This version of the form is not currently in use and is provided for reference only. Download this version of

Form MT-05A

for the current year.

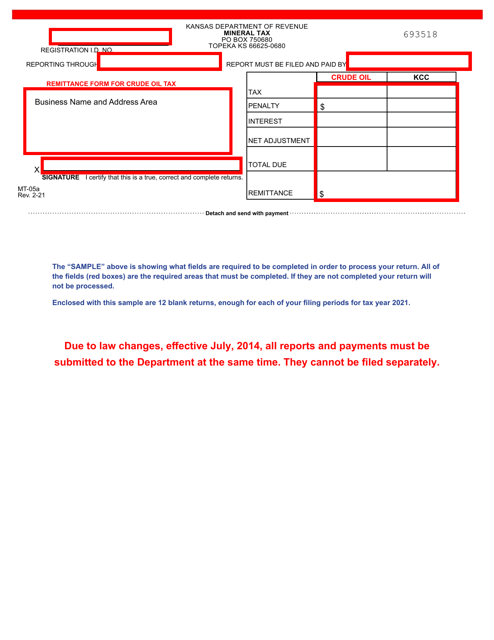

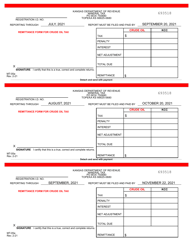

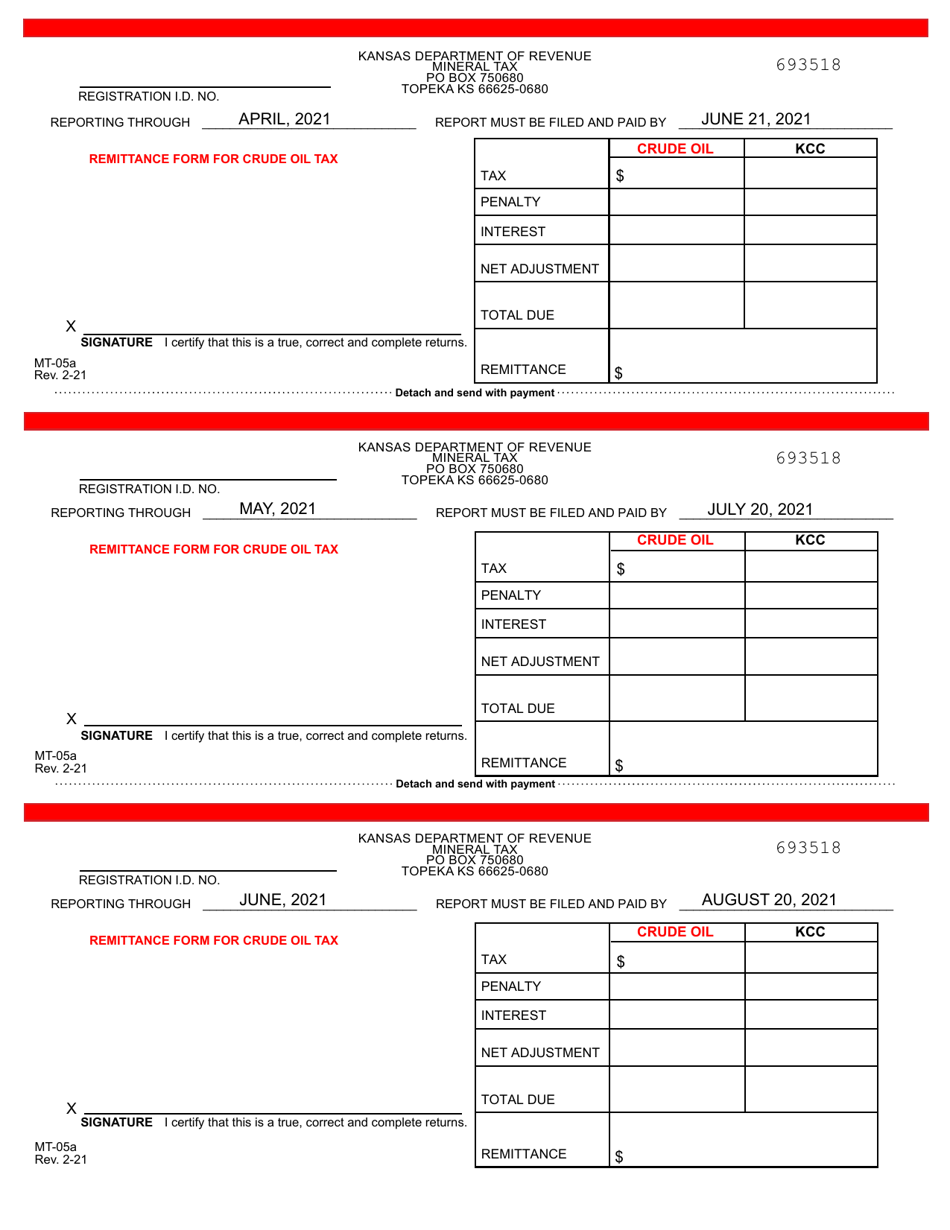

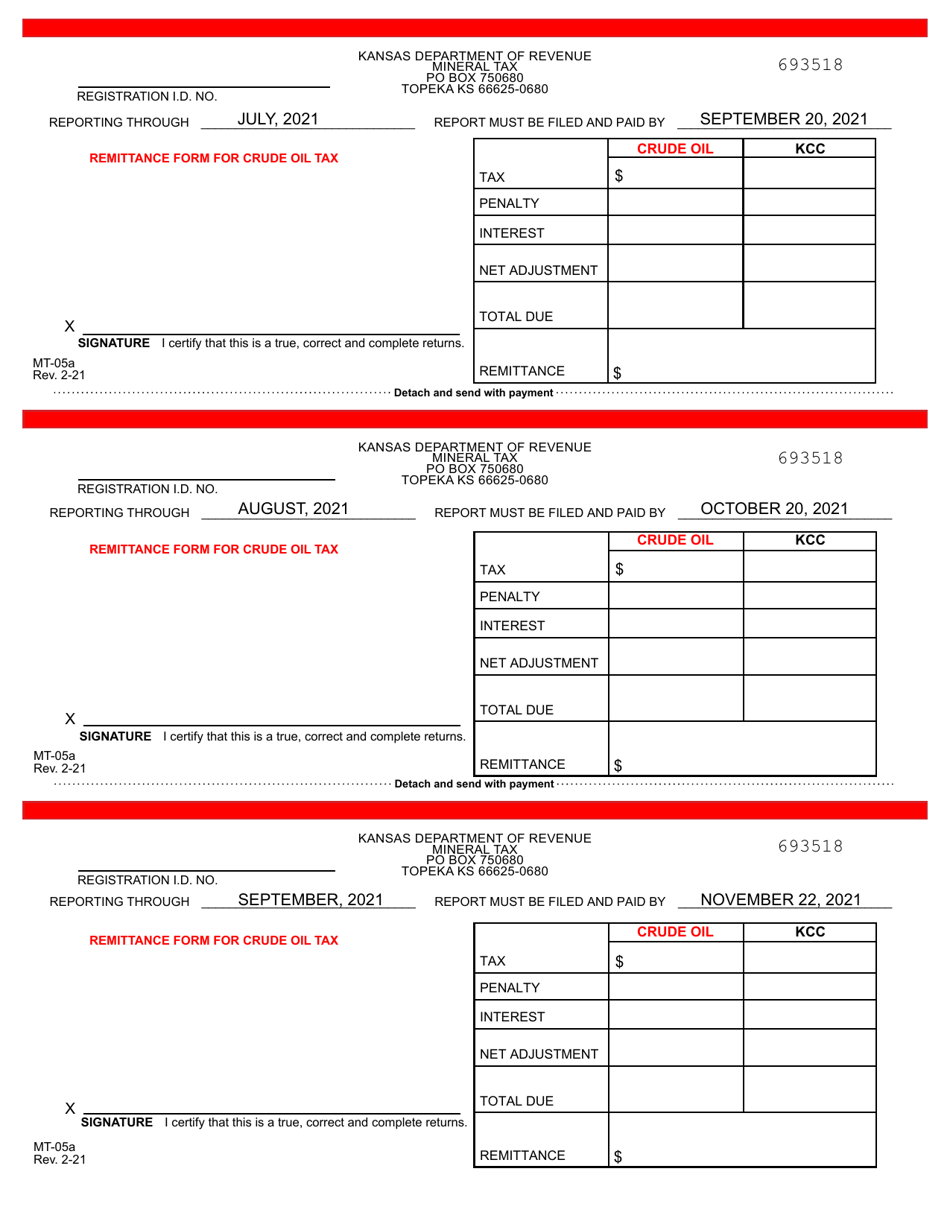

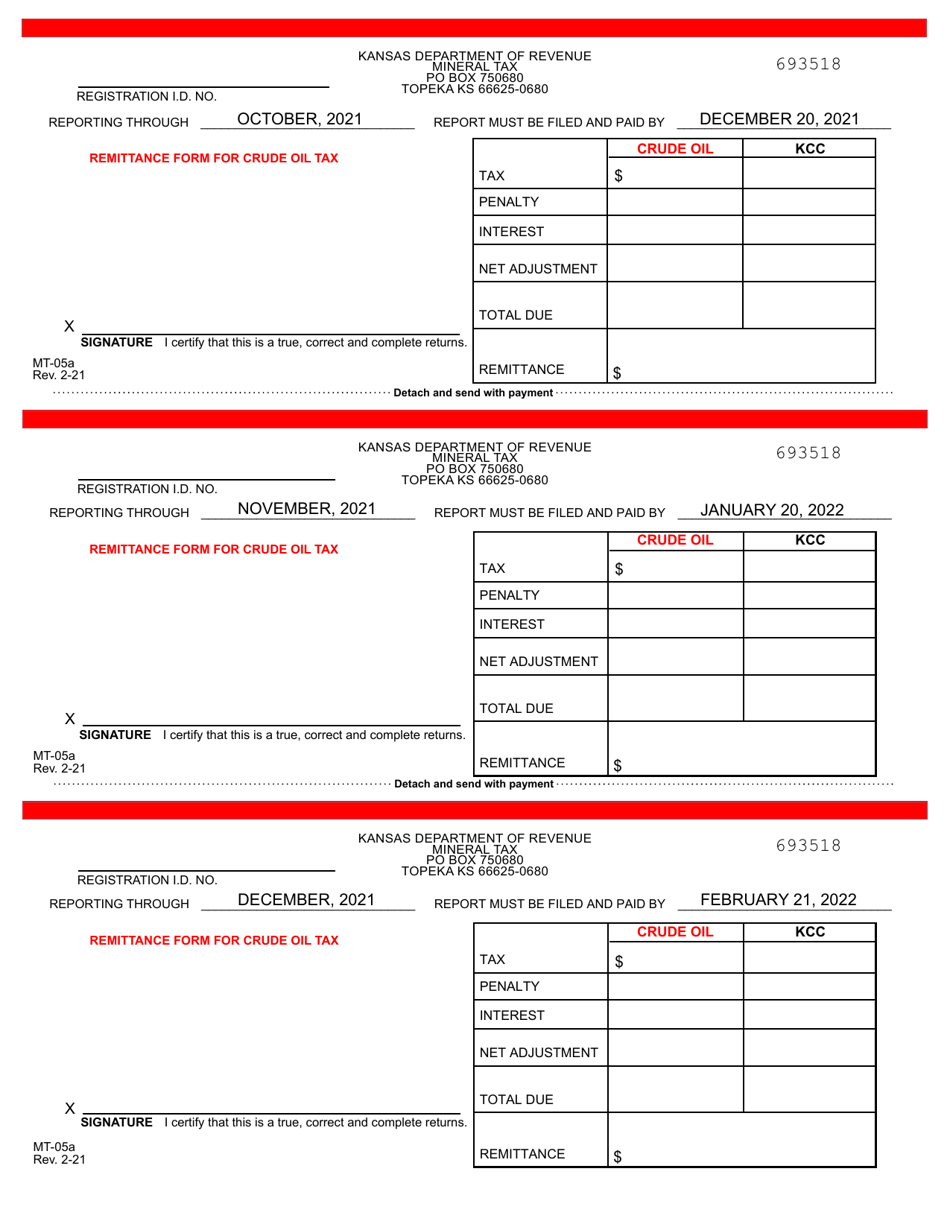

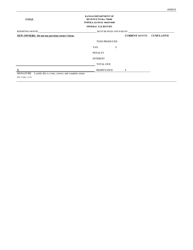

Form MT-05A Mineral Tax Return - Crude Oil - Kansas

What Is Form MT-05A?

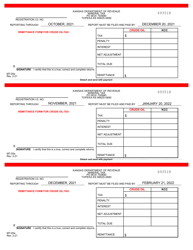

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MT-05A?

A: Form MT-05A is a Mineral Tax Return specifically designed for reporting crude oil production in the state of Kansas.

Q: Who needs to file Form MT-05A?

A: Any person or entity engaged in the production of crude oil in Kansas is required to file Form MT-05A.

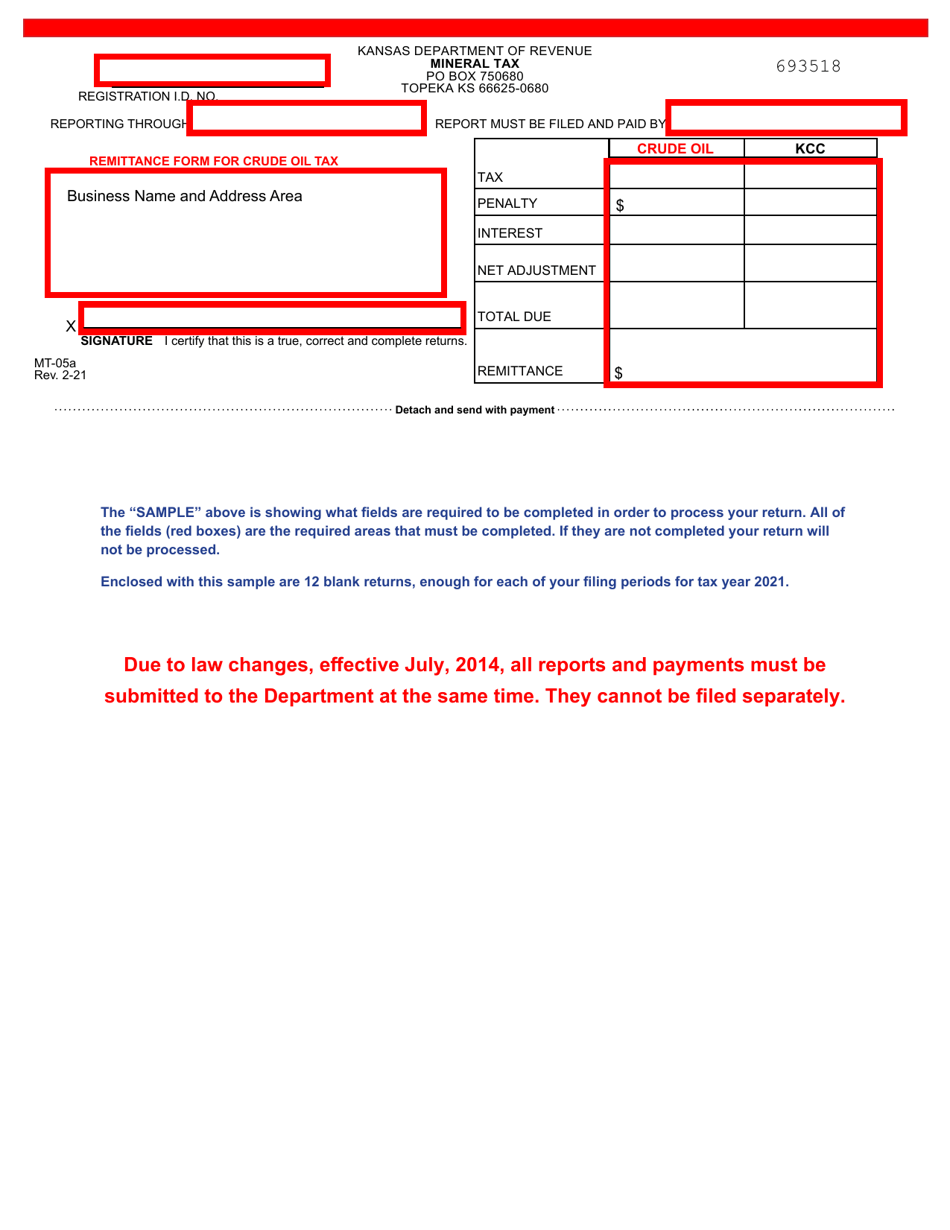

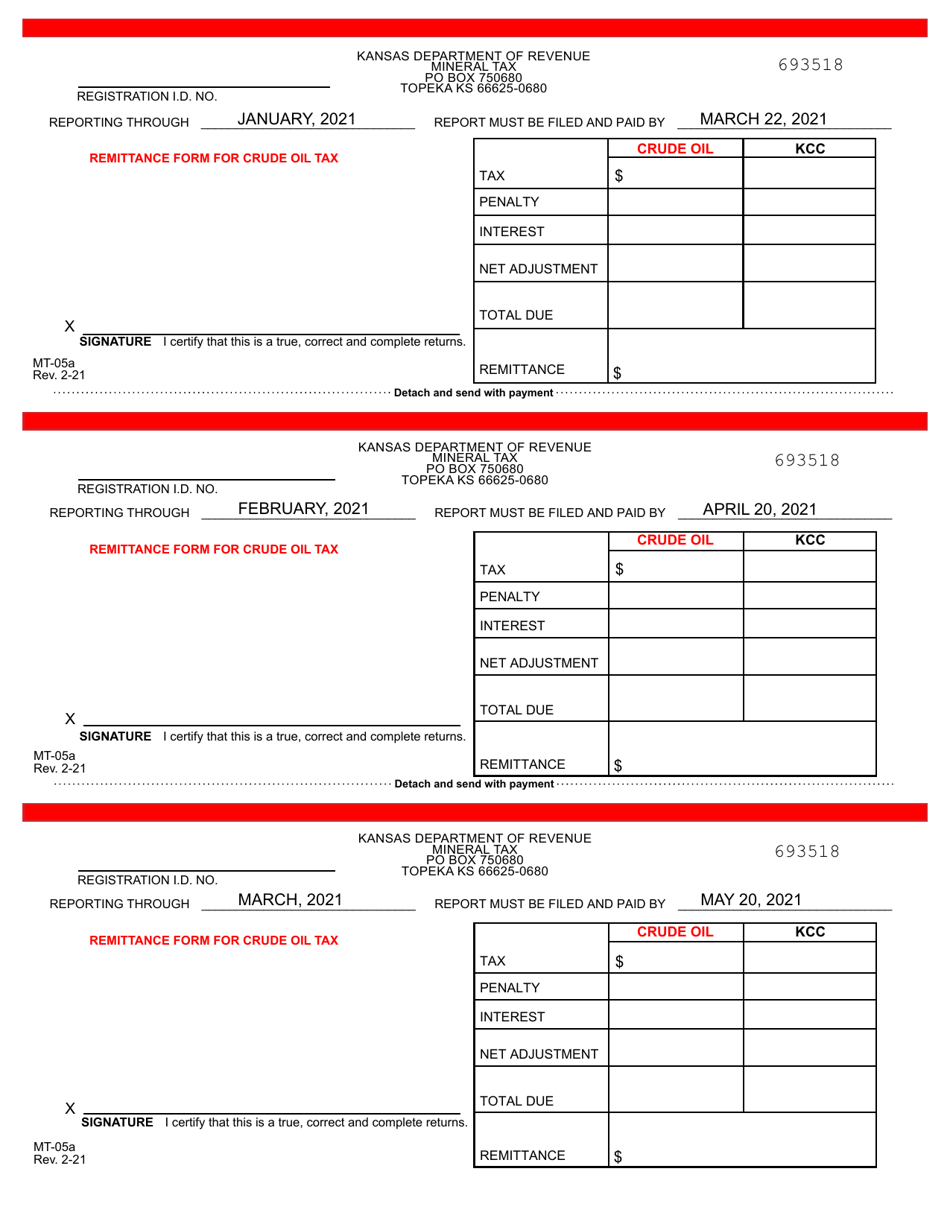

Q: When is Form MT-05A due?

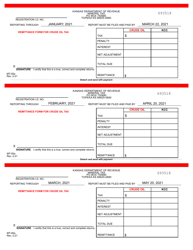

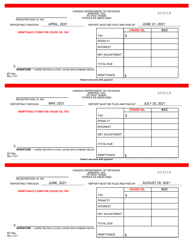

A: Form MT-05A is due on or before the 25th day of the following month in which crude oil production occurs.

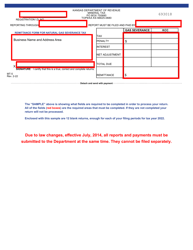

Q: What information is required to complete Form MT-05A?

A: Form MT-05A requires information such as the total barrels of crude oil produced, the amount of taxes due, and any credits or deductions applicable.

Q: Are there any penalties for not filing Form MT-05A?

A: Yes, failure to file Form MT-05A or filing it late may result in penalties and interest.

Q: What should I do if I need assistance with Form MT-05A?

A: If you need assistance with Form MT-05A, you should contact the Kansas Department of Revenue for guidance and support.

Form Details:

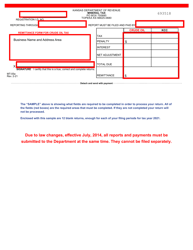

- Released on February 1, 2021;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MT-05A by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.