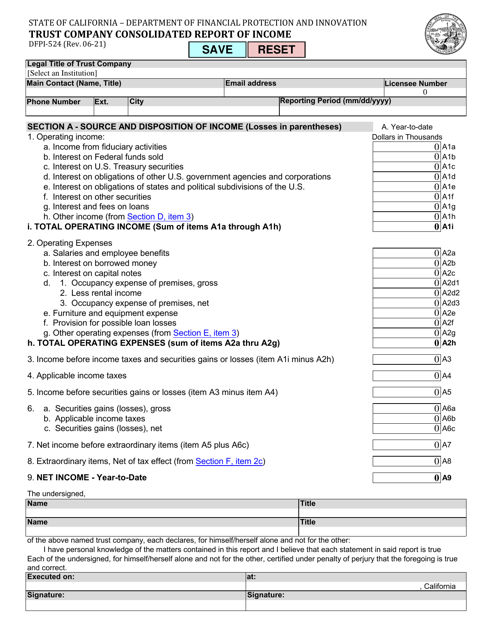

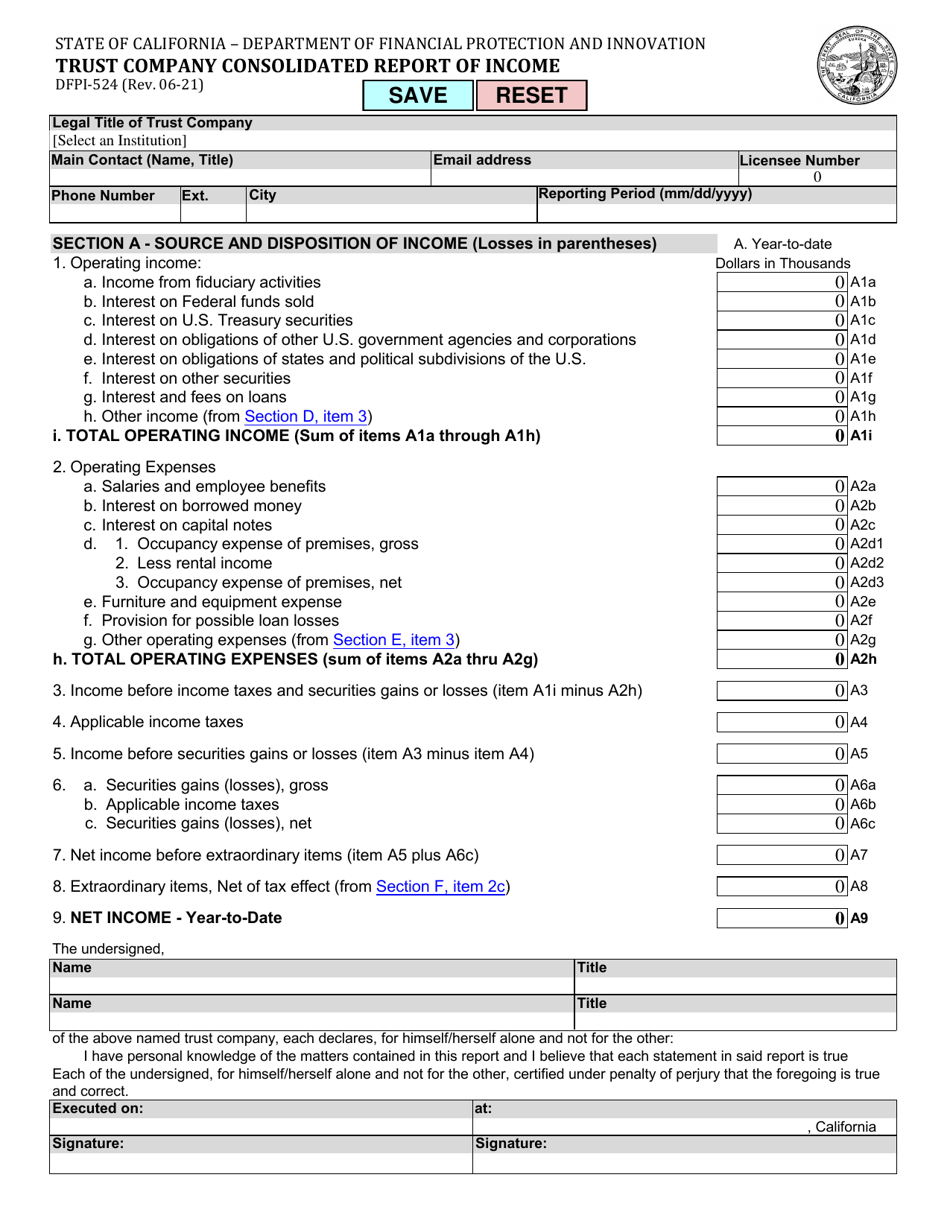

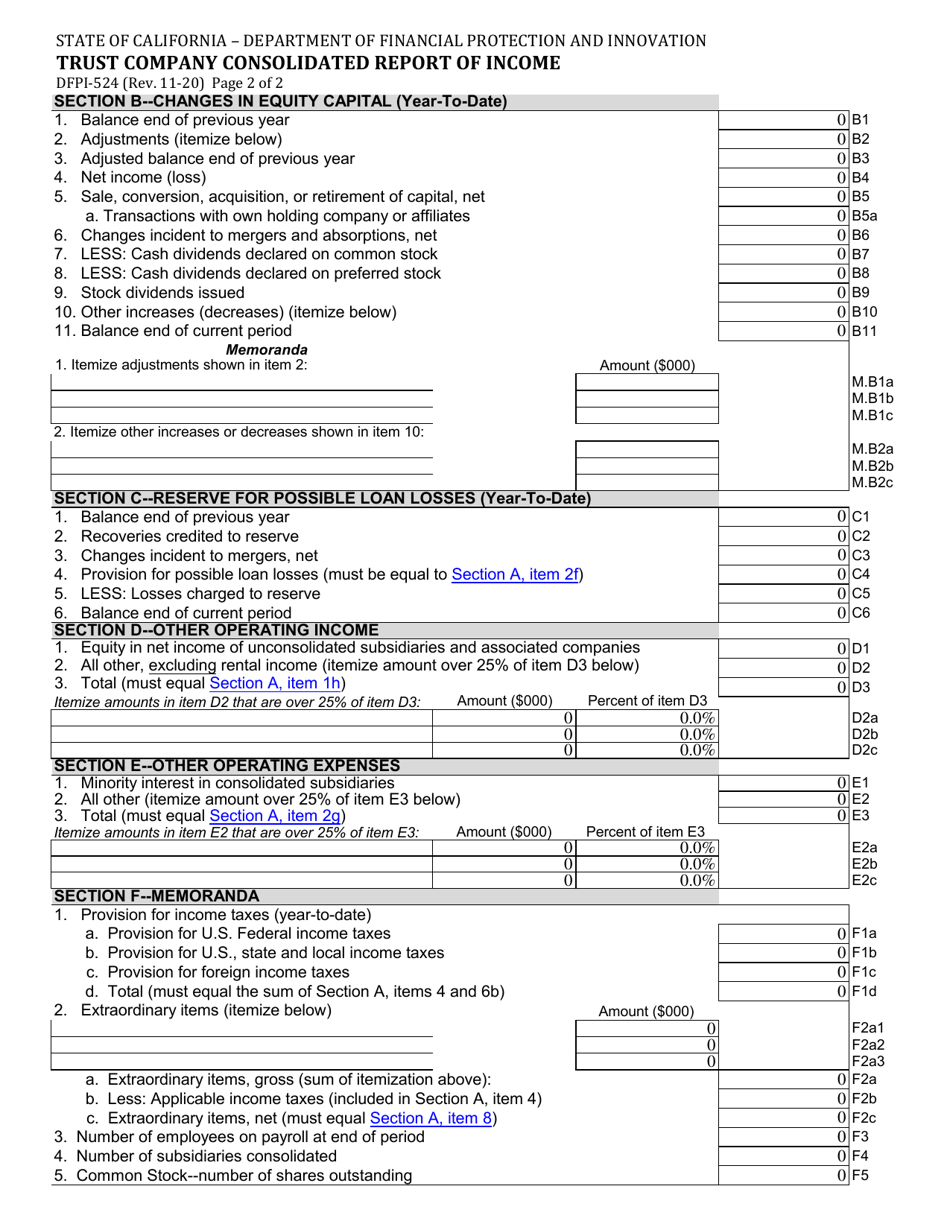

Form DFPI-524 Trust Company Consolidated Report of Income - California

What Is Form DFPI-524?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form DFPI-524?

A: The Form DFPI-524 is the Trust Company Consolidated Report of Income specific to the state of California.

Q: Who is required to file the Form DFPI-524?

A: Trust companies operating in California are required to file the Form DFPI-524.

Q: What is the purpose of the Form DFPI-524?

A: The Form DFPI-524 is used to report the income of trust companies operating in California.

Q: When is the deadline to file the Form DFPI-524?

A: The deadline to file the Form DFPI-524 varies and is typically provided by the California Department of Financial Protection and Innovation.

Q: Are there any penalties for not filing the Form DFPI-524?

A: Penalties may apply for not filing the Form DFPI-524 in a timely manner. It is important to comply with the filing requirements.

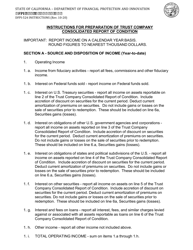

Q: Are there any specific instructions for completing the Form DFPI-524?

A: Yes, the Form DFPI-524 typically comes with detailed instructions on how to complete and file it.

Q: Are there any additional forms related to the Form DFPI-524?

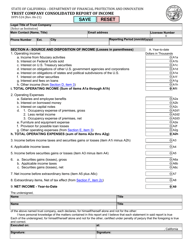

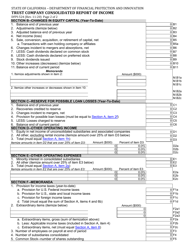

A: There may be additional forms or schedules that need to be filed along with the Form DFPI-524. It is important to review the requirements.

Q: Is the Form DFPI-524 required for both US and Canadian trust companies?

A: The Form DFPI-524 is specific to trust companies operating in California, so it is not required for Canadian trust companies.

Q: Who should I contact for more information about the Form DFPI-524?

A: For more information about the Form DFPI-524, it is best to contact the California Department of Financial Protection and Innovation or consult with a tax professional.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFPI-524 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.