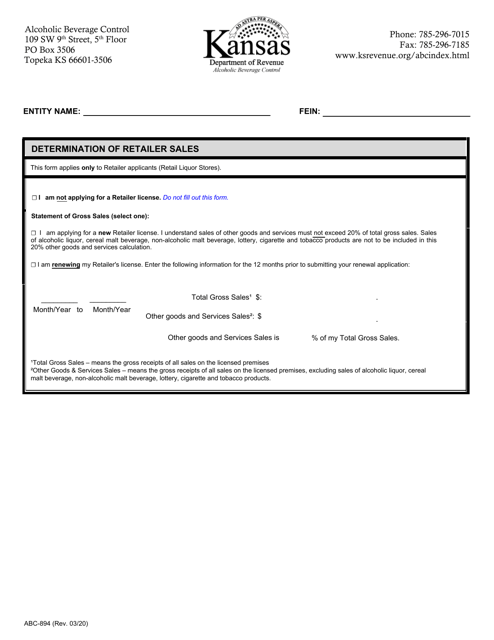

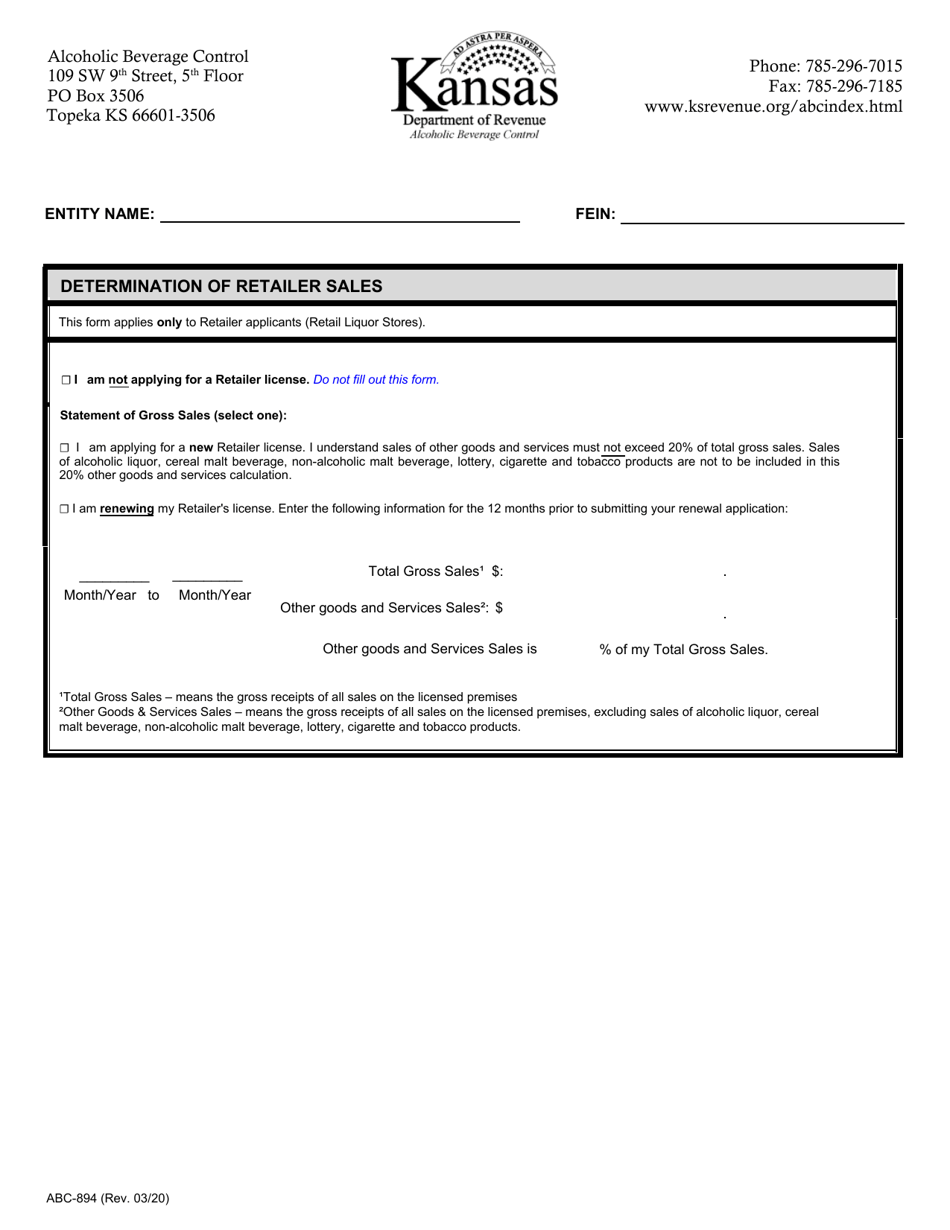

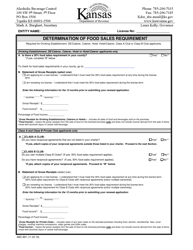

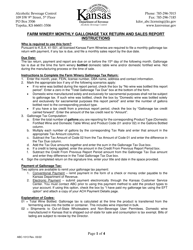

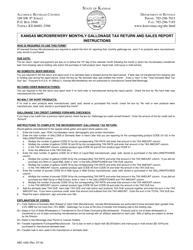

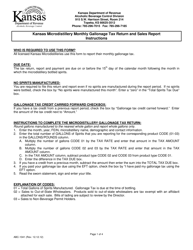

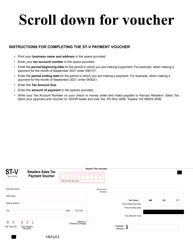

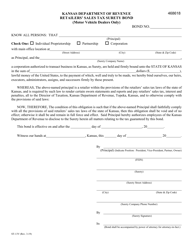

Form ABC-894 Determination of Retailer Sales - Kansas

What Is Form ABC-894?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form ABC-894?

A: Form ABC-894 is a document used in Kansas to determine retailer sales.

Q: Who uses form ABC-894?

A: Retailers in Kansas use form ABC-894 to report their sales.

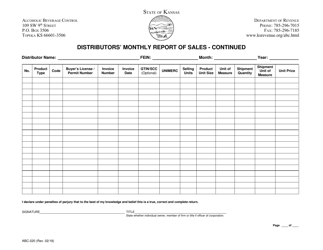

Q: What information is required on form ABC-894?

A: Form ABC-894 typically requires retailers to provide information about their sales, including the date, amount, and type of sales.

Q: Is form ABC-894 specific to Kansas?

A: Yes, form ABC-894 is specific to Kansas and is used to determine retailer sales in the state.

Q: Are there any fees associated with form ABC-894?

A: There are no fees associated with form ABC-894 itself, but retailers may be required to pay sales tax based on the information provided on the form.

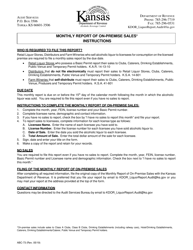

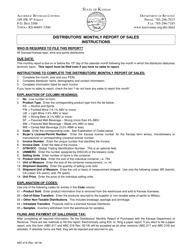

Q: How often do retailers need to submit form ABC-894?

A: The frequency of submitting form ABC-894 may vary, but retailers are generally required to submit the form on a regular basis, such as monthly or quarterly.

Q: What happens if a retailer fails to submit form ABC-894?

A: If a retailer fails to submit form ABC-894 or provides inaccurate information, they may be subject to penalties or fines by the Kansas Department of Revenue.

Q: Can I use form ABC-894 if I am not a retailer in Kansas?

A: No, form ABC-894 is specifically for retailers in Kansas and is not applicable to businesses or individuals outside of the state.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ABC-894 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.