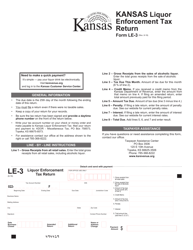

This version of the form is not currently in use and is provided for reference only. Download this version of

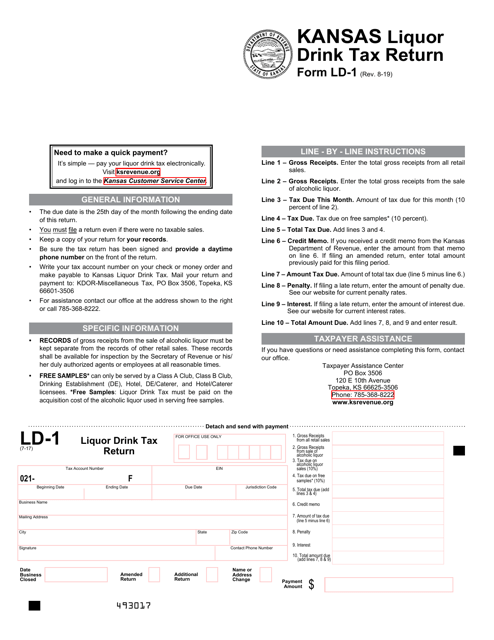

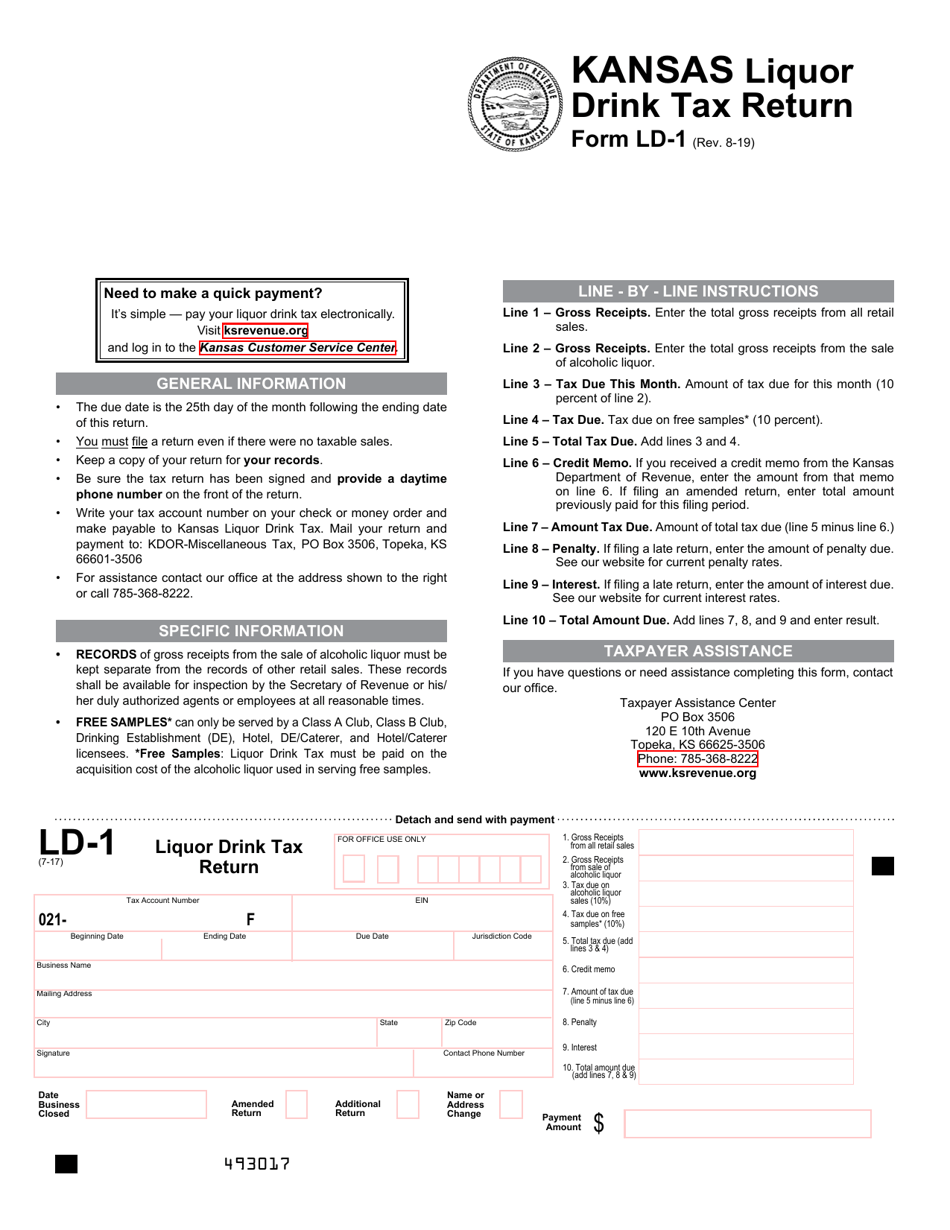

Form LD-1

for the current year.

Form LD-1 Kansas Liquor Drink Tax Return - Kansas

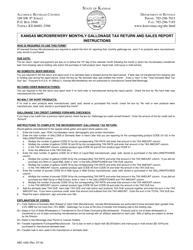

What Is Form LD-1?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LD-1?

A: Form LD-1 is the Kansas Liquor Drink Tax Return.

Q: What is the purpose of Form LD-1?

A: The purpose of Form LD-1 is to report and pay Kansas liquor drink taxes.

Q: Who needs to file Form LD-1?

A: Any business that sells or serves alcoholic beverages in Kansas needs to file Form LD-1.

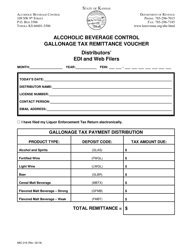

Q: What information is required on Form LD-1?

A: Form LD-1 requires information about the amount and types of alcoholic beverages sold or served, as well as the corresponding taxes due.

Q: When is the deadline to file Form LD-1?

A: Form LD-1 must be filed and the taxes paid on a monthly basis, with the deadline falling on the 25th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest on unpaid taxes and potential additional penalties.

Q: Is there any exemption from the Kansas liquor drink tax?

A: There are certain exemptions from the Kansas liquor drink tax, such as sales for resale or sales for diplomatic or military use. However, specific criteria and documentation may be required.

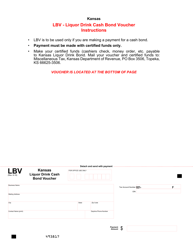

Q: Can I file Form LD-1 electronically?

A: Yes, electronic filing is available for Form LD-1. Information on electronic filing options can be obtained from the Kansas Department of Revenue.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LD-1 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.