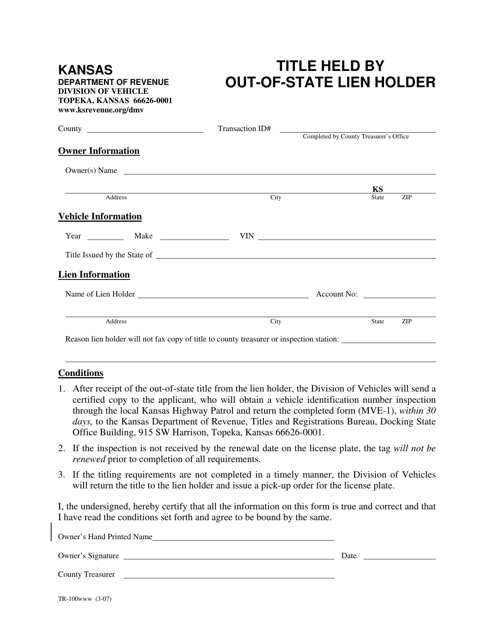

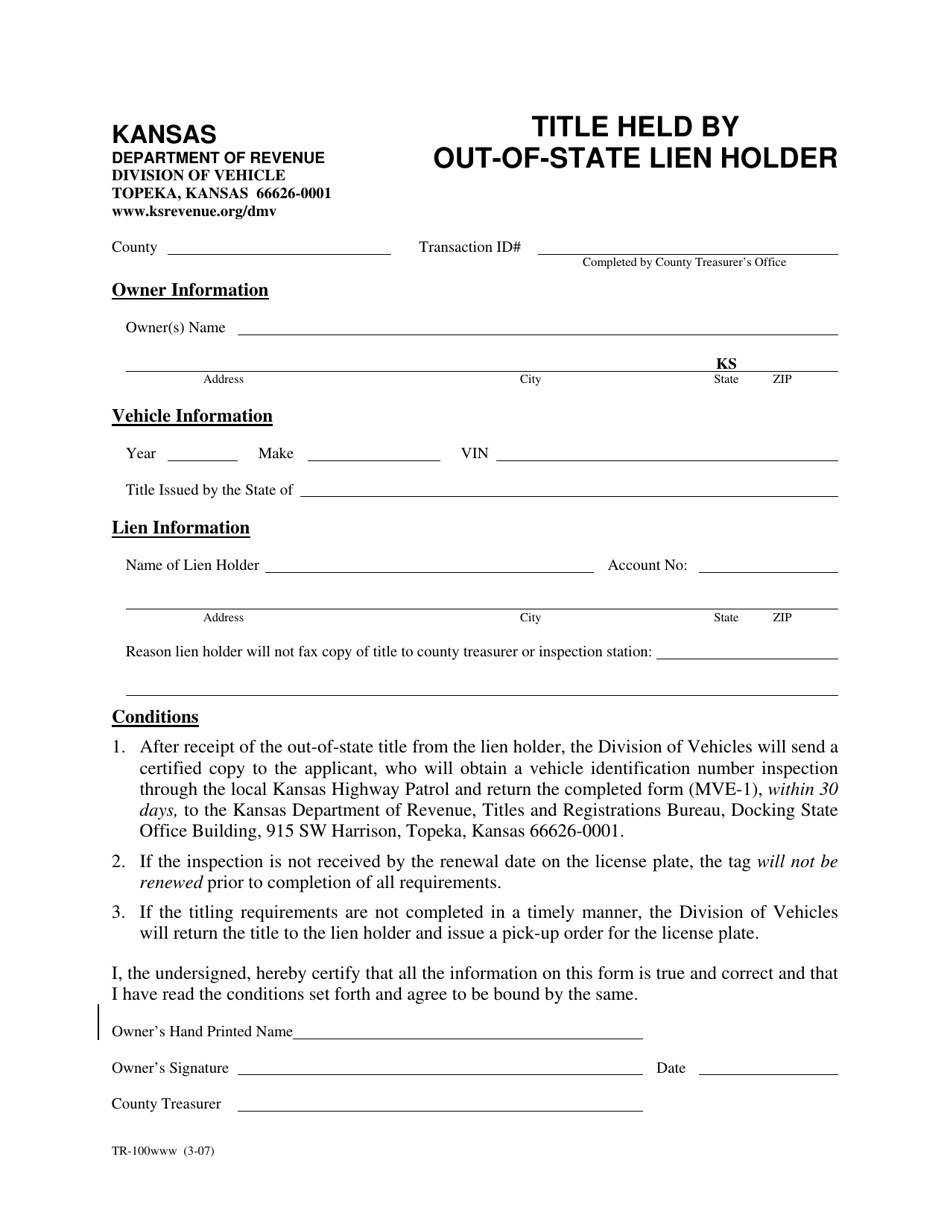

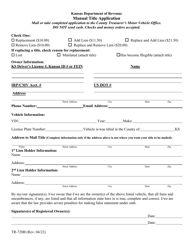

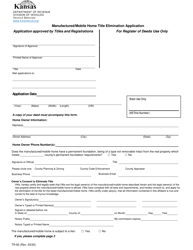

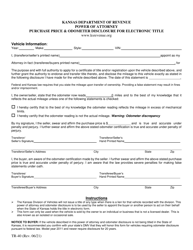

Form TR-100 Title Held by Out-of-State Lien Holder - Kansas

What Is Form TR-100?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

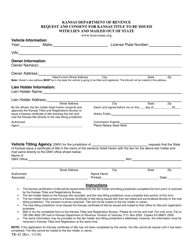

Q: What is a TR-100 form?

A: The TR-100 form is a document used in Kansas to show that the title of a vehicle is held by an out-of-state lien holder.

Q: Who is an out-of-state lien holder?

A: An out-of-state lien holder is a person or organization that holds a legal claim on a vehicle title but is located outside of Kansas.

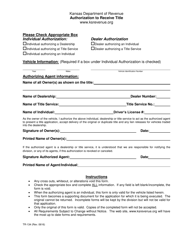

Q: What information is required on a TR-100 form?

A: The TR-100 form typically requires the vehicle make, model, year, and identification number, as well as the name and address of the out-of-state lien holder.

Q: Why would I need to file a TR-100 form?

A: You would need to file a TR-100 form if you have a vehicle registered in Kansas and the title is held by an out-of-state lien holder.

Q: Are there any fees associated with filing a TR-100 form?

A: Yes, there may be fees associated with filing a TR-100 form. You should check with the Kansas Department of Revenue for the most current fee information.

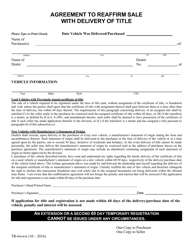

Q: What should I do with the completed TR-100 form?

A: You should submit the completed TR-100 form to the Kansas Department of Revenue to update the vehicle title information.

Q: Is the TR-100 form specific to Kansas?

A: Yes, the TR-100 form is specific to Kansas and is used to show out-of-state lien holder information for vehicles registered in Kansas.

Form Details:

- Released on March 1, 2007;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR-100 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.