This version of the form is not currently in use and is provided for reference only. Download this version of

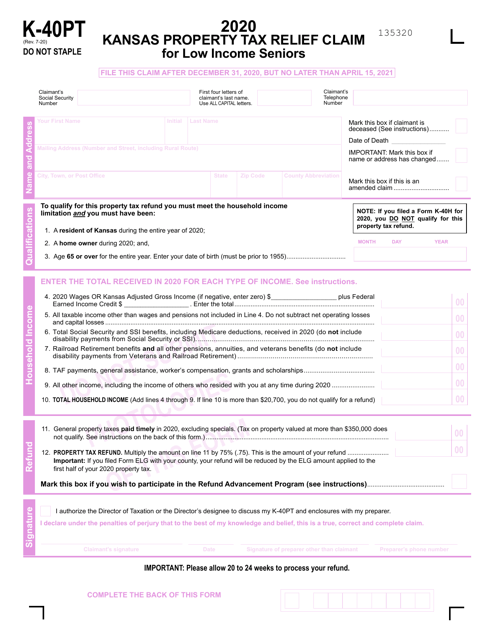

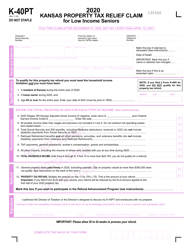

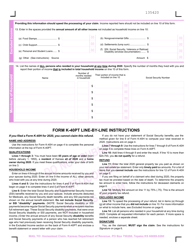

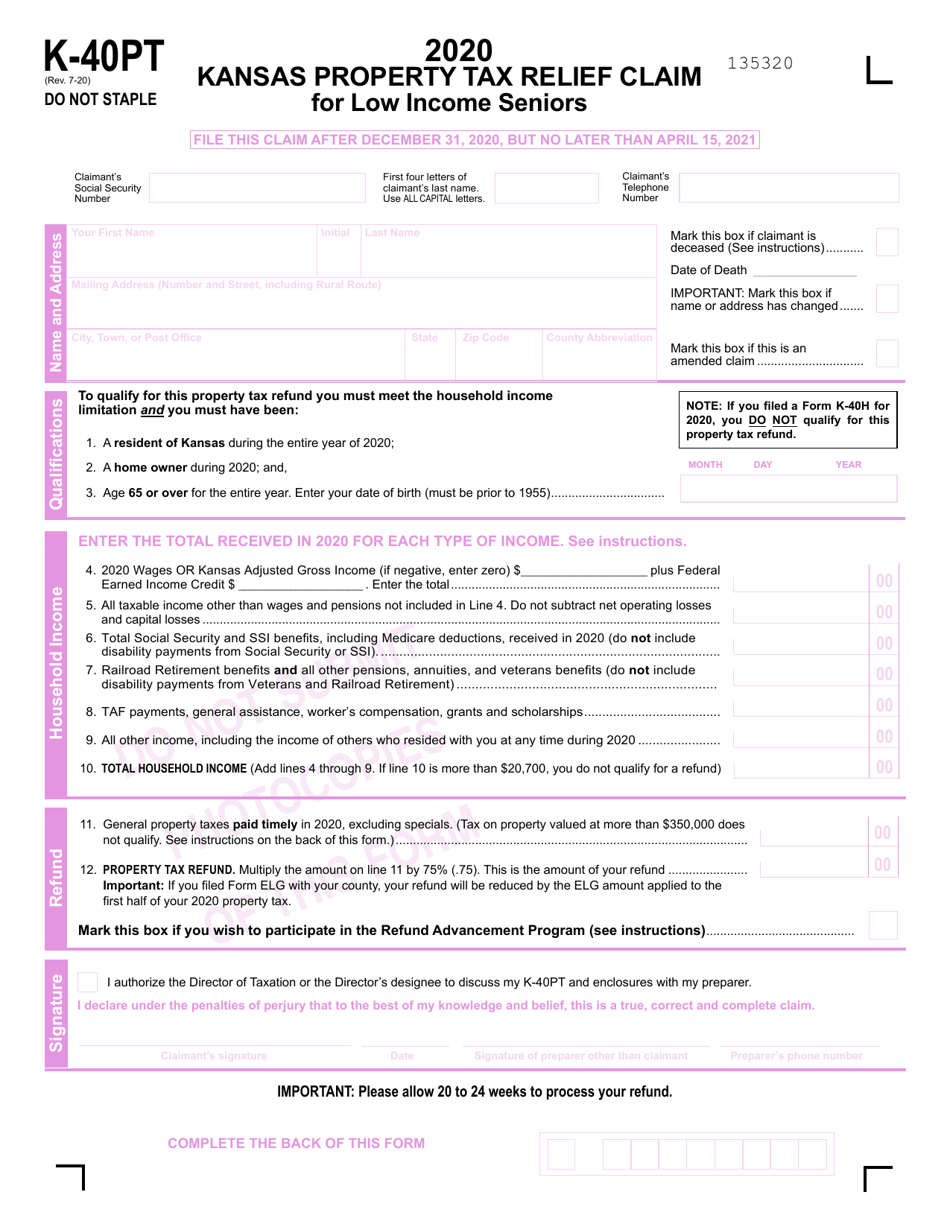

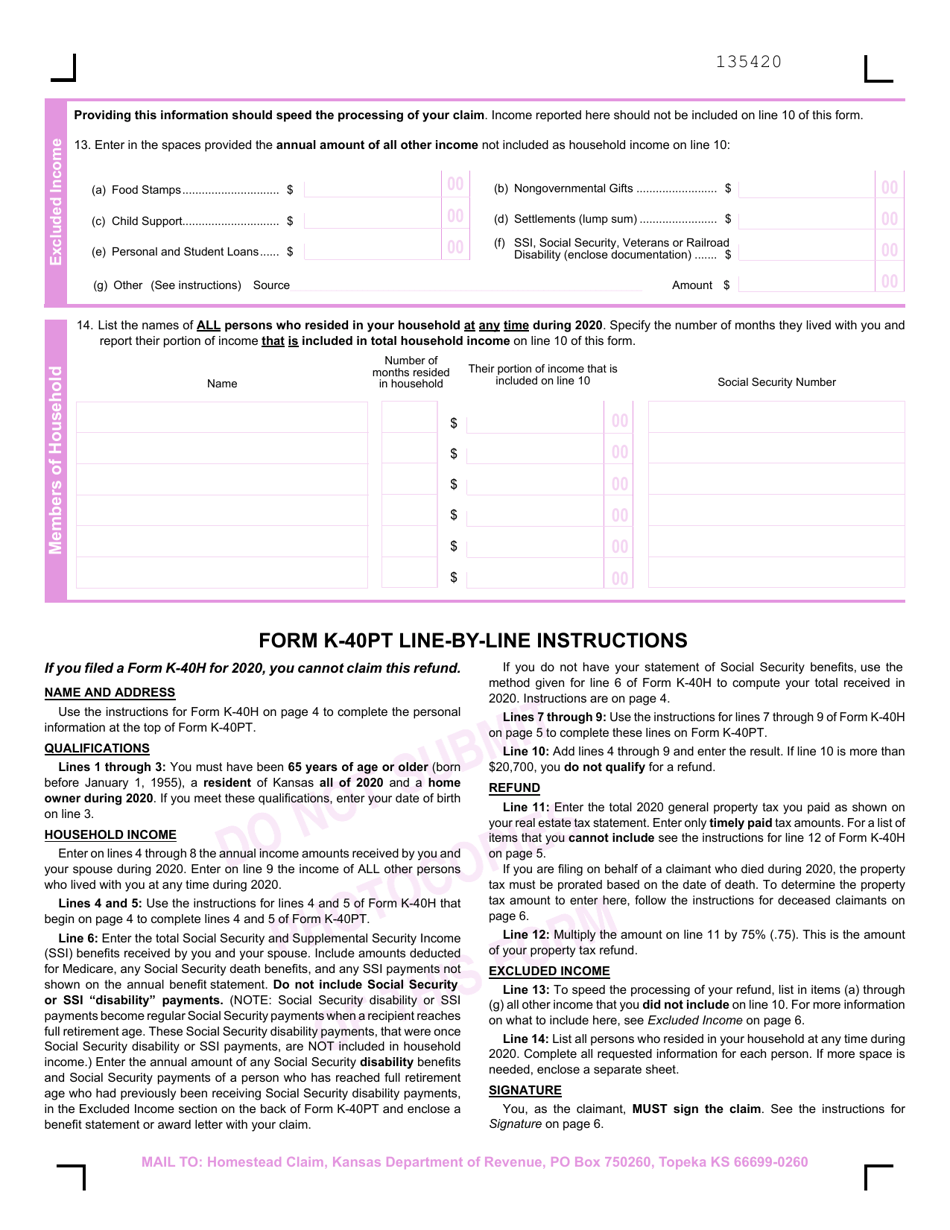

Form K-40PT

for the current year.

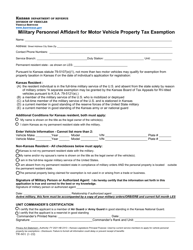

Form K-40PT Kansas Property Tax Relief Claim for Low Income Seniors - Kansas

What Is Form K-40PT?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-40PT?

A: Form K-40PT is a Kansas Property Tax Relief Claim for Low Income Seniors.

Q: Who is eligible to use Form K-40PT?

A: Low income seniors in Kansas are eligible to use Form K-40PT.

Q: What is the purpose of Form K-40PT?

A: The purpose of Form K-40PT is to claim property tax relief for low income seniors.

Q: What information is required on Form K-40PT?

A: Form K-40PT requires information such as your name, address, income details, and property tax information.

Q: When is the deadline to file Form K-40PT?

A: The deadline to file Form K-40PT is usually April 15th, but may vary each year.

Q: Is there a fee to file Form K-40PT?

A: No, there is no fee to file Form K-40PT.

Q: Can I file Form K-40PT electronically?

A: Yes, you can file Form K-40PT electronically if you meet the requirements.

Q: What benefits can I receive by filing Form K-40PT?

A: By filing Form K-40PT, you may be eligible for property tax relief based on your income and other qualifications.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-40PT by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.