This version of the form is not currently in use and is provided for reference only. Download this version of

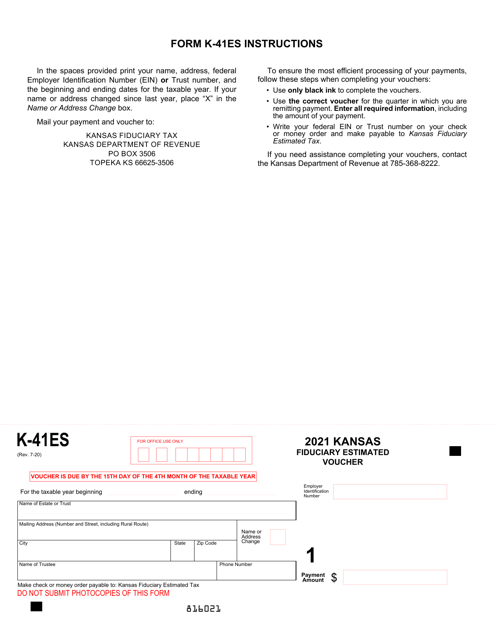

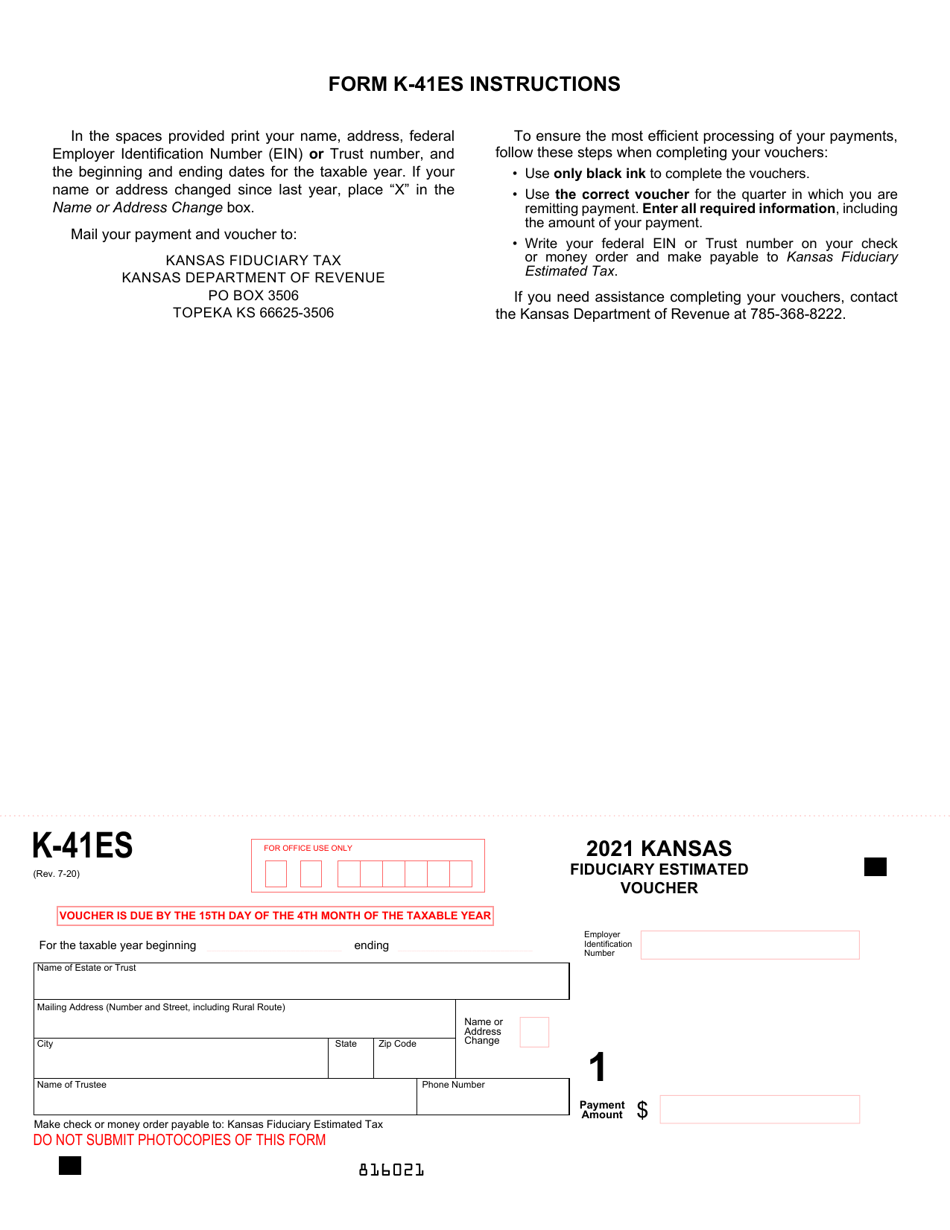

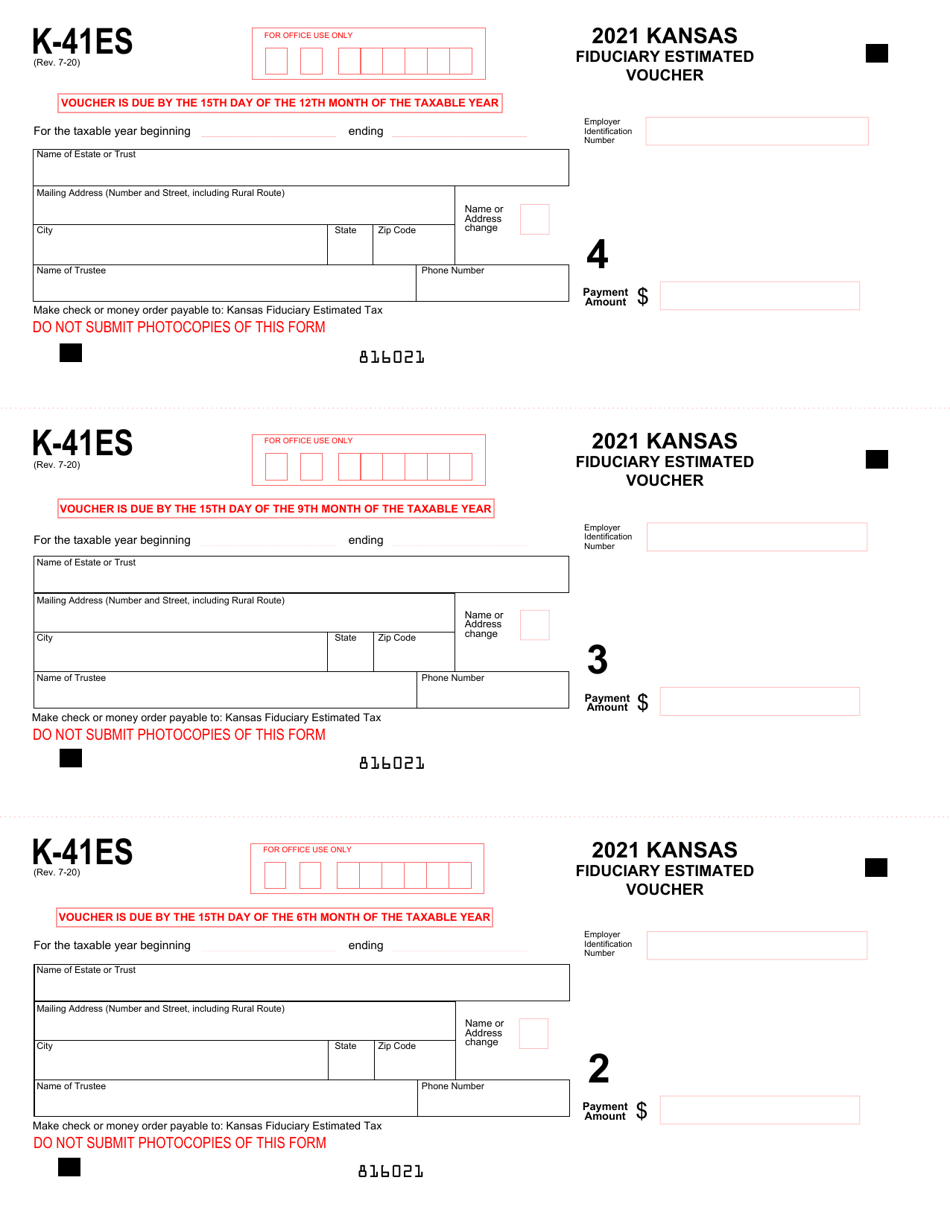

Form K-41ES

for the current year.

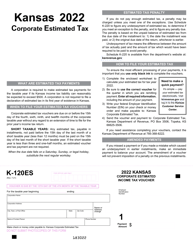

Form K-41ES Kansas Fiduciary Estimated Voucher - Kansas

What Is Form K-41ES?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-41ES?

A: Form K-41ES is the Kansas Fiduciary Estimated Voucher.

Q: Who uses Form K-41ES?

A: Form K-41ES is used by fiduciaries in Kansas.

Q: What is the purpose of Form K-41ES?

A: The purpose of Form K-41ES is to report and pay estimated taxes for fiduciaries in Kansas.

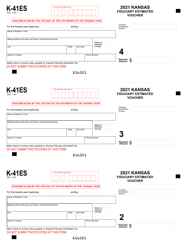

Q: How often should Form K-41ES be filed?

A: Form K-41ES should be filed quarterly.

Q: Are there any penalties for not filing Form K-41ES?

A: Yes, there may be penalties for not filing Form K-41ES or for underpaying estimated taxes.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-41ES by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.