This version of the form is not currently in use and is provided for reference only. Download this version of

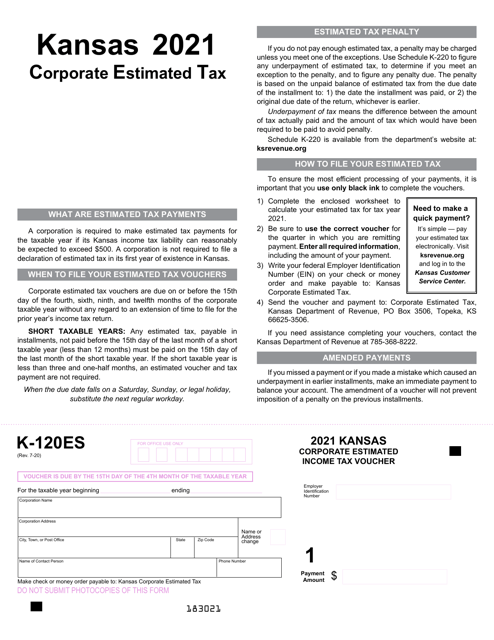

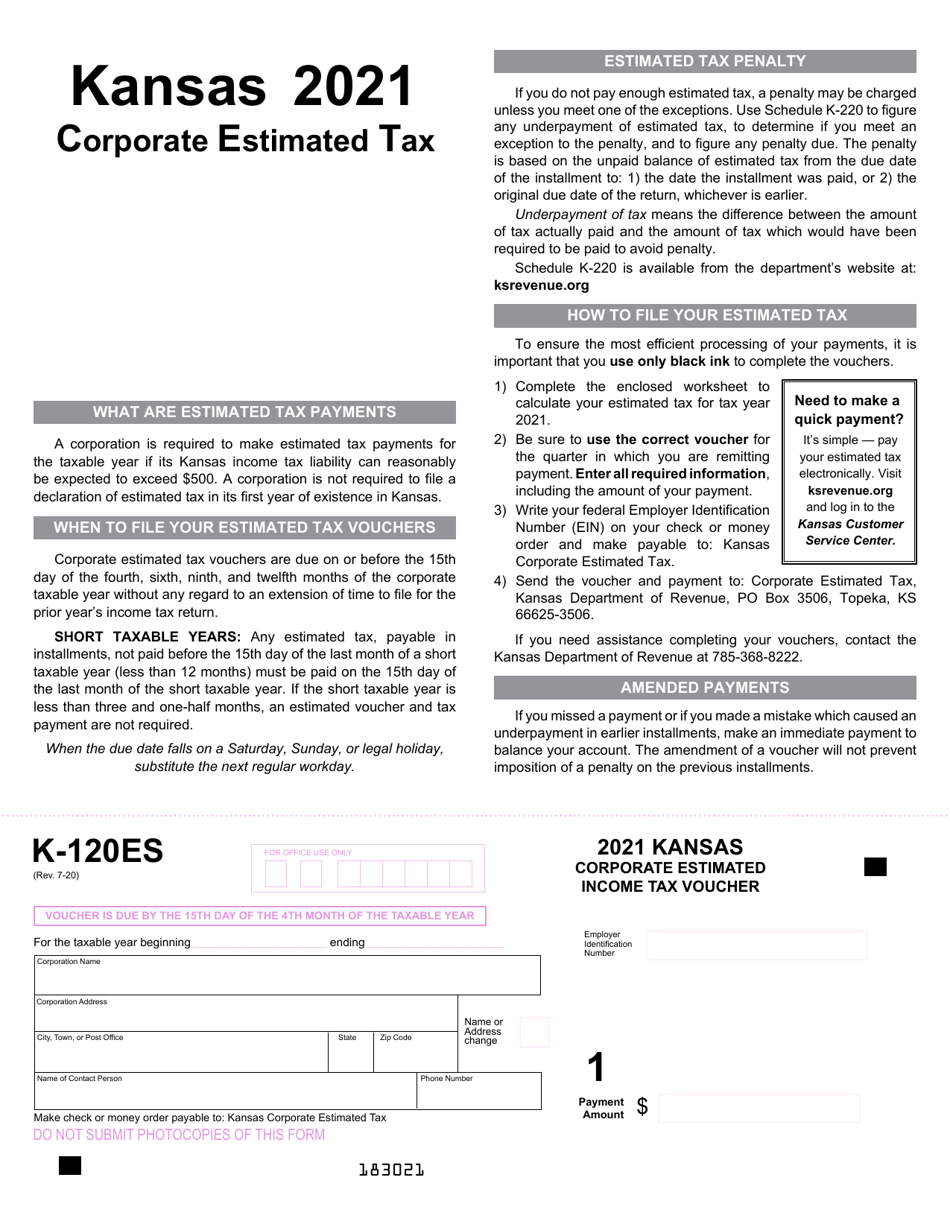

Form K-120ES

for the current year.

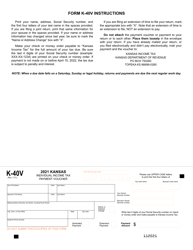

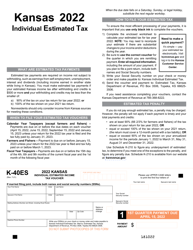

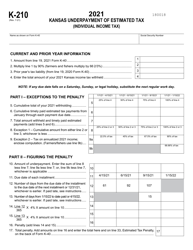

Form K-120ES Kansas Corporate Estimated Income Tax Voucher - Kansas

What Is Form K-120ES?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-120ES?

A: Form K-120ES is the Kansas Corporate Estimated Income Tax Voucher.

Q: Who needs to file Form K-120ES?

A: Businesses in Kansas that have estimated income tax due need to file Form K-120ES.

Q: What is the purpose of Form K-120ES?

A: Form K-120ES is used to make estimated income tax payments for corporations in Kansas.

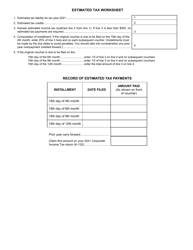

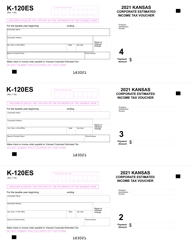

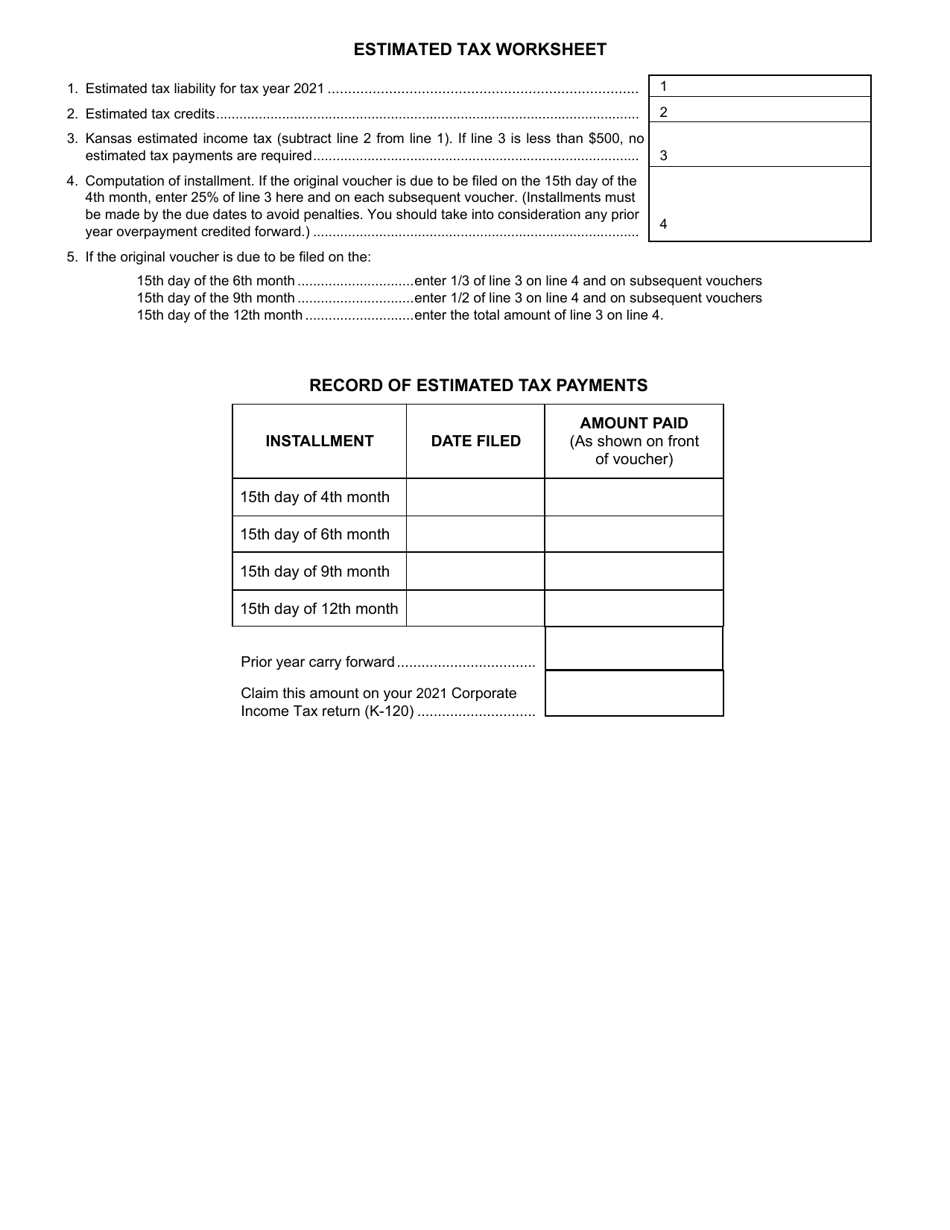

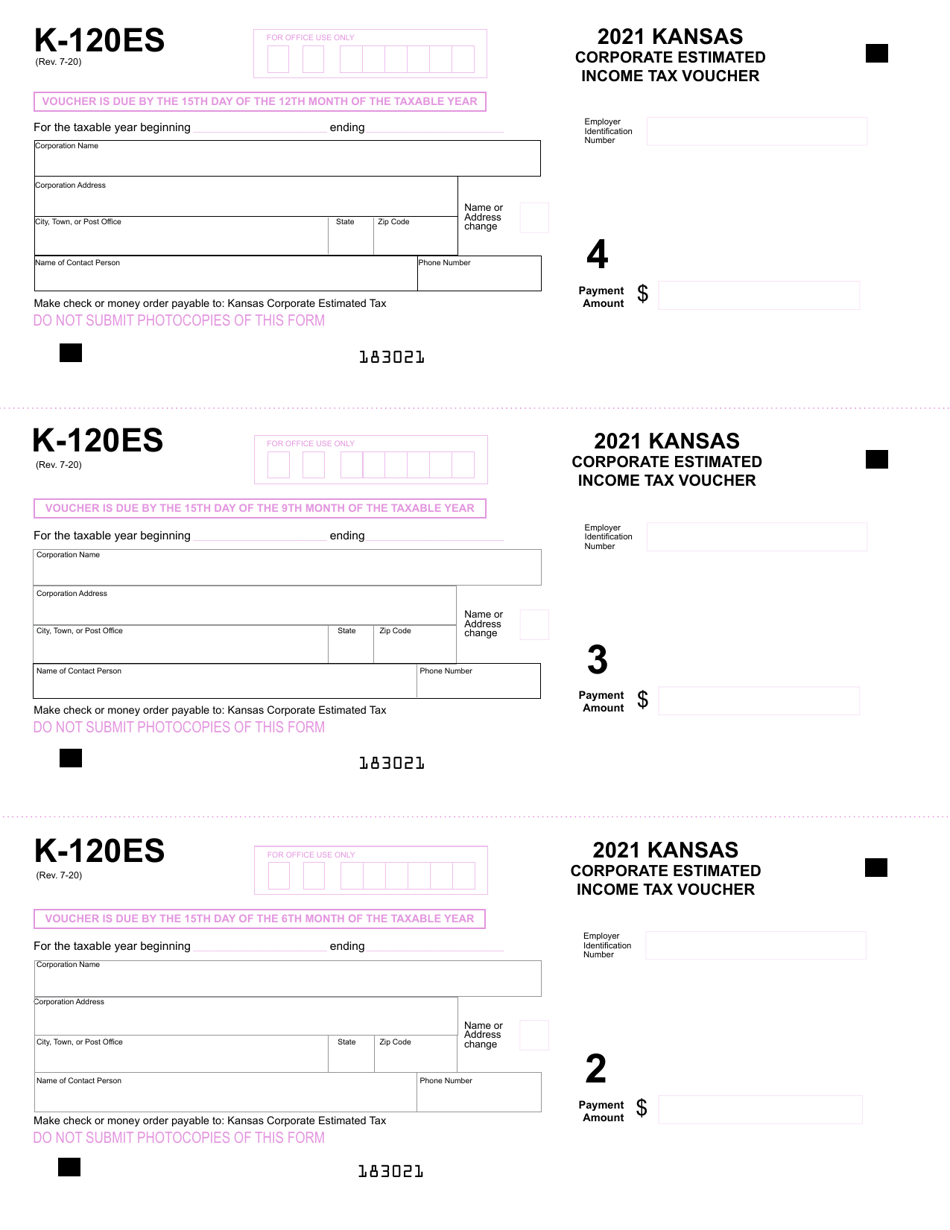

Q: When is Form K-120ES due?

A: Form K-120ES is due quarterly, with payment due dates in April, June, September, and December.

Q: Is Form K-120ES required for all businesses in Kansas?

A: No, Form K-120ES is only required for businesses that have estimated income tax due.

Q: What happens if I don't file Form K-120ES?

A: Failure to file Form K-120ES or pay the estimated income tax can result in penalties and interest.

Q: Are there any exceptions to filing Form K-120ES?

A: There may be exceptions or special rules for certain types of businesses or circumstances. It is advised to consult with a tax professional or the Kansas Department of Revenue for specific guidance.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-120ES by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.