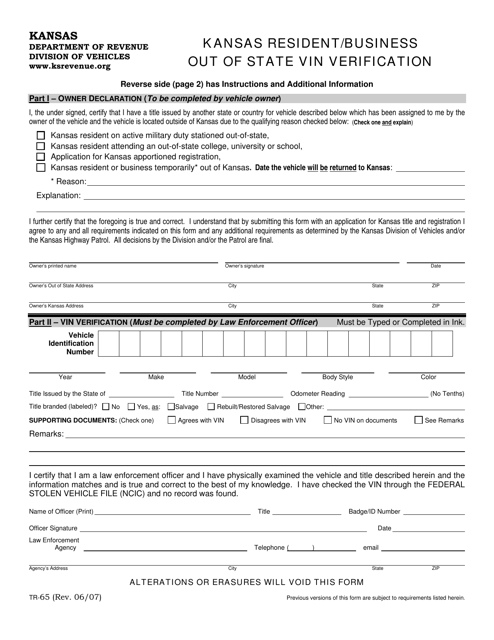

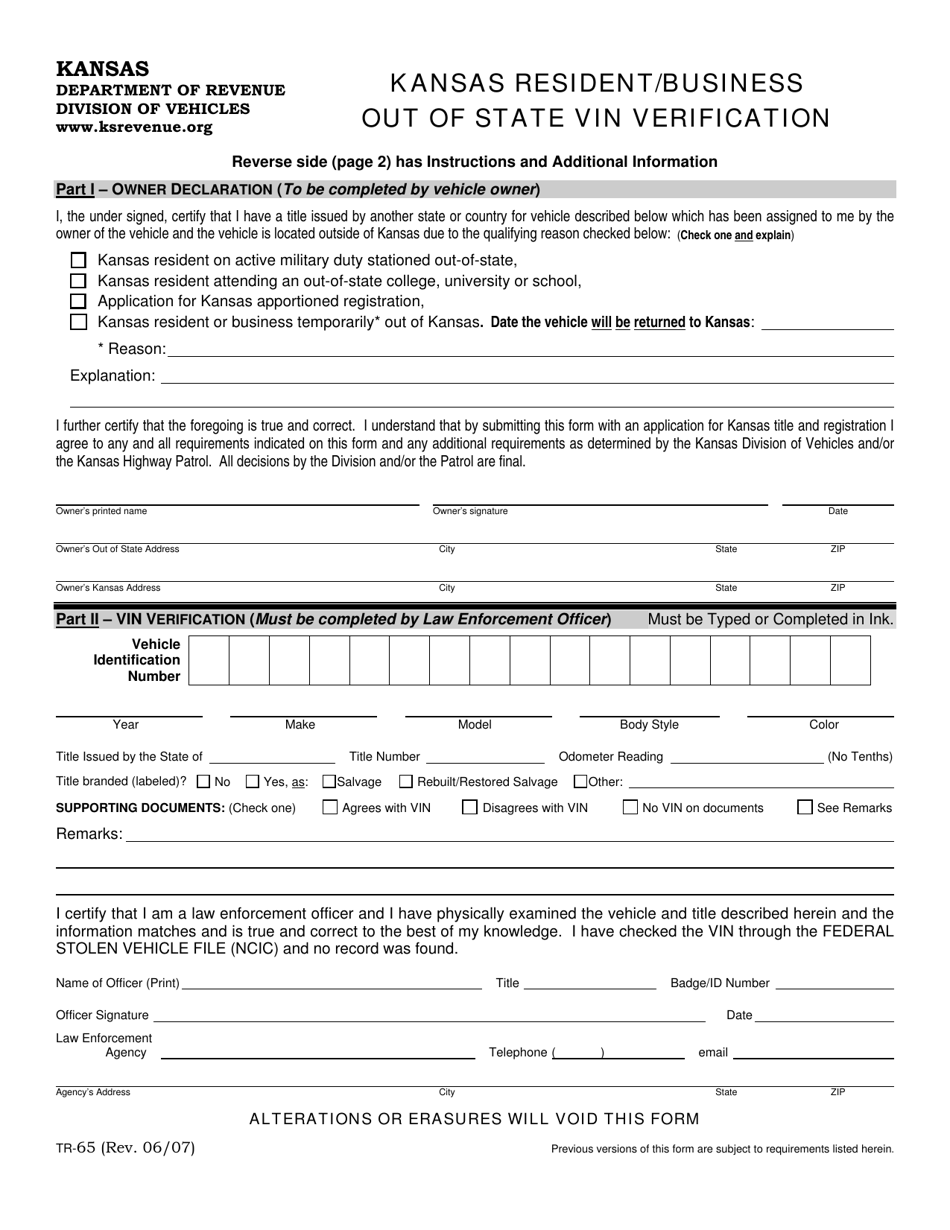

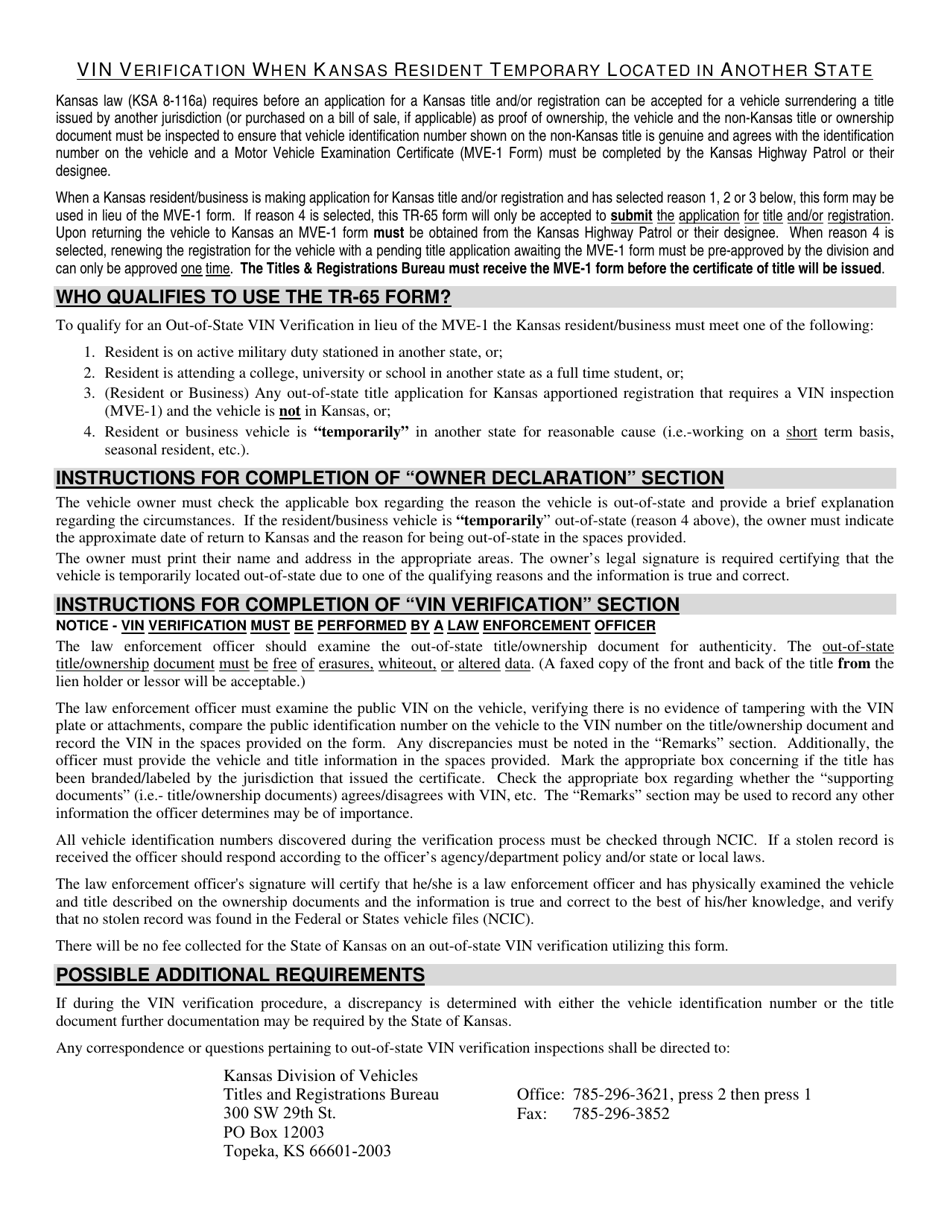

Form TR-65 Kansas Resident / Business out of State Vin Verification - Kansas

What Is Form TR-65?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TR-65?

A: Form TR-65 is a Kansas Resident/Business out of State Vin Verification form.

Q: What is the purpose of Form TR-65?

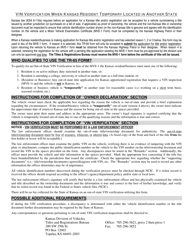

A: The purpose of Form TR-65 is to verify the Vehicle Identification Number (VIN) of a vehicle owned by a Kansas resident or business that is temporarily located out of state.

Q: Who needs to use Form TR-65?

A: Kansas residents or businesses that have a vehicle temporarily located outside of Kansas need to use Form TR-65 to verify the VIN.

Q: What information is required on Form TR-65?

A: Form TR-65 requires the owner's name, address, contact information, vehicle information, and the signature of the person verifying the VIN.

Q: How do I submit Form TR-65?

A: Form TR-65 can be submitted by mail or in person at a local County Treasurer's Office.

Q: Is there a fee for submitting Form TR-65?

A: There is no fee for submitting Form TR-65.

Q: What happens after submitting Form TR-65?

A: After submitting Form TR-65, the Kansas Department of Revenue will verify the VIN and update their records.

Q: Can I use Form TR-65 for a vehicle permanently located out of state?

A: No, Form TR-65 is only for vehicles temporarily located out of state.

Q: How long is the VIN verification valid?

A: The VIN verification is valid for 90 days from the date of the verification.

Form Details:

- Released on June 1, 2007;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-65 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.