This version of the form is not currently in use and is provided for reference only. Download this version of

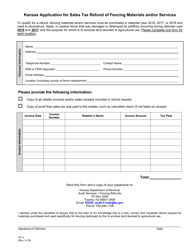

Form ST-21

for the current year.

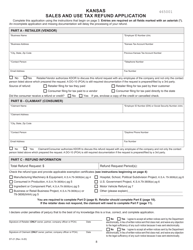

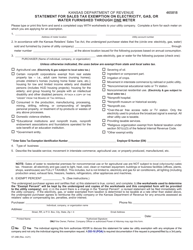

Form ST-21 Kansas Sales and Use Tax Refund Application - Kansas

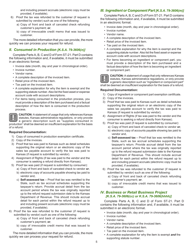

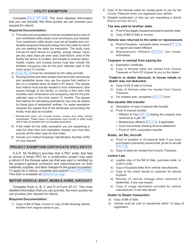

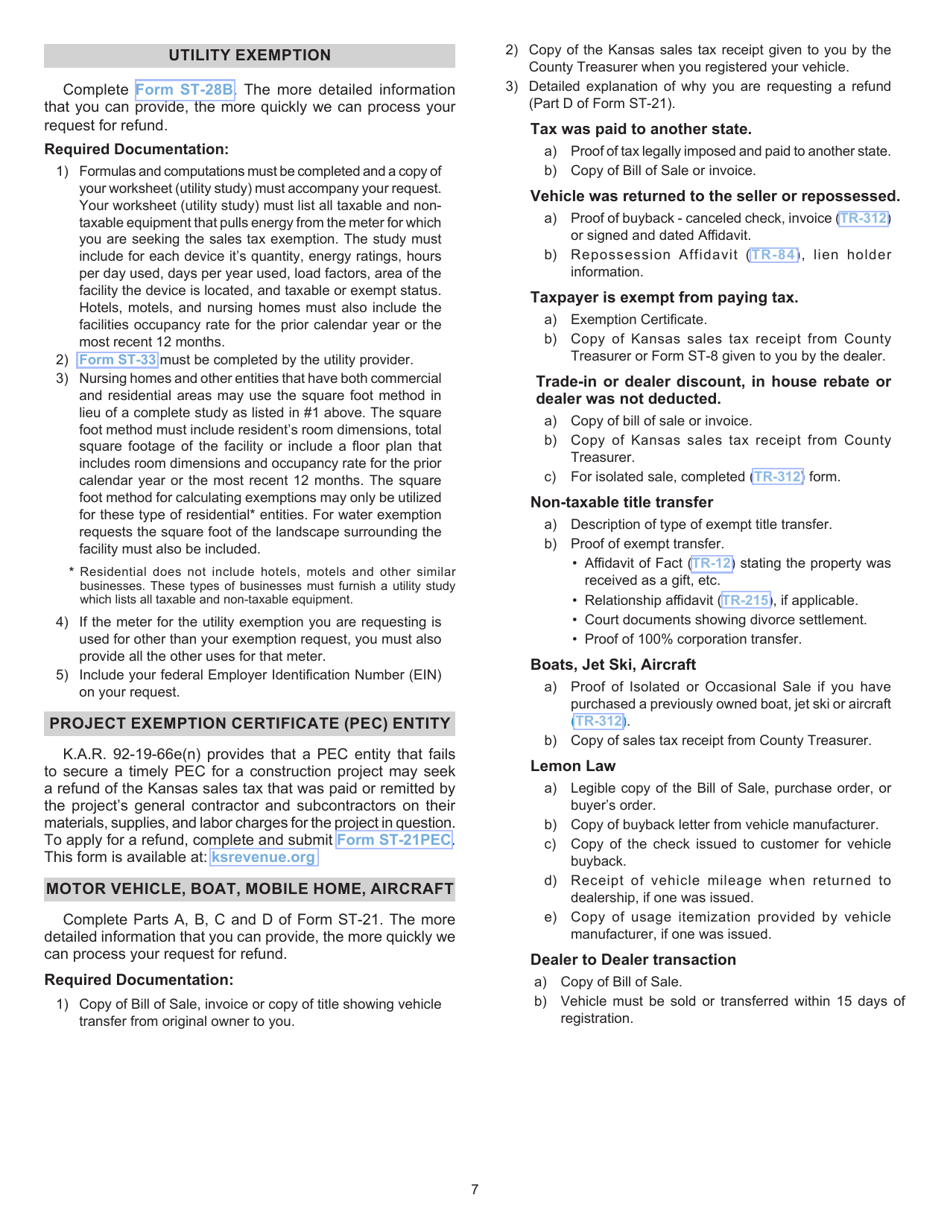

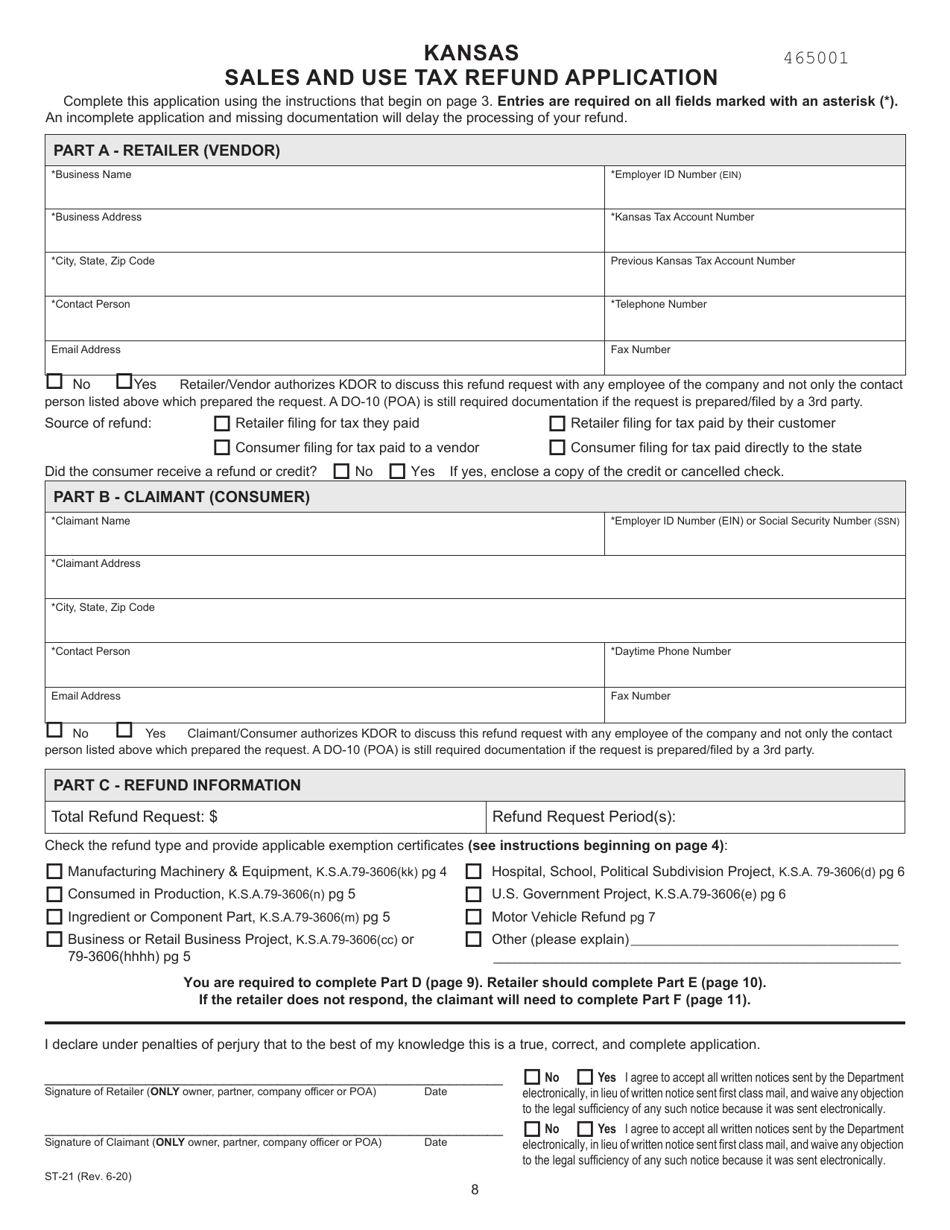

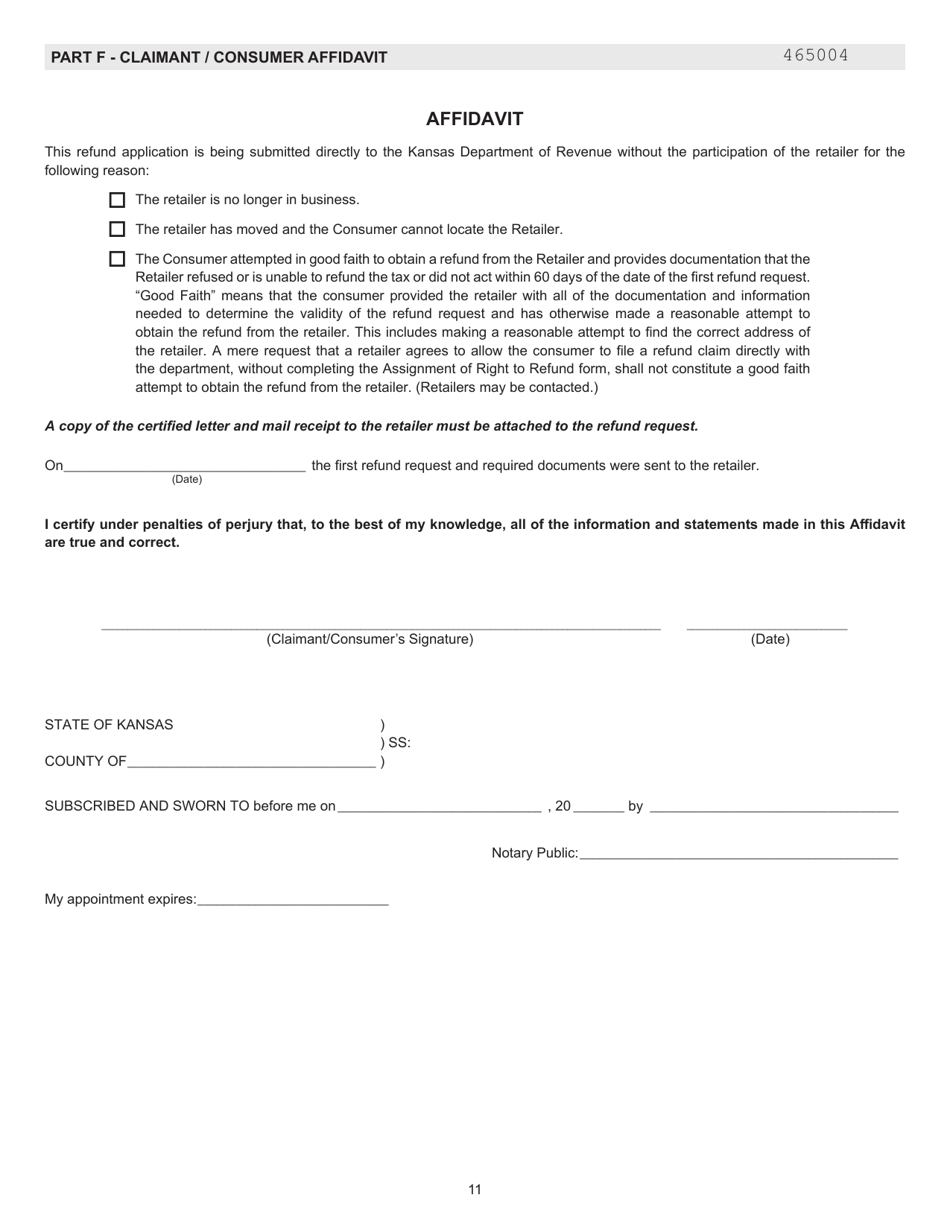

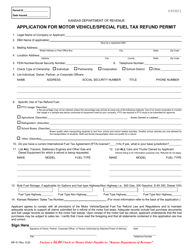

What Is Form ST-21?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-21?

A: The Form ST-21 is the Kansas Sales and Use Tax Refund Application.

Q: What is the purpose of Form ST-21?

A: The purpose of Form ST-21 is to apply for a refund of sales and use tax paid to the State of Kansas.

Q: Who can use Form ST-21?

A: Individuals, businesses, and organizations that have paid sales and use tax in Kansas can use Form ST-21 to apply for a refund.

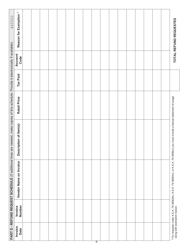

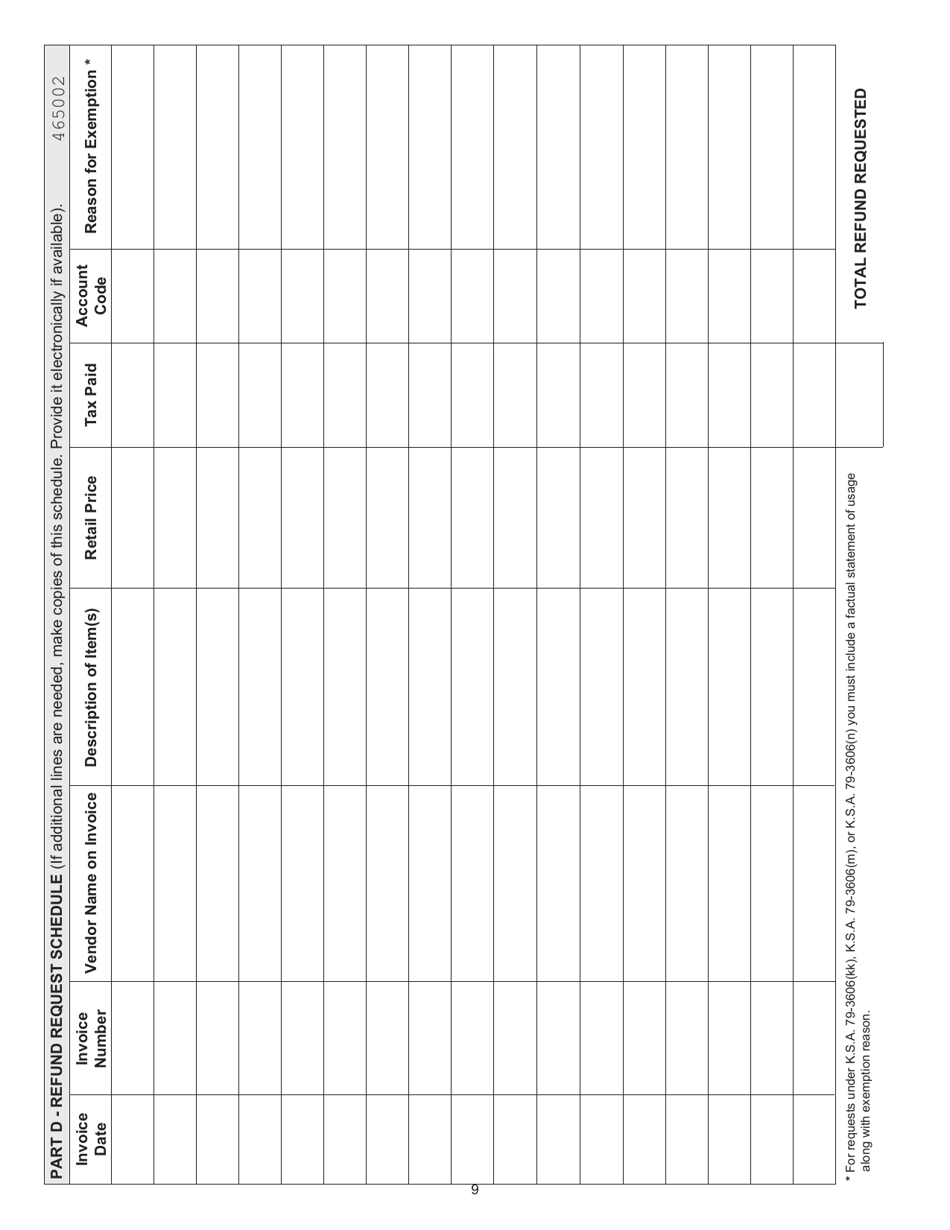

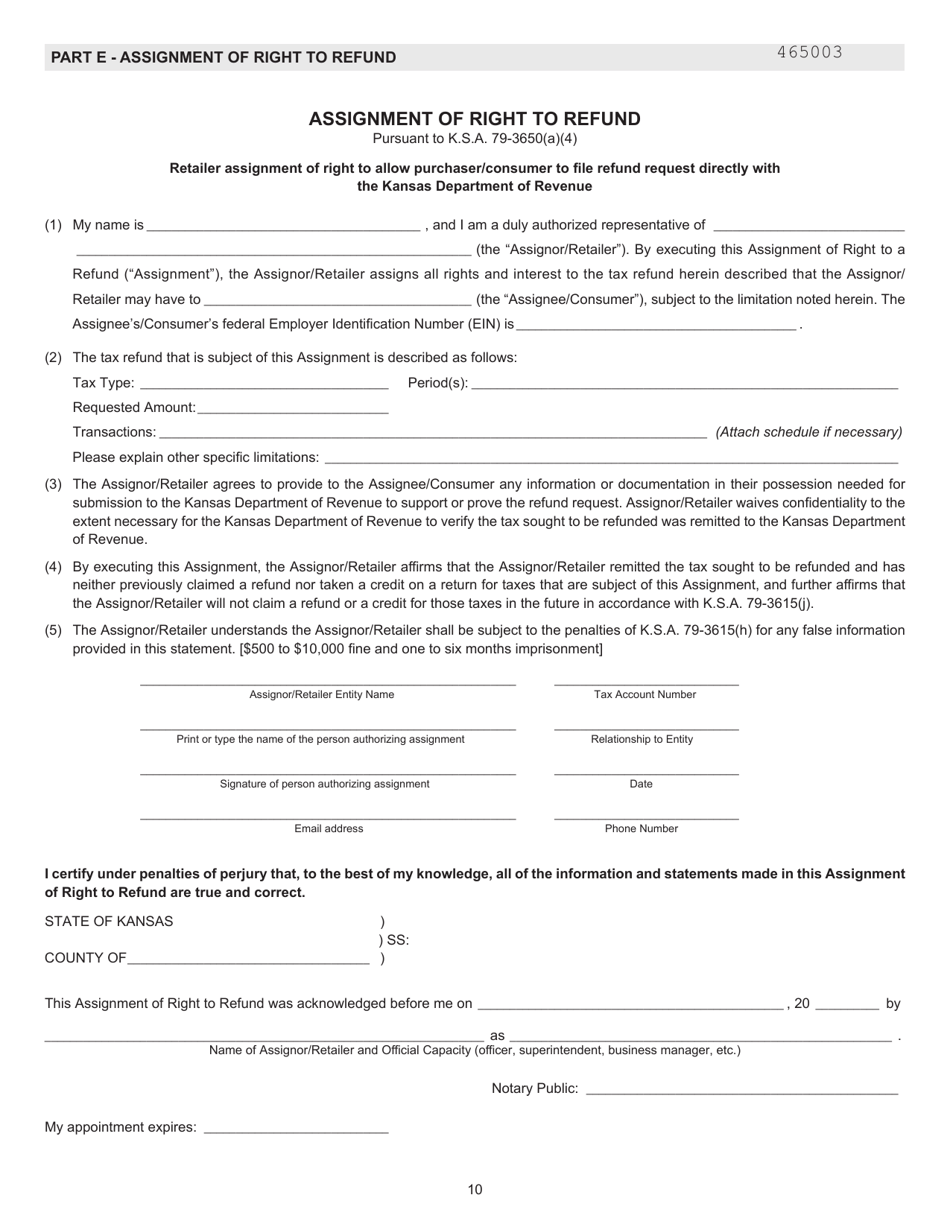

Q: What information is required on Form ST-21?

A: Form ST-21 requires information such as the taxpayer's identification number, contact information, description of the claim, and supporting documentation.

Q: What is the deadline to submit Form ST-21?

A: Form ST-21 must be submitted within three years from the due date of the tax or the date the tax was paid, whichever is later.

Q: How long does it take to process a refund request?

A: The processing time for a refund request varies, but it generally takes around 30 to 90 days for the Kansas Department of Revenue to review and process the application.

Q: Are there any fees associated with filing Form ST-21?

A: No, there are no fees associated with filing Form ST-21.

Q: What should I do if I have additional questions about Form ST-21?

A: If you have additional questions about Form ST-21, you can contact the Kansas Department of Revenue for assistance.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-21 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.