This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule K-210

for the current year.

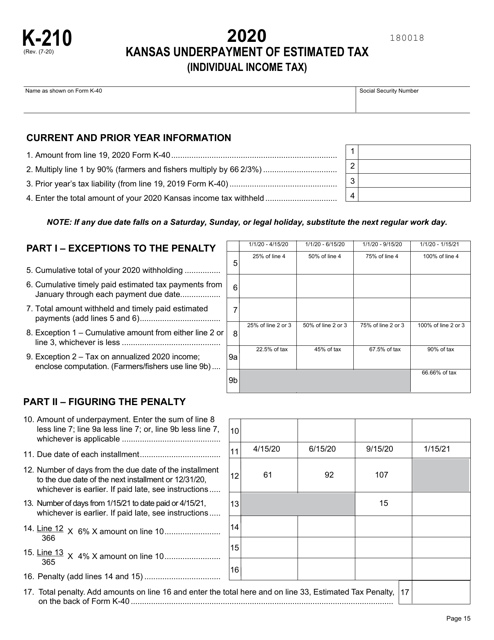

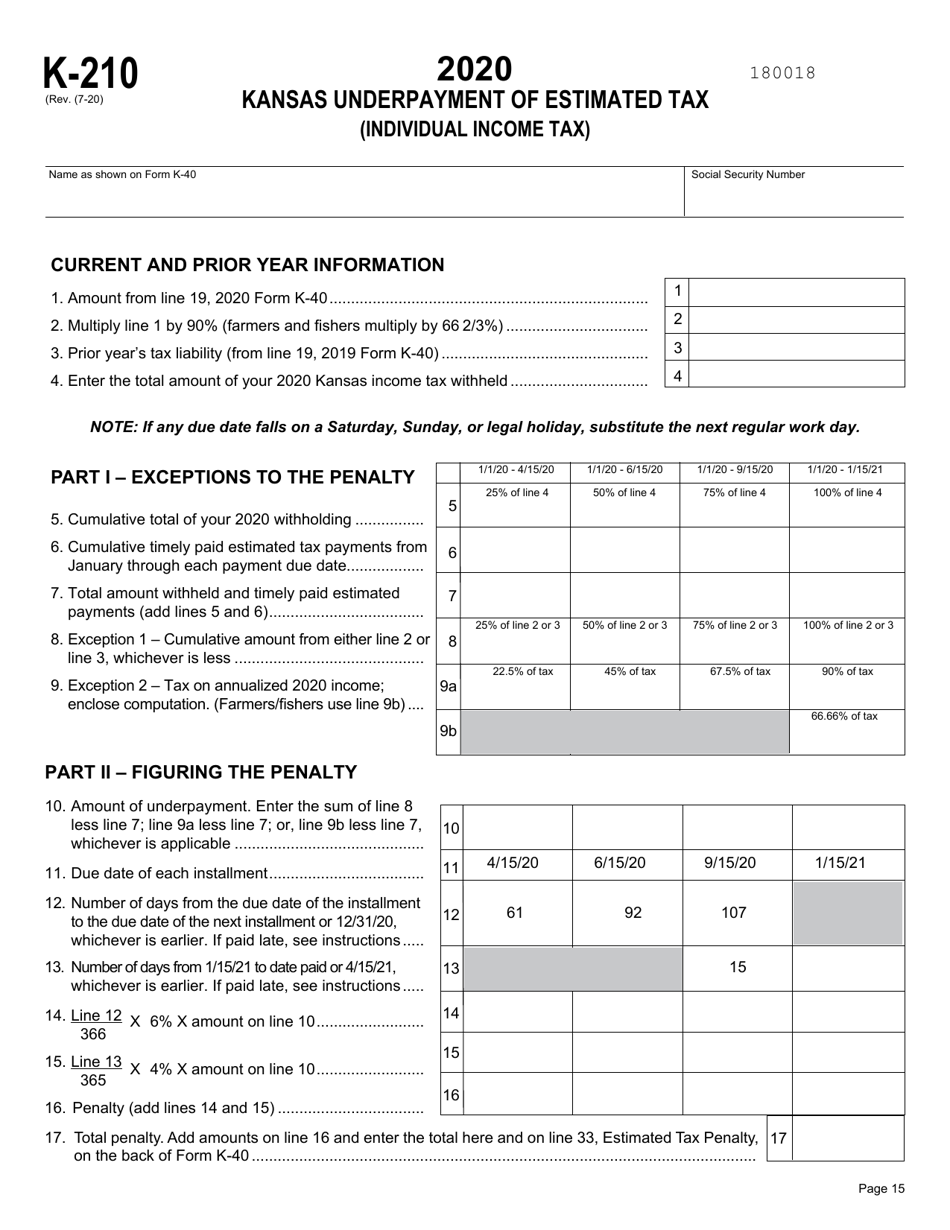

Schedule K-210 Kansas Underpayment of Estimated Tax (Individual Income Tax) - Kansas

What Is Schedule K-210?

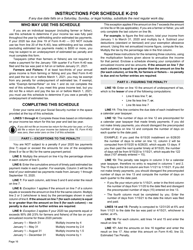

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-210?

A: Schedule K-210 is a form used for reporting underpayment of estimated tax in Kansas for individual incometax purposes.

Q: Who needs to file Schedule K-210?

A: Individuals who have underpaid their estimated tax in Kansas during the tax year need to file Schedule K-210.

Q: How do I know if I need to file Schedule K-210?

A: You need to file Schedule K-210 if you did not pay enough estimated tax in Kansas throughout the tax year.

Q: What information is required to complete Schedule K-210?

A: You will need to provide your name, Social Security number, Kansas adjusted gross income, total estimated tax paid, and the amount of underpayment.

Q: When is the deadline for filing Schedule K-210?

A: Schedule K-210 is typically due on the same date as your Kansas individual income tax return, which is April 15th for most taxpayers.

Q: Can I file Schedule K-210 electronically?

A: Yes, you can file Schedule K-210 electronically if you are e-filing your Kansas individual income tax return.

Q: What happens if I do not file Schedule K-210?

A: If you do not file Schedule K-210 when required, you may be subject to penalties and interest on the underpayment of estimated tax.

Q: Are there any exceptions or exemptions to the underpayment of estimated tax?

A: There may be exceptions or exemptions available for certain individuals, such as farmers and fishermen. Consult the instructions for Schedule K-210 or seek professional tax advice for more information.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-210 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.