This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule 2

for the current year.

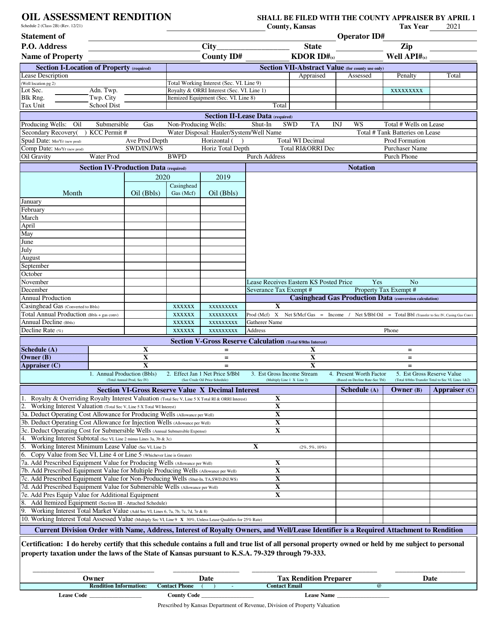

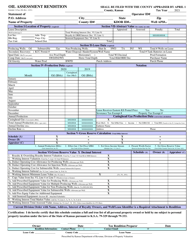

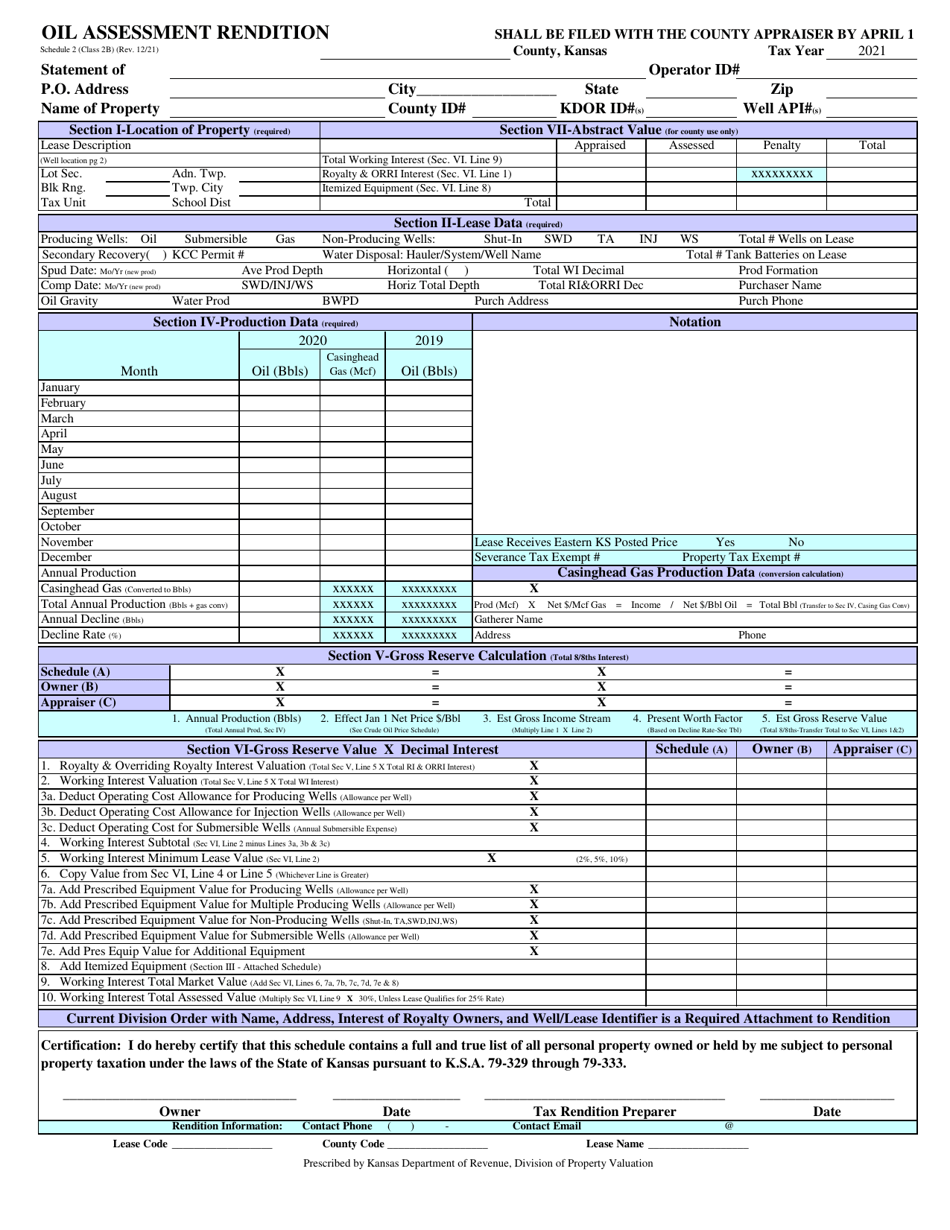

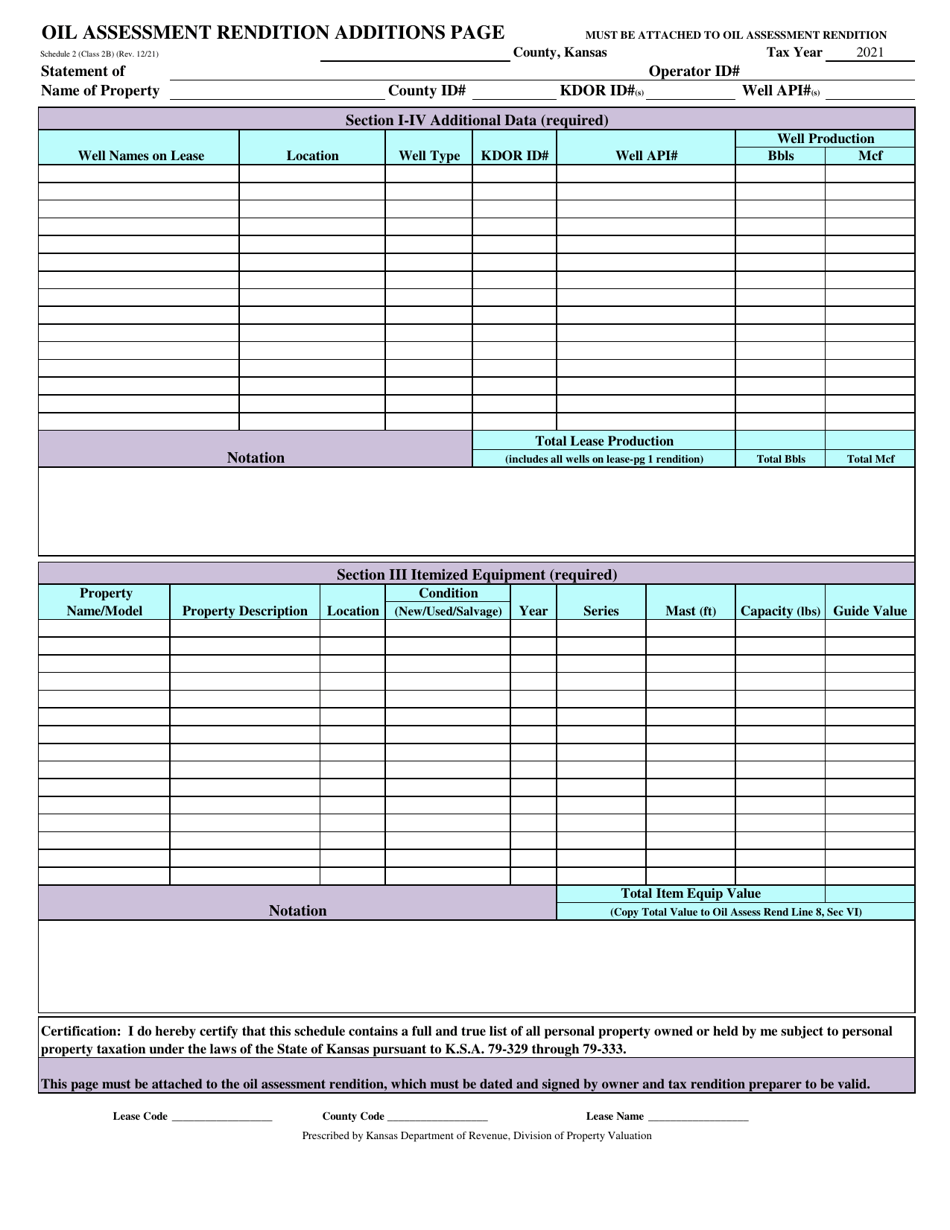

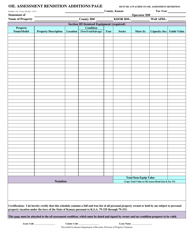

Schedule 2 Oil Assessment Rendition - Kansas

What Is Schedule 2?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 2 Oil Assessment Rendition?

A: Schedule 2 Oil Assessment Rendition is a document used to assess oil properties in Kansas.

Q: Who is required to file a Schedule 2 Oil Assessment Rendition?

A: Oil producers and operators in Kansas are required to file a Schedule 2 Oil Assessment Rendition.

Q: What information is included in a Schedule 2 Oil Assessment Rendition?

A: A Schedule 2 Oil Assessment Rendition includes details about the oil properties being assessed, such as production volumes and values.

Q: When is the deadline for filing a Schedule 2 Oil Assessment Rendition?

A: The deadline for filing a Schedule 2 Oil Assessment Rendition in Kansas varies each year and is determined by the Kansas Department of Revenue.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule 2 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.