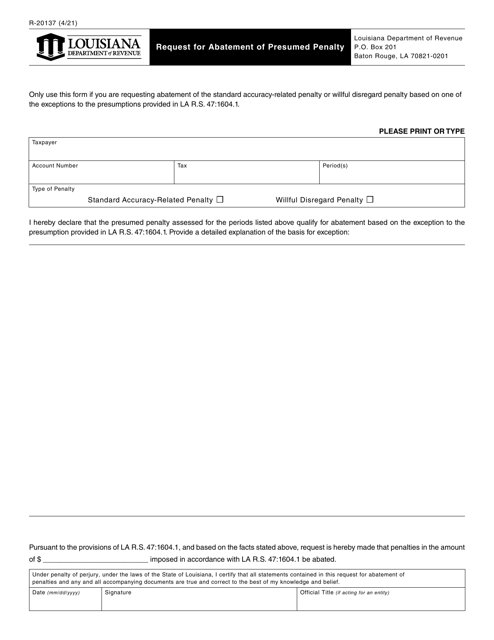

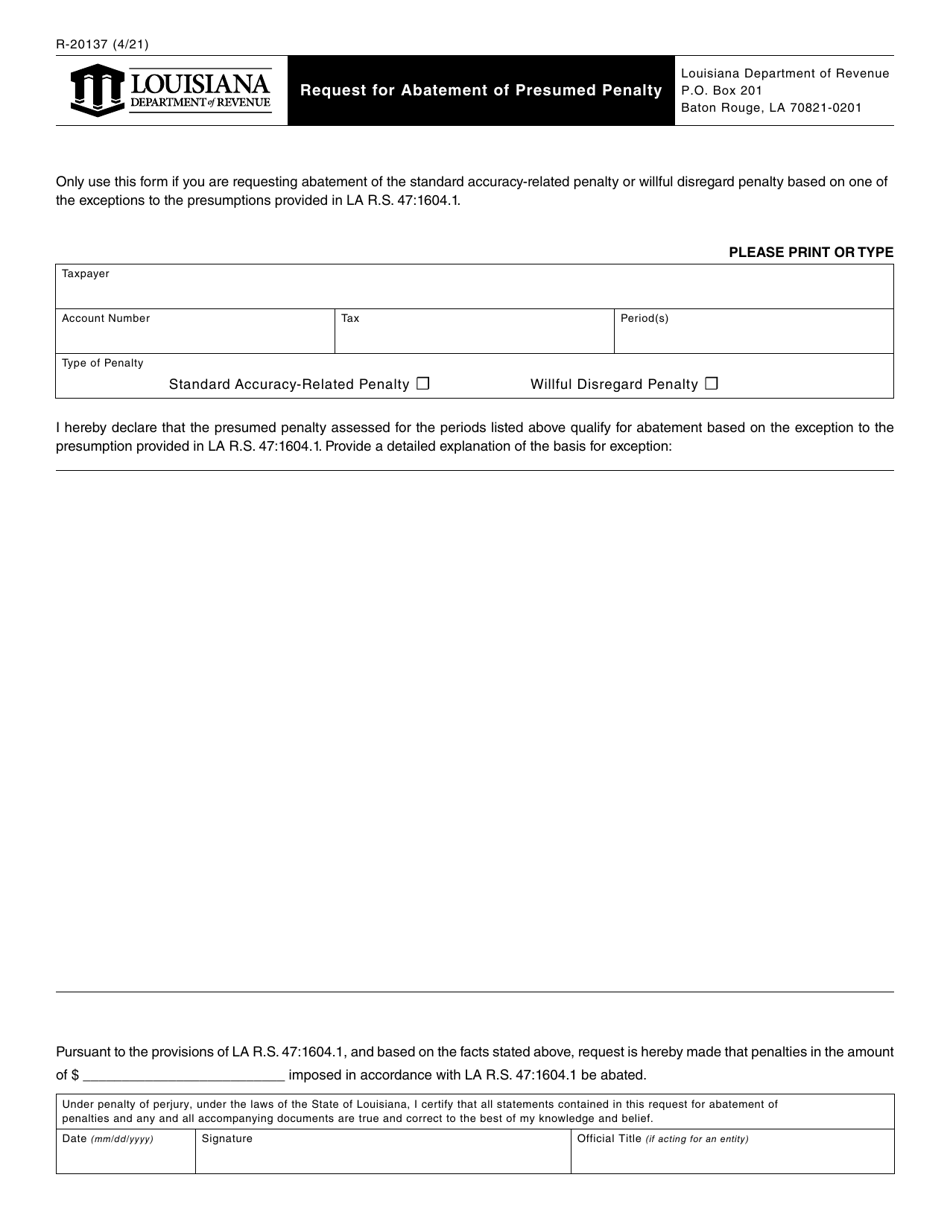

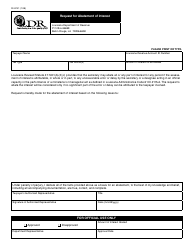

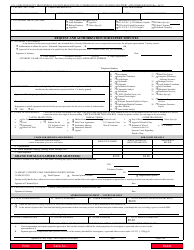

Form R-20137 Request for Abatement of Presumed Penalty - Louisiana

What Is Form R-20137?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-20137?

A: Form R-20137 is a request for abatement of a presumed penalty in Louisiana.

Q: What is a presumed penalty?

A: A presumed penalty is a penalty that is imposed automatically by the state.

Q: When should I use Form R-20137?

A: You should use Form R-20137 if you believe you should not be subject to a presumed penalty.

Q: How do I fill out Form R-20137?

A: You should provide the required information on the form, including the reason for the abatement request.

Q: Is there a fee to submit Form R-20137?

A: There is no fee to submit Form R-20137.

Q: What happens after I submit Form R-20137?

A: The Louisiana Department of Revenue will review your request and make a decision regarding the abatement of the presumed penalty.

Q: Can I appeal the decision made by the Louisiana Department of Revenue?

A: Yes, you have the right to appeal the decision made by the Louisiana Department of Revenue.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-20137 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.