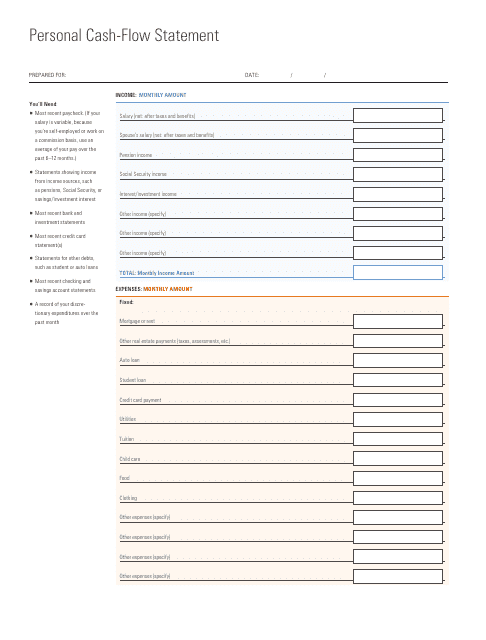

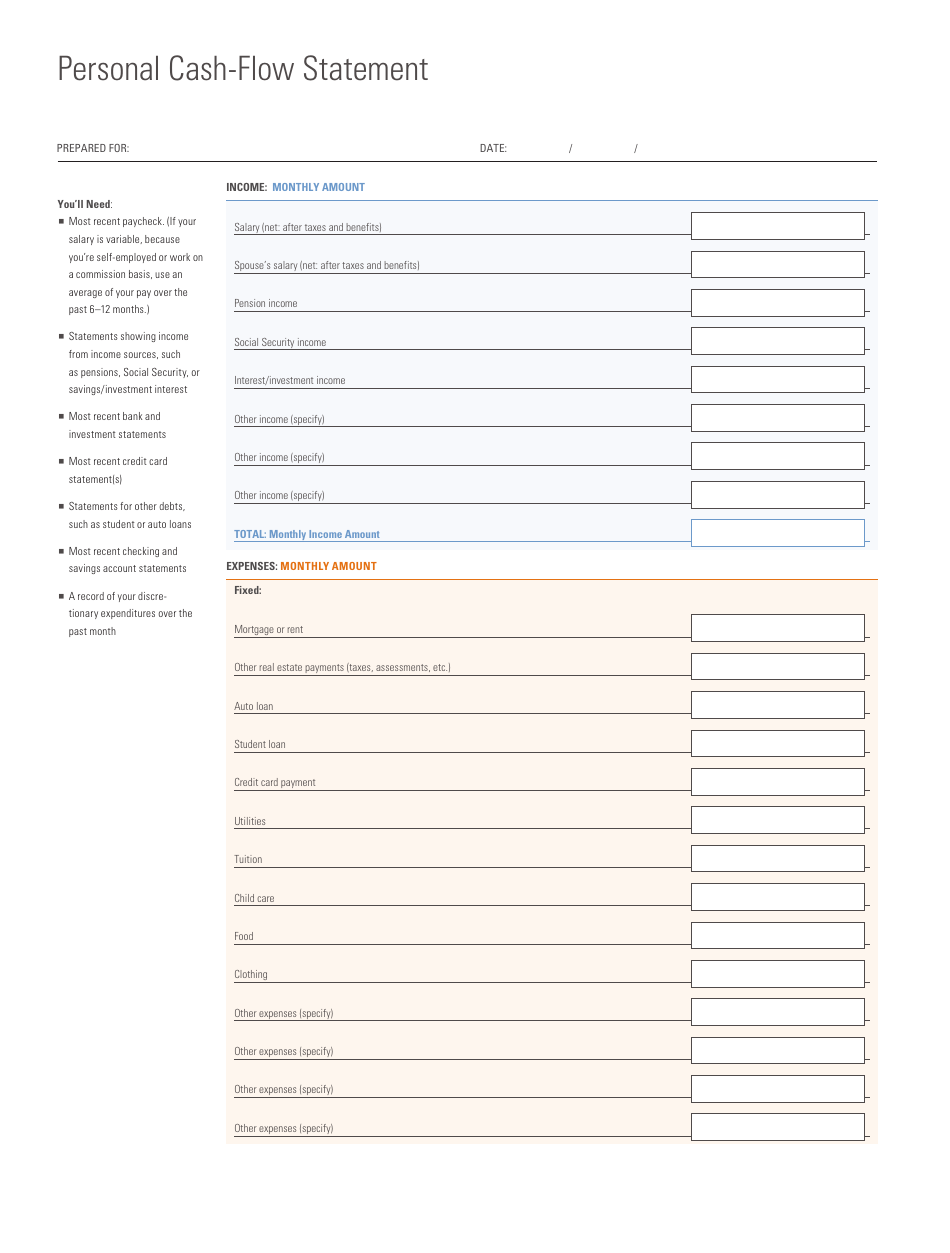

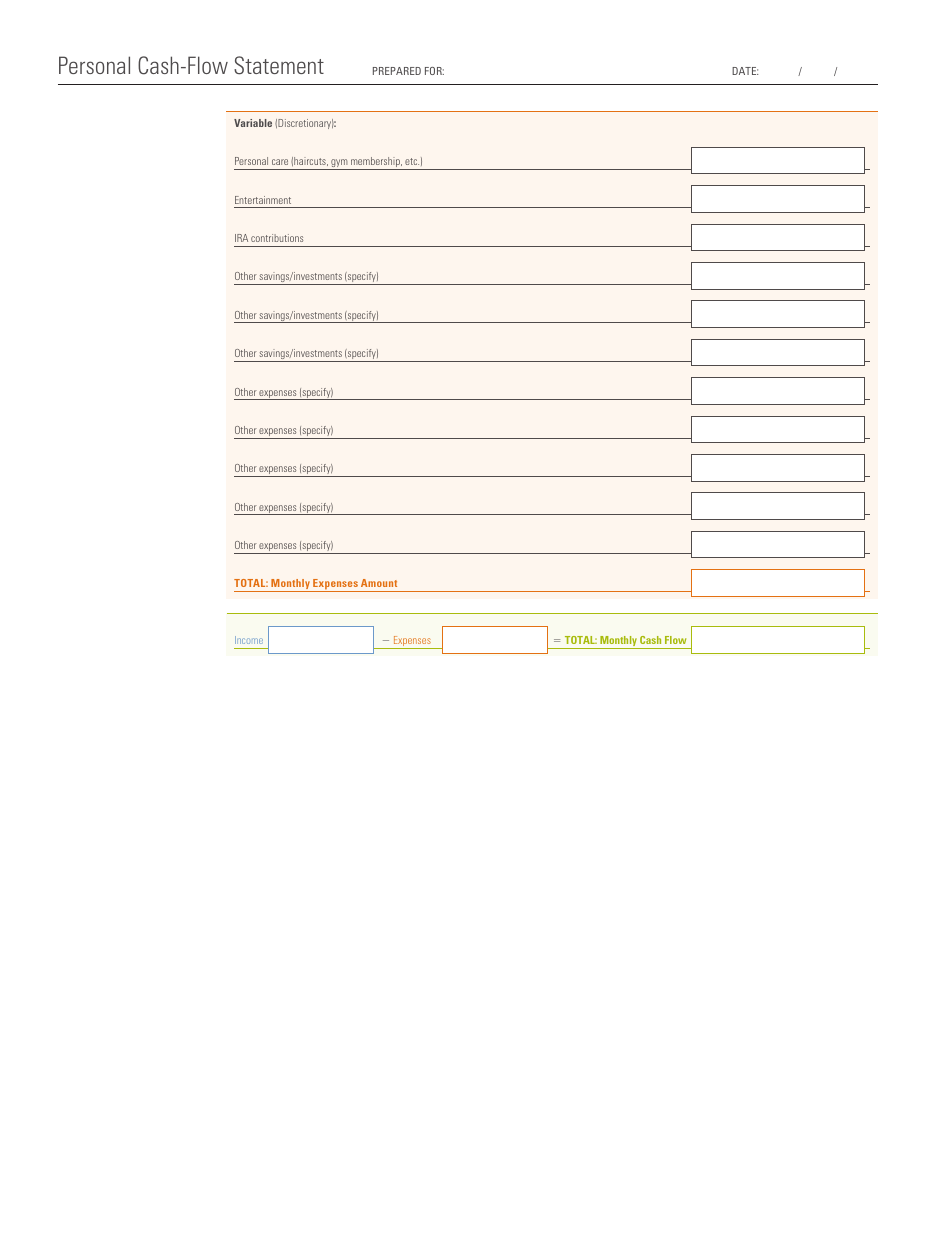

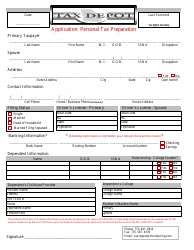

Personal Cash-Flow Statement Template

A Personal Cash-Flow Statement Template is used to track and analyze your income and expenses. It helps you understand how much money you are bringing in and where it is going, allowing you to better manage your finances.

The personal cash-flow statement template is typically filed by an individual or a household to track and analyze their income and expenses.

FAQ

Q: What is a personal cash-flow statement?

A: A personal cash-flow statement is a financial document that tracks your income and expenses.

Q: Why is a personal cash-flow statement important?

A: A personal cash-flow statement helps you understand your financial situation and make better financial decisions.

Q: How do I create a personal cash-flow statement?

A: You can use a template or spreadsheet to track your income and expenses and calculate your cash flow.

Q: What should I include in a personal cash-flow statement?

A: Include your income sources, such as salary and investments, and your expenses, such as housing, groceries, and transportation.

Q: How often should I update my personal cash-flow statement?

A: It's recommended to update your personal cash-flow statement monthly to keep track of your changing financial situation.

Q: What can I learn from a personal cash-flow statement?

A: A personal cash-flow statement can help you understand your spending habits, identify areas where you can save money, and see if you have enough income to meet your financial goals.

Q: Can a personal cash-flow statement help with budgeting?

A: Yes, a personal cash-flow statement can be used as a tool for budgeting by providing a clear picture of your income and expenses.

Q: Should I consult a financial advisor when creating a personal cash-flow statement?

A: If you're unsure about creating a personal cash-flow statement or need help understanding your financial situation, it's a good idea to consult a financial advisor.