This version of the form is not currently in use and is provided for reference only. Download this version of

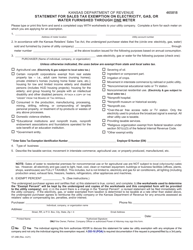

Form ST-21PEC

for the current year.

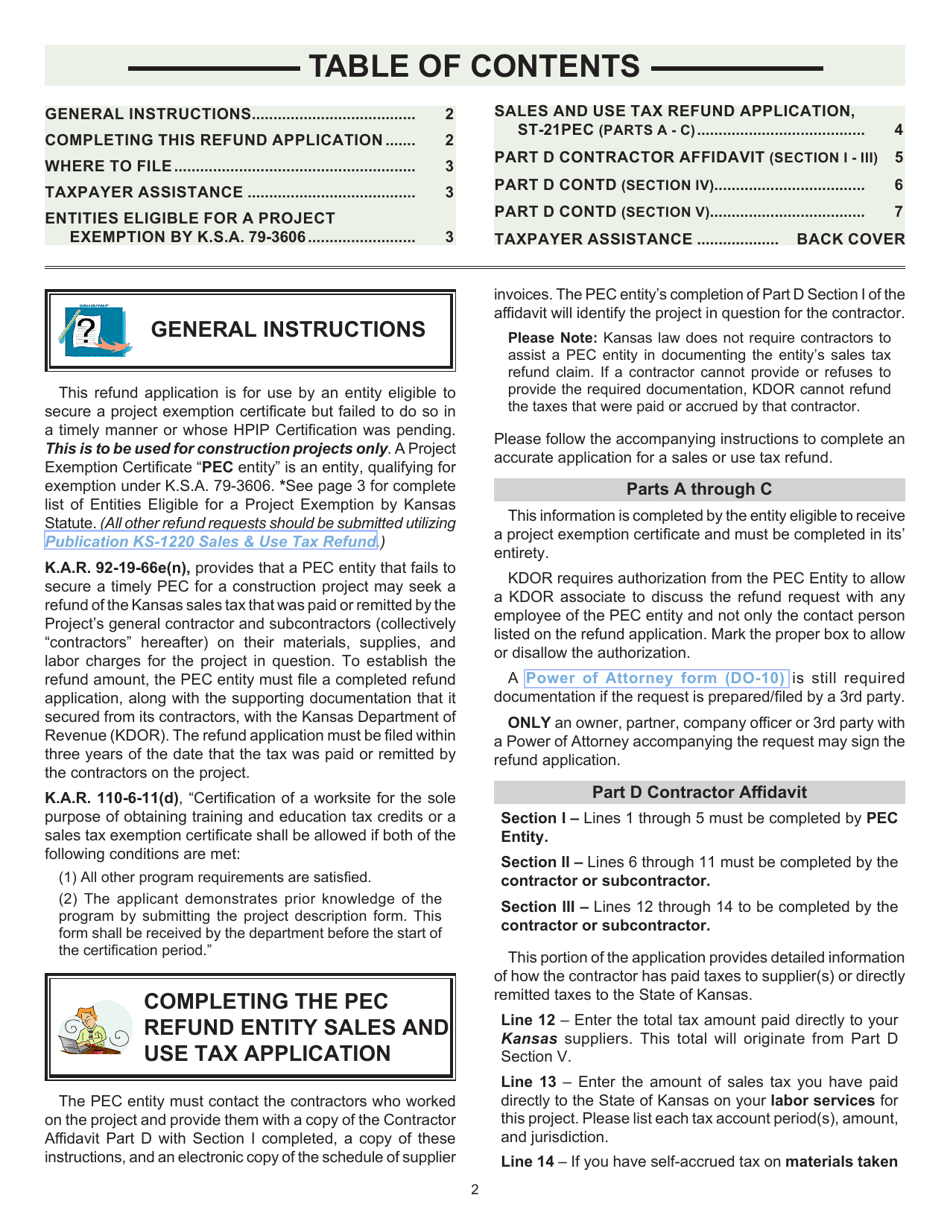

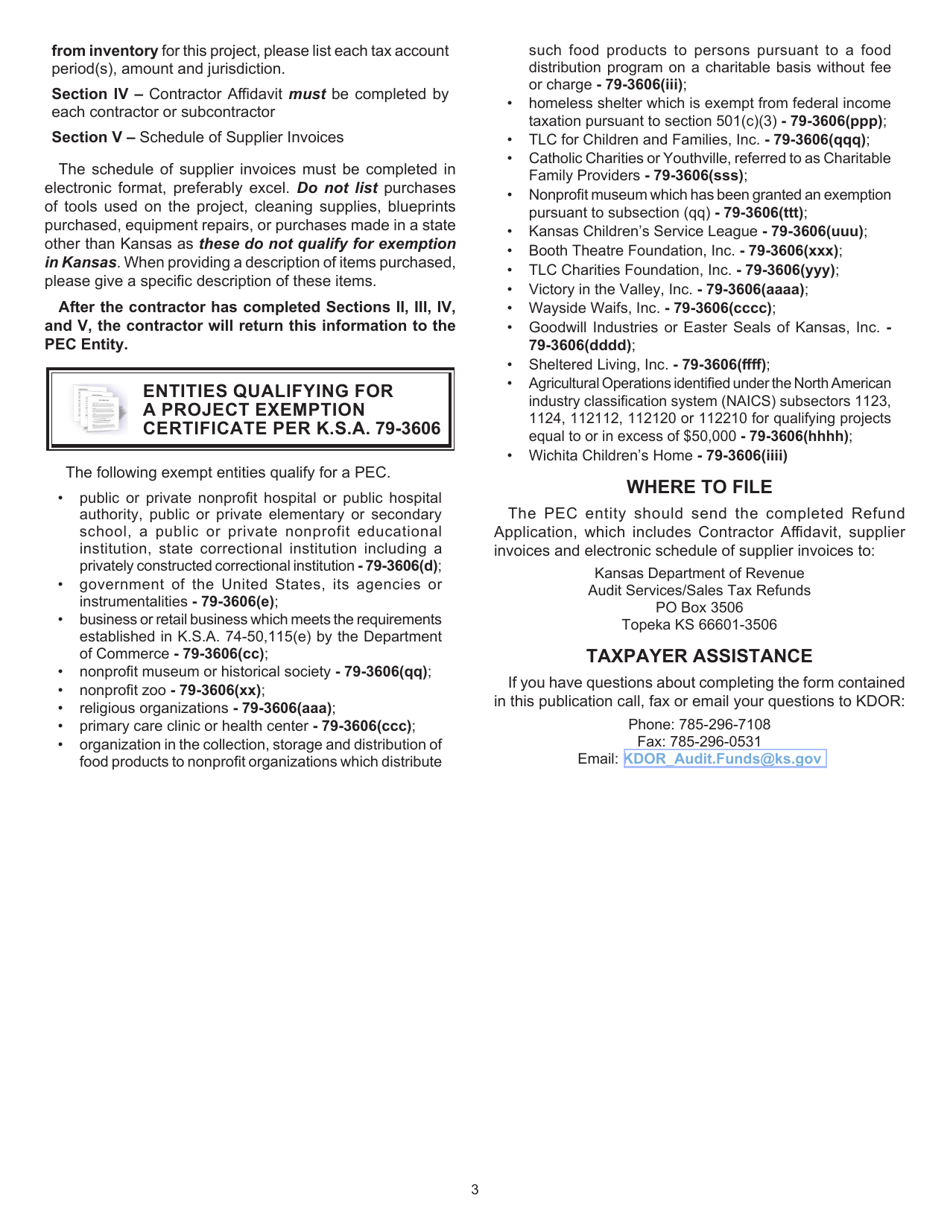

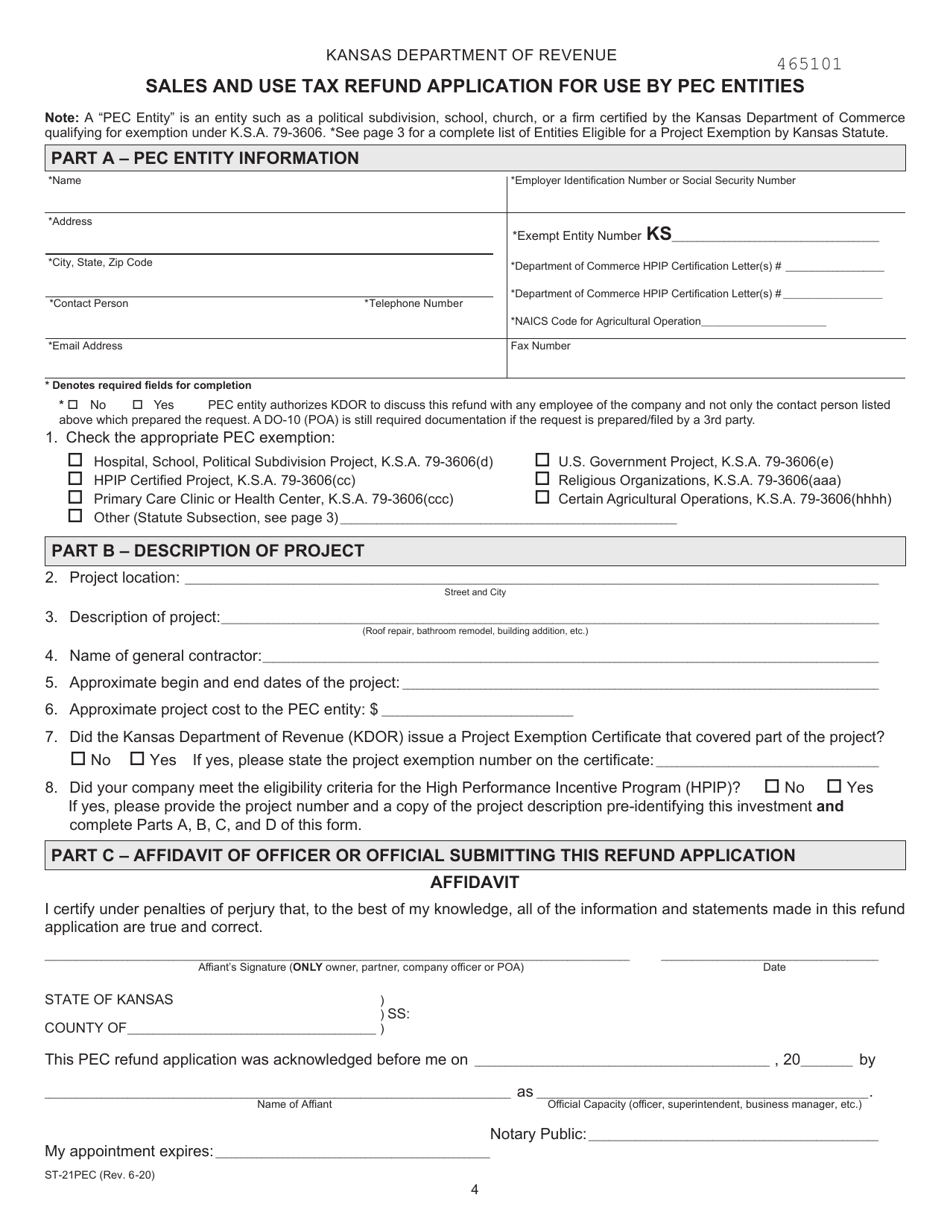

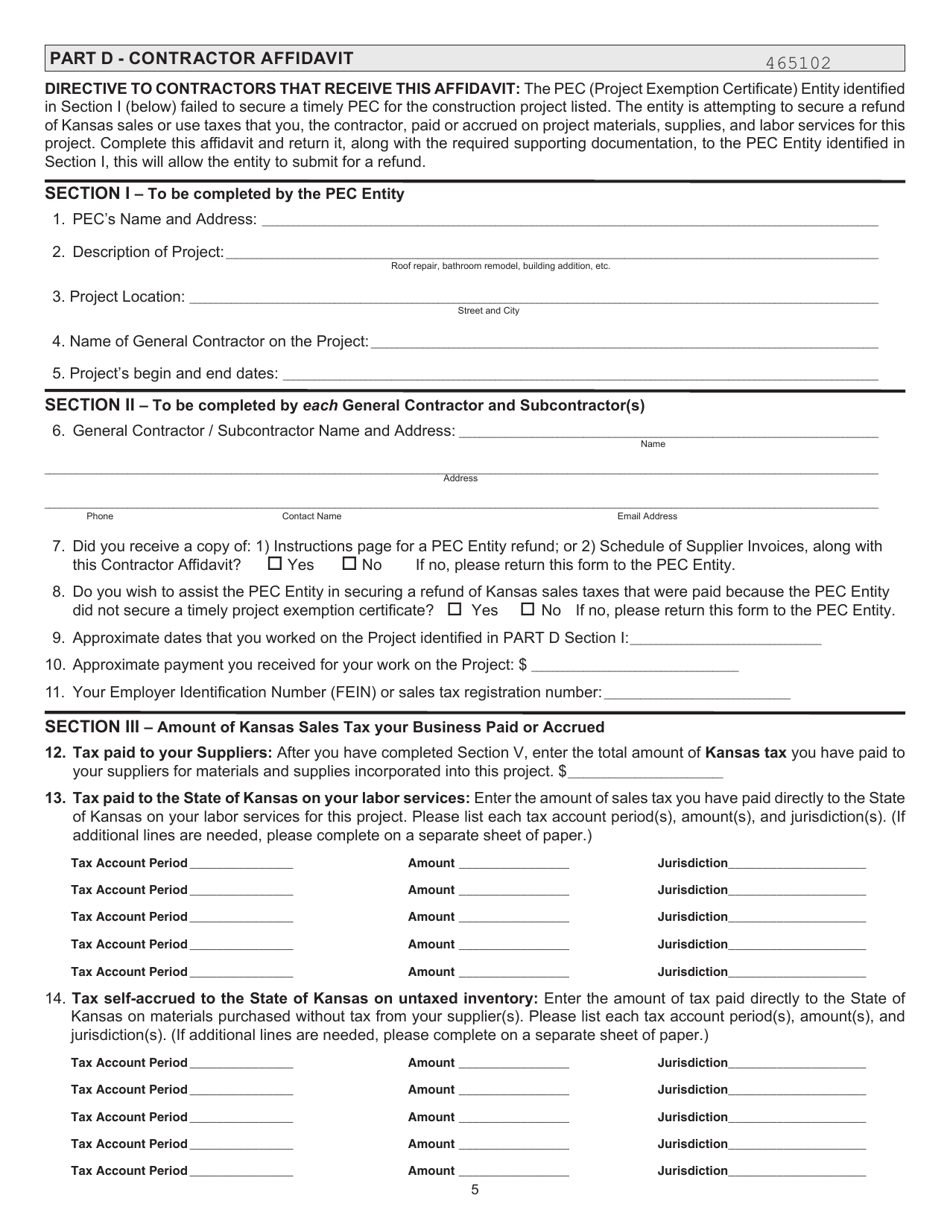

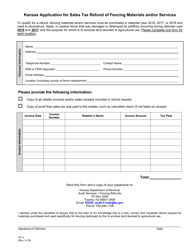

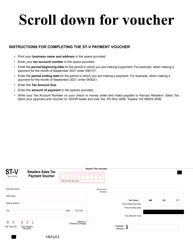

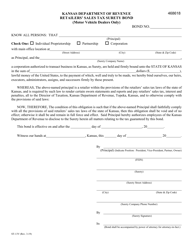

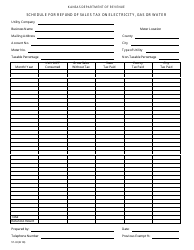

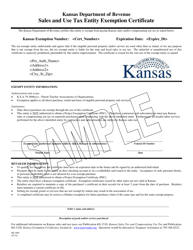

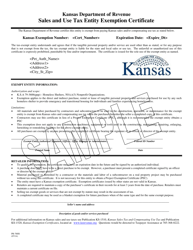

Form ST-21PEC Sales and Use Tax Refund Application for Use by Pec Entities - Kansas

What Is Form ST-21PEC?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

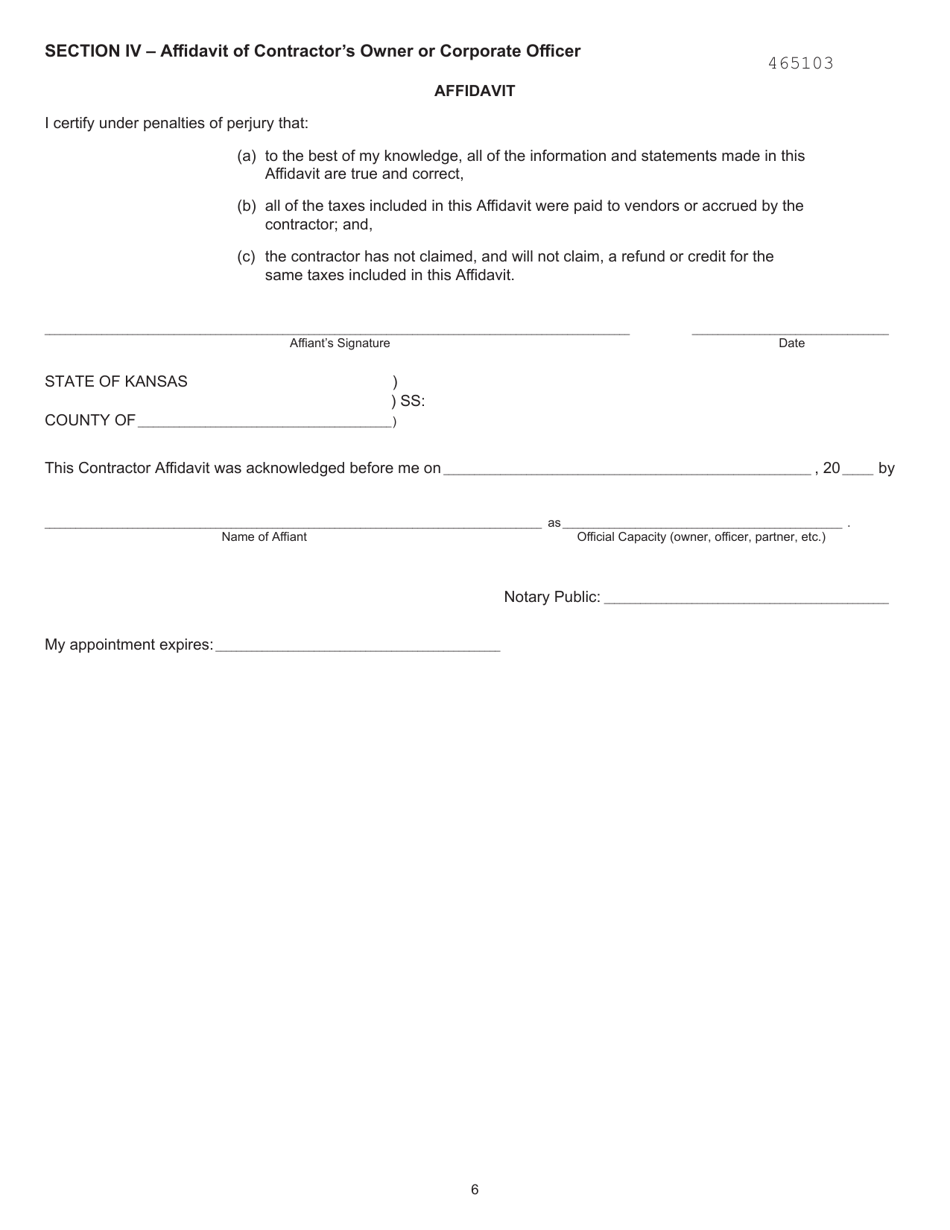

Q: What is Form ST-21PEC?

A: Form ST-21PEC is the Sales and Use Tax Refund Application for Use by Pec Entities in Kansas.

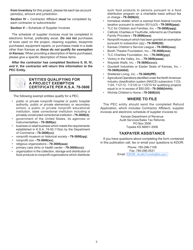

Q: Who can use Form ST-21PEC?

A: Form ST-21PEC can be used by PEC (Public Electric Corporation) entities in Kansas.

Q: What is the purpose of Form ST-21PEC?

A: The purpose of Form ST-21PEC is to apply for a sales and use tax refund for PEC entities in Kansas.

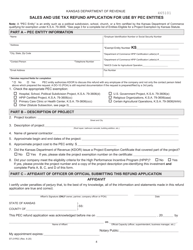

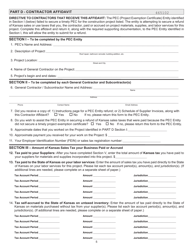

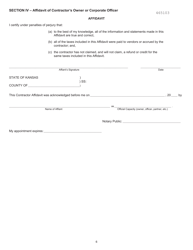

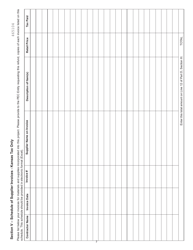

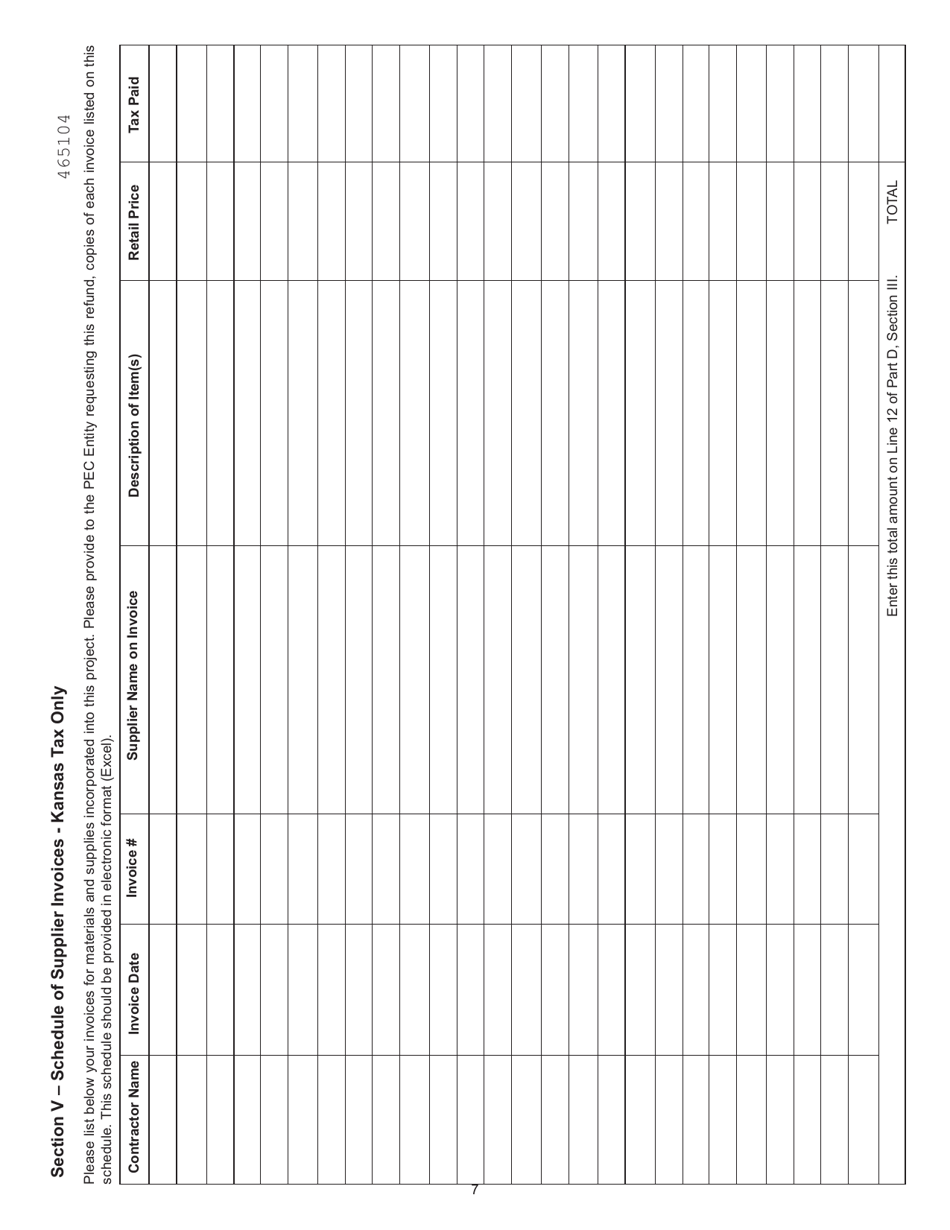

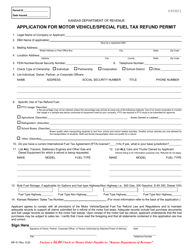

Q: What information do I need to provide on Form ST-21PEC?

A: You will need to provide information such as your entity's name, address, and tax identification number, as well as details about the taxes paid and the refund being requested.

Q: Are there any deadlines for submitting Form ST-21PEC?

A: Yes, there are specific deadlines for submitting Form ST-21PEC. It is recommended to refer to the instructions provided with the form to determine the deadline for your specific situation.

Q: How long does it take to process a Form ST-21PEC?

A: The processing time for a Form ST-21PEC can vary depending on various factors. It is best to contact the Kansas Department of Revenue for an estimated processing time.

Q: Is there a fee for submitting Form ST-21PEC?

A: There is no fee for submitting Form ST-21PEC.

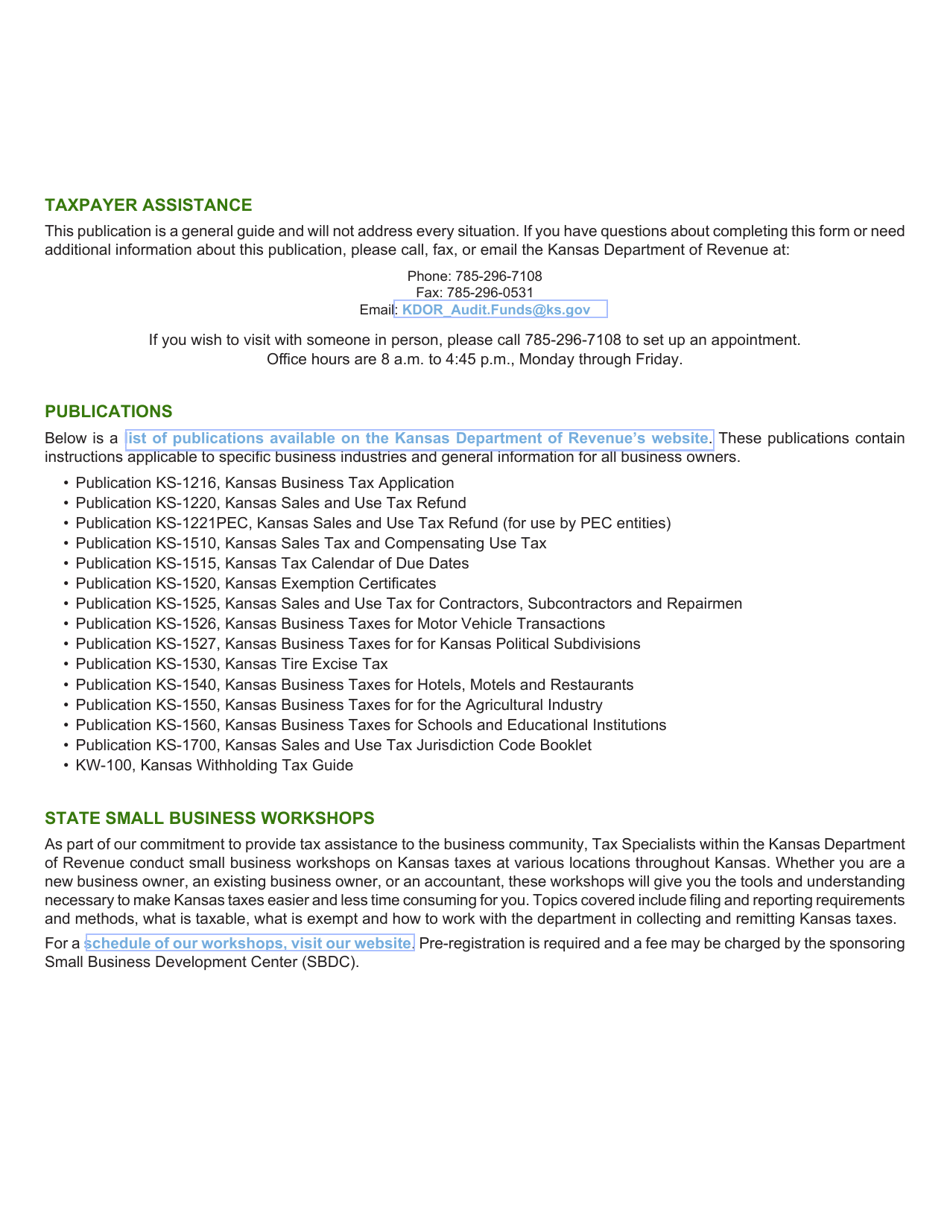

Q: What should I do if I have questions or need assistance with Form ST-21PEC?

A: If you have questions or need assistance with Form ST-21PEC, you can contact the Kansas Department of Revenue's customer service.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-21PEC by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.