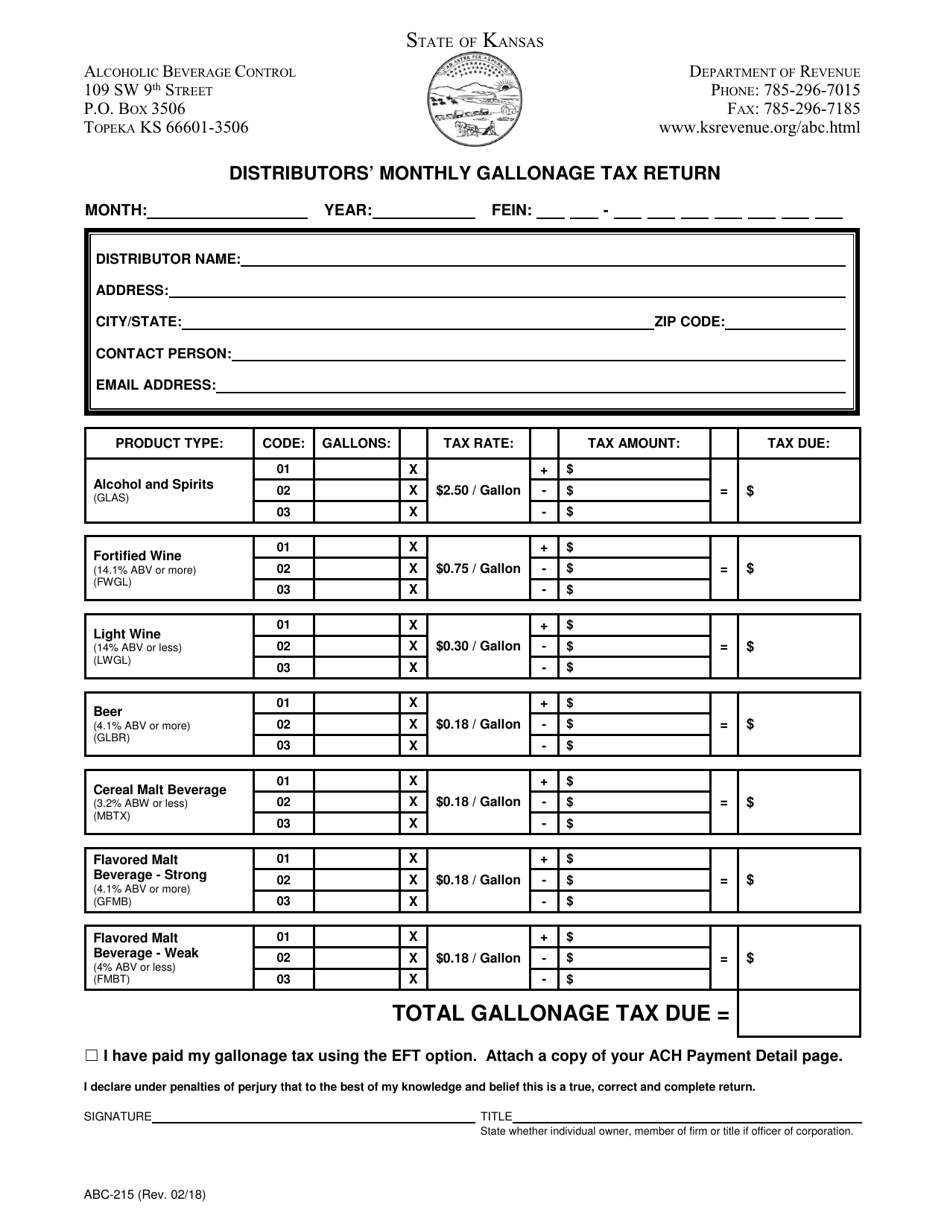

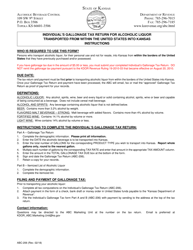

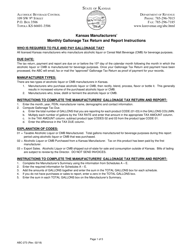

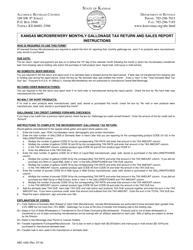

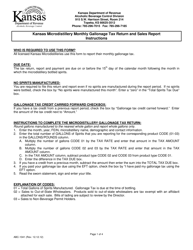

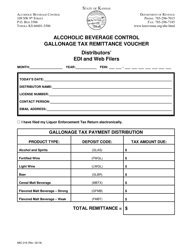

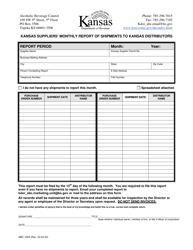

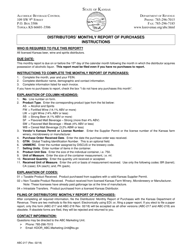

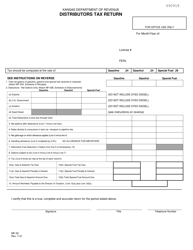

Form ABC-215 Distributors' Monthly Gallonage Tax Return - Kansas

What Is Form ABC-215?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form ABC-215?

A: Form ABC-215 is the Distributors' Monthly Gallonage Tax Return.

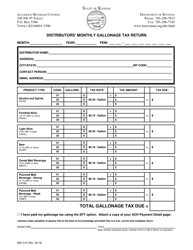

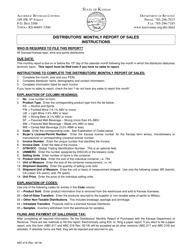

Q: Who needs to file form ABC-215?

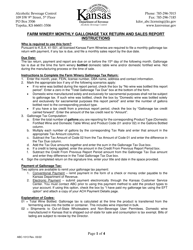

A: Distributors in Kansas who sell or distribute certain alcoholic beverages need to file form ABC-215.

Q: What is the purpose of form ABC-215?

A: Form ABC-215 is used to report and pay the gallonage tax on alcoholic beverages distributed in Kansas.

Q: When is form ABC-215 due?

A: Form ABC-215 is due on the 25th day of the month following the reporting period.

Q: Are there any penalties for late filing of form ABC-215?

A: Yes, there are penalties for late filing, including interest charges and possible license suspension.

Q: What should I include with form ABC-215?

A: You should include payment for the gallonage tax due along with form ABC-215.

Q: Can form ABC-215 be filed electronically?

A: Yes, distributors have the option to file form ABC-215 electronically.

Q: Is form ABC-215 required for all alcoholic beverages?

A: No, form ABC-215 is only required for certain alcoholic beverages as specified by the Kansas Department of Revenue.

Q: What happens if I don't file form ABC-215?

A: Failure to file form ABC-215 can result in penalties, including fines and possible legal action.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ABC-215 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.