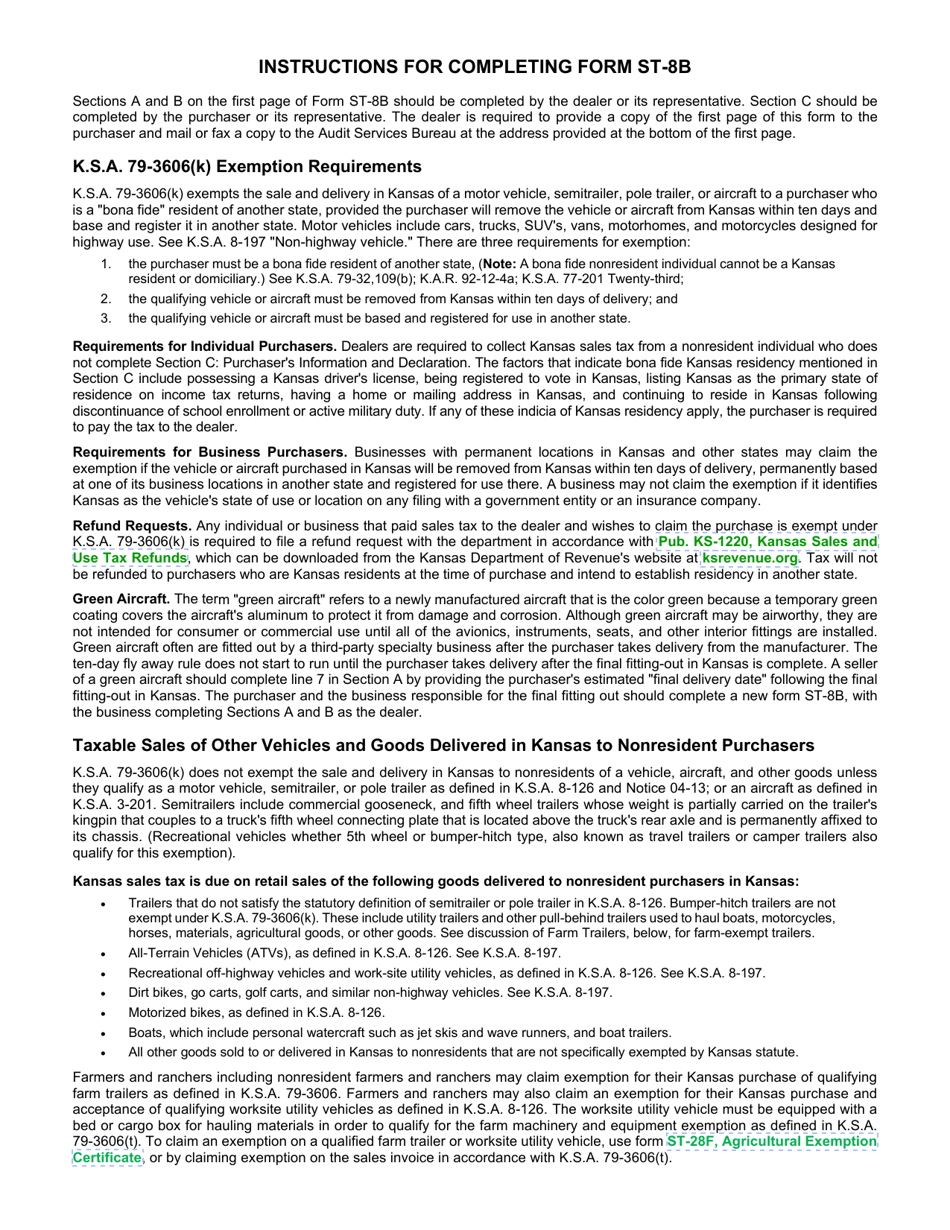

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-8B

for the current year.

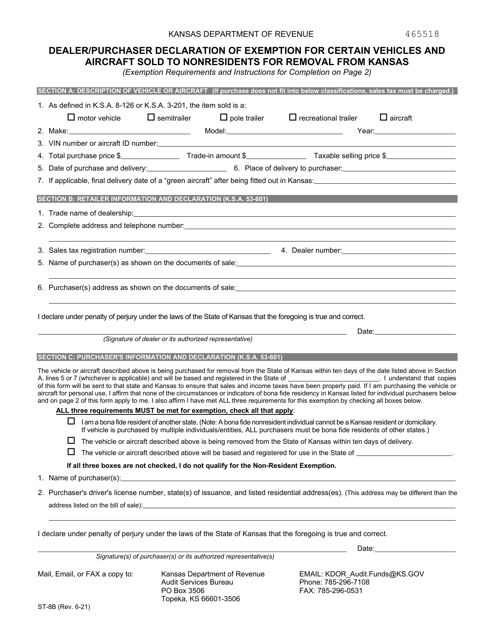

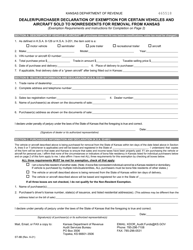

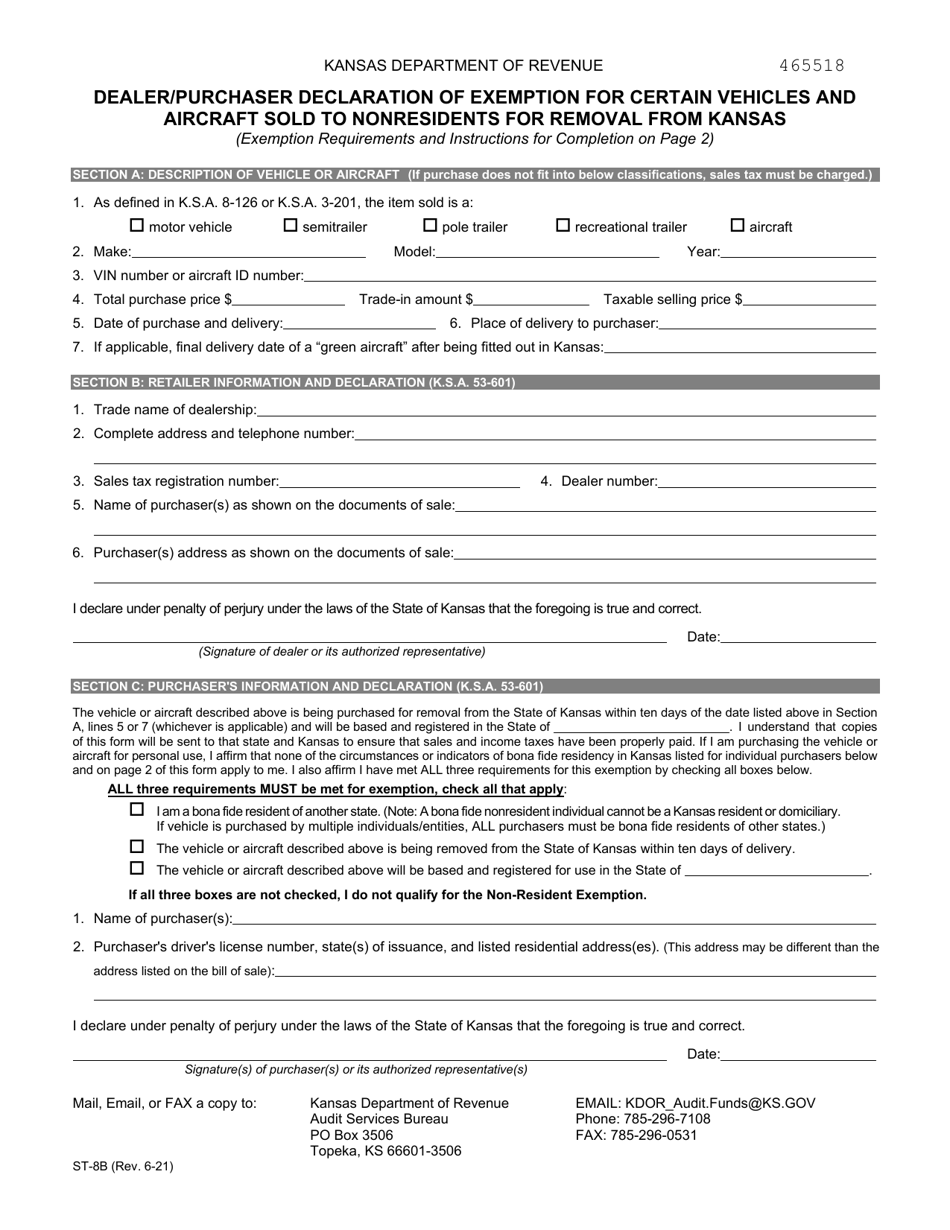

Form ST-8B Dealer / Purchaser Declaration of Exemption for Certain Vehicles and Aircraft Sold to Nonresidents for Removal From Kansas - Kansas

What Is Form ST-8B?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-8B?

A: Form ST-8B is a declaration of exemption for certain vehicles and aircraft sold to nonresidents for removal from Kansas.

Q: Who should use Form ST-8B?

A: Form ST-8B should be used by dealers or purchasers who are selling certain vehicles and aircraft to nonresidents who plan to remove them from Kansas.

Q: What is the purpose of Form ST-8B?

A: The purpose of Form ST-8B is to declare the exemption from sales tax for vehicles and aircraft sold to nonresidents for removal from Kansas.

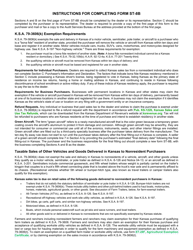

Q: Do I need to include any supporting documentation with Form ST-8B?

A: Yes, you will need to include documentation such as bill of sale, title, and proof of nonresidency with Form ST-8B.

Q: Are there any deadlines for filing Form ST-8B?

A: Yes, Form ST-8B should be filed within 60 days of the date of sale or within the time period authorized by the department.

Q: What happens if I sell a vehicle or aircraft to a nonresident without using Form ST-8B?

A: If you sell a vehicle or aircraft to a nonresident without using Form ST-8B, you may be liable for sales tax.

Q: Can I claim a refund if I paid sales tax on a vehicle or aircraft that qualifies for exemption?

A: Yes, you can claim a refund of sales tax if you paid tax on a vehicle or aircraft that qualifies for exemption by filing Form ST-50B.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

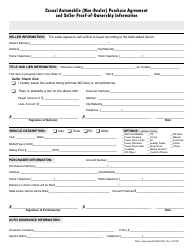

Download a fillable version of Form ST-8B by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.