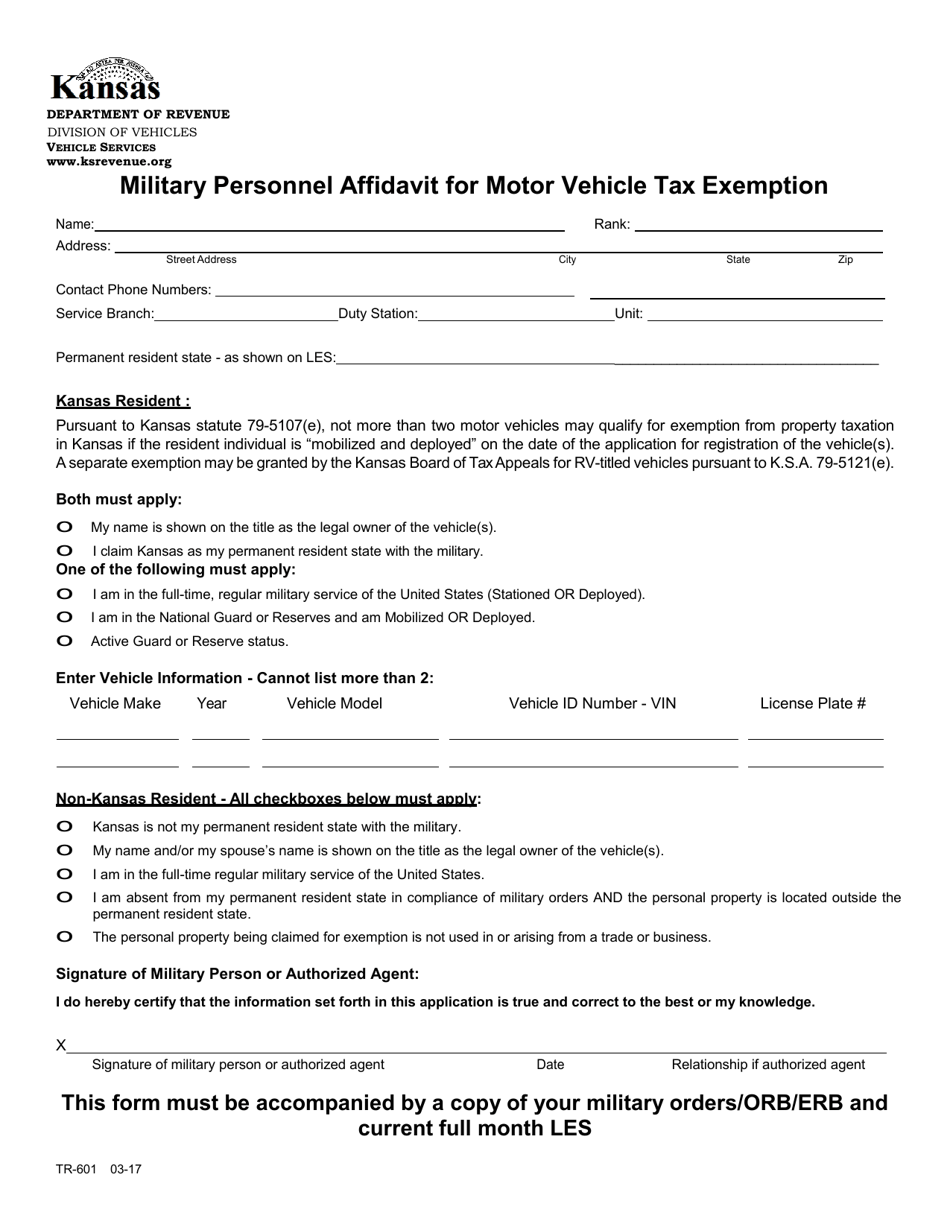

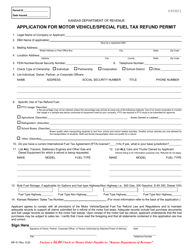

Form TR-601

for the current year.

Form TR-601 Military Personnel Affidavit for Motor Vehicle Tax Exemption - Kansas

What Is Form TR-601?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TR-601?

A: Form TR-601 is the Military Personnel Affidavit for Motor Vehicle Tax Exemption in Kansas.

Q: Who is eligible for the motor vehicle tax exemption in Kansas?

A: Military personnel who are residents of Kansas and are on active duty are eligible for the tax exemption.

Q: What is the purpose of Form TR-601?

A: Form TR-601 is used to claim a tax exemption for military personnel on motor vehicle registration and property taxes in Kansas.

Q: How do I fill out Form TR-601?

A: You need to provide your personal information, military service details, and vehicle information on the form.

Q: Are there any fees associated with the motor vehicle tax exemption?

A: No, there are no fees associated with the tax exemption for military personnel in Kansas.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-601 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.