This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule K-120EX

for the current year.

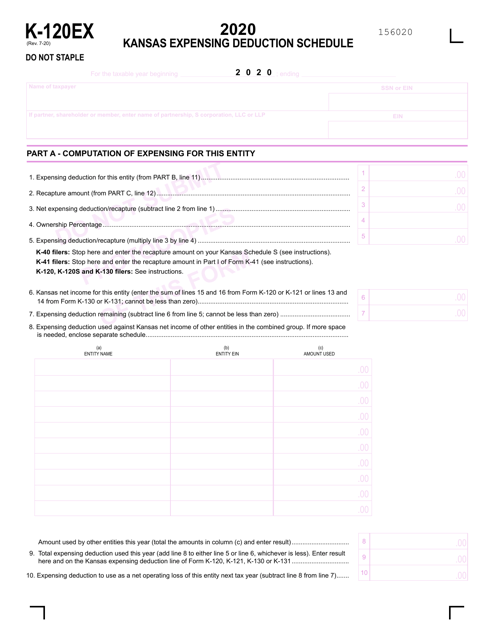

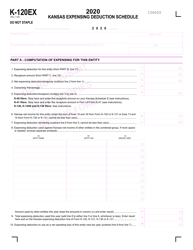

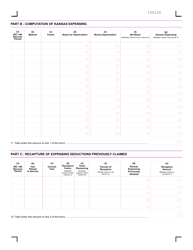

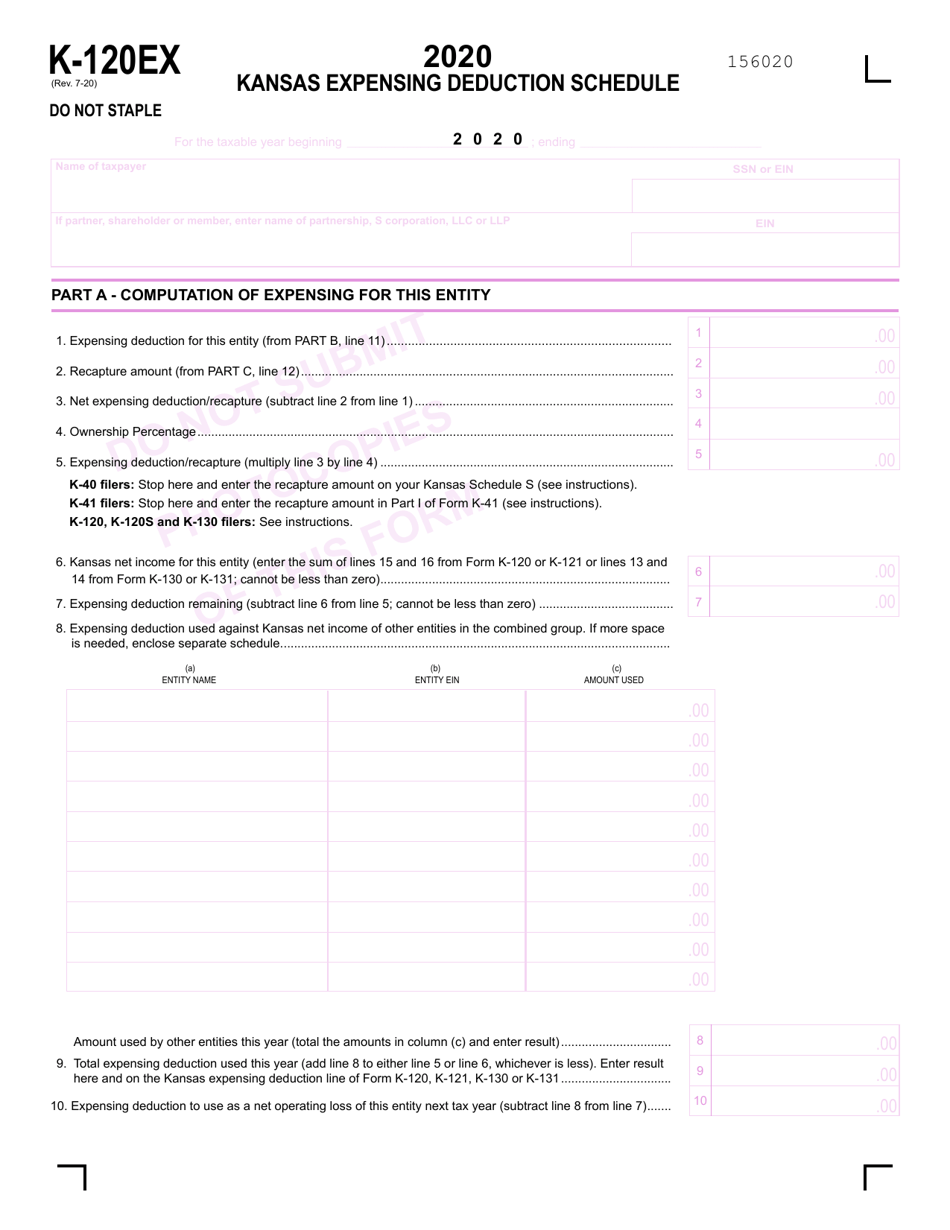

Schedule K-120EX Kansas Expensing Deduction Schedule - Kansas

What Is Schedule K-120EX?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

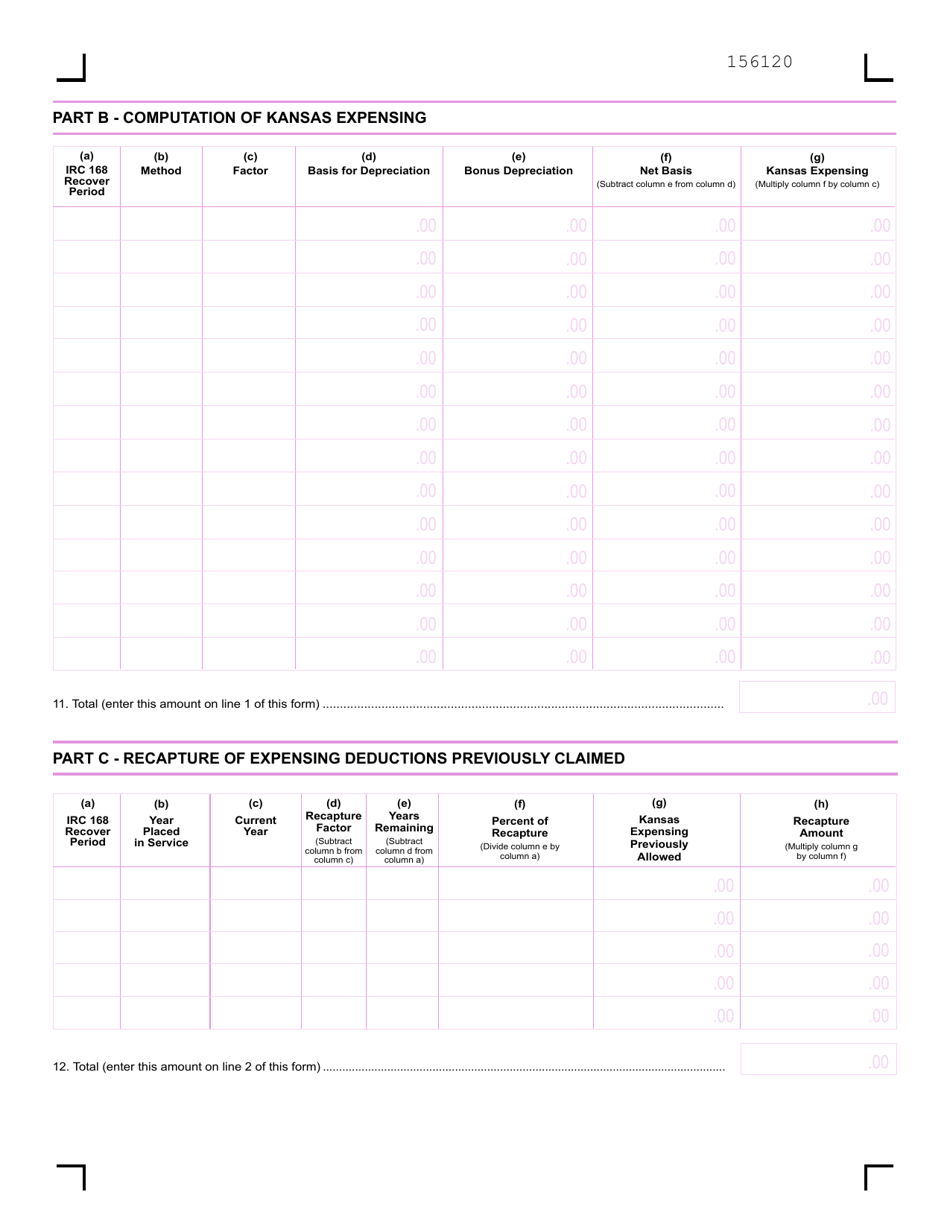

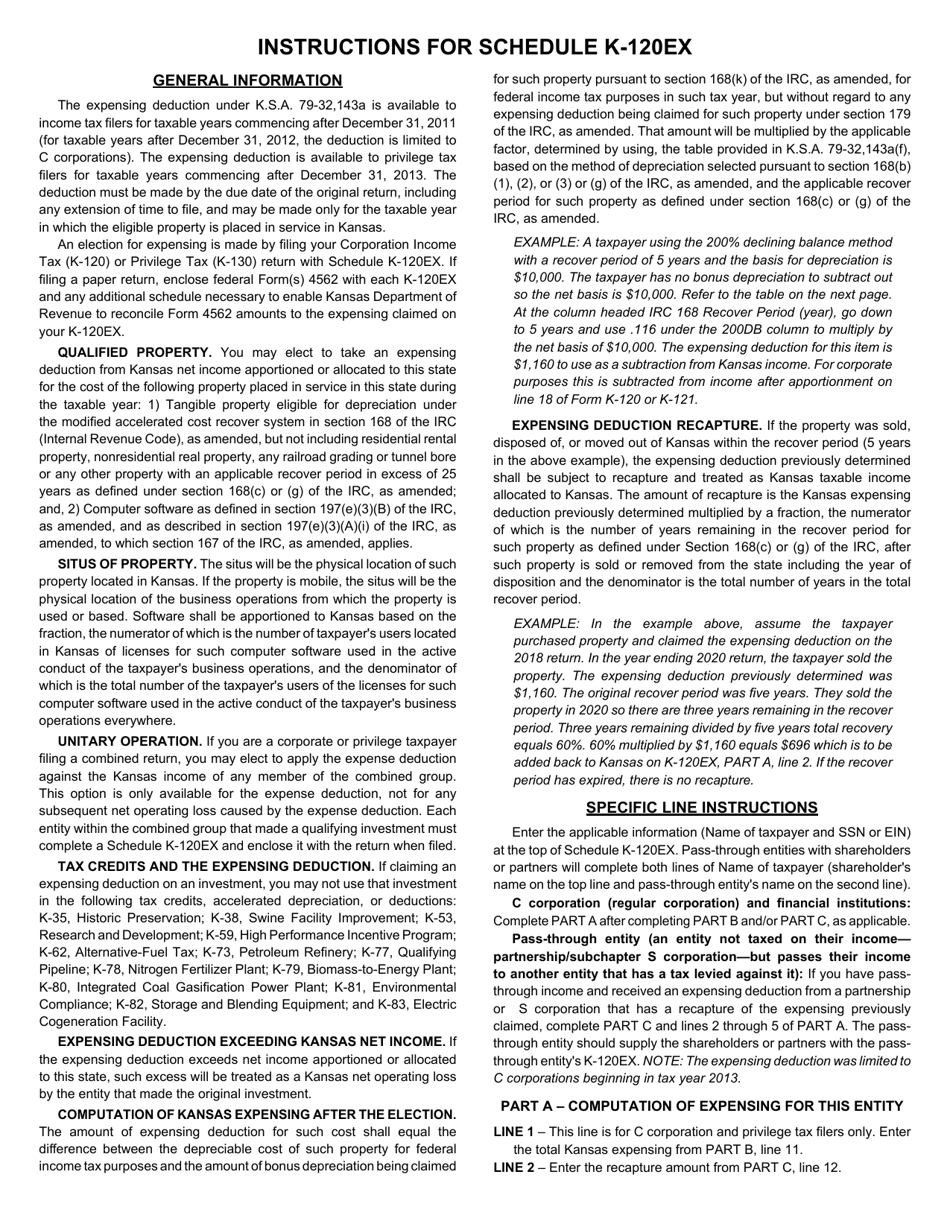

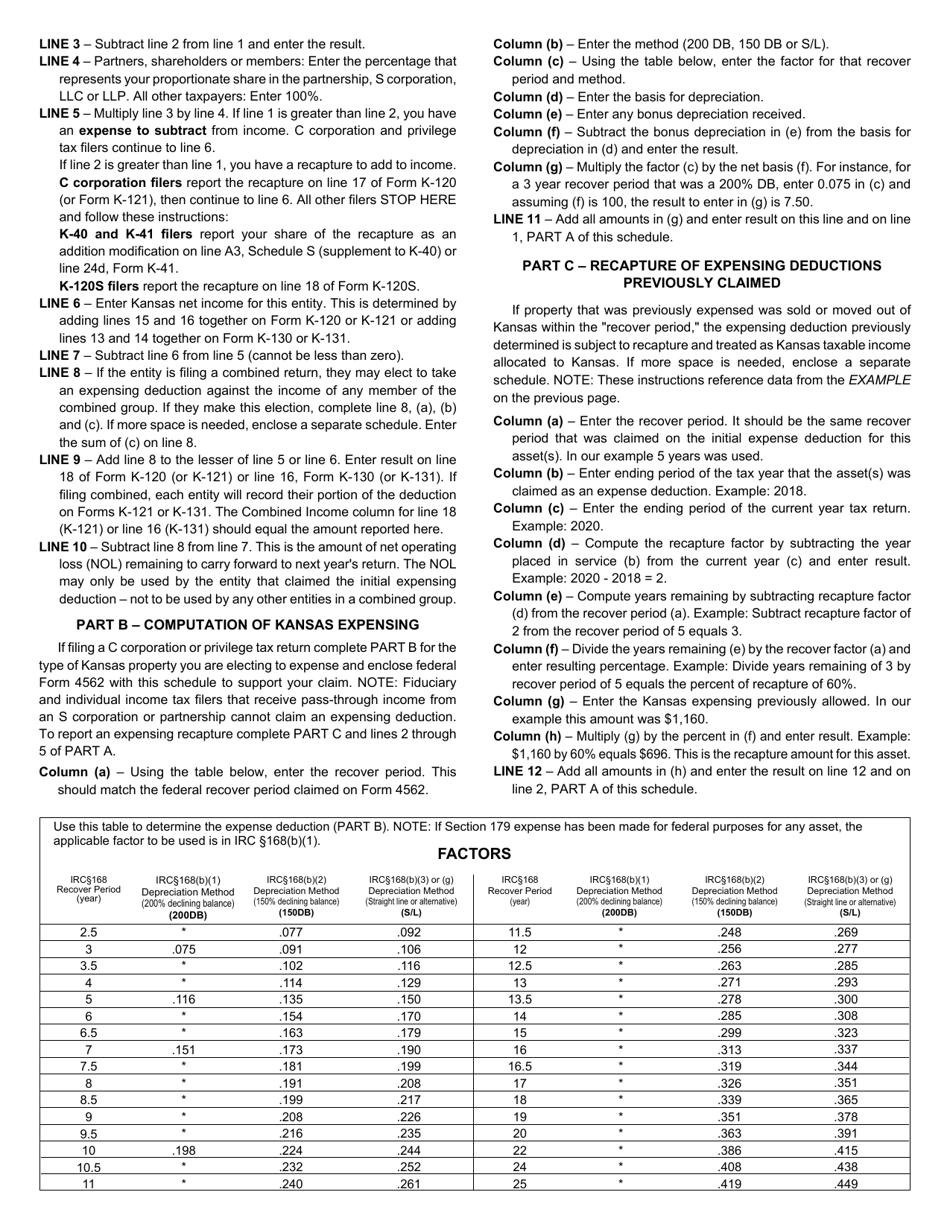

Q: What is Schedule K-120EX?

A: Schedule K-120EX is the Kansas Expensing Deduction Schedule.

Q: What is the purpose of Schedule K-120EX?

A: The purpose of Schedule K-120EX is to calculate and claim the Kansas Expensing Deduction.

Q: Who needs to file Schedule K-120EX?

A: Anyone who wishes to claim the Kansas Expensing Deduction needs to file Schedule K-120EX.

Q: What is the Kansas Expensing Deduction?

A: The Kansas Expensing Deduction allows businesses to deduct the cost of qualifying assets in the year they are purchased.

Q: What are qualifying assets?

A: Qualifying assets are tangible personal property used in a trade or business, with a useful life of less than 10 years.

Q: What is the benefit of claiming the Kansas Expensing Deduction?

A: By claiming the Kansas Expensing Deduction, businesses can reduce their taxable income, leading to a lower tax liability.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-120EX by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.