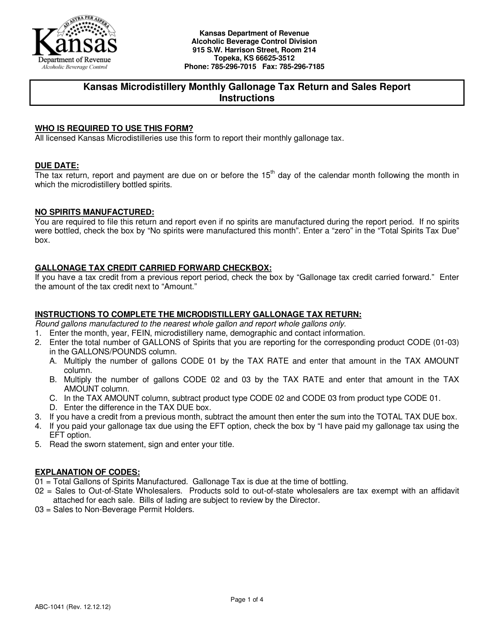

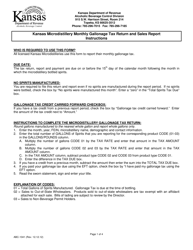

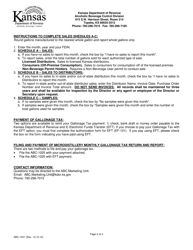

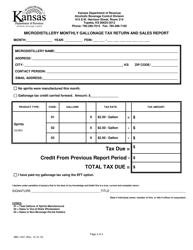

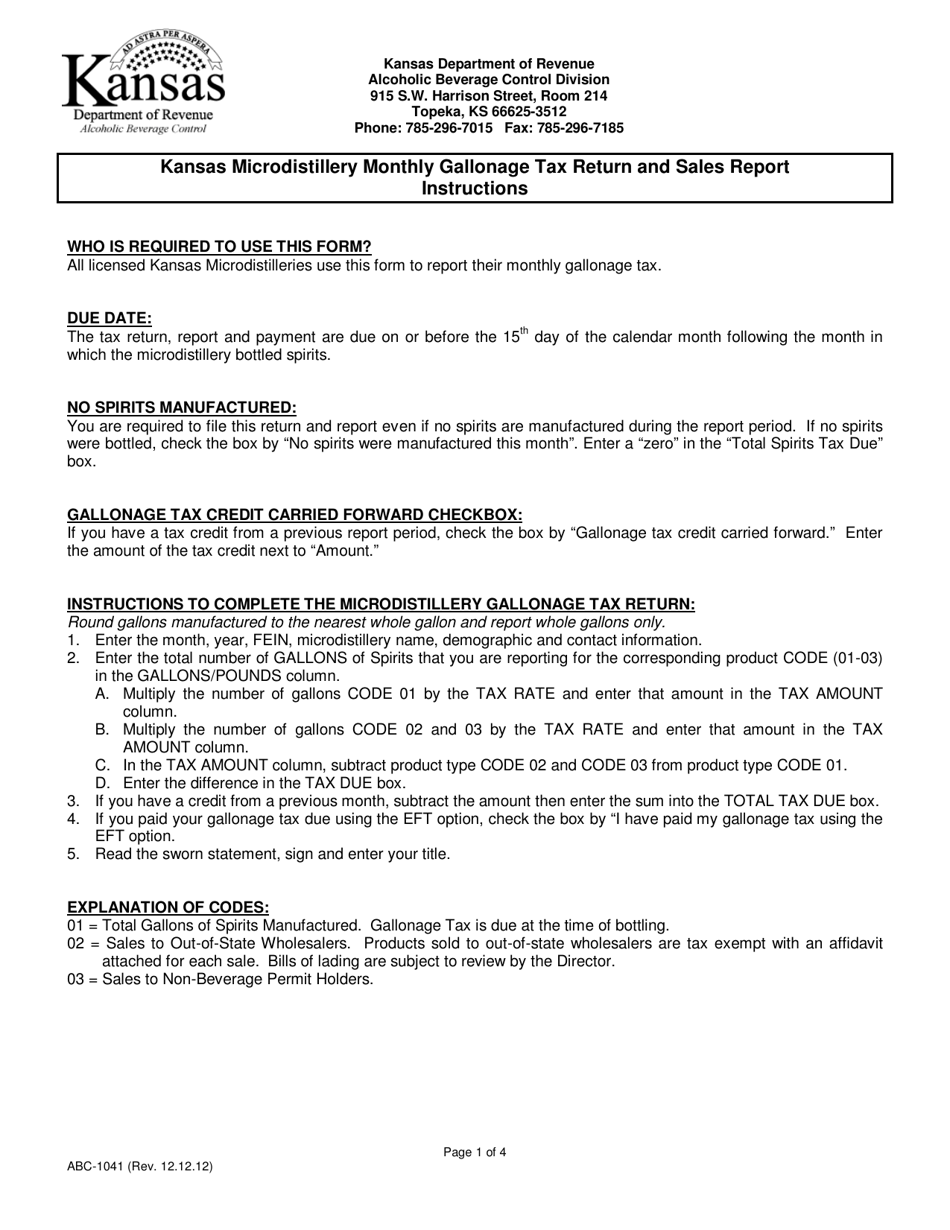

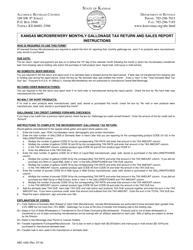

Form ABC-1041 Microdistillery Monthly Gallonage Tax Return and Sales Report - Kansas

What Is Form ABC-1041?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form ABC-1041?

A: Form ABC-1041 is the Microdistillery Monthly Gallonage Tax Return and Sales Report for microdistilleries in Kansas.

Q: Who needs to file form ABC-1041?

A: Microdistilleries in Kansas need to file form ABC-1041.

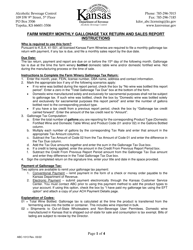

Q: What is the purpose of form ABC-1041?

A: The purpose of form ABC-1041 is to report the monthly gallonage tax and sales for microdistilleries in Kansas.

Q: How often should form ABC-1041 be filed?

A: Form ABC-1041 should be filed on a monthly basis.

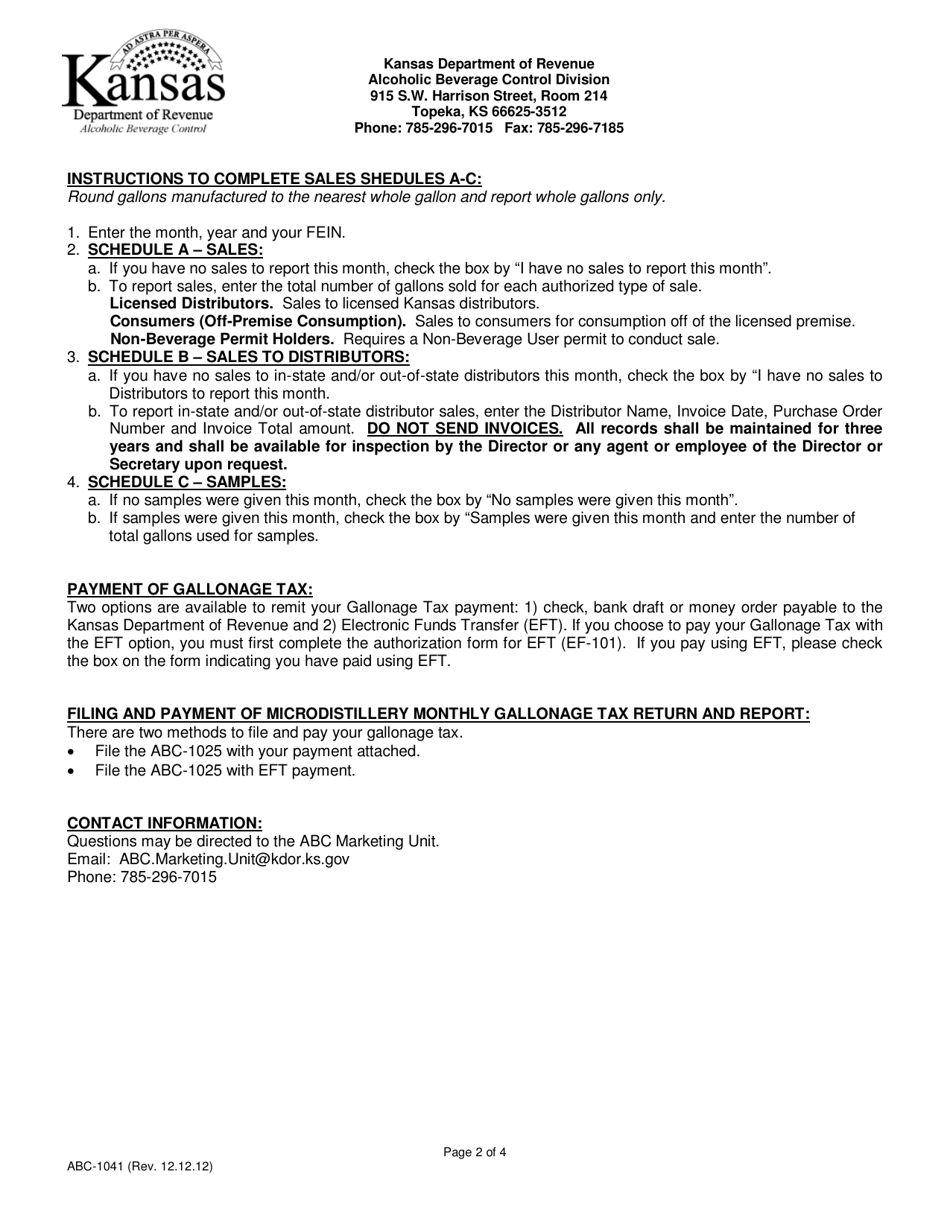

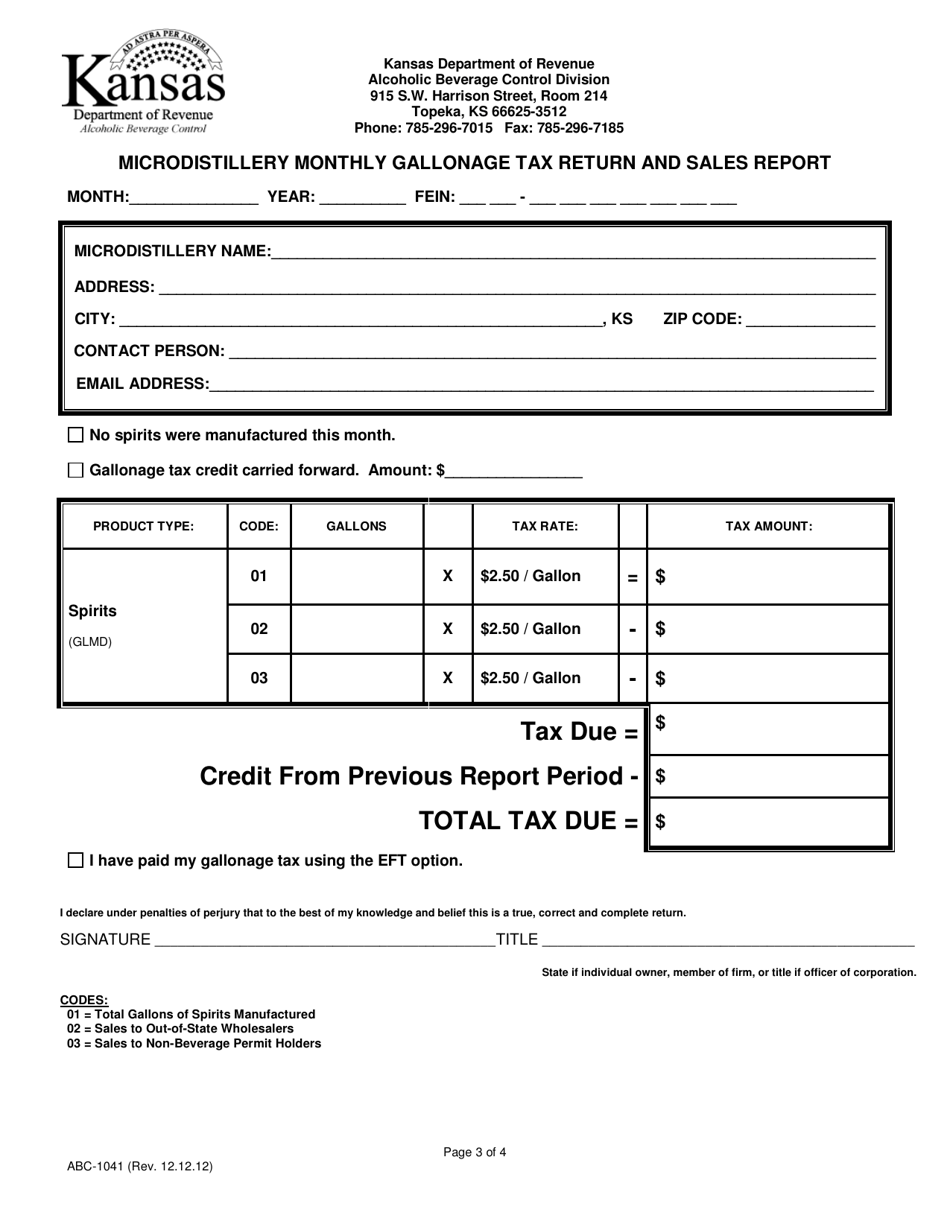

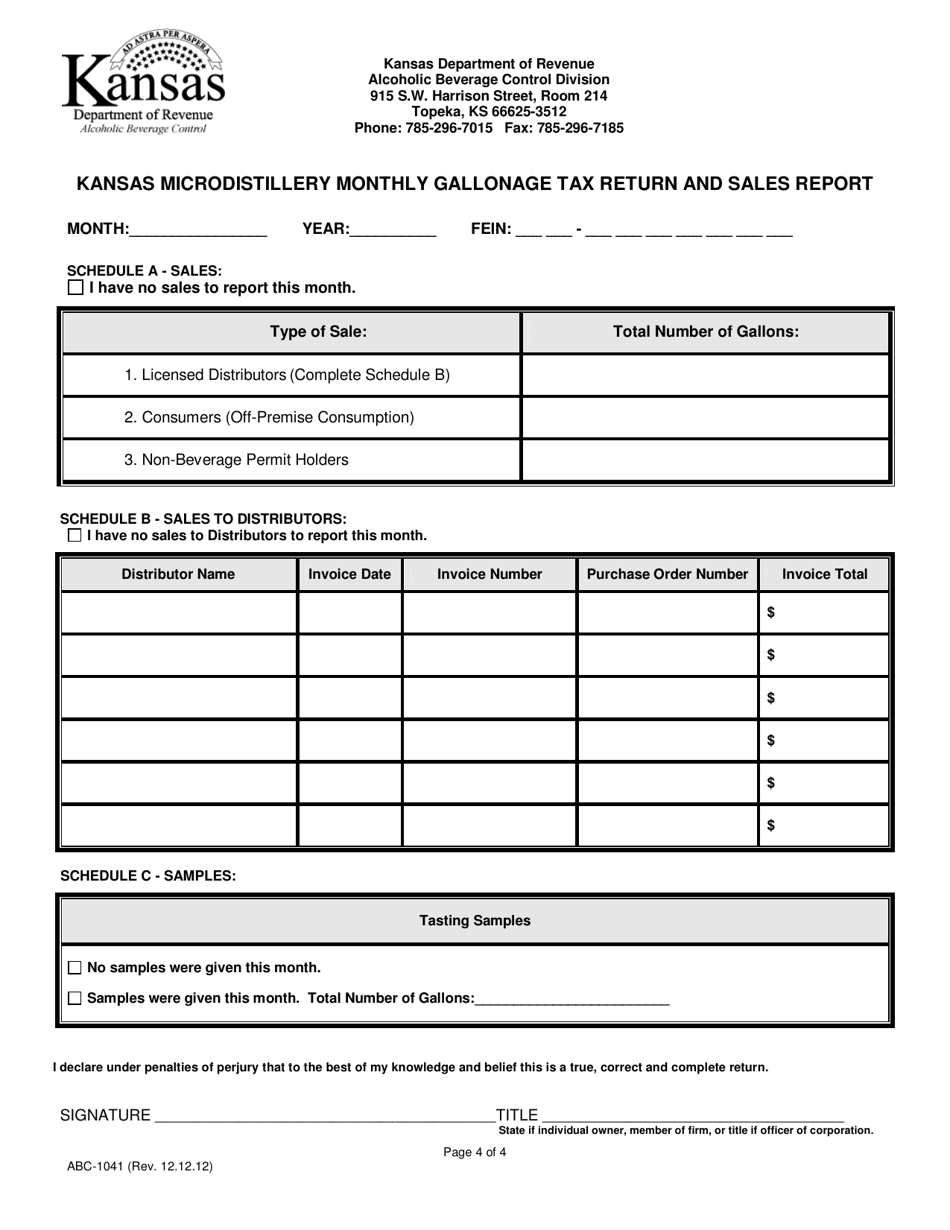

Q: What information is required on form ABC-1041?

A: Form ABC-1041 requires microdistilleries to provide information about their monthly sales and gallonage tax owed.

Q: Are there any penalties for not filing form ABC-1041?

A: Yes, there are penalties for not filing form ABC-1041 or for filing it late. It is important to file the form on time to avoid these penalties.

Q: Can form ABC-1041 be filed electronically?

A: Yes, microdistilleries have the option to file form ABC-1041 electronically.

Q: What is the deadline for filing form ABC-1041?

A: Form ABC-1041 must be filed by the 20th day of the month following the month being reported.

Form Details:

- Released on December 12, 2012;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ABC-1041 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.