This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule 2

for the current year.

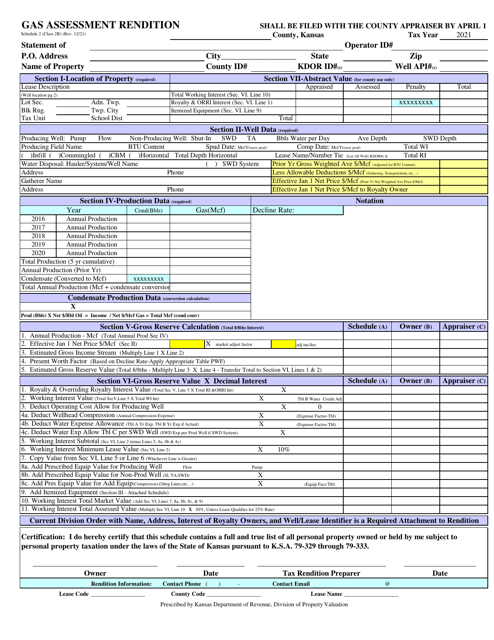

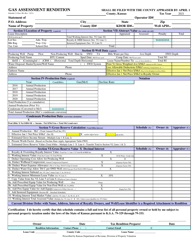

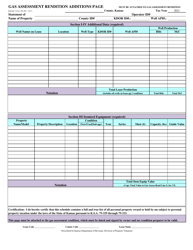

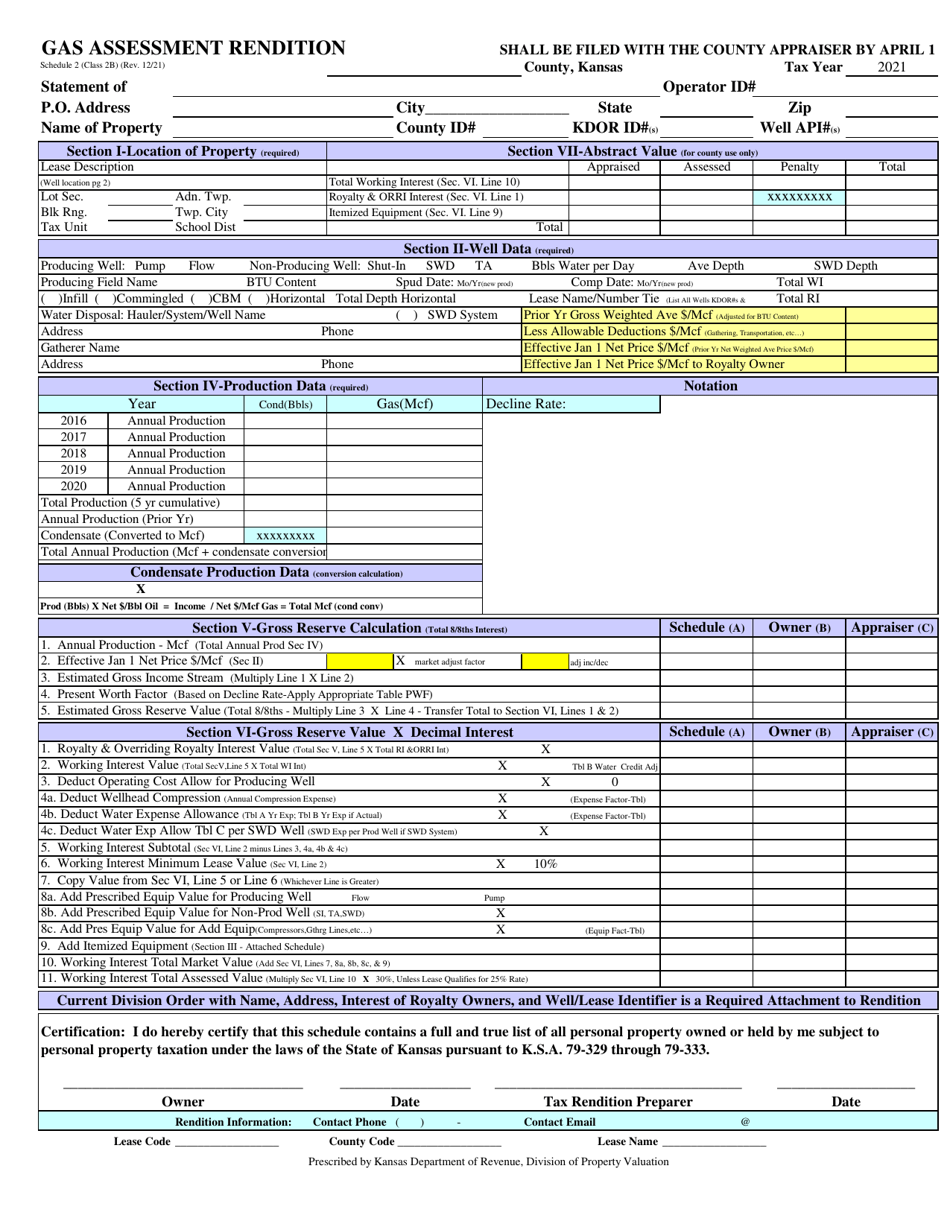

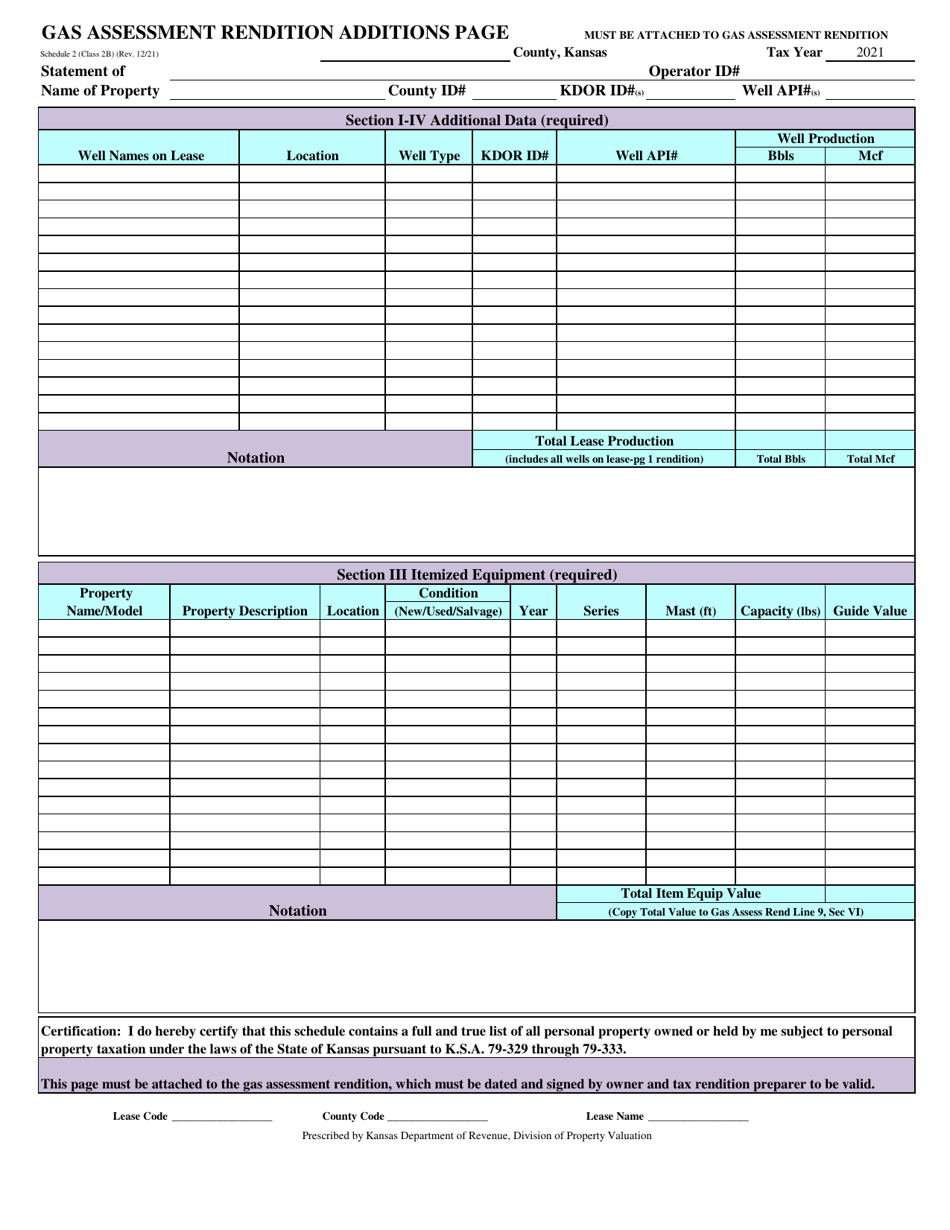

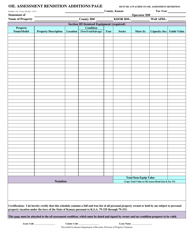

Schedule 2 Gas Assessment Rendition - Kansas

What Is Schedule 2?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Schedule 2 Gas Assessment Rendition?

A: A Schedule 2 Gas Assessment Rendition is a form used in Kansas to assess the value of natural gas production.

Q: Who is required to file a Schedule 2 Gas Assessment Rendition in Kansas?

A: Operators and owners of natural gas properties in Kansas are required to file a Schedule 2 Gas Assessment Rendition.

Q: What information is included in a Schedule 2 Gas Assessment Rendition?

A: A Schedule 2 Gas Assessment Rendition includes information about the production volume, market value, and taxable value of natural gas properties.

Q: When is the deadline to file a Schedule 2 Gas Assessment Rendition in Kansas?

A: The deadline to file a Schedule 2 Gas Assessment Rendition in Kansas is usually March 15 of each year.

Q: What happens if a Schedule 2 Gas Assessment Rendition is not filed in Kansas?

A: Failure to file a Schedule 2 Gas Assessment Rendition in Kansas may result in penalties and interest charges.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule 2 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.