This version of the form is not currently in use and is provided for reference only. Download this version of

Form MT-5

for the current year.

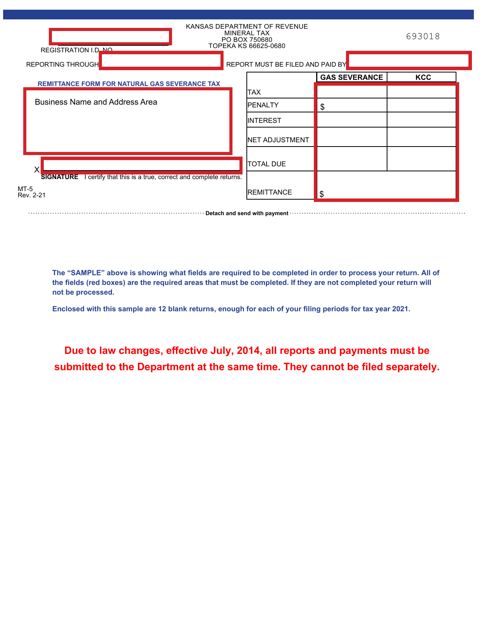

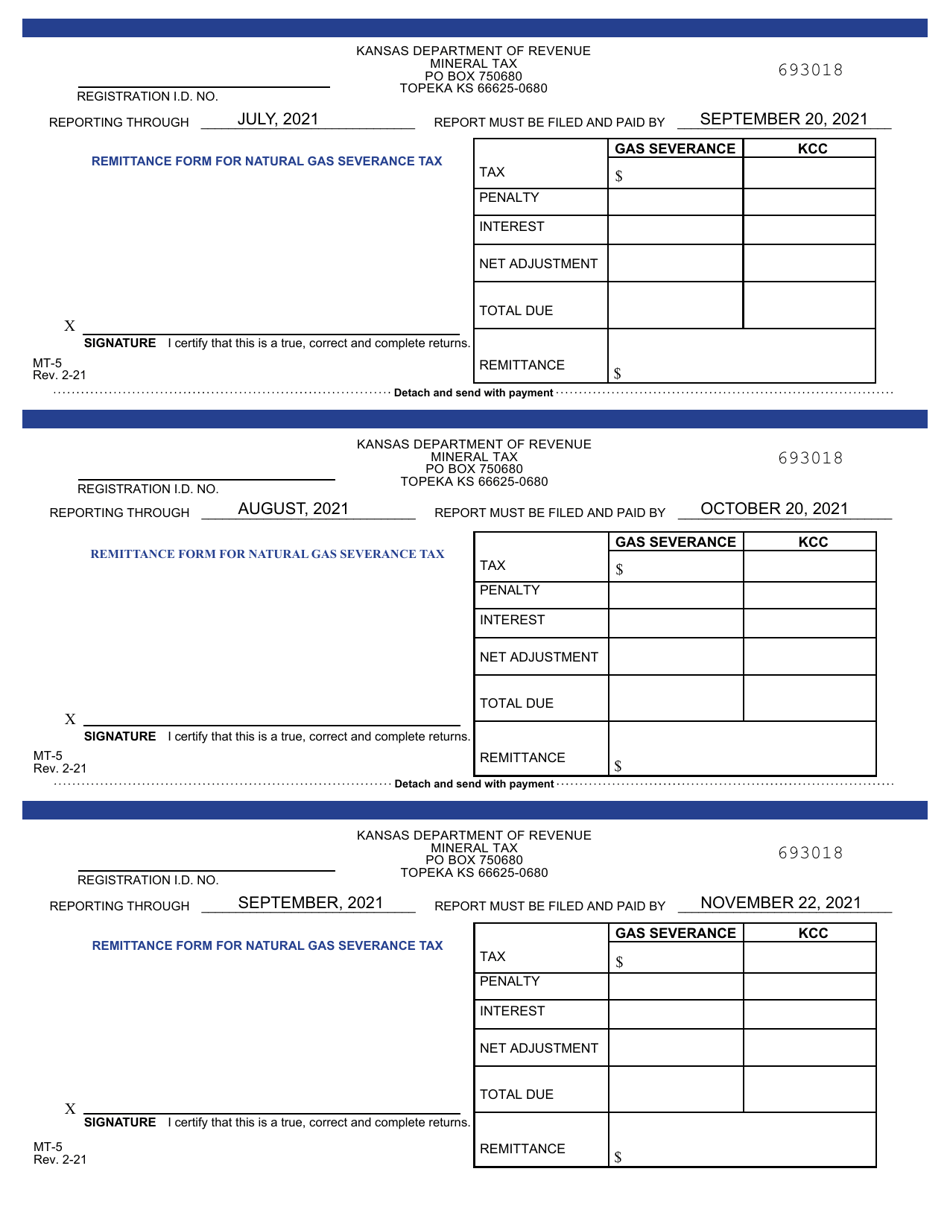

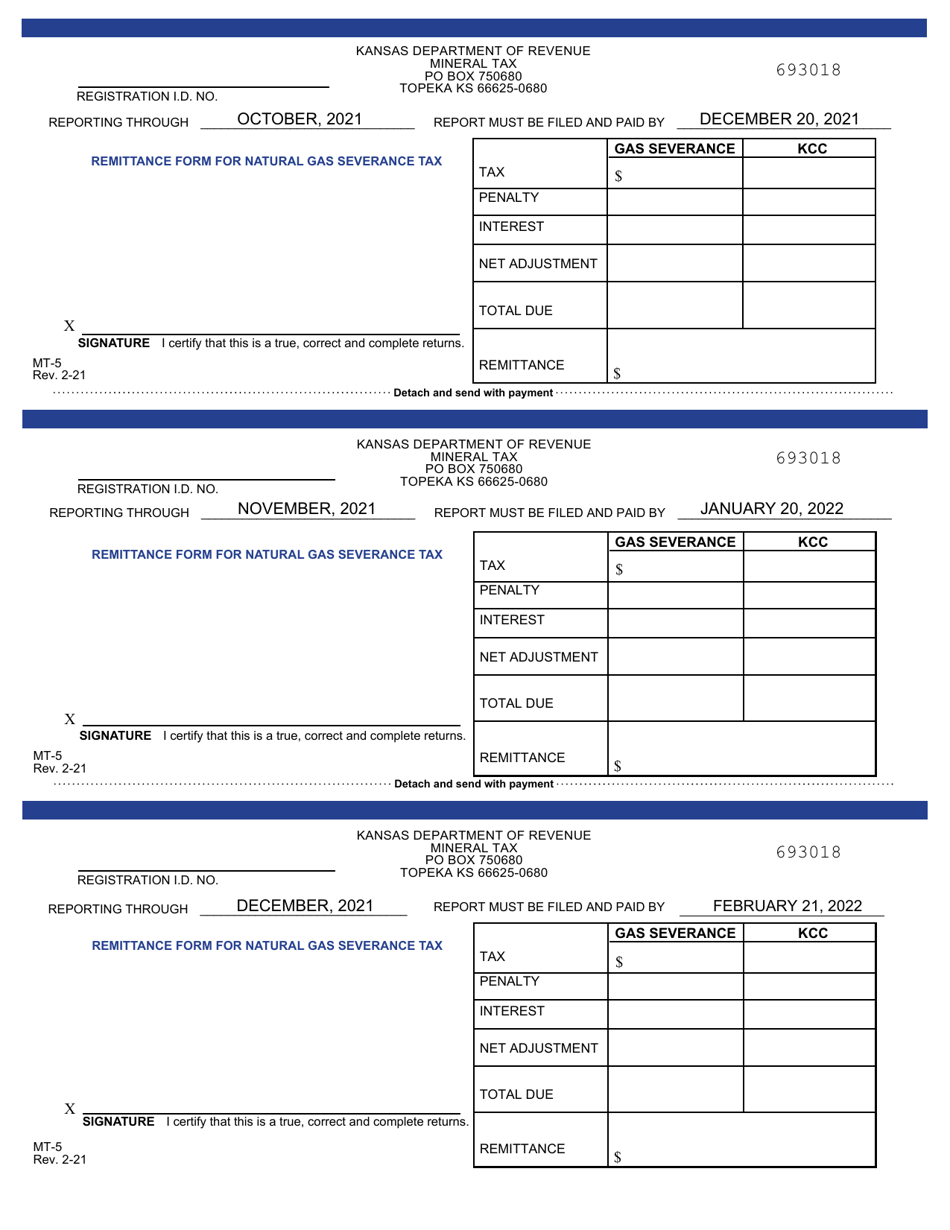

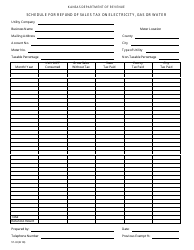

Form MT-5 Mineral Tax Return - Gas Severance - Kansas

What Is Form MT-5?

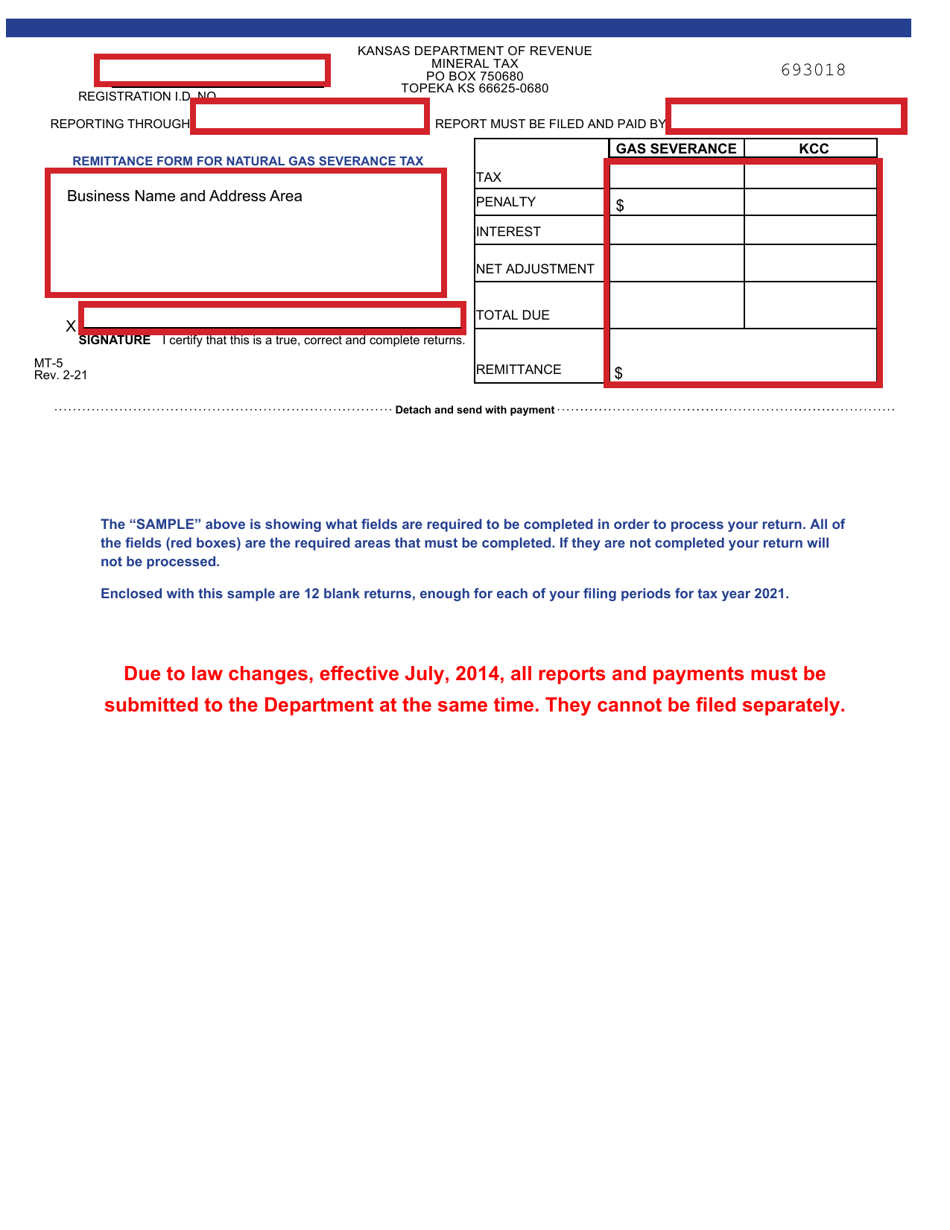

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-5?

A: Form MT-5 is the Mineral Tax Return for Gas Severance in the state of Kansas.

Q: Who needs to file Form MT-5?

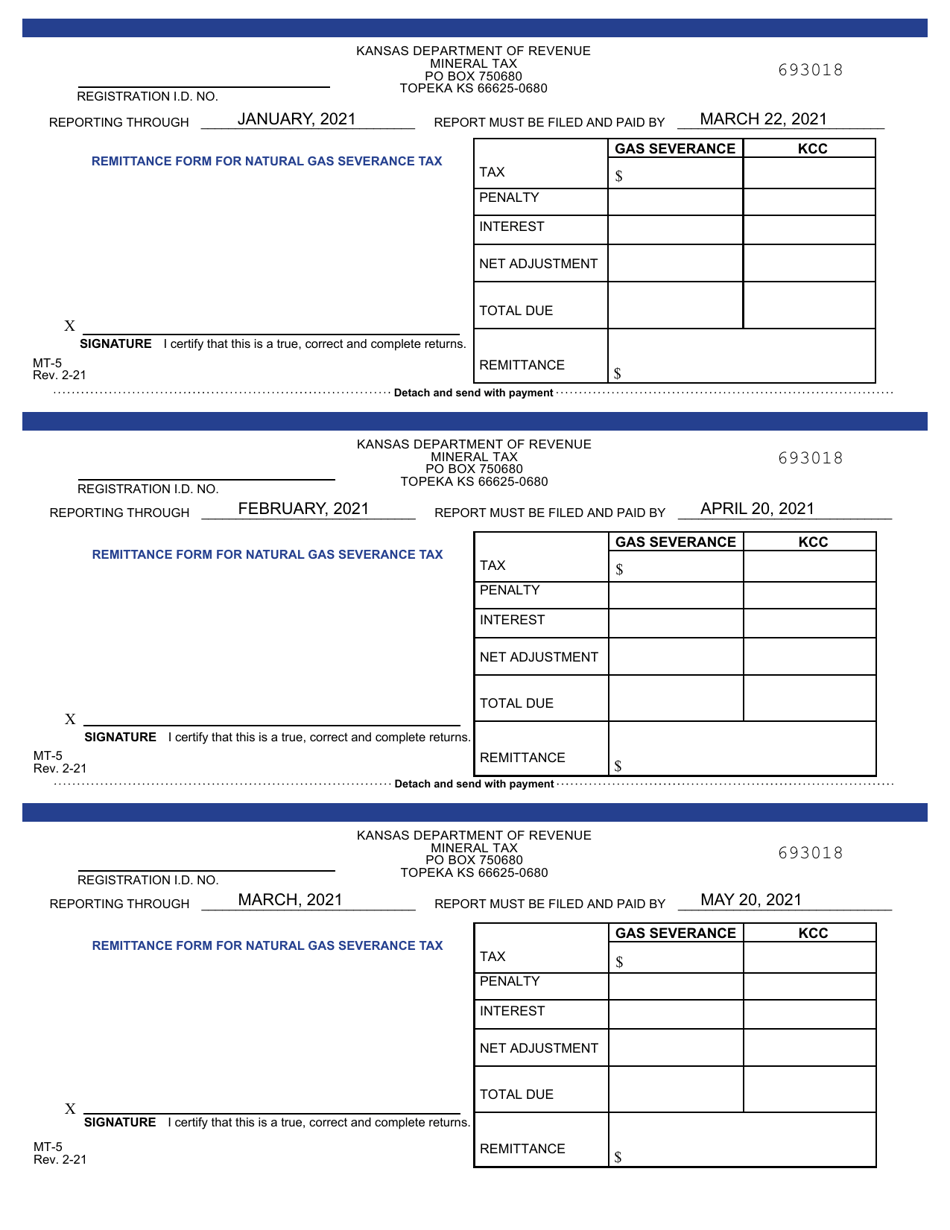

A: Anyone who is engaged in the severance of gas in Kansas is required to file Form MT-5.

Q: What is gas severance?

A: Gas severance refers to the extraction or removal of gas from the ground in Kansas.

Q: What information is required on Form MT-5?

A: Form MT-5 requires information such as the volume of gas extracted, the value of the gas, and any applicable tax credits.

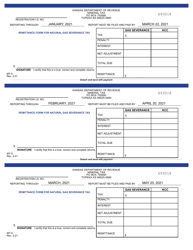

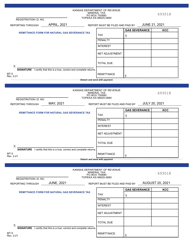

Q: When is Form MT-5 due?

A: Form MT-5 is due on the 25th day of the month following the end of the calendar quarter.

Q: Are there any penalties for late filing of Form MT-5?

A: Yes, there are penalties for late filing of Form MT-5, including interest charges on unpaid tax amounts.

Q: Do I need to keep records of gas severance for Form MT-5?

A: Yes, you are required to keep complete and accurate records of gas severance for at least three years.

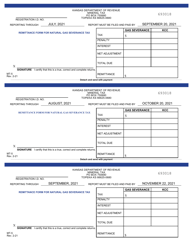

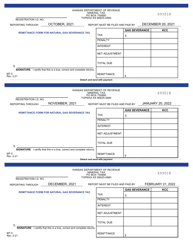

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MT-5 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.