This version of the form is not currently in use and is provided for reference only. Download this version of

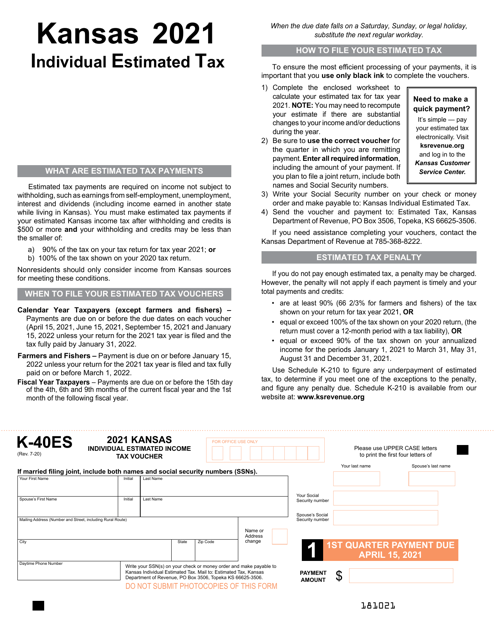

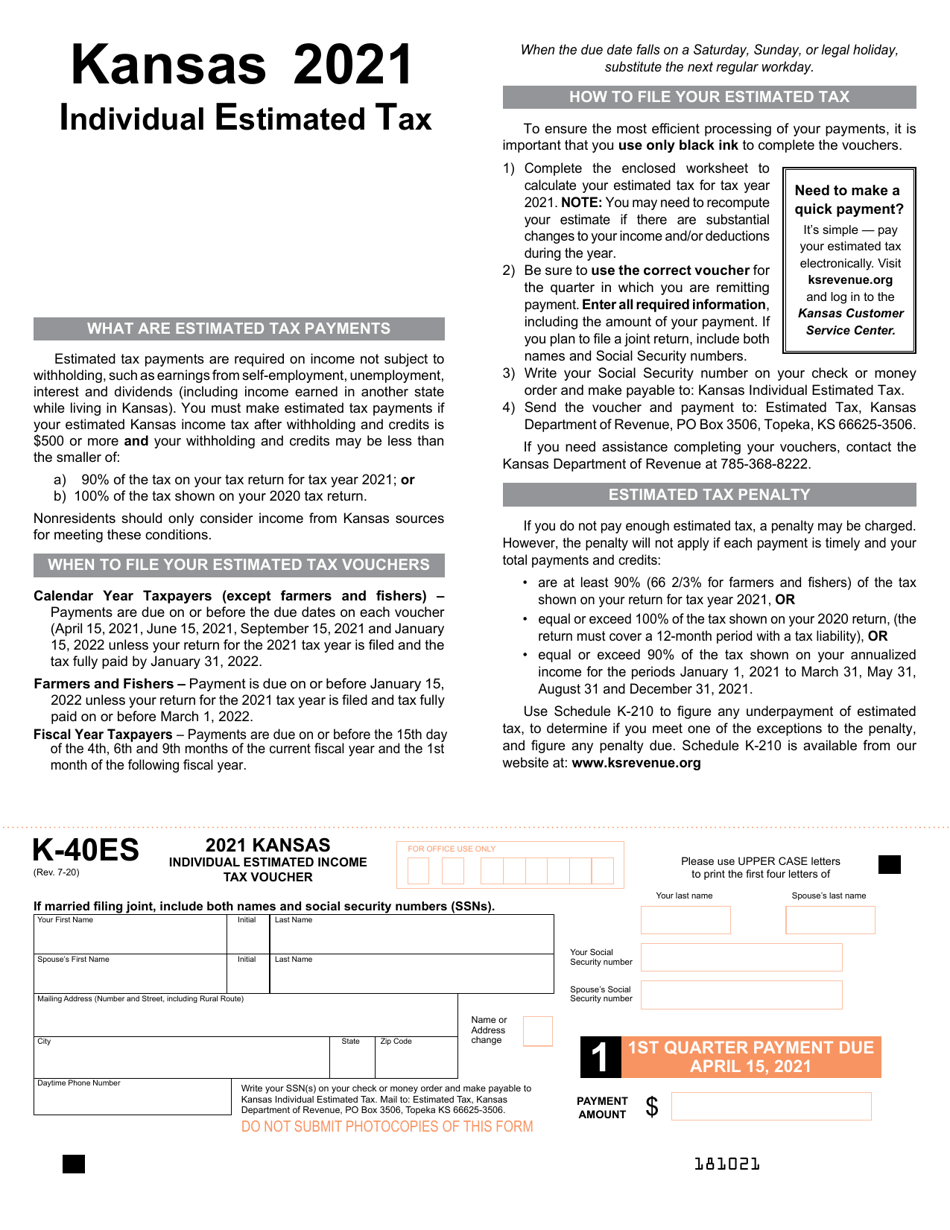

Form K-40ES

for the current year.

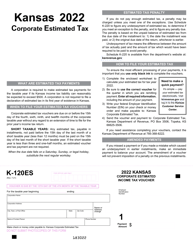

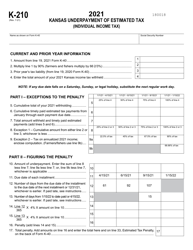

Form K-40ES Kansas Individual Estimated Income Tax Voucher - Kansas

What Is Form K-40ES?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

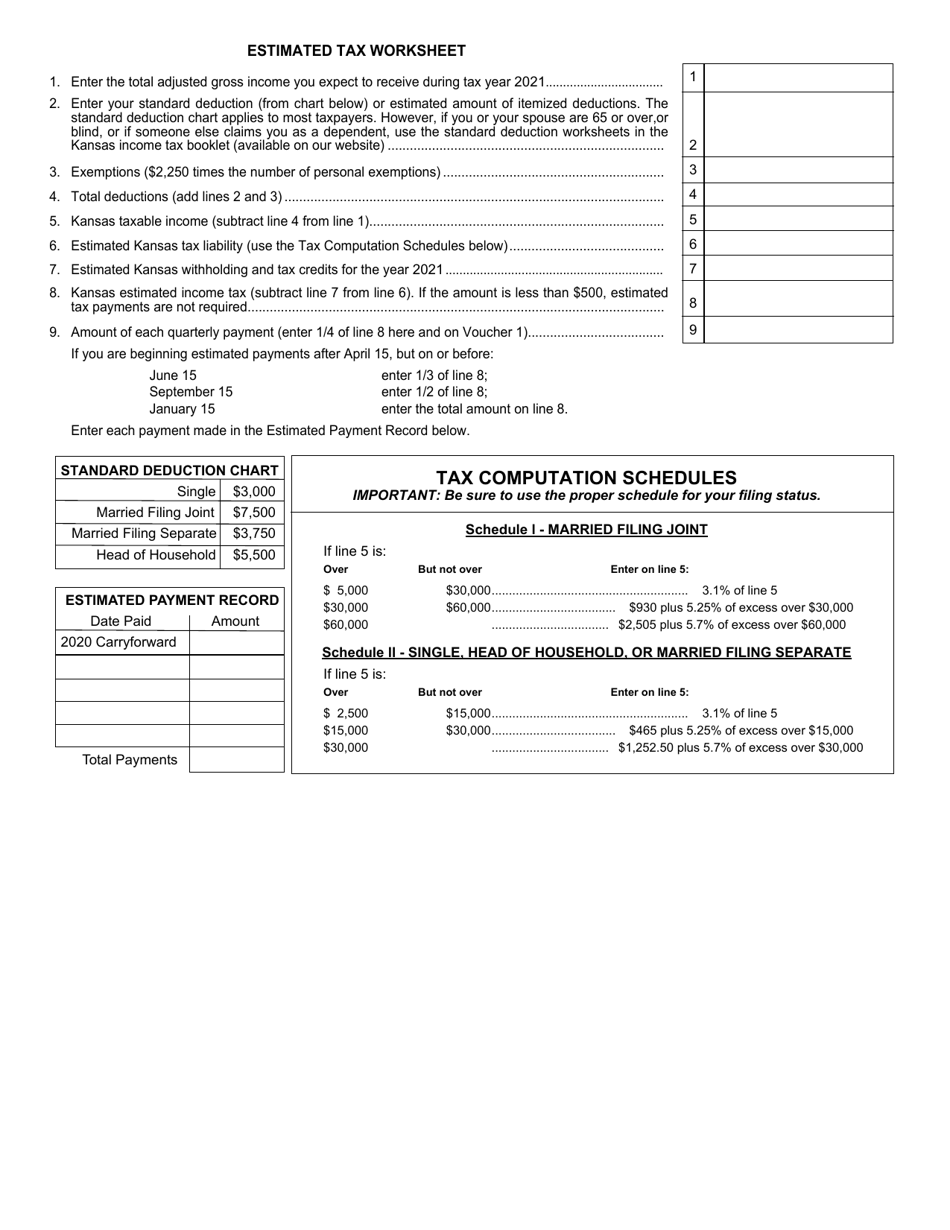

Q: What is Form K-40ES?

A: Form K-40ES is a Kansas Individual Estimated Income Tax Voucher.

Q: Who needs to use Form K-40ES?

A: Form K-40ES is used by individuals in Kansas who need to make estimated income tax payments.

Q: What is the purpose of Form K-40ES?

A: The purpose of Form K-40ES is to report and pay estimated income tax to the state of Kansas.

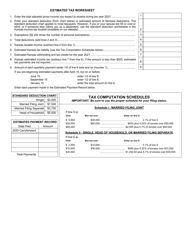

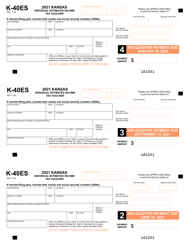

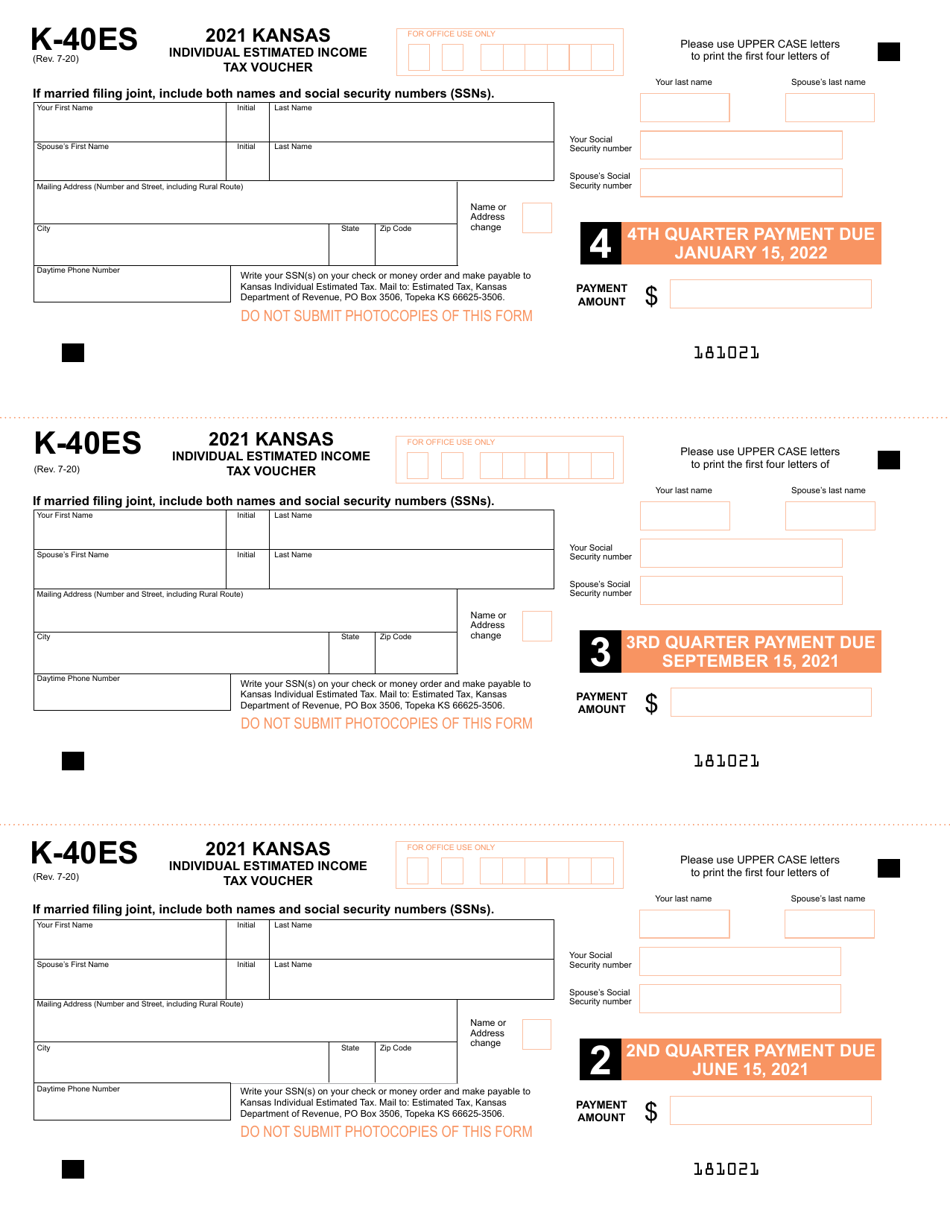

Q: How often do I need to file Form K-40ES?

A: Form K-40ES is generally filed quarterly, with due dates in April, June, September, and January.

Q: What information is required on Form K-40ES?

A: Form K-40ES requires the taxpayer's name, address, Social Security number, and estimated income information.

Q: Are there penalties for not filing Form K-40ES?

A: Yes, if you are required to file Form K-40ES and fail to do so, you may be subject to penalties and interest.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-40ES by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.