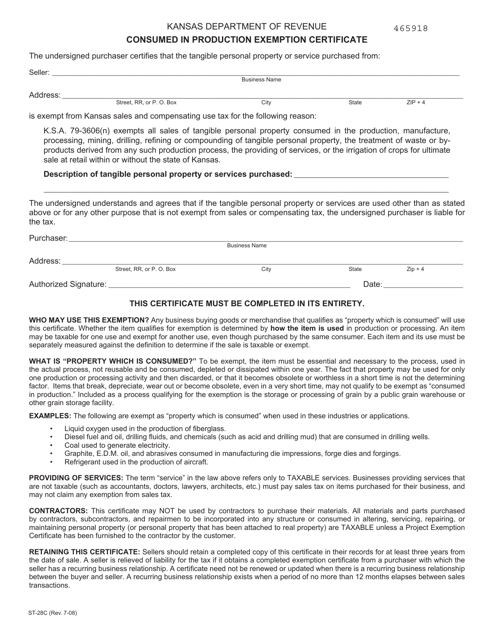

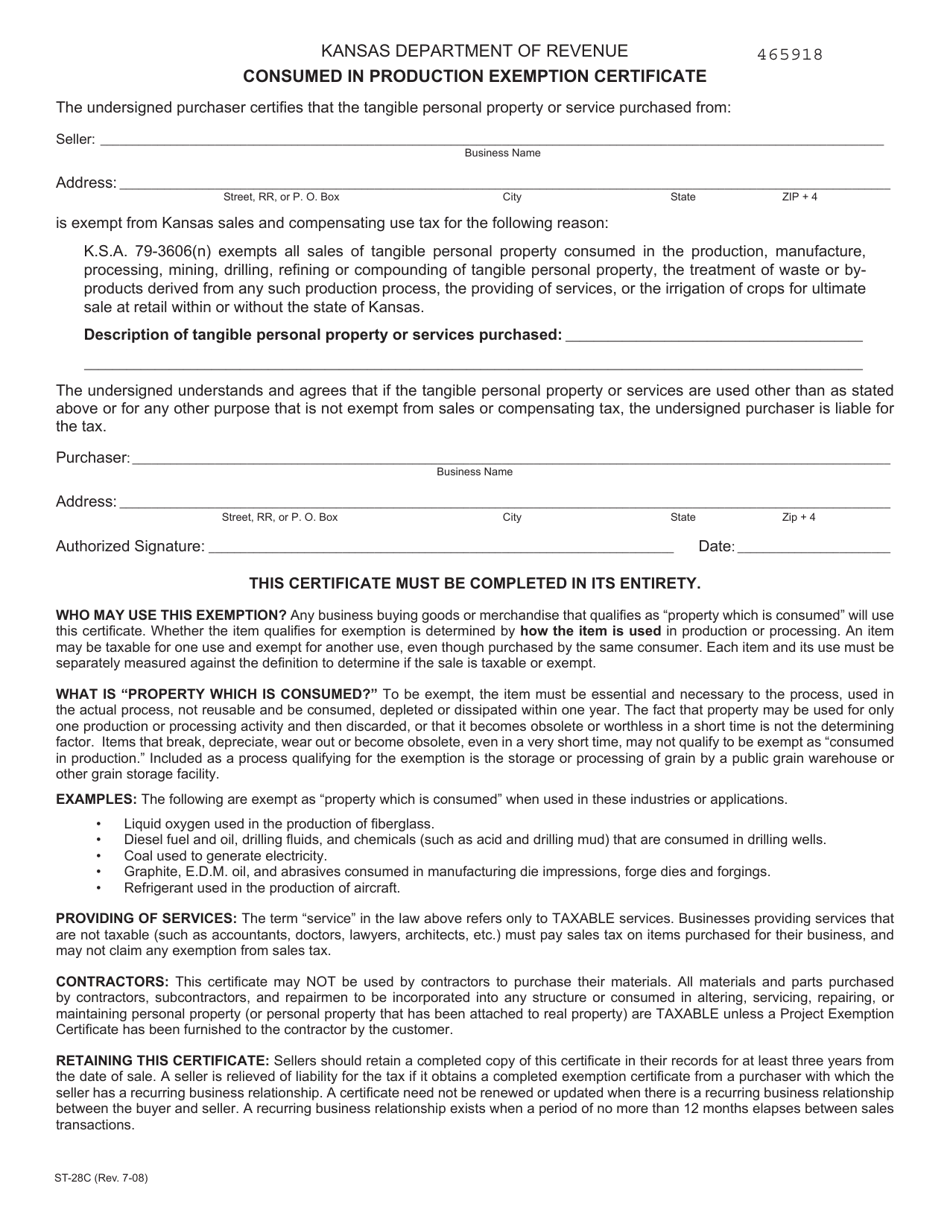

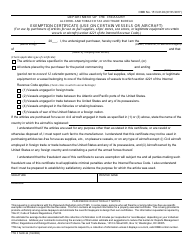

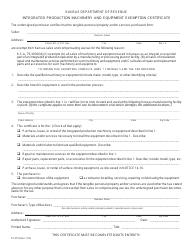

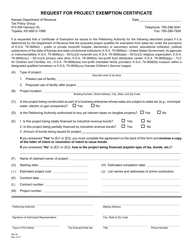

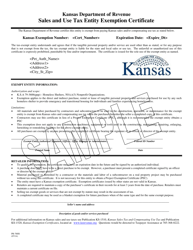

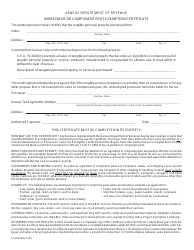

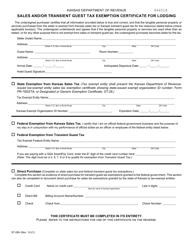

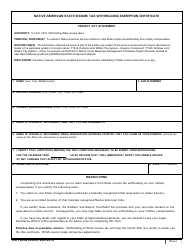

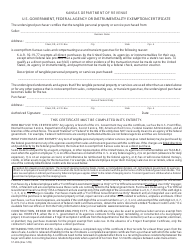

Form ST-28C Consumed in Production Exemption Certificate - Kansas

What Is Form ST-28C?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-28C Consumed in Production Exemption Certificate?

A: The Form ST-28C is a certificate provided by the state of Kansas for businesses to claim an exemption from sales tax on items consumed in the production process.

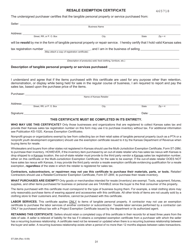

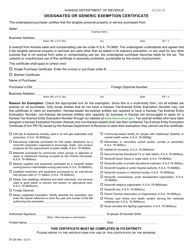

Q: Who is eligible to use the Form ST-28C in Kansas?

A: Businesses engaged in production activities in Kansas are eligible to use the Form ST-28C to claim the consumed in production exemption.

Q: What is the purpose of claiming the consumed in production exemption?

A: The purpose of claiming this exemption is to avoid paying sales tax on items that are used or consumed in the production process, such as raw materials and machinery.

Q: Are there any conditions or requirements to qualify for the consumed in production exemption?

A: Yes, businesses must meet certain criteria and provide supporting documentation to qualify for the consumed in production exemption. It is advisable to consult the Kansas Department of Revenue or a tax professional for specific requirements.

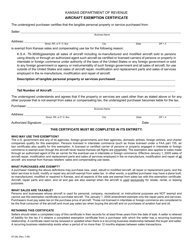

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-28C by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.