This version of the form is not currently in use and is provided for reference only. Download this version of

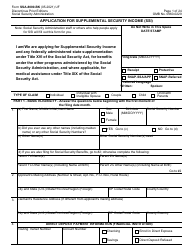

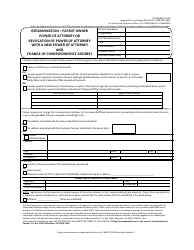

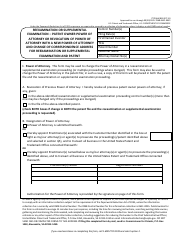

Schedule S

for the current year.

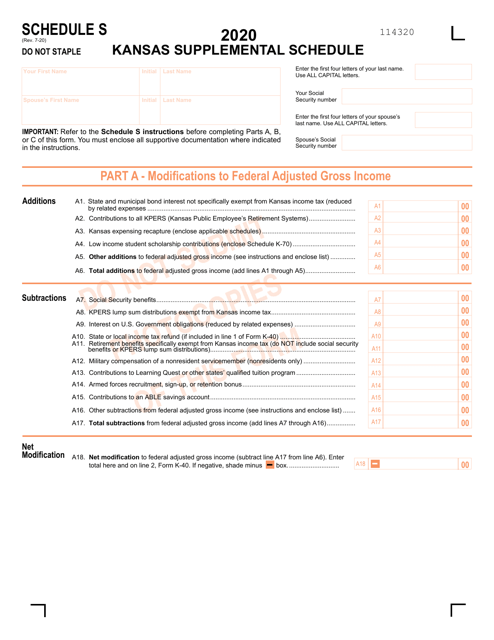

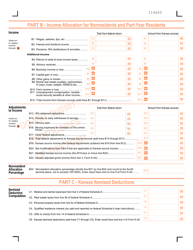

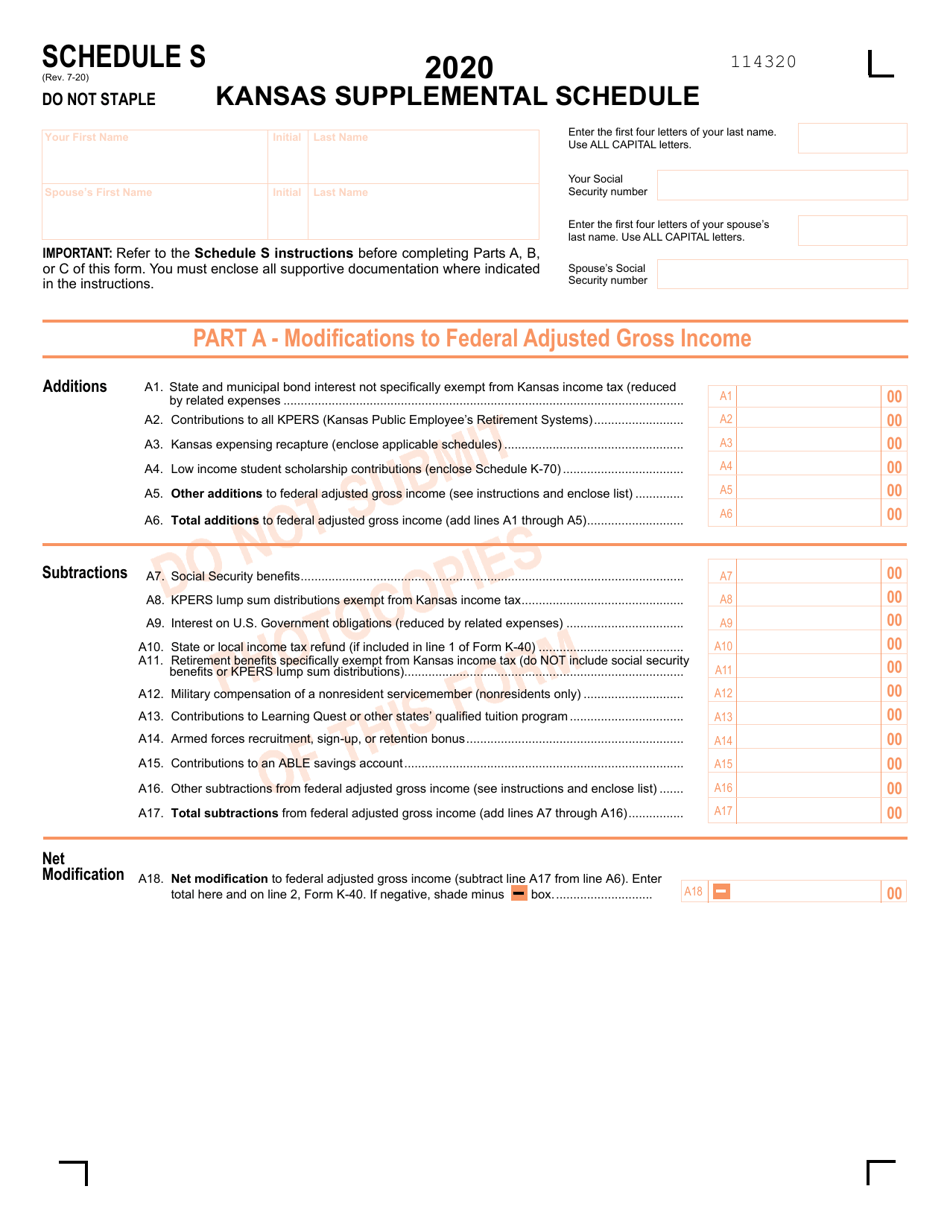

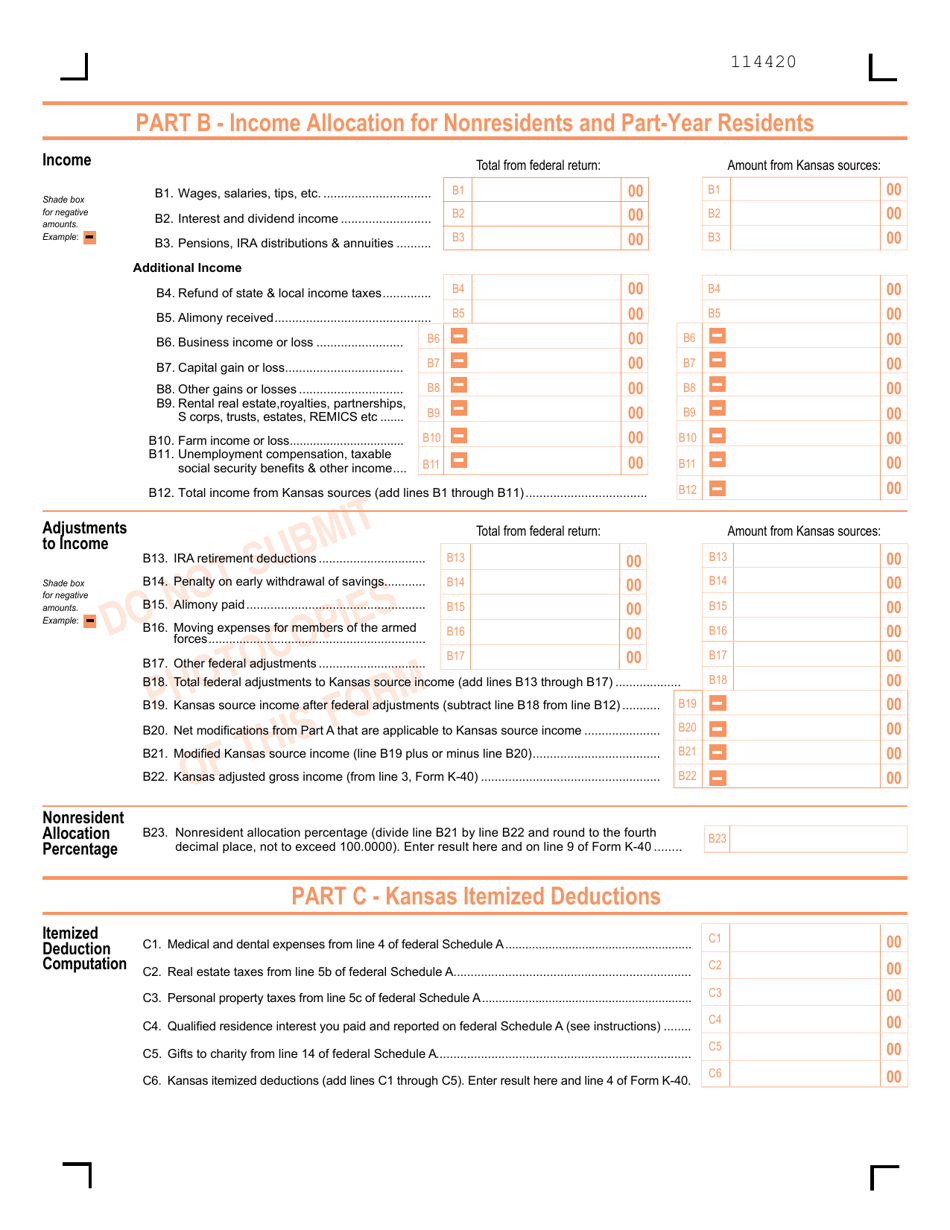

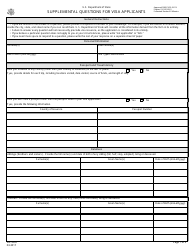

Schedule S Kansas Supplemental Schedule - Kansas

What Is Schedule S?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

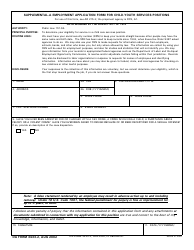

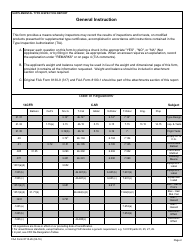

Q: What is the Schedule S Kansas Supplemental Schedule?

A: The Schedule S Kansas Supplemental Schedule is a form used by taxpayers in Kansas to report supplemental income and deductions.

Q: Who needs to file Schedule S?

A: Residents of Kansas who have supplemental income or deductions need to file Schedule S.

Q: What is considered supplemental income?

A: Supplemental income includes income from sources other than a regular job, such as rental income, self-employment income, or interest income.

Q: What deductions can be reported on Schedule S?

A: Deductions related to the supplemental income, such as business expenses or rental property expenses, can be reported on Schedule S.

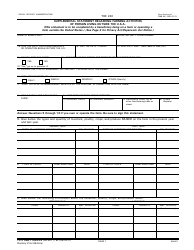

Q: When is the deadline to file Schedule S?

A: The deadline to file Schedule S is the same as the deadline for filing your Kansas income tax return, typically April 15th.

Q: Is there a separate fee to file Schedule S?

A: There is no separate fee to file Schedule S, it is included as part of your Kansas income tax return.

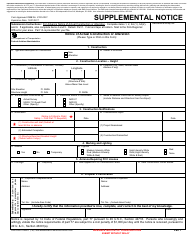

Q: Can I file Schedule S electronically?

A: Yes, you can file Schedule S electronically if you are filing your Kansas income tax return electronically.

Q: What happens if I don't file Schedule S?

A: If you have supplemental income or deductions and fail to file Schedule S, you may be subject to penalties or an audit by the Kansas Department of Revenue.

Q: Can I amend Schedule S if I made a mistake?

A: Yes, you can file an amended Schedule S if you made a mistake on your original filing.

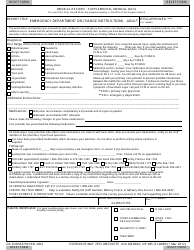

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule S by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.