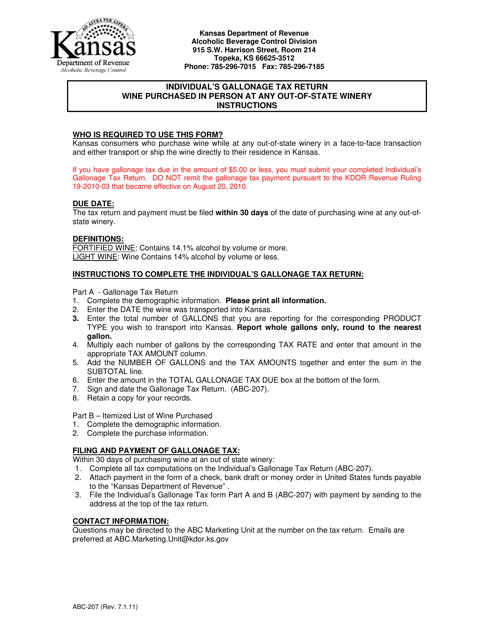

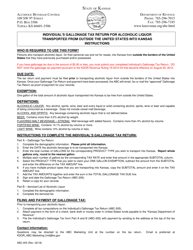

Form ABC-207 Individual's Gallonage Tax Return - Wine Purchased in Person Any of Out-of-State Winery - Kansas

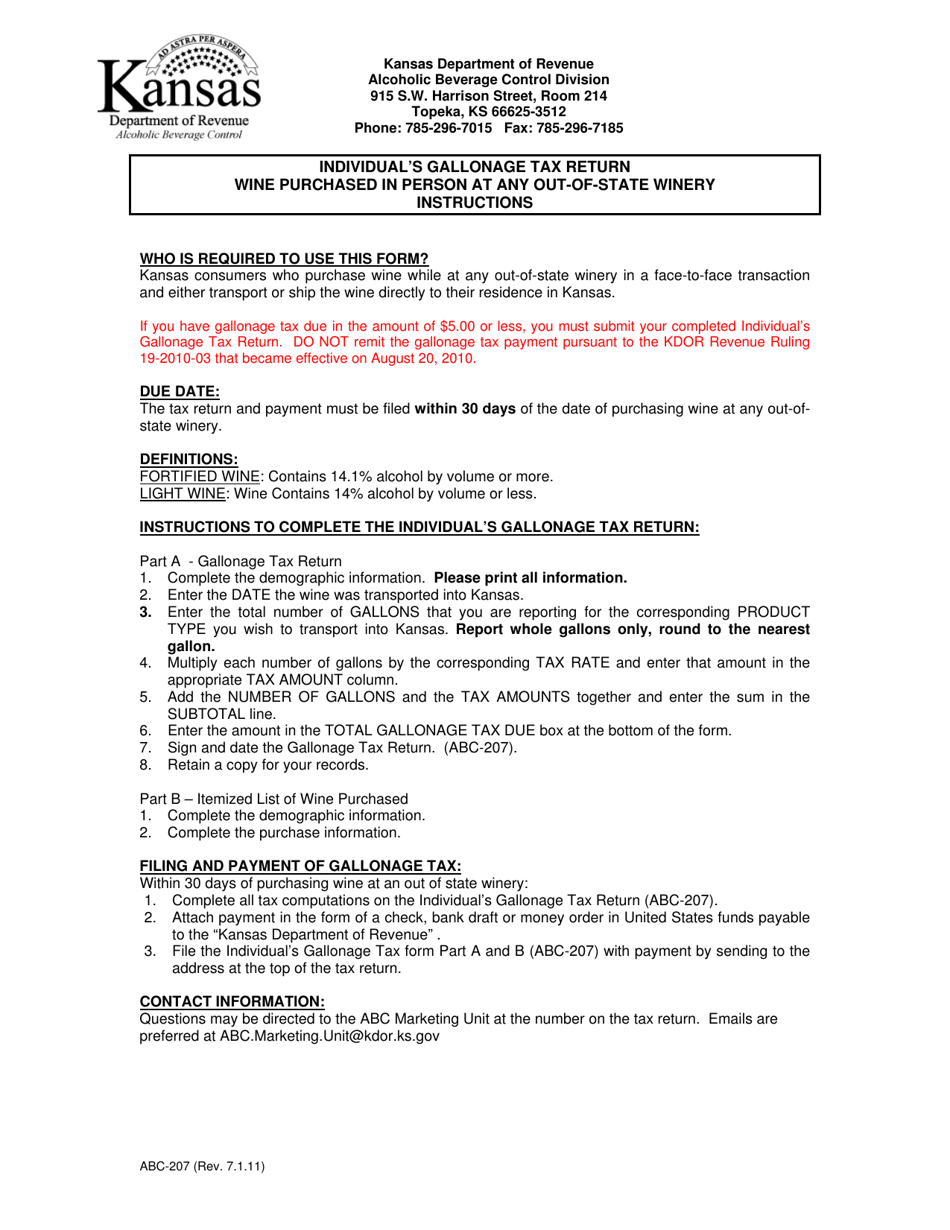

What Is Form ABC-207?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form ABC-207?

A: Form ABC-207 is the Individual's Gallonage Tax Return.

Q: What is the purpose of form ABC-207?

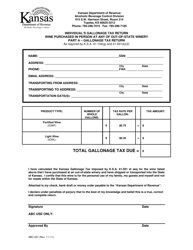

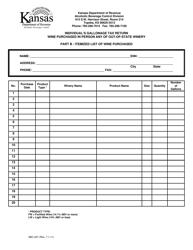

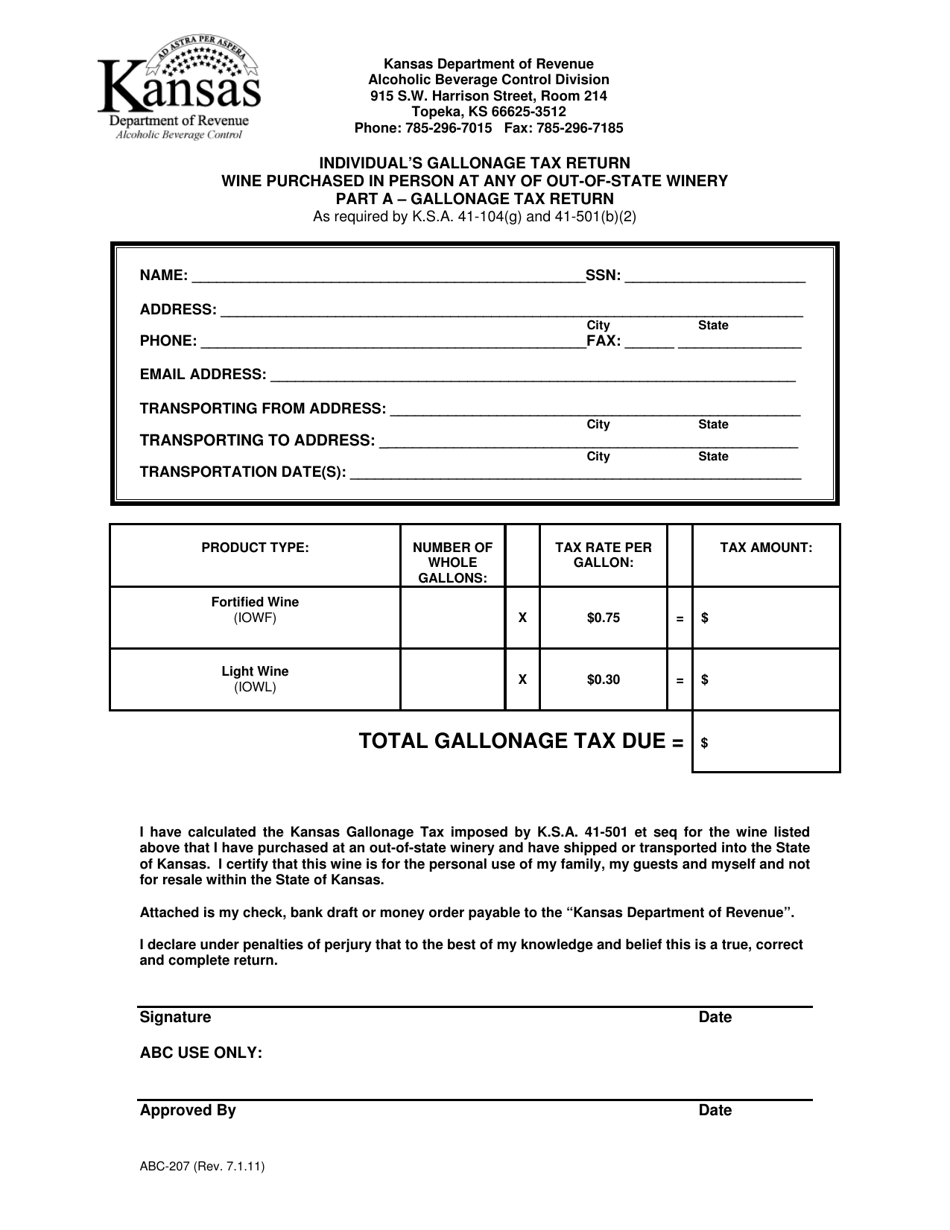

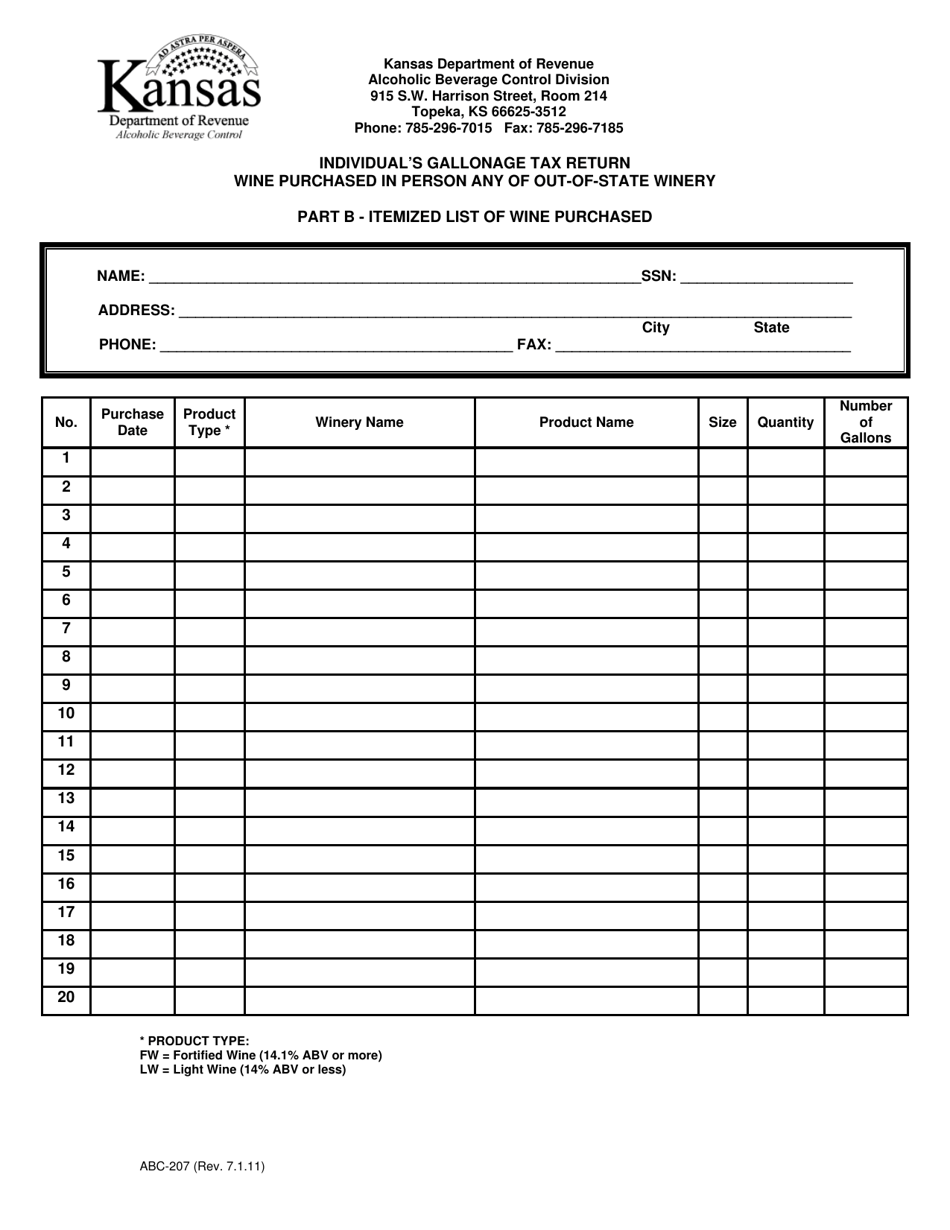

A: Form ABC-207 is used to report and pay the gallonage tax on wine purchased in person from any out-of-state winery in Kansas.

Q: Who needs to file form ABC-207?

A: Any individual who has purchased wine in person from an out-of-state winery in Kansas needs to file form ABC-207.

Q: What is the gallonage tax?

A: The gallonage tax is a tax on the volume of wine purchased.

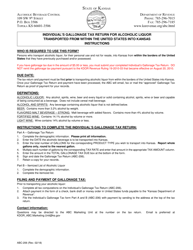

Q: Is there a deadline for filing form ABC-207?

A: Yes, the deadline for filing form ABC-207 is based on the individual's tax year. Please refer to the instructions on the form for specific deadlines.

Q: Do I need to include payment with form ABC-207?

A: Yes, you need to include payment for the gallonage tax owed with form ABC-207.

Q: Are there any exemptions or deductions for the gallonage tax?

A: No, there are no exemptions or deductions available for the gallonage tax on wine purchased in person.

Q: What happens if I don't file form ABC-207?

A: Failure to file form ABC-207 and pay the gallonage tax can result in penalties and interest charges.

Q: Can I file form ABC-207 electronically?

A: No, currently form ABC-207 can only be filed by mail.

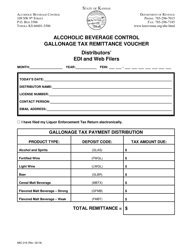

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ABC-207 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.