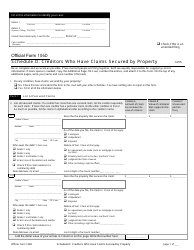

This version of the form is not currently in use and is provided for reference only. Download this version of

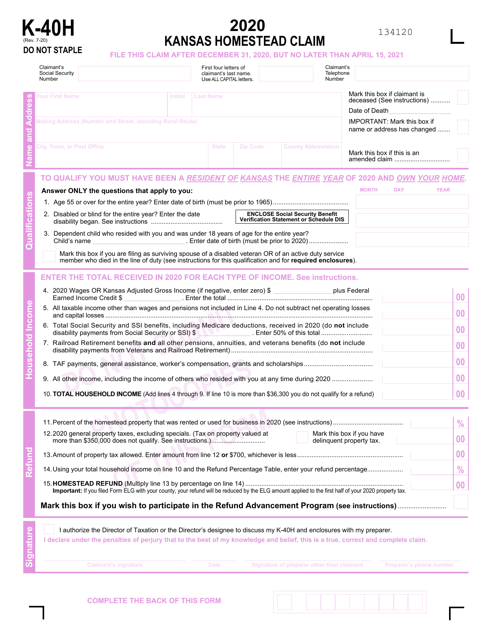

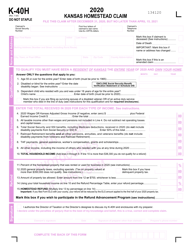

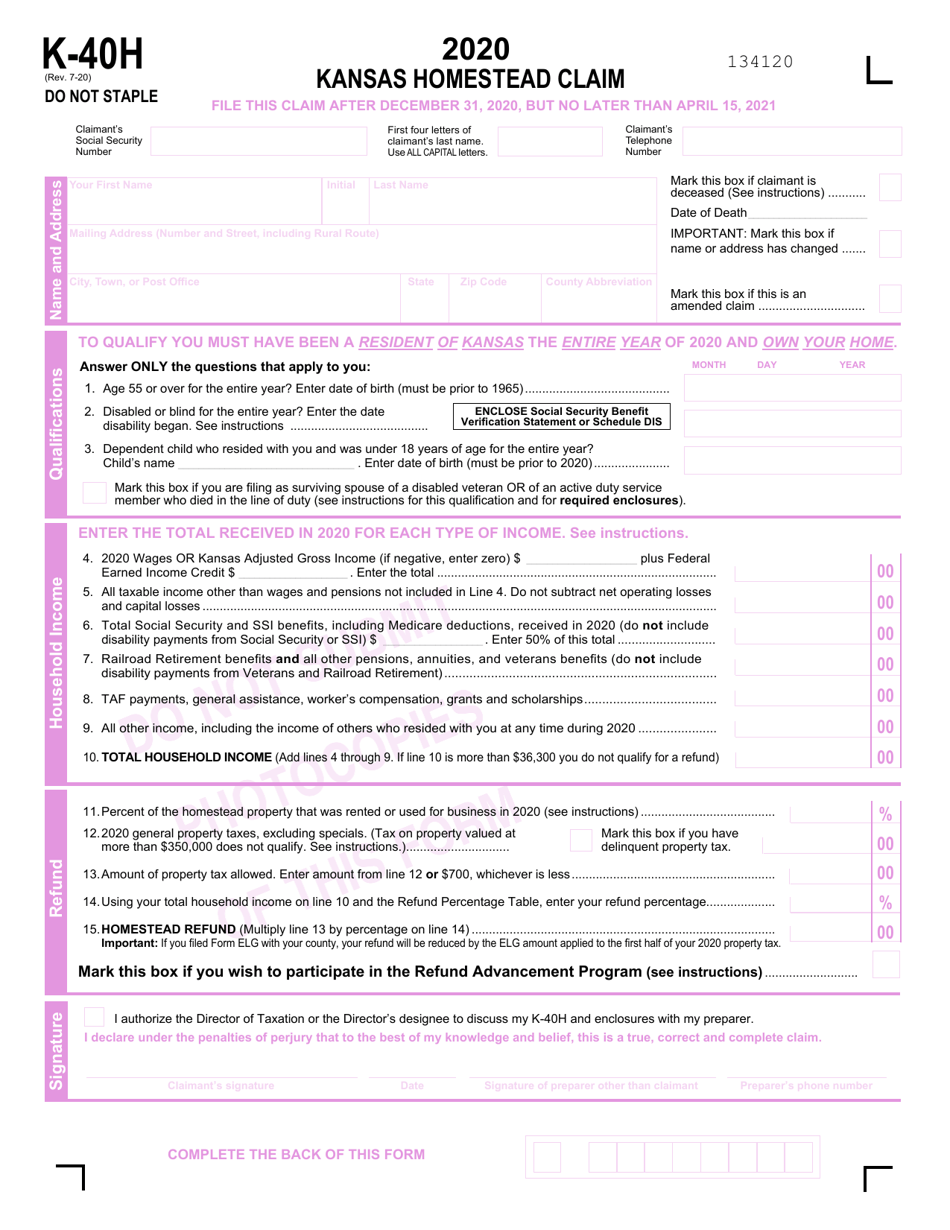

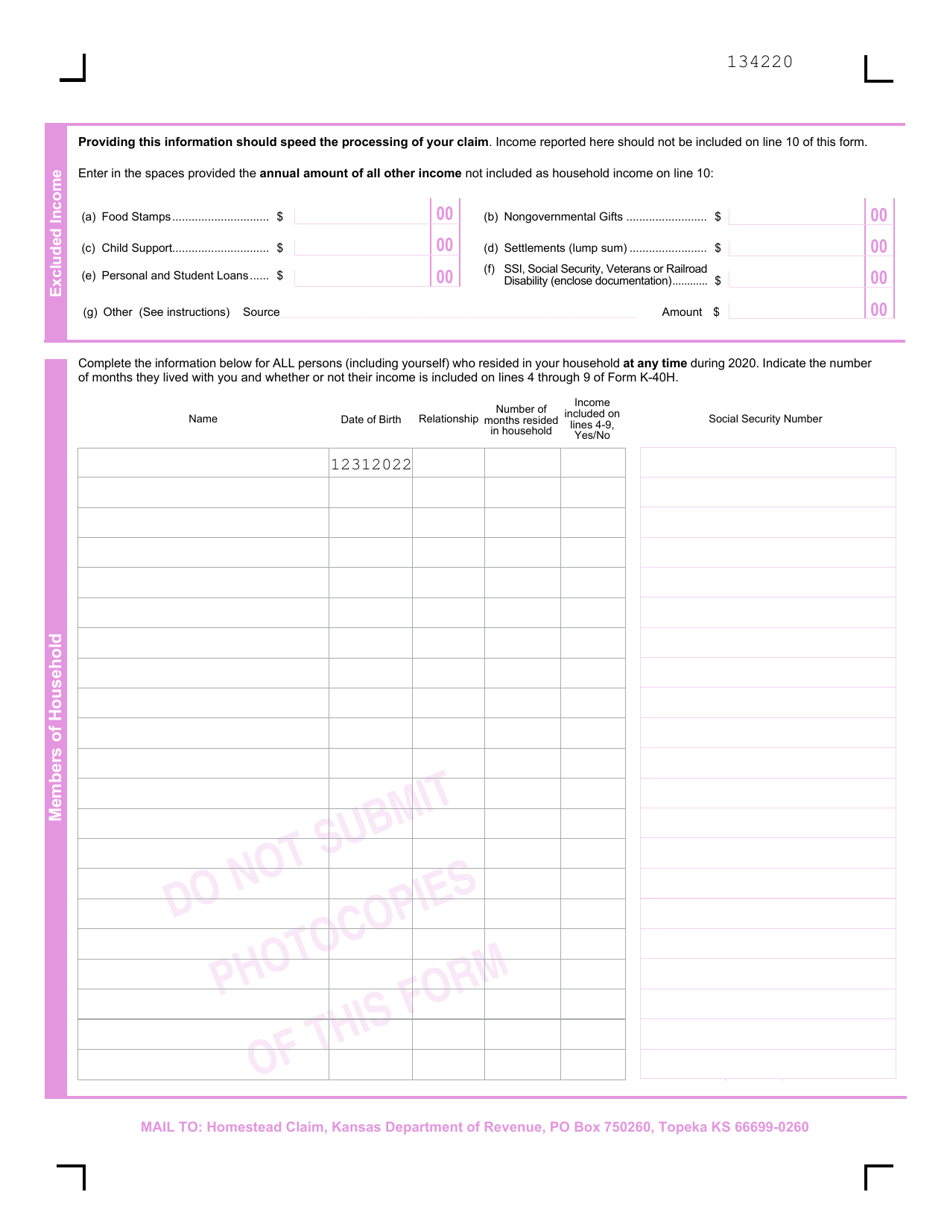

Form K-40H

for the current year.

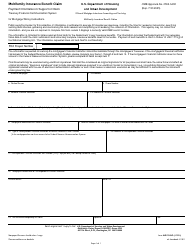

Form K-40H Kansas Homestead Claim - Kansas

What Is Form K-40H?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-40H?

A: Form K-40H is the Kansas Homestead Claim form.

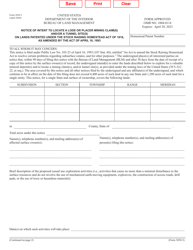

Q: Who can file Form K-40H?

A: Kansas residents who own and occupy a homestead property as their primary residence can file Form K-40H.

Q: What is the purpose of Form K-40H?

A: The purpose of Form K-40H is to claim a homestead refund on property taxes paid.

Q: When should Form K-40H be filed?

A: Form K-40H should be filed annually by April 15th.

Q: What information is required to complete Form K-40H?

A: To complete Form K-40H, you will need your Social Security number, property tax statements, and proof of residency.

Q: Is there a fee to file Form K-40H?

A: No, there is no fee to file Form K-40H.

Q: What happens after you file Form K-40H?

A: After you file Form K-40H, you will receive a refund if you qualify for the homestead refund.

Q: What if you miss the deadline to file Form K-40H?

A: If you miss the deadline to file Form K-40H, you may still be able to claim a refund by filing an amended return within three years of the original due date.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

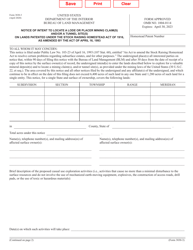

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-40H by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.