This version of the form is not currently in use and is provided for reference only. Download this version of

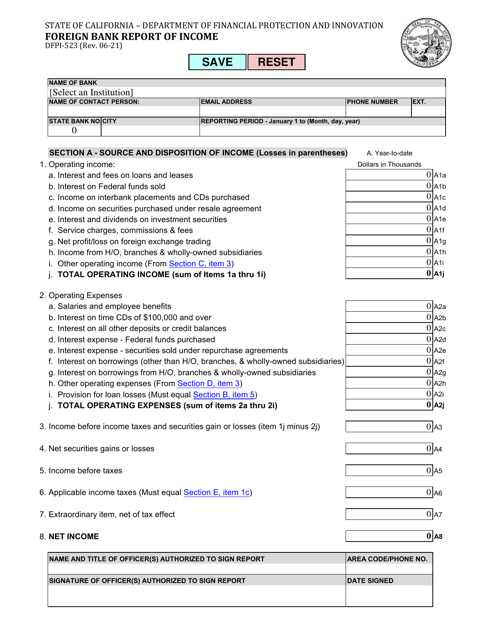

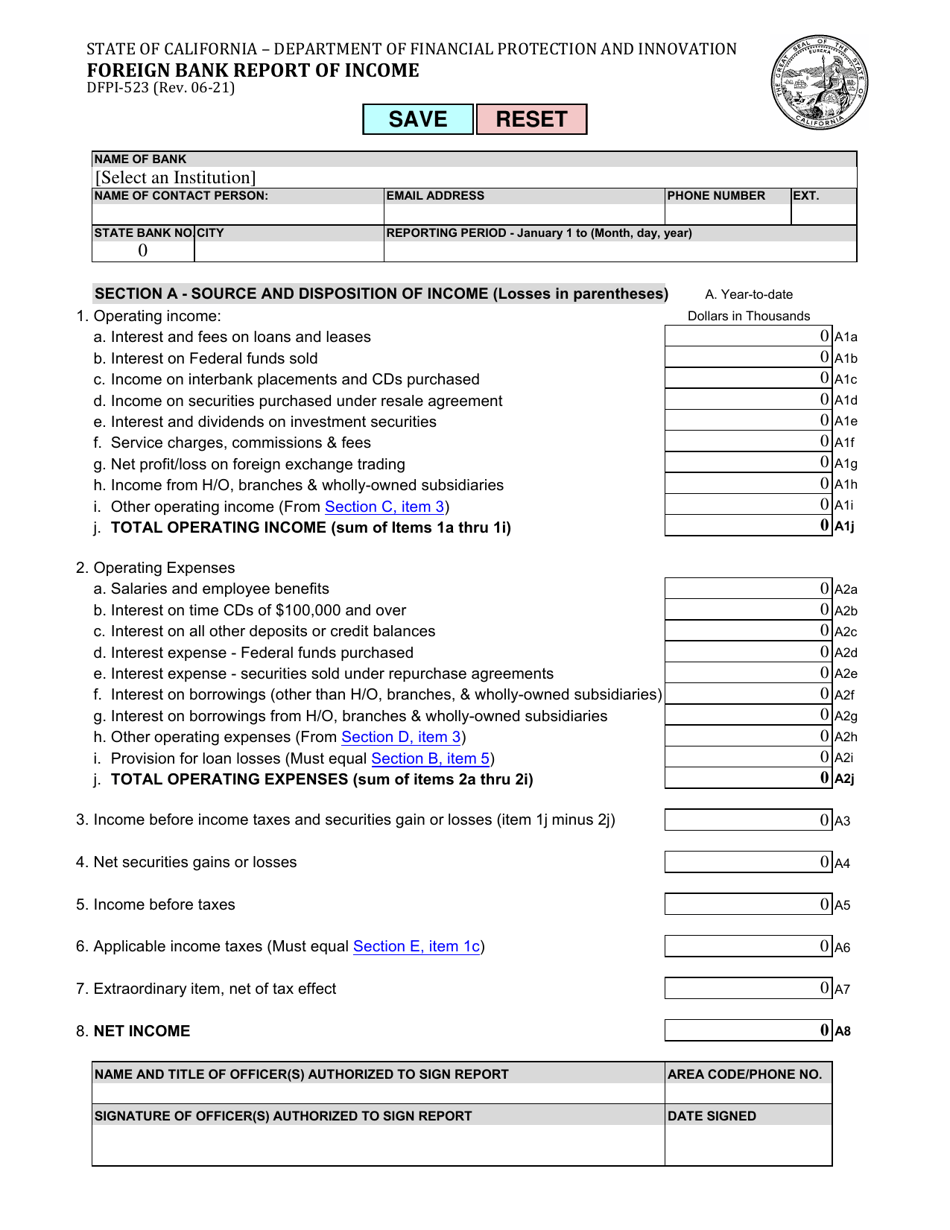

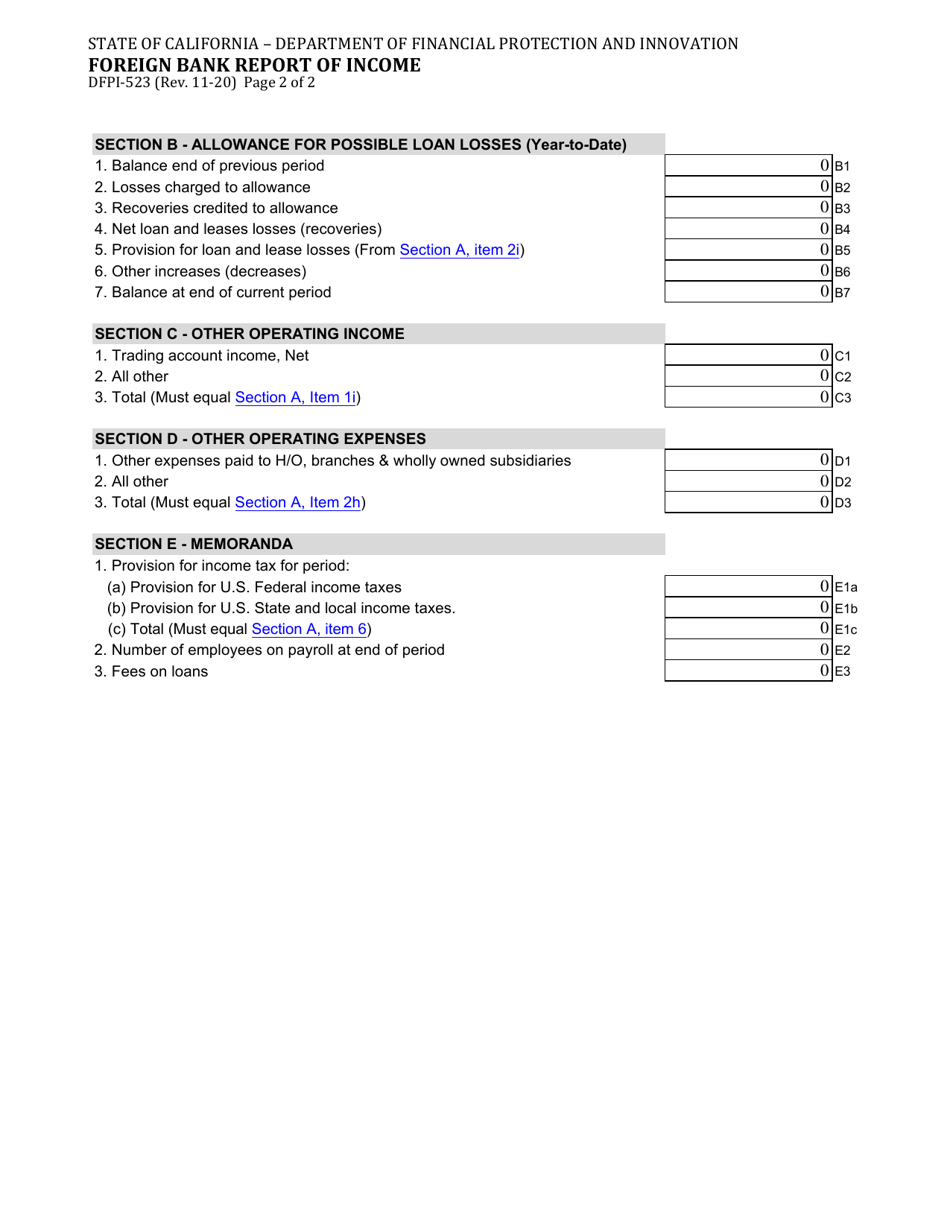

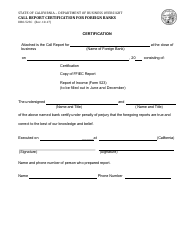

Form DFPI-523

for the current year.

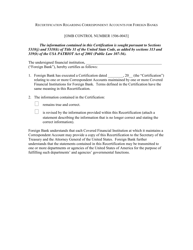

Form DFPI-523 Foreign Bank Report of Income - California

What Is Form DFPI-523?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DFPI-523?

A: Form DFPI-523 is the Foreign Bank Report of Income for California.

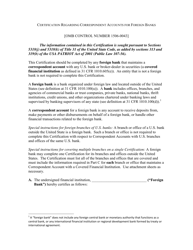

Q: Who needs to file Form DFPI-523?

A: Individuals or businesses that have accounts in foreign banks and earn income from those accounts in California.

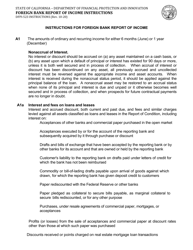

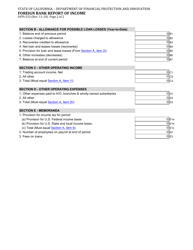

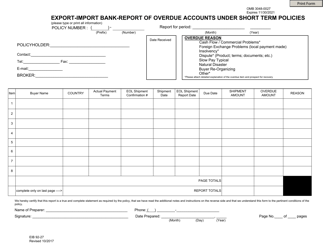

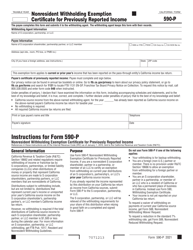

Q: What information is required on Form DFPI-523?

A: The form requires information about the foreign bank account, including the account number, the name of the bank, and the amount of income earned.

Q: When is the deadline for filing Form DFPI-523?

A: The deadline for filing Form DFPI-523 is typically April 15th of each year.

Q: Are there any penalties for not filing Form DFPI-523?

A: Yes, there can be penalties for not filing Form DFPI-523, so it is important to comply with the filing requirements.

Q: Is Form DFPI-523 only for residents of California?

A: No, Form DFPI-523 is for individuals or businesses that earn income from foreign bank accounts in California, regardless of their residency.

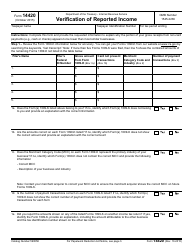

Q: Do I need to include proof of income with Form DFPI-523?

A: No, you do not need to include proof of income with Form DFPI-523, but you should keep records of your income in case of an audit.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFPI-523 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.